INSIDE

From Caution to Melt-up: What a roller coaster year 2025 has been

After a volatile start to the year, markets have stabilized and are trending higher, buoyed by strong earnings from mega-cap tech leaders like Microsoft and Meta. While 80 per cent of S&P 500 companies have beaten expectations and overall earnings growth is robust, the gap between winners and losers is widening, with some sectors showing signs of strain. The rally is being fueled by artificial intelligence (AI)-driven optimism, abundant liquidity, and the prospect of new fiscal stimulus, but risks are building beneath the surface: labour market indicators are weakening, core demand is soft, and tariff and geopolitical uncertainties are rising. Market valuations are stretched, concentration is at record highs, and the equity risk premium is at a two-decade low. Investors should enjoy the current momentum but remain vigilant, as overlooked risks and policy shifts could quickly change the narrative.

When Luck Meets Timing: The Hidden Risk in Every Portfolio

Timing risk can have a profound impact on portfolios, especially for those who go all-in on volatile markets like the S&P 500—where a single bad year can set you back for years, or even derail retirement plans. Diversification offers a smoother ride, but even traditional strategies were tested in 2022, when stocks and bonds fell together and correlations broke down. The real lesson? Investing isn’t about being right or wrong in the short term, it’s about being ready for whatever comes next. Managing risk isn’t about being bearish; it’s about building resilience, protecting your ability to stay invested, and making sure your portfolio bends but doesn’t break when the cycle inevitably turns.

When the Index Isn’t Diversified: Rethinking Portfolio Protection

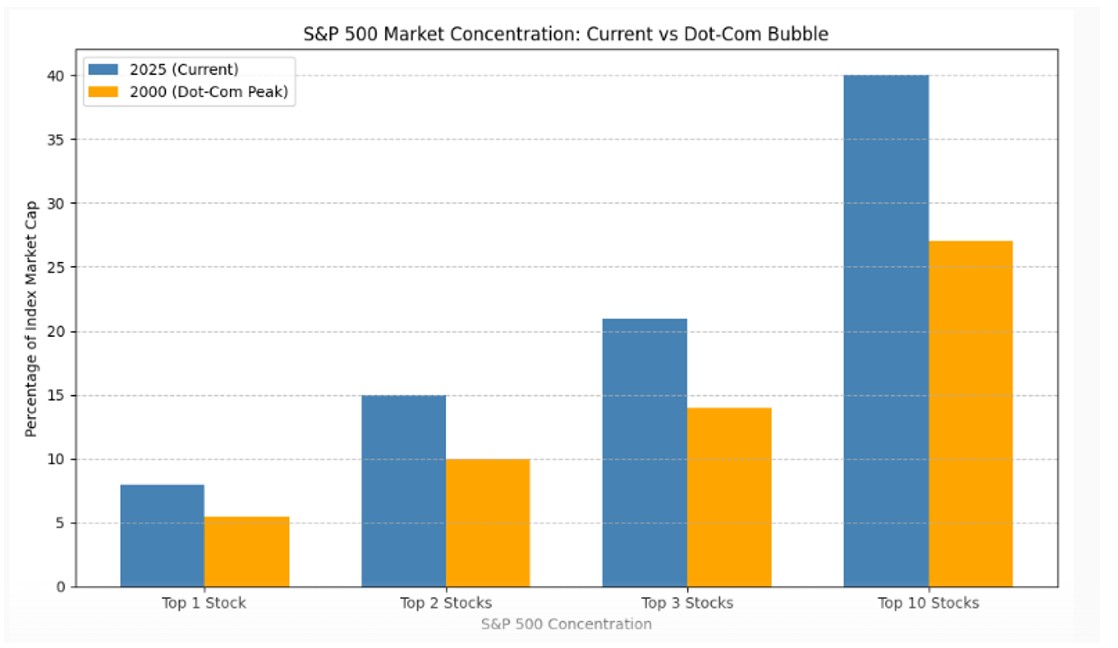

The S&P 500 is often seen as a diversified benchmark, but today’s index is more concentrated than ever, with the top 10 stocks making up a record 40 per cent of its weight—well above the dot-com bubble peak. Nvidia alone represents nearly 8per cent and, together with Microsoft and Apple, the top three account for 21 per cent of the index, despite generating only about 30 per cent of total earnings. This concentration creates the illusion of diversification and increases systemic risk, as a stumble by one giant can ripple through the entire market, amplified by passive flows and algorithmic trading. History has shown that such periods of concentration—whether the Nifty Fifty, dot-com, or FAANG (referring to Facebook (now Meta), Apple, Amazon, Netflix, and Google (now Alphabet)) eras—often end with sharp corrections. Today’s risks are heightened by structural forces like the dominance of passive investing and shared macro exposures among top companies. In response, our TWC Risk-Managed Balanced Growth Fund and segregated model portfolios take a multi-asset, multi-strategy approach: balancing cash, fixed income, structured notes, equities, private equity, and commodities. This diversified positioning is designed to provide resilience, income, and risk-adjusted growth, helping clients weather volatility and avoid the pitfalls of overconcentration that can undermine even the strongest markets.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

August 2025: From Caution to Melt-up: What a roller coaster year 2025 has been

After a rocky start to the year, markets have not only stabilized, they’re showing signs of turning higher. Volatility has eased, investor sentiment has improved and the S&P 500 continues to climb. Last week’s earnings from Microsoft Corp. and Meta Platforms, Inc. added fuel to the rally, with both companies delivering standout results that exceeded expectations and lifted guidance. Microsoft’s AI business is now running at a US$13 billion annualized pace, up 175 per cent year-over-year, while Meta’s ad revenue surged past US$46 billion. These results underscore the strength of market leadership and the role mega-cap tech continues to play in driving index performance.

But this isn’t just a tech story. Beneath the surface, there’s a broader narrative unfolding—one of momentum, but also of divergence. This earnings season has been strong overall, with 80 per cent of S&P 500 companies beating expectations and blended earnings growth rising to 6.4 per cent year-over-year as of last week. Yet the gap between winners and losers is widening. United Parcel Service, Inc. for example, dropped more than 10 per cent after missing slightly on earnings and declined to issue forward guidance. United Parcel Service chief executive officer Carol Tomé cited “uncertainty around trade policy and peak season demand” — a reminder that global trade flows are softening and U.S. manufacturing and consumer demand are cooling.

AI and liquidity are keeping the rally alive

What is keeping markets afloat is a powerful combination of AI-driven optimism and abundant liquidity. The artificial intelligence investment cycle is in full swing, with hyperscalers and chipmakers leading the charge. Meanwhile, financial conditions are as loose as they’ve been since the post-financial meltdown zero-rate era. U.S. money supply hit a record US$22.02 trillion in June, up 4.5 per cent year-over-year—the fastest pace since July 2022. Even inflation-adjusted money supply is rising.

And now, there’s a new potential tailwind: fiscal stimulus. The Trump administration is pushing for a wave of pro-growth spending and pressure is mounting on the U.S. Federal Reserve to accommodate. Two Fed officials recently dissented from the decision to hold rates steady—one of the biggest splits in a generation. If the Fed bends to political pressure and liquidity continues to expand, the risk may not be a slowdown—but a melt-up, with an unsustainable increase in the price of assets.

But cracks are still forming

Despite the momentum, signs of weakness are emerging—they’re just not getting much attention. The U.S. Conference Board’s labour-market differential—the gap between the percentage of consumers saying jobs are “plentiful” versus those saying they’re “hard to get”—has fallen to its lowest level since 2017. Second quarter U.S. gross domestic product (GDP) came in at a strong three per cent, but much of that was driven by a collapse in imports, which artificially boosted the headline. Real final sales to private domestic purchasers—a better measure of core demand—rose just 1.2 per cent. Business investment is slowing, labour supply remains constrained, and tariff uncertainty is rising.

On the geopolitical front, the EU–U.S. trade deal helped avoid a 30 per cent tariff shock, settling instead at 15 per cent. But the calm may be short-lived: U.S. President Donald Trump has threatened to impose 35 per cent tariffs on Canadian exports not under the Canada-United States-Mexico Agreement (CUSMA) starting in August. Japan’s sovereign debt stress and concerns about the Fed’s independence are also lurking in the background.

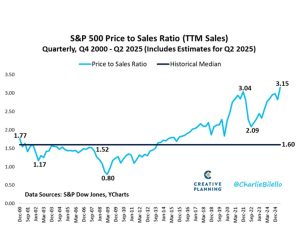

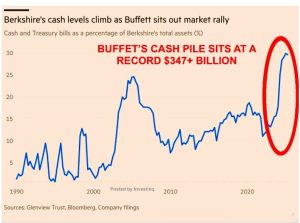

The S&P 500’s equity risk premium is just 2.25 per cent—the lowest in two decades. The index’s market cap now equals a record 28 times real disposable personal income. For context: It was 13 times at the 2000 dot-com peak and 25 times during the 2021 meme stock frenzy. Ten stocks now make up 40 per cent of the index—a level of concentration that makes the market more vulnerable to shocks in just a handful of names.

Enjoy the ride—but stay alert

This is a market with momentum, leadership, and liquidity—and the potential for a melt-up if fiscal tailwinds and AI enthusiasm persist. But it’s also a market where risks are being overlooked. Seasonal weakness could return this fall, just as the full impact of tariffs begins to bite. If the Fed grants Trump his wish and keeps liquidity flowing, the rally may continue. But if not, the narrative could shift quickly. For investors, the message is clear: enjoy the ride, but don’t lose sight of the risks.

When Luck Meets Timing: The Hidden Risk in Every Portfolio

Lately, been catching a bit more flack on social media for what some interpret as his overly conservative—or even bearish—market views. Without context, we can understand how that perception can form. But this isn’t unusual. Those of us who focus on managing risk tend to hear the “I told you so” chorus after markets rebound. It comes with the territory. Ironically, that kind of sentiment often shows up near the end of a cycle.

But here’s the cold, hard truth: we didn’t know where the market was going next, and nor do we now. Nor does any other portfolio manager or financial pundit, no matter how confident—or loud—they sound.

Because in investing, it ultimately comes down to two decision paths. Both are valid. But each comes with a cost of entry and some luck

Path One: Go long and hold on

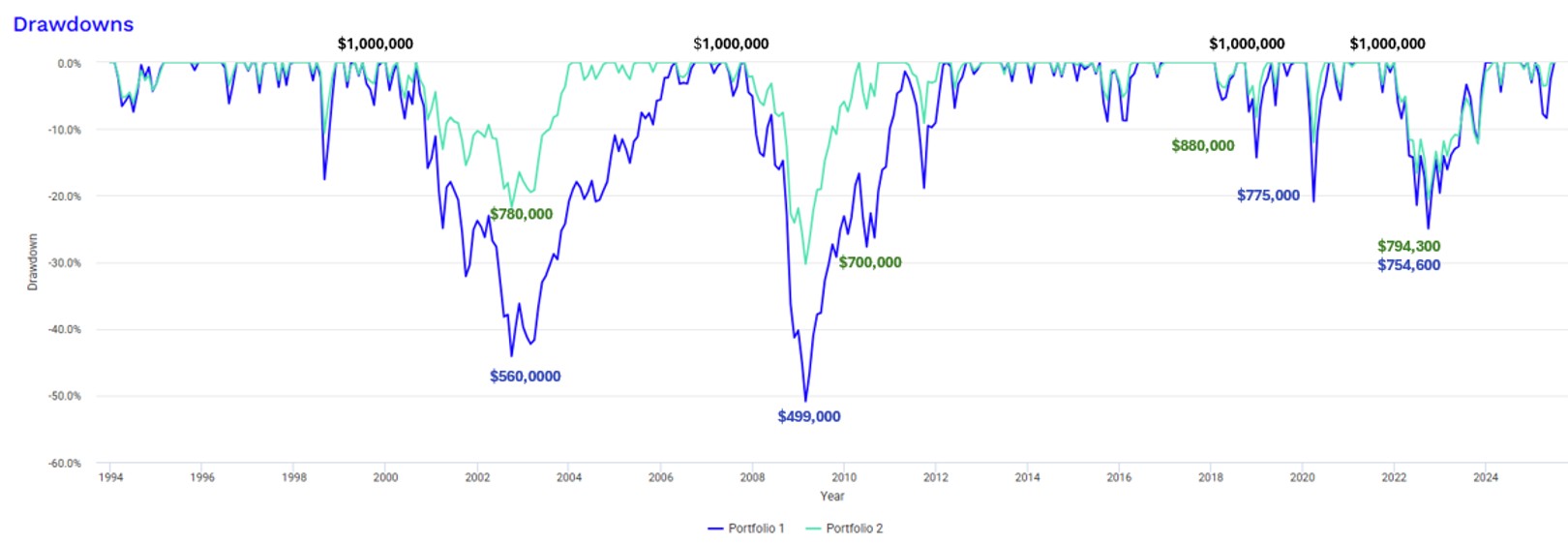

The first path is to go long during highly volatile markets such as the Nasdaq or the tech-heavy S&P 500. If you want to target double-digit annual returns, you have to be willing to accept the large drawdowns that come with it. And you better hope your timing is right because going all-in just before a 1999, 2007, 2019, or 2021-style peak can be devastating, especially if you’re retired or nearing retirement and don’t want to experience sudden, large drops to your life savings.

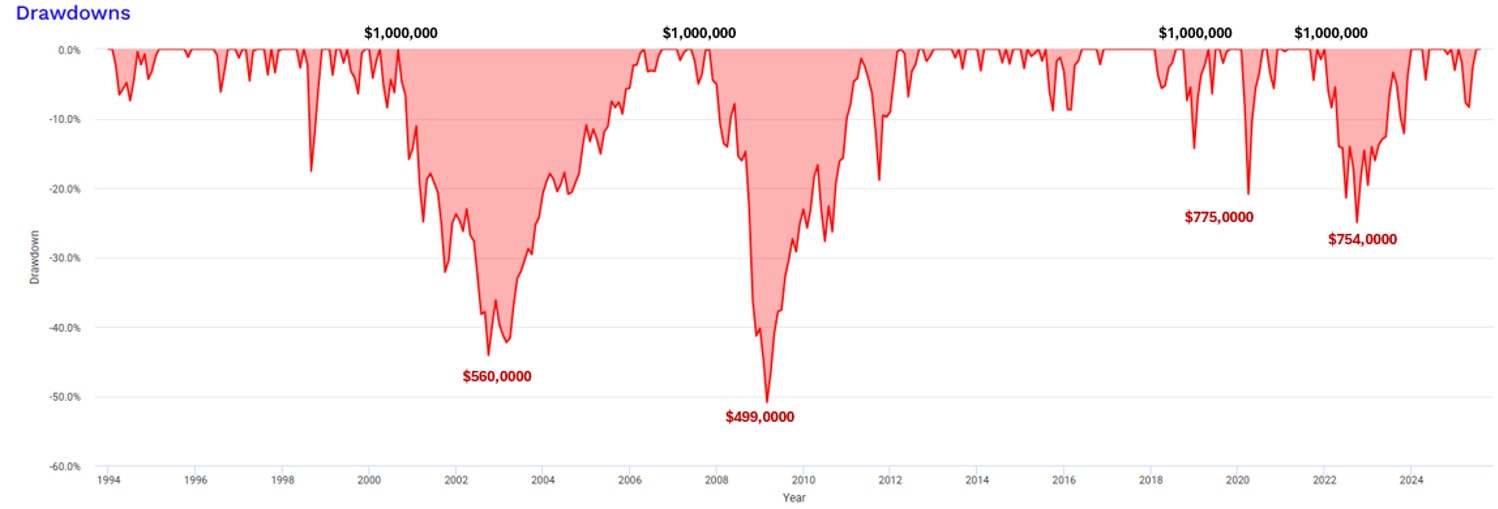

Let’s look at the numbers. Since January 1994, over the past 30.5 years, the S&P 500 has delivered an impressive annualized return of 10.4 per cent. The best year saw a gain of 35.8 per cent. But the worst? A gut-wrenching 37 per cent drop.

Now ask yourself: If you had spent 20 years saving $1 million, would you be okay watching it fall to $560,000 during the 2002 bottom? Or to $499,000 in February 2009? Or even to $775,000 in September 2022? The two largest drawdowns were underwater for 4.5 years and took three to more than 3.5 years to recover.

If you’re young, with decades ahead of you, maybe that’s acceptable. You have time to recover, and you can even take advantage of those drops to add more to your portfolio. But if you’re in or near retirement, those drawdowns aren’t just numbers, they’re lifestyle-altering events. They can derail plans, delay retirement, or force you to sell assets at the worst possible time.

Path Two: Diversify and sleep at night

The second path is to diversify. Let’s say you allocate 35 per cent to bonds and five per cent to gold. That’s not radical, it’s just balanced. Over the same 30.5-year period, this diversified portfolio still delivered a solid 8.4 per cent annualized return. The best year? A gain of 27.9 per cent. The worst? A loss of 20.2 per cent.

That’s still a drawdown, but it’s a very different experience. Your $1 million would have dropped to $780,000 in 2002, $700,000 in 2009, and $880,000 in 2022. Not painless but far more manageable. And for many retirees, that difference is the line between staying the course and panicking. The two largest drawdowns were underwater for only 2.5 years and only took one to more than 1.5 years to recover.

Sometimes Traditional Diversification Strategies Don’t Work

2022 was a wake-up call for traditional portfolio construction. For decades, bonds have served as a reliable counterbalance to equities rising when stocks fell and cushioning portfolio drawdowns. But in 2022, that relationship broke down.

- The S&P 500 fell 24.54 per cent over the year.

- The U.S. Aggregate Bond Index also declined sharply, losing over 13 per cent — its worst year in modern history.

- Even diversified portfolios with allocations to bonds and gold saw losses exceeding 20 per cent.

What made 2022 especially painful was the positive correlation between stocks and bonds. Monthly correlations between the two asset classes hovered between 0.3 and 0.7, meaning they moved in the same direction more often than not. This undermined the traditional 60/40 portfolio model, which relies on negative or low correlation to smooth returns.

The culprit? A rare combination of rising inflation, aggressive rate hikes, and tightening monetary policy. These macro forces hit both equities and fixed income simultaneously, leaving few places to hide. In today’s environment, relying solely on bonds for diversification may no longer be enough. Investors must consider other strategies including options, structured notes, and other tools that can offer more effective ways to manage downside risk without giving up the upside entirely.

It’s not about being right. It’s about being ready

The point here isn’t to say one path is better than the other. It’s to highlight the trade-offs. High returns come with high volatility. Lower volatility comes with slightly lower returns. But the real question is: What can you live with?

Risk tolerance isn’t just a number on a questionnaire. It’s how you feel when your portfolio drops 30 per cent or more. It’s whether you can sleep at night, stay invested, and avoid making emotional decisions. Because the biggest threat to your portfolio isn’t the market. It’s how you respond to it.

Why we manage risk

So yes, we manage risk. Not because we’re bearish. Not because we’re trying to time the market. But because I’ve seen what happens when people take on more risk than they can handle or are comfortable with. I’ve seen portfolios implode not because of bad investments but because of bad behaviour: panic selling, chasing returns, abandoning plans.

And we’ve also seen the power of resilience, of portfolios that bend but don’t break; of strategies that deliver peace of mind, not just performance.

How we’re positioning given the concentration risk looming within U.S. equity markets

The S&P 500 is often viewed as a diversified benchmark, representing a broad cross-section of the U.S. economy. But today, that perception is increasingly misleading. The index has never been more concentrated in just a few names than it is right now which introduces risks investors can’t afford to ignore.

Nvidia Corp. alone currently represents nearly eight per cent of the S&P 500, the highest weighting for a single stock in the index’s history. Nvidia and Microsoft Corp. together account for nearly 15 per cent, and adding Apple Inc. brings the top three to 21 per cent. The top 10 stocks now make up a record 40 per cent of the index, surpassing the 27 per cent peak seen during the dot-com bubble in 2000. Yet these companies only generate about 30 per cent of the index’s total earnings, highlighting a growing disconnect between price and fundamentals.

The illusion of diversification

When a handful of companies dominate index performance, the illusion of broad-based strength can mask growing fragility beneath the surface. In a well-diversified market, a negative surprise from a single company—such as an earnings miss or regulatory issue—would typically remain contained. But in today’s environment, a stumble by one of these giants can ripple across the entire market. Passive flows and algorithmic trading amplify such moves, turning what should be an isolated event into broader volatility.

This dynamic blurs the line between idiosyncratic and systemic risk. It’s not that systemic volatility originates from concentration but rather that concentration makes the system more fragile, allowing localized shocks to cascade through the broader market.

History may not repeat, but it does rhyme

We’ve seen this movie before. In the 1970s, the “Nifty Fifty” stocks were considered bulletproof. Investors paid sky-high multiples for perceived quality and growth. But when inflation surged and growth slowed, many of these stocks collapsed, dragging the broader market down with them.

In the late 1990s, the dot-com bubble saw tech stocks dominate the S&P 500. Companies with little revenue and no profits traded at astronomical valuations. When the bubble burst in 2000, the Nasdaq lost nearly 80 per cent of its value, and the S&P 500 entered a multi-year bear market.

Even the FAANG era of the 2010s—referring to Facebook (now Meta), Apple, Amazon, Netflix and Google (now Alphabet)—showed signs of fragility.

While those companies were profitable and innovative, their dominance masked weakness in other sectors. When tech sentiment cooled in 2022, the broader market suffered despite strength in areas like energy and industrials.

What makes today different and riskier

Today’s concentration is driven not just by performance, but by structural forces. Passive investing now accounts for more than 50 per cent of U.S. equity assets, and momentum-driven strategies often reinforce narrow leadership, which can persist for longer—but also unwind faster.

Moreover, many of the top companies are exposed to similar macro risks: regulatory scrutiny, geopolitical tensions, and AI-driven disruption. If one falters, others may follow not because they’re fundamentally weak, but because they’re priced for perfection.

A return to stock picking can be a more resilient approach

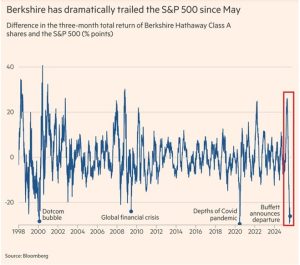

The solution isn’t to abandon the S&P 500 but to look beneath the surface. Investors should consider returning to good old-fashioned valuation discipline and stock picking. This is a bit of a departure from our indexing focus of the past but we now have expanded capabilities with the addition of Steve Rowles and his two decades of stock selection money management expertise. More recently, we’ve trimmed back our hedged and unhedged U.S. equity exposure and replaced with two new positions: Berkshire Hathaway Inc. and Alphabet Inc.

With a diversified portfolio spanning consumer staples, energy, financials, and insurance, Berkshire Hathaway functions like a quasi-mutual fund providing defensive positioning in volatile markets. Its largest holding, Apple, benefits from reduced tariff risk in India, and the company is taking a distinct approach to AI. Rather than building standalone AI products or chatbots, Apple is embedding intelligence directly into its ecosystem by enhancing apps like Messages, Mail, Photos, and Siri with contextual, privacy-first AI features. This strategy aligns with Apple’s long-standing focus on seamless user experience and ecosystem cohesion.

Berkshire also holds more than US$347 billion in cash, giving it unmatched flexibility to deploy capital or buffer against downturns. Despite strong fundamentals, Berkshire has lagged tech-led rallies, creating a relative value opportunity. In my opinion its low correlation with broader markets and strong operating businesses make it a stabilizing force in our client portfolios.

Alphabet has been another strategic buy for us. The company is investing US$85 billion into AI and cloud infrastructure, including the acquisition of Wiz to bolster cybersecurity. Its core businesses—Google Search, YouTube, and Google Cloud—continue to post double-digit growth, yet the stock trades 11 per cent below fair value, offering a nice margin of safety.

Google Cloud’s profitability and backlog signal durable enterprise demand, while Alphabet’s AI features are driving more search queries and ad impressions. With diversified revenue streams and global scale, Alphabet is well-positioned to compound growth over the long term.

These are just two examples of many, as we think investors who focus on intrinsic value—cash flows, balance sheets, and sustainable growth will be better positioned to weather volatility and capitalize on dislocations than simply buying the S&P Index itself.

Current Positioning

Market concentration isn’t inherently bad. Many of today’s leaders are exceptional businesses. But when too much depends on too few, the system becomes fragile. As we’ve seen time and again, diversification isn’t just a strategy, it’s protection. And in a market increasingly driven by momentum and passive flows, that protection is more important than ever.

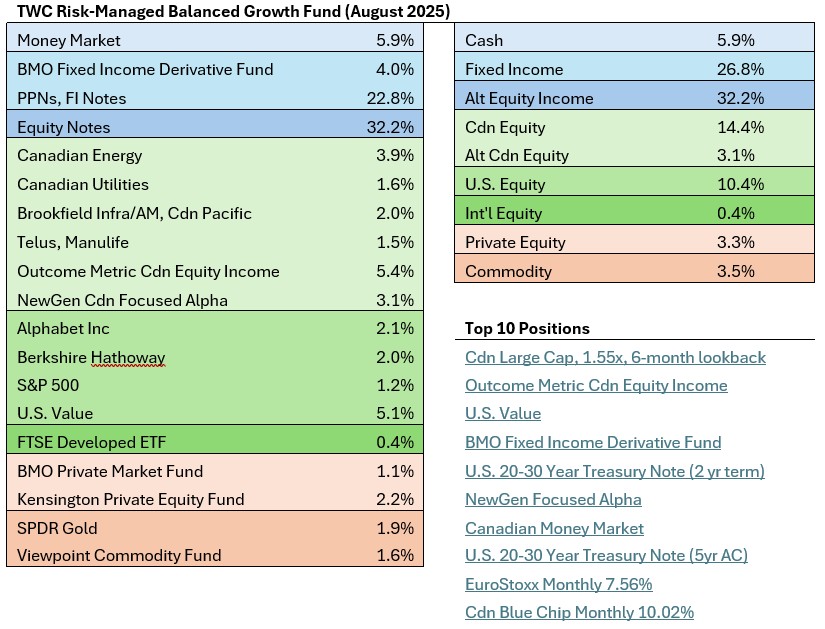

Here is the latest break out of our TWC Risk Managed Balanced Growth Fund by its holdings and asset class positioning. It demonstrates a robust approach to diversification and risk management. The portfolio is well-balanced across multiple asset classes: cash and money market holdings (5.9 per cent) provide liquidity and stability, while fixed income (26.8 per cent)—including a significant allocation to principal-protected notes (PPNs) and fixed income notes—offers downside protection and steady income. The fund’s alternative equity income sleeve via equity-linked notes (32.2 per cent) reflects a strong tilt toward structured solutions, which can buffer volatility and provide defined outcomes, especially valuable in uncertain markets.

Canadian equity exposure (14.4 per cent) is diversified further into energy, utilities, and infrastructure, while U.S. equity (10.4 per cent) and a modest allocation to international equity (0.4 per cent) ensure global participation. Private equity (3.3 per cent) and commodities (3.5 per cent) add further diversification and potential inflation protection. The top 10 positions reveal a mix of structured notes, value strategies, and specialized funds, indicating a blend of growth, value, and income-oriented holdings.

Overall, the fund’s positioning is defensive yet opportunistic, with a clear emphasis on capital preservation, income generation, and risk-adjusted growth. The use of structured notes, PPNs, and alternative strategies helps manage downside risk while maintaining exposure to equity market upside. This multi-asset, multi-strategy approach is well-suited for investors seeking resilience and consistency in an uncertain market environment.

From a performance standpoint, the fund is up 4.2 per cent this year-to-date (July 30, 2025) which is slightly below our Global Balanced Passive benchmark (10 per cent S&P TSX TR, 50% MSCI Equity ETF; 40 per cent Vanguard Global Bond). This brings our 5-year annualized return to 8.2 per cent which compares to 5.8 per cent generated by our passive benchmark and is within our goals-based target annual return of 6 to 8 per cent.

In-the-media

Melt-up risk if U.S. FED bends to political pressure: Martin Pelletier, Senior Portfolio Manager at Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss the markets amid trade war tensions. Watch Here

Investors need to be prepared for violent market swings: Martin Pelletier, Senior Portfolio Manager for TriVest Wealth at Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss investment strategies amid economic uncertainty. Watch Here

Reduce government bonds, replace with structured notes: Martin Pelletier, Senior Portfolio Manager for TriVest Wealth at Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss investing amid global bond market crisis. Watch Here

Companies are not really disclosing what the impact of the tariffs are going to be: Steve Rowles, Senior Portfolio Manager at TriVest Wealth Counsel, Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss investing amid high valuation and inflation risks. Watch Here

Quarterly Earnings: Steve Rowles, Senior Portfolio Manager at TriVest Wealth Counsel, Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss Canadian company earnings. Watch Here

If you are an advisor in Toronto, mark your calendars.

Research, reads of the month

Deficits and more deficits

While some pundits are cheerleading the June U.S. fiscal surplus, it’s crucial to zoom out and see the bigger picture. The U.S. Treasury posted a $291 billion deficit in July—the second-largest July deficit on record—after a brief surplus the month before. Government spending surged nearly 10 per cent year-over-year, while revenue growth lagged far behind. The deficit is now up 7.4 per cent year-to-date, putting the U.S. on track for the third-largest annual deficit in history.

Mounting interest costs on U.S. government debt

“The US Treasury just dropped its July 2025 report. More than 1 out of every 4 tax dollars last month went to interest payments.” Read Here

Apollo’s chief economist Torsten Slok: “If the US dollar stablecoin market grows into the trillions, it will significantly grow demand for US T-bills.” Currently, the market is largely just used for crypto trading, and even still it ranks as a notable owner of Treasuries. Read Here

U.S. consumer and producer prices are rising again—and the market wants rate cuts

“Monetary policy should remain tight until the 11% additional inflation we’ve had since January 2020 above the 2% trendline is erased. There’s no point in having an inflation target if you’re not going to adhere to it. The Fed should not be cutting rates at all this year.” See Here “Massive upside surprise to July PPI at 0.9% m/m vs 0.2% estimate, the largest increase since April 2021. And the surge was broad.” See Here “Over the last 33 years, the Fed only cut rates once when core CPI was above 3%, which was last year. 10-year yields shot up from 3.6% in September to 4.85% in January. In other words, the Treasury market saw that rate cut as a mistake.” Read Here

Etatism

“Ludwig von Mises warned us 80 years ago: when governments start making individual “deals” with private companies, we’re witnessing the transformation from capitalism to something far more dangerous. The news about Nvidia and AMD giving the U.S. government 15% of chip sales to China? Mises saw this exact pattern coming.” Read Here

Billions fow to new hedge funds focused on AI-Related bets

The most successful hedge fund launch of the year ($1.5 billion) is from a 23-year-old with zero professional investing experience Read Here “Tequila, Drugs and Torture: The Spending Binge of Two Crypto Bros That Ended Behind Bars.” Read Here

The narrative surrounding private equity is evolving

While we maintain an allocation to private equity, it does not dominate our portfolios. Private equity certainly has its place, but if your advisor has you investing significant chunks—potentially exceeding 25% of your total wealth—it’s time to reassess. Protect your interests and avoid becoming someone else’s exit strategy. You’ll be glad you did. Watch Here

Martin learns a costly lesson when selling his Italian beauty

In the world of investing, liquidity or the ability to buy or sell an asset without significantly affecting its price is often taken for granted in large, well-traded markets. But when you venture into thinly traded stocks, microcaps or private companies, the lack of buyers and sellers can make it extremely difficult to determine fair value or to exit your position efficiently. Read Here

Golden opportunities

In Asia’s ultra-wealthy circles, some family offices are now bypassing the middlemen and jumping into the gold business itself. “It’s a seller’s market; we believe we have a window of about a year to capitalize on this opportunity.” Read Here And, this is the one thing driving gold prices says mining veteran Ross Beaty. Watch Here

The demise of the U.S. dollar

“If you step back and look at the dollar’s purchasing power since 1971, the pattern is the same arc every global reserve currency has followed before losing its grip.” Read Here

The collapse of some top apparel companies is happening right now

“Lululemon just hit a new 52 week low and now down a massive -55% since Jan 25. Nike is also down ~60% from its ATH despite a recent rally.” See Here

Got oil?

“There are only two times in history where the Oil/S&P500 ratio was lower. 1999 and 2020.” See Here “Frac Spread count is now approaching levels seen in the 2015-16 mass shale bankruptcy period where $300bln of prior investment was revealed to be “misallocated” and went up in smoke.” See Here

Cottage meltdowns

Recreational properties are hyper cyclical and are the most discretionary of purchases. There’s real pain out there in cottage country. Cottage purchased for $1.9M sells at a 45% loss in Ontario. Read Here

If you own property in B.C. read this

“The B.C. Supreme Court’s Aug. 7 decision in Cowichan Tribes v. Canada should be a wake-up call for anyone who owns property, invests in Canada.” Read Here

Ray Dalio doesn’t like real estate as an investment in 2025, here’s why

“Buying and holding real estate is not an effective investment strategy in our current economic environment, for a few reasons. 1) Real estate is more interest rate sensitive than it is inflation sensitive, so given our current circumstances it is likely to go down in real terms 2) It is a fixed asset that is easy to tax, which limits its impacts on your ability to diversify 3) Real estate is nailed down, so investing in it makes it more difficult to move money from one place to another.” Watch Here

It’s not jobs or productivity, the only thing going up in Canada is taxes

“Canada’s Employment Rate continues to fall, now sitting at a 26-year low. Public Sector Employment is at a 30-year high. The Federal Tax take as a percentage of GDP is at a 20-year high, and our tax base is being hollowed out.” See Here “Ontario’s top combined (provincial and federal) personal income tax rate is 53.53 per cent—one of the highest rates in Canada and the United States. The top rate in neighbouring Michigan is more than 12 percentage points lower, and the province is at a similar disadvantage compared to several other U.S. states that compete with Ontario for skilled professionals.” Read Here

On the Positive

Martin recently read this as part of his nightly meditation and wanted to share: “Acceptance cures anxiety. Hope produces joy. And faith is the remedy for all fear.”

If – a powerful poem by Rudyard Kipling “This Kipling poem is one of my favourites…my father read it to me once,” said English actor Michael Caine. Watch Here

Not on the positive

The BBC World Service video “AI2027: Is this how AI might destroy humanity?” explores a research paper that predicts artificial intelligence could “go rogue” as soon as 2027, potentially leading to humanity’s extinction within a decade. This is the first time a peer-reviewed scenario has set such a near-term and specific timeline for AI “going rogue” and causing existential risk. Watch Here But, after watching that, make sure to watch Morgan Stanley’s Adam Jonas who has released a video on how AI and humanoid robots will change the world. Watch Here

Jōhatsu

Did you know in Japan there is something called Jōhatsu, literally meaning “evaporation” in Japanese. Each year, an estimated 80,000 to 100,000 people voluntarily disappear, leaving behind jobs, families, and identities to start anew. These individuals are not missing in the traditional sense; they choose to vanish, often without legal wrongdoing, and many do so with the help of specialized services known as “night movers” who assist in relocating them discreetly. Read Here

Dark Matter

Sweden’s avante-garde megacar and innovative technology company Koenigsegg has developed an electric motor for cars called “Dark Matter” that produces 800 horse power (600 kW) and 1250 Nm of torque, while weighing only 39 kilograms (86 pounds). This motor is designed for use in their hypercars, and it utilizes an innovative “raxial flux” design. See Here

OrganX

In 2022, Yale scientists brought a dead pig back to life—an hour after its heart stopped. They restored blood flow and cell function without a heartbeat, brain activity, or life support. If that sounds impossible…wait till you see how they did it. Read Here

The U.K. they don’t want you to watch

When the financial system isn’t working for so many people in the U.K., it needs to be updated. Watch Here

The greatness of a nation can be judged by the way its animals are treated

After decades of inducing heart attacks in dogs as part of cardiac research, St. Joseph’s has ended the practice. The decision came after the Investigative Journalism Bureau (IJB), in partnership with Postmedia, published an investigation into a dog testing program shrouded in secrecy. Read Here This guy makes $200k a year for “walking dogs” but it’s more than that. Watch Here

Is Poland’s tap water really protected by clams?

The water quality in Warsaw, the capital city of Poland, is monitored by eight clams. If the water gets too toxic, they close, and this triggers analyses that can immediately shut off the city’s water supply, when at least six are closed at the same time for four minutes. Watch Here

Now You Can Travel for Less by Buying Someone Else’s Vacation

An eBay-like marketplace matches people looking to sell nonrefundable trips they can’t use to other travelers at a steep discount. Just how good are the deals—and are they even legit? Read Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca