INSIDE

Now is the time for active asset allocation

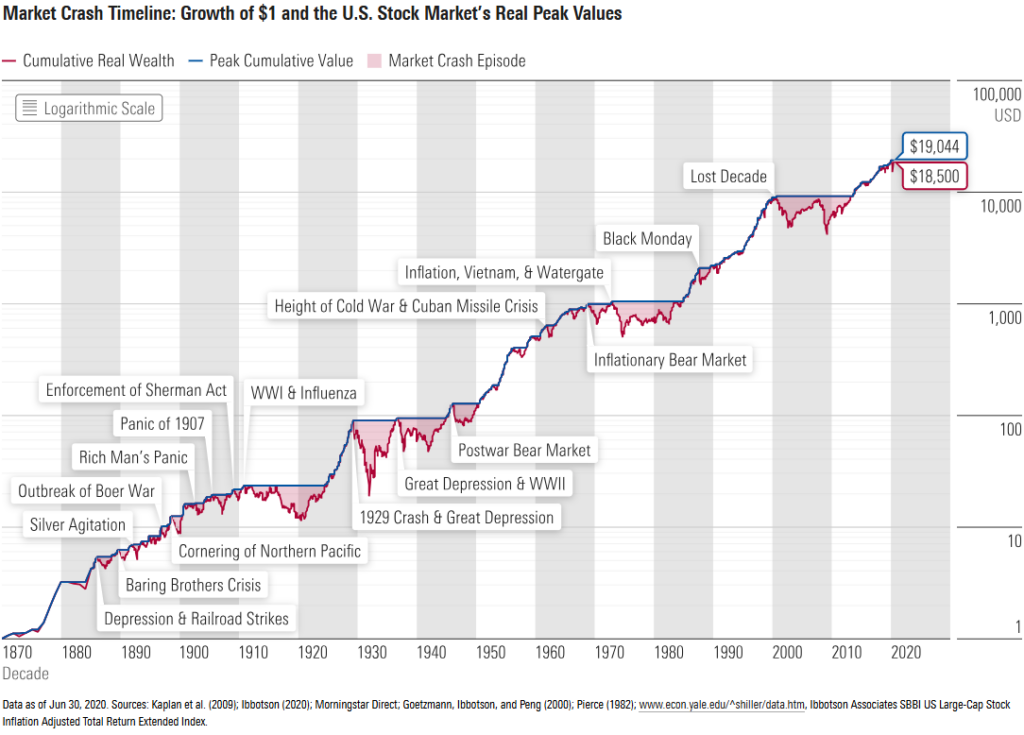

There is a great saying about investing: it isn’t about timing the market but rather time in the market that matters. This principle generally holds true, as history has shown that the probability of a loss decreases considerably the longer one stays invested. However, there have been periods where equity markets have struggled to deliver attractive returns, highlighting the fact that timing can still play a role.

Stagflationary positioning doing its job

As we move forward into the remainder of the year, we remain focused on navigating evolving market conditions with a disciplined and proactive investment strategy, ensuring our portfolios remain resilient in the face of the ongoing uncertainty. Some of these trades are starting to pay dividends with gains in a year where broader equity markets have been selling off.

We’re expanding

We have some exciting news to share as TriVest is expanding. We are starting the new quarter with two additions, a new Senior Portfolio Manager and a Portfolio Associate. With the bigger team comes an enhancement in internal research capabilities, which strengthens our portfolio management processes and contributes to delivering superior investment strategies for our clients. This also allows us to expand into providing some new investment portfolio options for those investors looking to access our service but have portfolios under our $2 million minimum. Please see our website for more details.

April 2025: Navigating uncertain times

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

There is a great saying about investing: it isn’t about timing the market but rather time in the market that matters. This principle generally holds true, as history has shown that the probability of a loss decreases considerably the longer one stays invested. However, there have been periods where equity markets have struggled to deliver attractive returns, highlighting the fact that timing can still play a role.

For example, the S&P 500 experienced zero or negative annual returns from 2000 to 2010, a period infamously known as “The Lost Decade.” Similarly, from about 1972 to 1982, high inflation and rising interest rates created an environment of stagflation, suppressing returns. Going further back, the Great Depression (1929 to 1939) also resulted in a prolonged period of weak market performance. Fast forward to today and the 60/40 (60 per cent stocks, 40 per cent bonds) portfolio has essentially gone nowhere since the beginning of 2022, with only a 2 per cent annual return for the past three and a half years.

One commonly recommended approach to mitigate these risks is dollar-cost averaging (DCA), where investors consistently invest a fixed amount over time, such as making monthly contributions. This strategy has proven to be a highly effective way to build wealth over the long run, smoothing out the market’s ups and downs and reducing the impact of volatility.

Fidelity Investments’ Jurrien Timmer conducted an insightful analysis on the effectiveness of DCA. He examined the results of investing $100 into the U.S. stock market every month over 10-year periods, using data dating back to 1926. The results showed that in 90 per cent of cases, the outcome was positive, with an inflation-adjusted compounded annual growth rate (CAGR) of 3.9 per cent.

However, the timing of when one began a DCA strategy had a significant impact on results.

Investors who started in the 1940s were rewarded with double-digit returns, whereas those who began in the mid-1960s or in 1999 faced negative returns. For those who believe a 10-year period is too short to assess the strategy’s effectiveness, Timmer extended his analysis to 20-year periods. The probability of positive returns improved to 96 per cent, with an average CAGR increasing to four per cent. The best CAGR over this period was 9.1 per cent, while the worst return was -0.7 per cent. As Timmer noted, “while the worst loss was minimal, it does show that equities have not always kept up with inflation, even if held for 20 years.”

This is why we prefer investments that offer asymmetrical payoff profiles; those that provide downside protection while capturing upside potential. Having downside protection is especially crucial for investors who have already accumulated wealth and wish to avoid the volatility associated with equity markets. For younger investors employing a DCA strategy, we suggest adjusting the approach by increasing investments after significant market corrections and diversifying more when valuations are high. This can involve adding fixed income, gold, commodities, or other asset classes to balance exposure.

Tactical asset allocation strategies can be particularly beneficial in achieving this balance. Fortunately, some exchange-traded funds (ETFs) and mutual funds offer these types of services, providing investors with an active approach to portfolio management.

We think such an approach may be especially useful in today’s market environment, where structural shifts could be unfolding. With U.S. President Donald Trump taking office, uncertainties surrounding tariffs, U.S. isolationist policies, reshoring, and rising global debt levels — including within the U.S. — could all impact future long-term market returns.

The last thing an investor needs is rising inflation coupled with moderating returns, leading to flat or negative real returns over extended periods. Furthermore, the increasing concentration of technology stocks in passive portfolios poses additional risks, especially after a decade of strong equity market performance.

In light of these challenges, a more strategic and diversified investment approach may be necessary to navigate the evolving market landscape effectively. As a result, many of our top positions happen to be in segments of the market that are doing quite well in the unfolding stagflationary environment.

This includes levered upside structured notes on 20-year Treasuries with embedded downside protection, a large position in U.S. value stocks (including names like Berkshire Hathaway that are leading the market this year) and Canadian dividend companies that have returned over 5 per cent this year. We also continue to own hard assets like commodities that are a good hedge, and added an alternative long-short fund in Canadian mid and small-caps that we think will be able to add some incremental value in a tough market environment.

There can be uncertainty in markets, in economies and in geopolitics but it doesn’t have to live in our minds rent-free. Having a plan to mitigate risks is something not only within our control but also a great first step to at least collecting rent from our portfolios while the world is becoming a more hostile place.

We have some exciting news to share as TriVest is expanding. We are starting the new quarter with two additions, a new Senior Portfolio Manager and a Portfolio Associate. With the bigger team comes an enhancement in internal research capabilities, which strengthens our portfolio management processes and contributes to delivering superior investment strategies for our clients. This also allows us to expand into providing some new investment portfolio options for those investors looking to access our service but have portfolios under our $2 million minimum. Please see our website for more details.

Thank you for reading, and please feel free to reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

Market strategy and asset allocation

As we move forward into the remainder of the year, we remain focused on navigating evolving market conditions with a disciplined and proactive investment strategy, ensuring our portfolios remain resilient in the face of the ongoing uncertainty.

Multiple economic indicators are already flashing red. Retail sales, restaurant and bar sales, motor vehicle and parts purchases are all declining. Moreover, the National Federation of Independent Business (NFIB) survey reveals the most significant drop in U.S. small business expansion plans since the 2020 pandemic. This is particularly concerning, as small businesses drive approximately 43.5 per cent of U.S. GDP. When small businesses struggle, the broader economy feels the impact. And just earlier this month, the Atlanta Federal Reserve model is predicting that U.S. gross domestic product (GDP) will contract by 2.83 per cent in the first quarter, revised lower from its 1.48 per cent contraction forecasted at the end of February.

Overall, we have an 8 per cent cash position in our TWC fund allowing us to take advantage of any prolonged market sell off. We also have a 25 per cent weighting to equity notes with a larger focus on monthly contingents with larger 30 per cent downside barriers. Canadian equity is at 12 per cent with a notable drop in energy as we discussed in our last monthly update. U.S. equities are at 13 per cent of which over 80 per cent is hedged with embedded put protection. This is rounded out with a 2.5 per cent weighting to a long/short fund out of Toronto, 3.5 per cent in private equity and roughly 2 per cent in commodities.

One key move has been our recent allocation to U.S. health care via the Health Care Select Sector SPDR Fund, which holds major positions in Eli Lilly and Co., Johnson & Johnson, AbbVie Inc., Merck & Co. Inc., Abbott Laboratories, and Thermo Fisher Scientific Inc. Health care tends to perform well during recessions due to its essential nature, making it a defensive and reliable sector.

Dividend stocks are another cornerstone of our strategy. These stocks tend to outperform in recessions because they provide consistent income and stability when market conditions become volatile. They also offer something called “yield support,” which means high quality companies with strong balance sheets that are able to service a dividend during a correction. Many of the strongest dividend-paying companies are in defensive sectors such as utilities, health care and consumer staples, where demand remains relatively stable.

We have positioned ourselves in this segment of the market primarily through Outcome Metric Asset Management’s Canadian Equity Income Fund, a rules-based fund with premium dividend yield to the S&P/TSX Composite and targeting approximately 20 per cent lower volatility than the broader market. Key holdings include Alamos Gold Inc., Wheaton Precious Metals Corp., Franco-Nevada Corp., Finning International Inc., Waste Connections Inc., and Metro Inc. It is also faring quite well this year. According to Morningstar it is the top-performing fund out of several hundred in its category on a year-to-date basis, last six months, and last one-year basis. As of market close on Friday, April 11, the fund was up 3.5 per cent so far this year vs. a decline of 3.8 per cent for the iShares Core S&P/TSX Composite Index ETF (XIC) and a decline of 5.9 per cent for the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (CDZ).

We have also maintained significant positions in the Vanguard Value ETF (VTV) and the Simplify Hedged Equity ETF (HEQT), both of which serve different but complementary roles in our portfolios. VTV’s largest position is in Berkshire Hathaway Inc., offering a safer and diversified way to gain exposure to the U.S. market due to the positions it owns and larger cash position that can be used during any sell off.

Meanwhile, HEQT has embedded put options that provide downside protection, allowing investors to stay invested while mitigating risks during market downturns. As you are aware we also make extensive use of structured notes. While they are not the most tax-efficient option, they offer attractive risk-adjusted returns depending on the specific strategy implemented.

Some of these trades are starting to pay dividends with strong gains in a year where broader equity markets have been selling off. For example, our TWC Risk-Managed Balanced Growth Fund grew by 0.5 per cent in the quarter, with these trades more than offsetting some of the weaker portfolio components. For more details on some of these strategies, Martin was recently on BNN Bloomberg.

In the media

Research, reads of the month

Howard Marks is one of those voices

Howard Marks is one of those voices

An excellent interview and worth watching in these turbulent times. In the midst of storms, a calm voice becomes a beacon of stability, guiding us through chaos with clarity and purpose. Discipline serves as an anchor, grounding us when emotions threaten to overpower reason. It is in these challenging moments that self-control and quiet resolve shine brightest, allowing us to approach problems with a steady mind and unwavering focus. Like a gentle stream carving through stone, calmness and discipline have the power to overcome obstacles, not through force but through persistence and composure. By cultivating these qualities, we not only weather the difficulties but emerge from them stronger and wiser. Watch Here

Margin of safety

When you have a massive margin of safety from an improperly valued company you can do this. For perspective: Between 2002 and 2003, Berkshire Hathaway invested approximately $488 million in PetroChina. By the time they sold their stake between 2006 and 2007, the investment had grown to about $4 billion, yielding a return of over 700 per cent in five years, or more than 55 per cent annually compounded between 2002 and 2007. Watch Here

It’s more alpha than beta

My glass-half-full interpretation of the markets is that the S&P 500 and ACWI will meander in shallow correction territory while the Mag 7 reprice and the rest of the world outperforms. That seems like a reasonable expectation for the coming months. For diversified investors, it’s more alpha than beta. Read Here

Capital wars and the death of fiscal illusions

In Episode 410 of Hidden Forces, Demetri Kofinas speaks with investors Paulo Macro and Le Shrub about the consequences of a breakdown in the international capital and trading system—and what this means for markets and investor portfolios. Listen Here

Why Trump could lose his trade war with China

Tom Friedman believes the whole Washington consensus on China — that the country is a hostile adversary — is dangerous and based on an outdated understanding of what China now is. He saw how China’s manufacturing and technology have advanced so far that in many ways it now surpasses the United States’. Watch Here

Nobelist Milton Friedman on tariffs

“Any half-baked graduate student can give you 1/2 a dozen special cases for tariffs… The trouble is, that those arguments don’t work in practice. In practice, we put on the WRONG tariffs in the WRONG places in the WRONG way.” Watch Here

Stagflation

Economists once again increased their estimates for U.S. inflation this year. See Here Dallas Fed Manufacturing Index fell to -16.3 for a second consecutive monthly decline. See Here The S&P 500 has typically declined by about 25 per cent around economic recessions. See Here S&P 500 earnings revisions: worst since 2020. See Here Fed’s preferred inflation gauge shows prices increased more than expected in February. Read Here U.S. layoffs are spiking. See Here

China tech revolution

BYD is constructing a massive factory covering 130 square kilometers, larger than cities like San Francisco or Paris. This facility will include homes, shops, schools, and soccer fields for 100,000 workers and their families, resembling a whole town. The goal is to produce over 1 million electric cars annually. Watch Here BYD just unveiled its DiSus-Z Intelligent Suspension System, debuting on the Yangwang U7. See Here Tim Cook explains why Apple chooses China for manufacturing. Watch Here

Charts of the month

Excellent chart here by the Richmond Fed illustrating the impact of tariffs across sectors. See Here U.S. dollar hasn’t had such a challenging start to year in quite some time. See Here Foreign tourism to the U.S. has fallen off a cliff. This is a $100B domestic industry largely concentrated in NYC, southern Florida, southern California, and Las Vegas. See Here Investors are “moving” to Canada See Here Year-to-Date Asset Returns… Yikes! See Here Rising yields, weakening dollar, jump in repo volumes, tighter swap spreads and surging gold suggest an exodus of foreign real money investors. Foreigners hold a lot of dollars assetsif they were to rebalance away then prices have much more to fall. See Here A new kind of geopolitical risk premium – Canadian and Danish institutional investors are, umm, reconsidering the extent of their exposure to the United States. See Here If you find talk of bond and forex markets hard to track, this graph does an amazing job illustrating what’s going on (and why). See Here

Oh Canada.

We are at the economic mercy of the U.S. president because we have not invested in ourselves, we have not innovated in the ways we needed and we have not built the infrastructure required, writes Michael Higgins. Read Here “Trump is the symptom of our problems. I know most Canadians, starting with our national leadership say Trump is our problem.” “Trump has exposed fundamental problems in our economy of rapid declines in productivity.” Watch Here We need wealth creation and not Robin Hood. Read Here ‘We’re seriously outgunned’ in trade war, warns former Bank of Canada governor. Read Here

U.S. shale peaking?

“It’s just going to be painful,” said Dan Pickering, chief investment officer at energy-focused financial services firm Pickering Energy Partners. “What comes next, and we’ve already heard whispers of this, it will be slowing down of drilling activity, releasing frack crews.” Read Here When an oil well produces excess associated natural gas while its oil output declines, it typically indicates that the well is maturing or nearing the end of its productive life. Associated natural gas is the gas dissolved in crude oil under pressure, and as the pressure decreases, more gas is released. See Here Drill, baby, drill doesn’t work at $50-a-barrel. See Here Real-time U.S. crude oil production data pegs April at ~12.7 million b/d. That’s -950k b/d from the consensus average for Q2. See Here

On the Positive

What are you worried about?

Watch this before going to bed tonight. You’re welcome. Watch Here

The power of your mindset

Think about this when talking to or about your spouse, your kids, your coworkers, your employees and your friends. Just change your mindset and watch what you can help shape and create. Watch Here

Unlocking happiness

Some simple but often forgotten key points in life that will unlock happiness. By Allan Watts. Watch Here

We could all use a little bit of this

Citigroup mistakenly credited a customer account with $81 trillion. Read Here

Clutch stuff from Rory Mcilroy

This will go down as one of the greatest shots in Masters history. Watch Here

Everyone is an expert

Having an opinion doesn’t make you an expert. Touch the ground. Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca