INSIDE

Bond Market Breakdown: A Historic Shift

This month we highlight the unprecedented stress in global bond markets, with U.S. Treasuries experiencing their longest drawdown in history—58 months and counting. The traditional role of bonds as a safe haven has been upended by persistent inflation, rising interest rates and waning demand from key buyers like foreign governments and central banks. This “higher for longer” rate environment challenges the conventional 60/40 portfolio model, urging investors to rethink fixed income strategies and embrace more dynamic, diversified approaches.

Housing Headwinds and Bank Stability

We explore growing risks in Canada’s housing market, particularly in Ontario and British Columbia, where mortgage delinquencies and inventory levels are rising. Despite these challenges, Canadian banks have shown resilience, supported by strong capital positions and disciplined risk management. However, the looming “mortgage renewal wall” and elevated interest rates could test their stability. Investors are advised to monitor these developments closely while maintaining diversified exposure to sectors and instruments that can weather economic turbulence.

Strategic Adaptation: Portfolio Resilience

In response to the shifting landscape, we have made a strategic pivot towards asymmetric profile instruments which have delivered strong, risk-adjusted returns while offering downside protection and tailored exposure. Our TWC Risk-Managed Balanced Growth Fund now allocates over a third of its assets to structured notes, with additional exposure to commodities, private equity and alternatives. This reflects a broader philosophy of building portfolios that are flexible, forward-looking and resilient in the face of volatility and fiscal uncertainty.

June 2025: Breaking Bonds

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

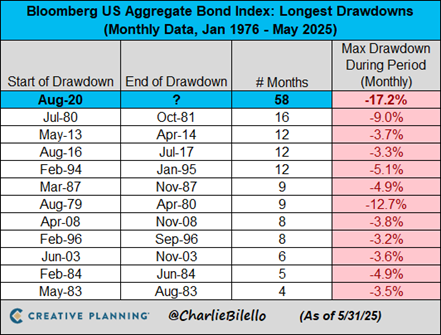

This month we dive deeper into the domestic and global bond market as it’s a risk few seem to be talking about despite being in uncharted territory. According to market strategist Charlie Bilello of Creative Planning, it has now been in a drawdown for 58 consecutive months—by far the longest such stretch in recorded history. Over this period, the bond market has endured a peak-to-trough decline of -17.2 per cent, a staggering figure for an asset class traditionally viewed as a safe haven.

For decades, bonds—especially U.S. Treasuries—have served as the cornerstone of diversified portfolios. They’ve offered stability, income and a reliable counterbalance to equity market volatility. Historically, bond market drawdowns have been relatively short-lived and shallow. But the current environment has flipped that narrative on its head.

What’s driving the drawdown.

Several forces have converged to create this prolonged period of stress. Chief among them is the Federal Reserve’s interest rate policy in response to the risk of persistent inflation. As rates rise, bond prices fall—particularly for longer-duration bonds, which are more sensitive to changes in interest rates. The result has been a steady erosion of bond values, with little relief in sight. Adding to the pressure are concerns about inflation itself. While headline inflation has moderated from its post-pandemic peaks, underlying price pressures remain sticky. Recent tariff threats and ongoing geopolitical tensions have only added to inflationary fears, further undermining confidence in fixed income as an asset class.

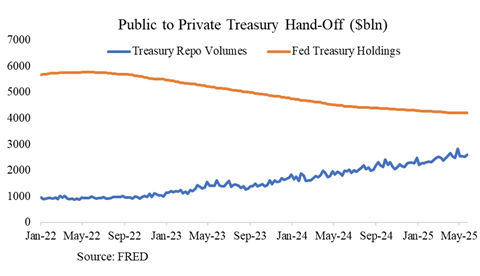

But perhaps the most concerning development is the shifting landscape of bond market demand. According to former Federal Reserve senior trader Joseph Wang, the major buyers of U.S. Treasuries over the past five years have included the Fed itself, foreign governments, hedge funds and domestic banks. Today, that picture is changing (email Martin if you would like a copy of Joseph’s report).

With the Federal Reserve reducing its balance sheet and foreign appetite for Treasuries waning, the burden of absorbing new bonds being issued—expected to exceed US$2 trillion annually due to ongoing fiscal deficits—will increasingly fall on hedge funds and banks. This shift raises serious questions about who will step in to support the market, and at what price.

Does this mean higher for longer?

All signs point to a world where interest rates remain elevated for an extended period. This “higher for longer” environment poses a direct challenge to conventional portfolio construction strategies, particularly the traditional 60/40 stock-bond allocation. Investors who once relied on bonds for downside protection have found themselves exposed to simultaneous declines in both equities and fixed income. The implications are far-reaching. For individual investors, it means rethinking the role of bonds in their portfolios. For institutions—pension funds, insurance companies, endowments—it raises concerns about meeting long-term liabilities and income targets. Bonds, once the bedrock of capital preservation, are now a source of volatility and uncertainty.

This historic bond market drawdown is more than just a statistical anomaly; it’s a wake-up call. It underscores the need for a more dynamic approach to portfolio construction, one that accounts for the possibility of prolonged inflation, fiscal imbalances and shifting demand. Diversification beyond traditional asset classes is becoming increasingly important. Investors are exploring alternatives such as private credit, infrastructure, real assets and structured products to help mitigate risk and generate income. Active management, once out of favour, is regaining relevance as markets become more complex and less forgiving.

The investor rule book has changed.

The bond market’s longest drawdown in history is a stark reminder that even the most stable-seeming assets are not immune to structural shifts. As the financial landscape evolves, so too must the strategies we use to navigate it. For investors, the message is clear: the old rules may no longer apply, and adaptation is not optional—it’s essential.

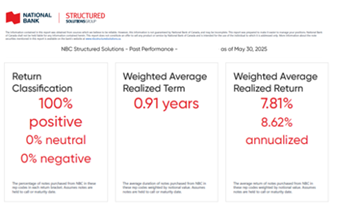

Fortunately, our use of structured notes as a bond replacement has not only met expectations—it has exceeded them. These instruments have proven to be a powerful tool in helping clients navigate a world where traditional fixed income no longer offers the same protection or yield. Structured notes allow us to tailor risk and return profiles to specific market conditions, offering downside buffers, enhanced income and asymmetric upside potential.

For example, we were recently asked to present an institutional proposal on structured notes. As part of our preparation, one of our capital markets partners provided a performance summary of the notes we’ve implemented since April 2021. The results were compelling: across a range of market environments, these notes consistently delivered attractive risk-adjusted returns, often outperforming traditional bonds while offering built-in protection against drawdowns.

We’ve deployed a variety of strategies, including accelerator notes with look-back features, contingent income notes on defensive sectors and buffered equity-linked notes. One of our more innovative structures locked in the lowest point of a Canadian equity basket six months into the term and offered 1.18x the upside from that level, with a 30 per cent downside buffer. Another U.S.-dollar-denominated note offered 1.55x upside participation, capitalizing on higher U.S. interest rates.

These strategies have become a core component of our registered account allocations, where tax efficiency is critical. In many cases, we allocate up to 100 per cent of a client’s RRSP or TFSA to structured notes, allowing for enhanced returns without sacrificing protection. And because these notes are designed to mature with defined outcomes, they provide clarity and confidence in an otherwise uncertain market.

In a world where traditional bonds are no longer the safe haven they once were, structured notes offer a compelling alternative. They allow us to stay invested, manage risk proactively and align portfolios with our clients’ long-term goals. As we continue to navigate this evolving landscape, we believe structured notes will remain a vital part of our toolkit—helping us deliver stability, income and growth in a way that traditional fixed income simply can’t.

Thank you for reading, and please feel free to reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

How Sovereign Debt Stress Is Reshaping Global Markets

The global bond market is facing increasing turmoil, with long-term yields rising across major economies and governments struggling to manage growing debt burdens. Many investors remain unaware of the scale of this unfolding crisis, but recent developments suggest the next phase of financial instability may be driven by weakness in sovereign debt markets.

Japan’s 30-year government bond yield surged to an all-time high last week of 3.14 per cent, following a weak bond auction that highlighted investor concerns over the country’s fiscal stability. The 40-year yield also hit a record 3.6 per cent, reflecting broader unease about Japan’s ability to manage debt without causing market disruptions.

The Bank of Japan (BOJ) is now stuck in a dilemma. If the BOJ raises interest rates to defend the yen or combat inflation it risks increasing debt servicing costs, which could exceed 30 trillion yen (about $289 billion USD) in fiscal 2025 if rates rise just one per cent beyond expectations. Conversely, keeping rates low risks destabilizing Japan’s bond market, as investor demand for long-term Japanese government bonds has weakened significantly.

This may have implications reaching beyond its borders as Japan holds about US$1.13 trillion in U.S. Treasuries, making it the largest foreign holder of U.S. debt. Japanese institutions had already sold off US$119.3 billion worth of U.S. Treasuries in just one quarter, marking the steepest quarterly decline since 2012. This suggests Japan may be offloading U.S. debt to fund domestic obligations or defend the yen, potentially triggering broader market shocks.

U.S. Treasury demand weakens

The situation in Japan is mirrored in the United States, where Treasury auctions are also showing signs of strain. A US$16 billion auction of 20-year Treasury bonds last month saw weaker-than-expected demand, forcing yields higher. The 30-year Treasury yield breached five per cent, reflecting concerns over rising deficits and long-term borrowing capacity.

As a result, Moody’s downgraded its U.S. debt rating, which has intensified investor skepticism. The Federal Reserve’s uncertain monetary policy and growing fiscal instability have further contributed to higher risk premiums for U.S. long-term Treasuries. As confidence in government debt declines, borrowing costs could rise, further exacerbating deficit concerns.

Governments’ spending problem

Despite growing pressure from bond markets, governments continue to resist spending cuts. The U.S. leads in deficit spending, with a deficit that was equivalent to 6.4 per cent of GDP in 2024, according to the U.S. Congressional Budget Office. This is compared to other larger economies, according to Trading Economics, such as France (5.8 per cent of GDP in 2024), the United Kingdom (4.8 per cent in 2024) and Germany (2.8 per cent in 2024). Canada’s deficit to GDP ratio was two per cent, according to the government’s 2024 Fall Economic Statement. Interestingly some countries have moved toward budget surpluses, such as Norway, with -13.20 per cent of GDP in 2024 according to Trading Economics, showing that fiscal discipline is possible despite global headwinds.

There is growing concern that trade uncertainty, particularly in the wake of policy shifts by the Trump administration, could serve as an excuse for governments to maintain large deficits. The spectre of new tariffs, trade wars and economic retaliation could add further pressure to already fragile bond markets.

What this means for investors

Bond markets are applying increasing pressure on governments to confront their fiscal realities, but policymakers seem unwilling to rein in spending. This means that sovereign debt markets will continue to dictate economic conditions in the months ahead, making it critical for fixed-income investors to adapt before the landscape shifts even further.

Rising long-term yields translate to lower returns for bondholders, threatening the traditional 60/40 balanced portfolio. Investors may need to reassess their fixed-income strategies, but caution is required as shifting entirely into equities introduces substantial risks.

Additionally, with governments potentially using inflation as a stealth tool for debt repayment, investors should consider having some exposure to real assets such as commodities to protect purchasing power. Dividend-paying companies in stable sectors such as Canadian utilities can offer defensive income, though volatility will remain elevated.

The unfolding crisis in global bond markets is not something investors can afford to ignore. As debt burdens expand and fiscal discipline remains elusive, adaptability will be the key to preserving wealth. Investors must embrace diversification, balancing fixed income, real assets, structured products and select equities to shield their portfolios from mounting risks. While volatility may continue to dominate markets, strategic positioning can help navigate these turbulent times with confidence.

The Mortgage Wall: Why Canada’s Housing Market Could Test Bank Resilience

Despite a challenging economic backdrop, Canada’s major banks continued to deliver decent results, underscoring the strength of their oligopolistic market structure and operational discipline. Yet, beneath the surface of earnings beats and dividend hikes, a growing undercurrent of risk is emerging—particularly in the housing market.

We’ve noticed that the phrase “cautiously optimistic” has become a staple in the forward guidance of Canadian banks in 2025. While earnings remain robust, management teams are clearly aware of the mounting pressures facing consumers and the broader economy. The banks’ ability to maintain profitability is largely thanks to their scale, pricing power and relentless focus on what they’ve been calling “operational efficiencies.” These advantages have allowed them to weather rising credit costs and margin compression better than many global peers.

However, there is a looming risk that we’re keeping a very close eye on: Ontario’s real estate market. According to Equifax, the province’s 90-plus-day mortgage delinquency rate surged by 71.5 per cent year-over-year in the first quarter of 2025, the highest level since mortgage tracking began in 2012. In total, 1.4 million Canadians, or roughly 1 in 22, missed at least one credit payment during the quarter. These figures point to a growing strain on household finances, particularly in regions where home prices and debt levels soared during the pandemic.

The situation is further complicated by what the Bank of Canada has dubbed the “mortgage renewal wall.” About 60 per cent of all outstanding mortgages in Canada are set to renew in 2025 or 2026. Many of these loans originated during the pandemic at historically low fixed rates, often below two per cent. Even with recent rate cuts, renewal rates remain in the four to five per cent range.

The impact on borrowers could be significant. A indicated that 57 per cent of renewing mortgage holders expect higher monthly payments, with 22 per cent anticipating a substantial increase. Alarmingly, 81 per cent of those facing higher payments say they will experience financial strain, and 34 per cent describe it as “significant.” This wave of refinancing risk could lead to further delinquencies and a potential softening in home prices, especially in overheated urban markets.

And it’s not just Ontario. British Columbia is showing signs of a sluggish market as well.

In Metro Vancouver, inventory levels have surged to some of the highest in more than a decade, with more than 15,000 listings in April alone. Realtors are reporting that buyers are hesitant, and properties are sitting longer on the market. Sales are down roughly 24 per cent year-over-year and remain well below 10-year seasonal averages, reflecting a broader buyer hesitation amid economic and political uncertainty. In a telling anecdote, a local signpost company is now offering credits to realtors who return used signposts—because demand for new listings has outpaced supply of signage.

That said, Canadian banks continue to remain a pillar of stability in an uncertain economic environment. Their ability to manage costs, maintain capital strength and deliver shareholder returns is commendable, especially when viewed against the backdrop of financial volatility. These institutions benefit from a well-regulated financial system, conservative lending practices and a diversified revenue base that includes retail banking, wealth management and capital markets.

One of the key strengths of Canadian banks is their disciplined approach to risk management. Even as credit conditions tighten, most banks have proactively increased their loan loss provisions, bolstered capital buffers and maintained strong liquidity positions. This prudence has helped them absorb shocks from rising interest rates and slowing economic growth without compromising their core operations.

However, not all banks are equally positioned. Institutions with greater international diversification, such as the Bank of Nova Scotia with its Latin American footprint or Toronto-Dominion Bank and Bank of Montreal with their U.S. exposure, may be better insulated from domestic housing market volatility. Conversely, banks with heavier exposure to Canadian consumer lending and real estate, particularly in Ontario and British Columbia, could face more pronounced headwinds.

Investors would be wise to monitor several key indicators in the months ahead.

Asset Allocation & Performance Update

As retail investors continue to bet on a return to the momentum-driven rallies of the past two years—particularly in U.S. equities—we remain cautious. While recent market strength has been encouraging, we believe fragility persists beneath the surface, especially in sovereign bond markets where long-term yields are rising and fiscal imbalances are becoming harder to ignore. The global bond market is no longer the stabilizing force it once was. With the U.S. bond market in its longest drawdown in history and Japan’s long-term yields hitting record highs, the traditional 60/40 portfolio is under pressure. Investors must be prepared for a world where fixed income no longer provides the same protection or predictability.

In this environment, portfolios built on quality, balance and adaptability are best positioned to weather volatility and capitalize on recovery. Rather than chasing yesterday’s winners, we believe investors should use recent rallies as opportunities to rebalance and prepare for what may be a more structurally complex market cycle ahead.

Our current positioning reflects this view. Within our TWC Risk-Managed Balanced Growth Fund, we maintain a diversified allocation that emphasizes flexibility and downside protection. Equity-based structured notes now represent the largest allocation at 35.7 per cent, reflecting our conviction in their ability to deliver asymmetric returns and income with embedded risk management features. Fixed income remains a core component at 25.4 per cent, though we are highly selective in duration and credit quality. Canadian and U.S. equities are held at 13.8 per cent and 10.5 per cent respectively, with a continued emphasis on dividend-paying and value-oriented names. We also maintain exposure to private equity (3.4 per cent) and alternatives (3.0 per cent) to diversify return streams. We recently boosted our commodities exposure (3.0 per cent), buying gold on its dip a month ago as a hedge against the unfolding global debt instability. Our cash and money market holdings total 5.1 per cent, providing liquidity and optionality in a volatile environment.

From a performance standpoint, our TWC fund is up 0.8 per cent year-to-date (as at May 31, 2025), which is in line with our global passive balanced index (composed of 10 per cent S&P/TSX Composite, 50 per cent MSCI Global Equity and 40 per cent Vanguard Global Bond). More importantly, our five-year annualized return stands at 7.8 per cent—well ahead of the 5.7 per cent delivered by the passive benchmark. This outperformance reflects our commitment to active risk management, strategic diversification and disciplined execution.

The key takeaway is that we remain vigilant, flexible and prepared. Rather than overcommitting to short-term narratives or lagging indicators, we are focused on building portfolios that can adapt to a wide range of outcomes. In today’s market, resilience is the new alpha—and that starts with thoughtful, forward-looking asset allocation.

Research, reads of the month

Understanding the scale of unfolding bond crisis

Martin Pelletier, senior portfolio manager for TriVest Wealth at Wellington-Altus Private Counsel, shares his analysis of the bond crisis unfolding. Watch Here

Dimon—I am not a buyer of credit today

Bonds: I think credit today is a bad risk. Equities: an extraordinary amount of complacency. Watch Here. The price of credit default swaps on U.S. Government Debt is rising to its highest level since 2023 and one of the highest levels since 2008. See Here

It’s Over

Efforts to push yields lower can lead to other problems such as a weakening currency and higher inflation. In the U.S., a weaker currency would likely lead to significant declines in the equity market as overexposed foreign investors exit. In any case, the era of big deficits ends when it becomes painful either through higher yields, higher inflation or lower asset prices. Market price action is looking like the end is in sight, and what ultimately follows is a painful period of austerity. Read Here (email Martin if you wish to receive a copy.)

Analysts making larger earnings cuts than average

Q2 EPS estimates for S&P 500 companies according to FactSet. See Here

This is the LARGEST bubble in human history

Bitcoin’s whole story is a staged illusion, scripted by insiders to convince you governments and institutions are “all in”—and that this market is booming on real demand. Read Here

The sky is the limit

Worth a read of Cisco’s Letter to Shareholders in the 2000 Annual Report. Read Here

Apollo: The bubble in AI valuations was simply the result of a long period with zero interest rates

With upward pressures on inflation coming from tariffs, deglobalization and demographics, interest rates will remain high and continue to be a headwind to tech and growth for the coming years. See Here

Canaries

I’ve always watched the RV market for signs of things to come. See Here

U.S. housing market now has 500,000 more home sellers than homebuyers

That’s the most homebuyers have outmatched home sellers in over a decade, according to Redfin. See Here

Ron Butler: Condo Crash Meets Housing Crisis

In this episode of the Missing Middle podcast, mortgage broker Ron Butler sits down with conservative pundit Sabrina Maddeaux and economist Mike Moffatt to discuss the current crisis in the Toronto condo market. Watch Here

Housing isn’t a home anymore

They lined up overnight in the rain…not for shelter, not for food, but for condos that lost 25% of their value before even opening. Metro Vancouver has 2,000+ unsold units and investors still call it a “booming market.” Watch Here. In case you don’t know yet, here’s what’s wrong with the Canadian real estate market in one chart. See Here

The latest federal immigration data

Canada took in 817,000 new immigrants in first four months of 2025.

Important especially to Canadian investors

Buried deep in the more than 1,000-page tax-and-spending bill that U.S. President Donald Trump is muscling through Congress is an obscure tax measure that’s setting off alarms on Wall Street and beyond.

On the Positive

Mindset is Everything

Mathematician George Dantzig was late to class one day in college and copied down a few problems he saw on the board. Thinking they were homework, he completed and turned them in not realizing they were actually two famous unsolved problems in statistics.

Changing your perspective

You can choose to live a reactive life or a creative life. So many of us choose to live a reactive life. Watch Here

An 8-step formula for creating a life of alignment and fulfillment

We don’t agree with everything entrepreneur Vishen Lakhiani says, but there are some interesting gems. Listen Here

How’d I do, Joe? Is that your ATM PIN code?

Podcaster Joe Rogan clearly uncomfortable after ‘mentalist’ Oz Pearlman successfully guesses his ATM PIN code on his recent show. Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca