INSIDE

The return of market volatility

Markets have been overly volatile this month thanks to global trade war threats coming out of the U.S. Pair this with unexpected U.S. earnings reports and we are witnessing some large daily moves especially in the highly valued tech-heavy market. For example, did you know that the S&P 500 Tech sector has wiped out its entire post-election gain and has gone nowhere since last June?

Important changes being made to client portfolios

We’ve been very busy trading portfolios over the past few weeks. Overall, we liken today’s environment to entering the third period of a hockey game with a lot of goals over the first two periods and suddenly the other team is coming out swinging. Therefore, now is not the time to go on the offence and onboard more risk but rather play a bit more of what is called the neutral zone trap by protecting the gains and looking for opportunities to selectively strike.

Some exciting new trades

Just recently we also derisked our energy exposure by selling half of our exposure, locking in some large gains. We then replaced it with a U.S. dollar note on energy stocks that has a 20 per cent annual coupon paired with 40 per cent downside exposure. These are just a few of the many trades done and so please read on in the rest of this report to find out more about the trades we’ve implemented within client portfolios directly and/or within our fund.

February 2025: FINDING THE RIGHT BALANCE

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

Markets have been overly volatile this month thanks to global trade war threats coming out of the U.S. Pair this with unexpected U.S. earnings reports and we are witnessing some large daily moves.

We certainly haven’t been sitting idle. Overall, we liken today’s current environment to entering the third period of a hockey game with a lot of goals over the first two periods and suddenly the other team is coming out swinging. Therefore, now is not the time to go on the offence and onboard more risk but rather play a bit more of what is called the neutral zone trap by protecting the gains and looking for opportunities to selectively strike.

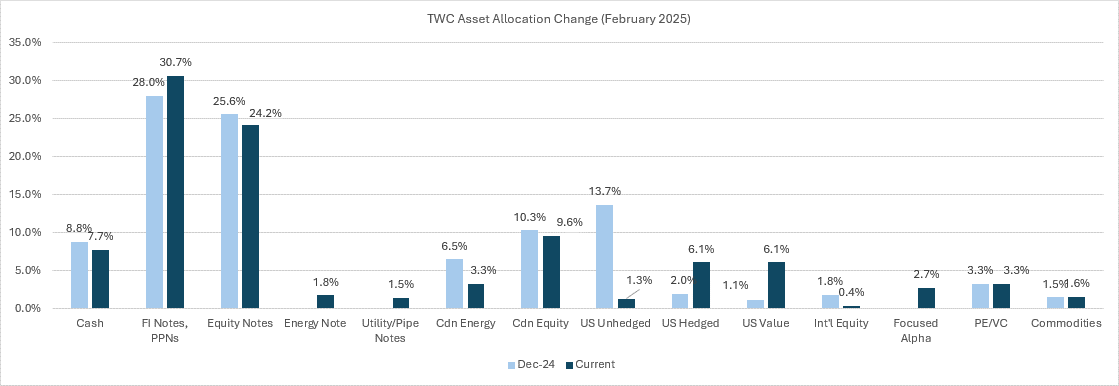

For example, we’ve been very busy trading client portfolios over the past few weeks taking advantage of the 30-day tariff reprieve. This involved reducing our large S&P 500 exposure, as its top tech holdings have some exposure to the tariff risks. We then replaced it with a fully protected, costless covered call strategy on the Russell 2000 along with moving into some attractively valued segments within the U.S. market that includes names like Berkshire Hathaway.

We are also derisking our energy exposure by selling half of our exposure, locking in some large gains. We then replaced it with a U.S.-dollar note that has a 20 per cent annual coupon paired with 40 per cent downside exposure.

These are just a few of the many trades done and so please read on in the rest of this report to find out more about the strategies we’ve implemented alongside some in-depth analysis of the market and our positioning. Martin is also travelling out to Vienna at the end of the month at the behest of the Organization of Petroleum Exporting Countries (OPEC) and will report back on any interesting insight on the global energy markets.

Thank you for reading, and please feel free to reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

![]()

Asset allocation changes and the region-beta paradox

Risk is truly a four-letter word and the nature of it, like our perception of reality, depends on where you are standing.

Some of us actively seek it out while many of us fall privy to what is called the region-beta paradox as we recently learned from an investment class Martin’s son is taking at the University of Calgary, that just so happens to be taught by a friend of ours. This paradox is that we often tolerate mediocrity and not-too-bad situations to avoid change, growth and the rewards that come with it.

Perhaps this is what Nassim Taleb meant when we said that “the three most harmful addictions are heroin, carbohydrates, and a monthly salary.”

When it comes to managing risk, TriVest’s entire philosophy and approach is built around goals-based investing. This means focusing in on a specific target return for each client depending on their own financial goals and objectives and then adjusting the risk level given conditions of the market and their overall tolerance for it.

Since the types of clients we work with generated substantial wealth by taking a lot of risk as entrepreneurs or professionals there usually isn’t a huge appetite for risk-taking as they approach retirement or are already in it. Therefore, obtaining a 6 to 8 per cent annual return while mitigating the ups and downs of the market is plenty enough to meet lifestyle spending requirements and leaving a large inheritance to their family and/or to charity.

As a result, we have little desire for levered beta plays like cryptos or chasing high flying U.S. tech that also comes with a lot of volatility, meaning downside risk that matches upside potential. However, we have to be especially careful not to fall privy to the region-beta paradox such as the traditional, passive 60/40 portfolio and settling for mediocre returns.

This means it is important for us to adjust risk levels based on the market environment allowing us to participate in broader market rallies like we’ve witnessed over the past two years and minimizing the impact of a correction such as in 2022.

We are not implying one should try to time the market such as moving to cash as there is all kinds of evidence showing this is impossible to do. That said, things like the options market tell you a lot about the environment you are in and provides the ability to add insurance when it is inexpensive, and when you think don’t you need it.

Today, surprisingly market participants are not overly concerned about the numerous uncertainties around global trade wars being initiated along with heightened geopolitical uncertainty.

Corporate bond spreads are at ultra-low levels, high yield or junk bond prices are approaching new highs, U.S. tech companies are trading at levels not seen since the dot.com bubble, and investors are buying every dip on the S&P 500 despite historical data telling you that based on current multiples the forward annualized 10-year return has been paltry +/- 2 per cent. By-the-way, this doesn’t imply flat markets over this entire period but rather the high probability for a sizable correction.

There is a time to add risk and a time not to, and we think now is not the time. For those that follow hockey, we’re coming out of some solid wins over the last two periods and why not play a little more defensive heading into the third period?

We call this our trap zone investment strategy aiming for as much downside protection as possible so that we can secure the past two years of solid returns while still being able to participate in the market upside this year with a targeted mid-to-high single digit return.

For example, the current level of complacency allowed us to put a trade on the Russell 2000 index where the insurance was so cheap that we were able to fully protect the downside with 15 per cent capped upside through to this fall.

We also sold nearly our entire tech-heavy S&P 500 exposure locking in some excellent returns and replaced it with U.S. value stocks via a diversified exchange-traded fund holding companies such as Berkshire Hathaway Inc., JPMorgan Chase & Co., Broadcom Inc., Exxon Mobil Corp., and UnitedHealth Group Inc. Overall, we worry that tariffs have the potential to really hurt many of the companies dominating the S&P 500. So far this trade has yielded nearly two times the return of the S&P 500, and isn’t selling off nearly as much on the U.S. announcing tariffs.

In regards to the Canadian-energy heavy market, who knows where global energy markets will settle out as U.S. President Donald Trump is going after Iran with strong sanctions which would send oil prices higher, but the Russia-Ukraine war could be dealt with, resulting in more Russian barrels and lower oil prices. Unfortunately, there remains added tariff risk as we only have one market to send our oil to.

Now that we’ve been given a month to get things sorted out before the tariffs kick in, why not use it to also re-risk? For example, we locked in some very large gains on our energy companies reducing our long exposure by half and replaced it with a U.S. dollar denominated structured note that has 40 per cent downside protection and, should they trade positive in a year, we obtain a 20 per cent coupon. We did a similar trade on Canadian pipeline and utility companies but with a geared 30 per cent downside, and a 14 to 15 per cent coupon.

We have also been adding to our U.S. dollar exposure for our clients as our dollar rallied back to near 70 cents on the 30-day delay in tariffs. However, should there be a resumption in the sell-off we may look to convert some back into Canadian dollars for a hefty profit.

These are just a few of the many strategies we’ve deployed, but hopefully demonstrate that there is value in managing risk in one’s portfolio. Just like in life there is a good time to eat carbohydrates but we tend to save them for after a long hard day of skiing without injury or winning that third period of a hockey game.

For those wanting more details on these trades and our strategic positioning, Martin had an in depth chat via Amber Kanwar’s In The Money Podcast:

YouTube: https://youtube.com/watch?v=F7t27LBKifE…

A closer look at potential rip tides in the market

When caught in a rip tide, every instinct is to fight the current, which is exactly the wrong thing to do. Instead, one has to not panic and swim parallel to the shore to get out of trouble.

This is why we strongly believe this is the same approach Canadians need to take when dealing with the recent U.S. protectionist threats as ignoring the problem isn’t going to help, nor is trying to fight it. Instead look for a safe way out by remaining calm and calculating.

Martin’s daily living motto involves constantly reminding himself that outside of health and tragic events, most things happen FOR you, not TO you. When trouble hits we can go to the default 1) poor me or 2) blame them, or we can be brave enough to move immediately to 3) what am I going to do about it?

The same exercise should be done with managing our investment portfolios, as many of us have also become over-reliant on U.S. stock markets. These are looking a little long in the tooth with record setting valuations no longer backstopped by fundamentals and facing some serious threats from the Trump administration’s actions.

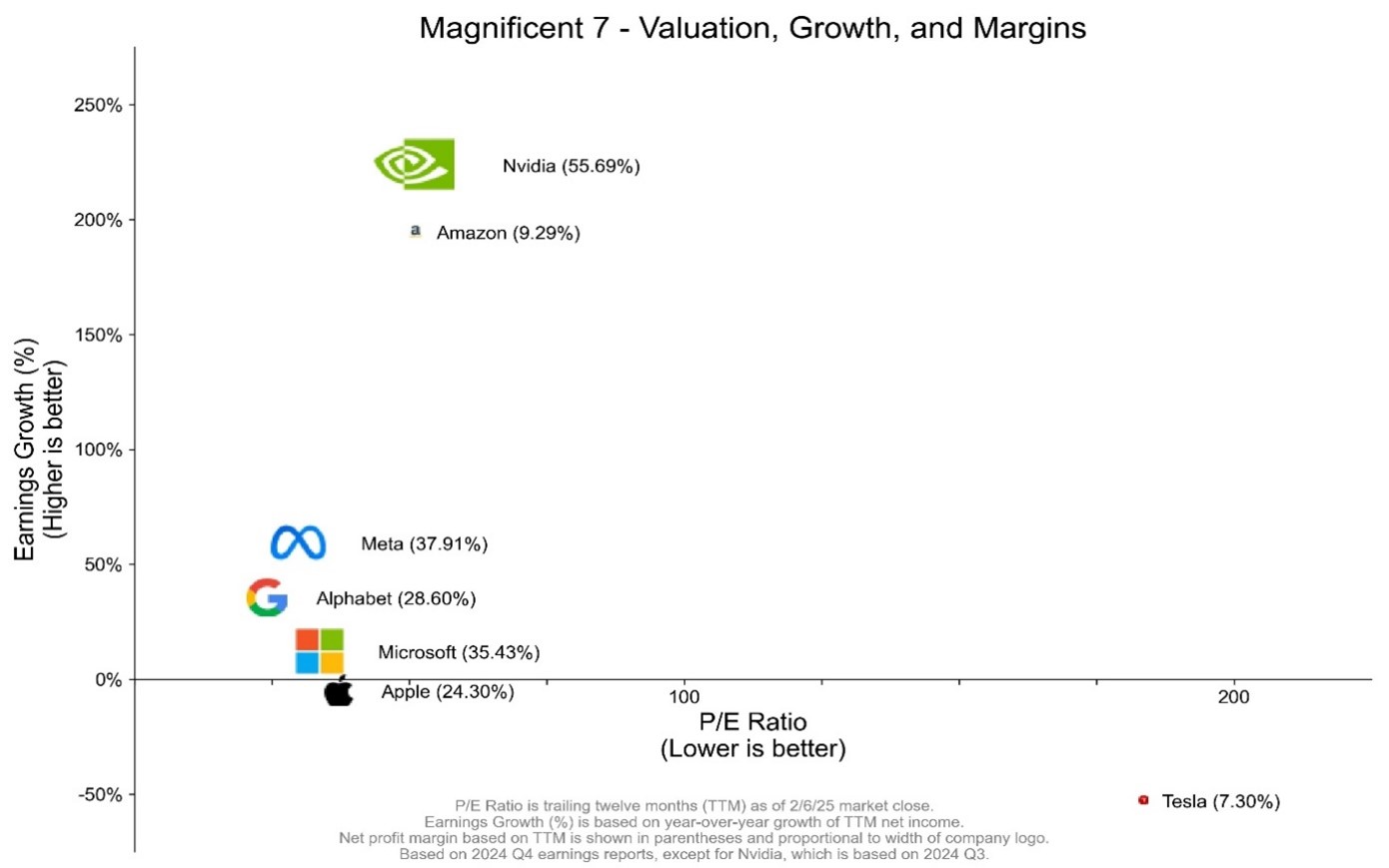

Take a look at Apple Inc. Its revenue growth has been fairly flat since September 2021 and yet its share price is up just over 60 per cent. As a result, it is trading at all-time highs representing nearly 10 times sales and 40 times earnings. The company also has 56 per cent of its sales coming from outside of the Americas. Take a look at Telsa Inc. Its share price gained 63 per cent in 2024 and its revenue only grew one per cent. 51 per cent of its total sales outside of the U.S.

We really do worry that the U.S. market has the potential to be what we call “Trumped,” with global tariffs having the potential to be a black swan event. We are not alone, as David Rosenberg recently posted:

“It is interesting to look at U.S. equity futures and see that the launching of this trade war is so far being treated no differently than the initial reaction to DeepSeek. The lack of panic tells me that investors expect this tariff file to be resolved quickly. Room here for disappointment when you look at the real reason for the trade action – to defray the cost of the Trump tax-cut agenda.”

However, most strategists are recommending tobuy the dip. But this is ignoring the risk that Trump’s actions have the potential to be a material change in the global economy of which the U.S. is a large part. Trump has now thrown a giant wrench into the cogs of international trade and commerce and the longer it stays in, the greater the chance something will break. This is a scenario few market participants are considering.

This brings us to a saying we live by when managing portfolios. You can live by the sword and die by the sword, or you can diversify. However, we currently live in a world where many are telling you diversification is bad.

Why own bonds when they’ve performed so poorly? Why own international markets when they’ve paled in comparison to U.S. markets? Heck, even the mighty S&P 500 has thrown in the towel as the Magnificent Seven tech stocks now represent over one-third of the index, up from a fifth of the index two years ago.

Can it really be that easy?

In the context of the market action over the past 10 years, apparently it is. The near 20 per cent drop in the S&P 500 in 2020 seems like a distant memory, given two back-to-back years of more than 20 per cent gains.

Investors who diversified may have achieved decent returns with less variability, but I fear that they may capitulate to the mantra that U.S. tech stocks only go up and wonder why they should own anything else?

The problem is that markets have cycles, and you better get the timing right if going all-in.

For example, in the decade following the dotcom bubble bursting, U.S. tech stocks got pummelled. They contributed less and less to the S&P 500, resulting in some material underperformance of the index. Meanwhile, the Chinese infrastructure boom and the corresponding bull run in commodities resulted in outstanding performance in resource-based stock markets such as in Canada or emerging markets. It, too, at that time was the only place to be and many investors wondered why they would own anything else.

The best solution for high prices is high prices. Rocketing oil prices rapidly incentivized U.S. shale development, which flooded the market with oil, resulting in an OPEC price war and the resulting end of the bull run in oil. At the same time, the China story unravelled as the country took on too much debt and overbuilt.

This is called disruption.

A swift mean reversion leaves many who got the timing wrong with a lot of damage and their portfolio can take a long time to recover. This is why you diversify as you get older, as having a large position losing 17 per cent in one day can become unbearable, despite the promise of continued high double-digit returns.

Remember this whenever hearing strategists talk only about highly volatile investments, such as cryptocurrencies and tech stocks. Sure, these could play some part in a portfolio and certainly make for a great narrative but could lead you straight into another rip tide.

Instead, we think the focus really should be on ways to generate targeted returns to meet financial goals and objectives while mitigating the risk.

It is all relative, or is it?

“A flower does not think of competing with the flower next to it. It just blooms.” – Zen Shin

One of the more important lessons we’ve learned over the years is that the value of a dollar is relative. Human psychology plays a huge role, often leading to emotion overruling logic. This is because money is used as a measure of fairness and so we make comparisons in the determination of its value.

A study by Solnick and Hemenway asked participants to choose between two options: A. You earn a yearly salary of $50,000 while others earn $25,000. Or B. You earn a salary of $100,000 while others earn $200,000.

Interestingly, half of the participants choose the first option, which makes no sense whatsoever. For many of us, we would prefer to live in a world where we earned half of what we could, as long as we were earning more than others.

A great real-life example is the recent emergence of the notion of “our fair share.” We have seen this over the past few years, via members of the public service or academia giving policy recommendations to the federal government advocating punitive tax changes affecting higher earners, including doctors or small and medium business owners.

The problem is that often in order to make a higher income, people need to take on risk that those making a safer but lower paying salary may not be comfortable doing.

When we look at investing, these notions of risk and comparison to others both play an important role.

This is the problem of benchmarking when it comes to investing. Investors are heavily swayed by whichever segment of the global market is performing the best, in spite of those fine print warnings that past performance does not indicate future results. Risk and reward are suddenly no longer part of the equation.

We find that the entrepreneurs have an excellent understanding of this relationship, having learned through direct experience. They have charted their own course independent of everyone else by setting their own individual targets based on their perceived risks weighed against the upside potential.

It’s no different when managing portfolios. Our “goals-based” approach means that we can avoid the risks that come with performance chasing. Doing an investment review suddenly means looking at the performance with a different set of eyes by asking if the pre-set goals are being achieved rather than if they beat everyone else.

For example, in the old days when interest rates were much higher, it wasn’t uncommon to do a laddered Guaranteed Investment Certificate (GIC) strategy that would yield six to eight per cent. If this was even an option today, I’m sure it would encompass a large part of our portfolios given the nature of many of our clients. However, this would mean not allowing two back-to-back strong years in equity markets to influence our asset allocations, which can be a very tough thing to do.

Unfortunately, the days of high paying GIC rates are long gone, but the good news is that there are other vehicles such as structured notes that can achieve these targets, albeit with more risk than GICs but a lot less than global equities.

This doesn’t mean that by adopting such an approach there isn’t room for improvement. But we believe true success is not being better off than someone else but rather being better off than you used to be.

Research, media, and reads of the month

The path to success often comes through avoiding major mistakes rather than pursuing brilliant moves. This isn’t about being passive – it’s about being thoughtful and disciplined about where and how you compete. – Avoiding Stupidity is Easier than Seeking Brilliance

One of the best takes on tariffs and Canada

“A crisis of this magnitude – whether the tariffs materialize in 30 days or not – should be a wake-up call. We need to be an independent country that actually gets things done so that we are never as susceptible to the whims of our neighbour as we are today. That means diversifying our trade in earnest, as the European Union has done in signing three new trade deals in just the last two months. We need to maximize our internal efficiencies by dismantling interprovincial trade barriers and building a pipeline to get Alberta oil to eastern provinces without going through the U.S.” Read Here

How has China been preparing for a bigger trade war with the U.S.?

Some very interesting points here. Maybe it’s time investors start establishing a position in Chinese markets and selling down U.S.? Watch Here

DeepSeek a Sputnik moment?

“If AI becomes part of a new global arms race, a lack of guardrails could lead to a scary future — one far more dangerous than anything people imagined because of Sputnik”. Watch Here

The region-beta paradox

“Do you only get motivated to work hard and grind after a big downswing?” This is an example of the region-beta paradox, a levered beta trade. That isn’t to downplay its usefulness, but it helps to understand its relationship when running a portfolio. Read Here

Valuations matter

Equities don’t always outperform inflation, even if held for 20 years. Therefore, starting points matter, even for a dollar cost averaging (DCA) strategy. Something many have forgotten in 2025. Read Here

Follow the flow.

Something we missed in 2024 was the $6 trillion injected into the market as a means for the Biden Administration to get re-elected. That said, will markets move higher absent U.S. Federal Reserve and Treasury liquidity? See Here

Very interesting charts and Michael Howell interview.

Found this interview via a client recommendation to read his book Capital Wars: the rise of global liquidity. Watch Here

Debt maturities

This will be a major headwind in the next decade. We’ve kicked the can on debt refinancing risk. See Here

The electric vehicle revolution

Alberta will start collecting a $200 annual tax on electric vehicles next Thursday. Albertans will need to pay the annual fee when they register their electric vehicle. Think this will become a trend globally? Read Here

Ford Motor Company expects a $5 billion-$5.5 billion loss in its “Model e” electric vehicle segment this year due to cost challenges, executives said, as the company aims to increase its EV volume. Read Here

Porsche’s deliveries last year dropped 3 per cent compared with 2023, with its push into the fast-growing market for electric vehicles in China misfiring. The group’s Chinese sales slumped 28 per cent last year, with consumers failing to embrace its electric Taycan sedan. Read Here

“BYD’s new Denza Z9 GT EV can parallel park in place by turning and spinning its right rear wheel forward and left rear wheel backward. It can also crab walk through tight spaces. Deliveries have already begun in China and start at US$47,000”. Watch Here

I know “fundamentals don’t matter” anymore with $TSLA, but still find it remarkable that the consensus 2025 estimate for adjusted earnings-per-share (EPS) ($3.05) has completely round-tripped to where it was in 2019, before the stock went parabolic. See Here

Iranian sanction enforcement

Trump’s Iranian sanctions hit three ships active in China trade measures that stopped short of maximum pressure pledged by the U.S. One very-large crude carrier and two Aframaxes were affected. Read Here

On the Positive

“The real man is one who always finds excuses for others but never excuses himself.”- Henry Ward Beecher

Augmented reality breakthrough on medical imaging

Viewing MRI results on patients during examinations became that much easier. Watch Here

The MIQ Process

Chess prodigy Josh Waitzkin developed a process to achieve peak performance in any craft or career. He’s applied it to the world of investing, professional sports, science and more. The MIQ Process. It is not a quick fix, but rather a rewiring of your default settings. Watch Here

When a cougar enters the room

This is exactly how we need to deal with threats when they arise. Calmly shutting the door to give us time to safely come up with a response. Watch Here Make important decisions out of harmony and peace. Watch Here

Don’t be afraid of failure

Some sage words here by Ed Sheeran. Watch Here

RealCTZN

Martin‘s recent podcast on Canada’s economic challenges, ways we can use it to transform our country to maximize its potential and some of the mantras that he finds helpful in navigating life and business. Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca