INSIDE

The Fed’s Grip Is Slipping — and the Debasement Trade Is Front and Centre

The U.S. Federal Reserve’s growing reliance on balance sheet maneuvers and liquidity injections signals a structural shift toward what we call the debasement trade — a strategy built on the erosion of currency value as policymakers prioritize financial stability over inflation control. With the U.S. dollar down 9 per cent year-to-date, its sharpest drop since 1973, and the Fed expected to resume T-bill purchases amid repo stress, money supply expansion is accelerating. This liquidity-driven environment inflates asset prices while wages stagnate — housing affordability would require a 40 per cent price drop or a 60 per cent wage increase, neither is likely — widening inequality and fueling political risk. Central banks are hedging aggressively, buying over 1,000 tonnes of gold annually for four years, pushing gold’s share of reserves higher as de-dollarization gains momentum. For investors, the playbook is clear: allocate to assets that can’t be printed which includes stocks, gold, silver, commodities, and infrastructure — as the Fed quietly shifts from tightening to monetizing deficits, keeping the debasement trade firmly in effect.

A Closer Look at the K-Shape U.S. Economy

The U.S. economy in late 2025 is a textbook example of a K-shaped recovery, where the upper leg of the “K” reflects booming sectors like artificial intelligence (AI) and affluent households driving elite consumption, while the lower leg represents stagnation or decline for the broader population and traditional industries. Despite headline GDP growth of 3.9 per cent, only 18 per cent of the U.S. economy is actually expanding, with the top 10 per cent of earners now responsible for half of all consumer spending. This extreme concentration of wealth and investment is masking widespread economic weakness, job losses, and declining demand in core consumer sectors. As AI-driven capital expenditure inflates asset prices and fuels market optimism, the bottom half of the income spectrum faces mounting pressure, political polarization, and economic exclusion — a dynamic that presents both opportunity and risk for investors.

Canada’s Hidden Fiscal Risk: Why Investors Shouldn’t Be Fooled by the Numbers

Canada’s latest federal budget paints a deceptively optimistic fiscal picture, citing a low net debt-to-GDP ratio to justify a ballooning C$78.3 billion deficit. However, this figure includes assets from the Canada and Quebec Pension Plans — funds not available to service federal debt — masking the country’s true fiscal vulnerability. When provincial liabilities are properly accounted for, Canada’s gross debt-to-GDP ratio soars to 113 per cent, placing it among the most indebted advanced economies. With rising debt servicing costs, no new revenue measures, and a highly leveraged household sector, Canada faces mounting sovereign credit risk. Foreign ownership of Canadian debt is also elevated, raising the stakes should investor sentiment shift. At TriVest Wealth Counsel, we believe the risks are being dangerously underestimated and have zero exposure to Government of Canada bonds as a result.

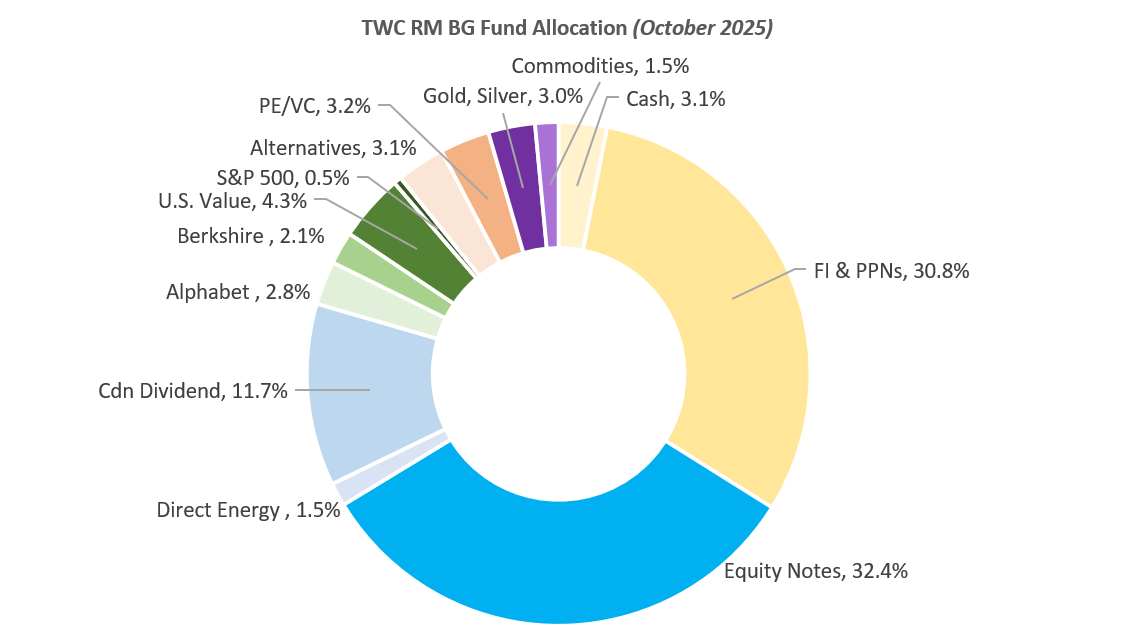

Positioned for Resilience: Risk-Managed Growth in a Debasement-Driven Market

In line with American investor Joel Greenblatt’s philosophy that the best positions are those least likely to lose money, our TWC Risk-Managed Balanced Growth Fund continues to track this year’s market rally while maintaining a defensive posture. Despite being underweight on direct equities, our structured note strategy and selective equity exposure — including Alphabet (+40 per cent), gold (+25 per cent), and NewGen Focused Alpha (+21 per cent) — have contributed meaningfully to performance. We also realized a 54 per cent gain in MEG Energy ahead of its acquisition. Looking ahead, we remain overweight on structured notes and Canadian dividend stocks, while balancing AI exposure through Alphabet and Berkshire Hathaway. Importantly, we’ve added strategic exposure to gold and silver as a hedge against U.S. dollar debasement, which we view as structural rather than cyclical. With the U.S. Federal Reserve expected to resume T-bill purchases and central banks prioritizing liquidity, we believe precious metals, including our holdings in SLV, SVR, GLD, and Agnico Eagle Mines, are well-positioned to benefit from the ongoing shift toward real assets.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

November 2025: The Fed’s Grip Is Slipping — and the Debasement Trade Is Front and Centre

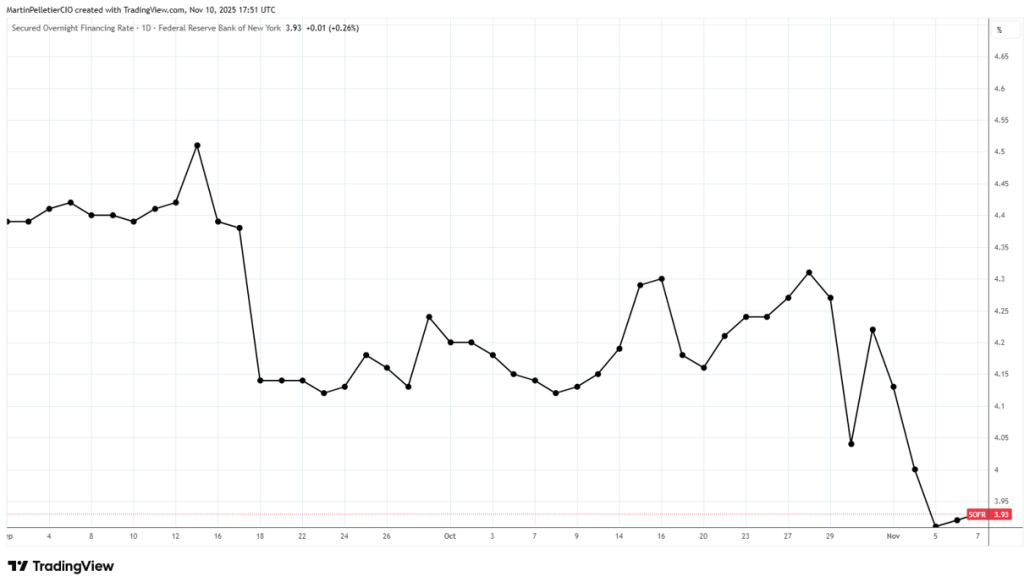

A few weeks ago, U.S. Federal Reserve chair Jerome Powell made a striking admission: if the Fed stopped paying interest on bank reserves, it would lose control of interest rates. That’s not just a technical detail — it’s a signal that the Federal Reserve is increasingly relying on artificial tools to steer the economy rather than letting market forces do the work. For years, banks were flush with reserves from stimulus programs but that cushion is shrinking. Massive U.S. Treasury issuance to fund growing deficits is pulling liquidity out of the system. Investors buy these Treasuries using repo financing, which depends on cheap, abundant cash. As the Federal Reserve tightens and allows bonds to mature without reinvestment, it drains reserves, reducing the cash available for repo lending.

This fragility was, until recently, showing up in the repo market. The “cash-futures basis” trade — buying Treasuries with borrowed cash and shorting futures — is highly leveraged and depends on stable repo funding. If repo rates spike, the trade breaks. That’s what happened in March 2020, triggering margin calls and forced selling.

Until recently, conditions were trending in the same direction. But now, something’s changing. Repo and Secured Overnight Financing Rate (SOFR) markets are stabilizing, signaling that liquidity is returning. The Federal Reserve appears ready to pivot — not just in rate policy but in balance sheet strategy. There are signs the Federal Reserve may resume T-bill purchases and even use its Mortgage-Backed Securities (MBS) holdings to offset quantitative tightening (QT). This is a tactical move to preserve credibility while quietly boosting liquidity.

Secured Overnight Financing Rate (SOFR) – Federal Reserve Bank of New York

SOFR (inverted) vs. Nasdaq (QQQ)

Are 50-Year Mortgages the Solution?

Meanwhile, the Trump administration is reportedly exploring 50-year mortgages, a move that could help offset the impact of MBS runoff and support the housing market. If coordinated with the Federal Reserve, this could be a powerful tool to stabilize long-duration credit markets and consumer sentiment.

All of this points to a more supportive environment for risk assets heading into December and early 2026. Liquidity is the lifeblood of markets, and the combination of easing repo stress, potential Federal Reserve support, and housing policy innovation could provide a meaningful tailwind.

Powell’s earlier comment — that we’re “near the end of balance sheet contraction” — wasn’t a declaration of victory. It was a quiet admission that the system can’t handle much more tightening. The Federal Reserve’s balance sheet has become a permanent fixture of the financial system. Every attempt to shrink it has ended in market stress. Every expansion has been a rescue mission.

The Federal Reserve is no longer reacting to the economy but the economy is reacting to the Federal Reserve. And now, the Federal Reserve is reacting to the market.

Yet this raises a deeper concern: what happens when the MBS side of the balance sheet runs out? Much like the drawdown in the reverse repo facility, the Federal Reserve could soon find itself with limited tools left as it accelerates outright purchases of U.S. debt. At that point, we may be witnessing the quiet implementation of Modern Monetary Theory (MMT): money printing to fund government deficits under the guise of market operations.

Unless there’s a political will to rein in the massive fiscal deficit, the Federal Reserve may have no choice but to monetize it. And that’s exactly why we believe gold and silver have been rallying, not just as inflation hedges, but as forward-looking signals of currency debasement risk.

Debasement: The Silent Driver and Why It Matters for Real People

The term “debasement” refers to the erosion of a currency’s purchasing power through the expansion of the money supply. Historically, this was literal — think Roman silver coins, which contained less and less silver over time. Today, it happens when central banks inject liquidity to finance deficits or stabilize markets. The U.S. dollar has fallen 9 per cent year-to-date, its sharpest drop since 1973. This isn’t just cyclical weakness; it’s structural, driven by soaring sovereign debt and the Federal Reserve’s growing reliance on balance sheet operations. Inflation control is taking a back seat to financial stability. In essence, the Federal Reserve is expanding the money supply to fund deficits which is the textbook definition of debasement.

Debasement doesn’t just show up in currency charts; it’s embedded in everyday life. Asset prices have surged while wages have barely moved. To return to 2019 levels of housing affordability, home prices would need to fall 40 per cent or wages rise 60 per cent — neither scenario is realistic. This imbalance is the direct result of liquidity-driven asset inflation. When money printing props up markets, those who own assets thrive while wage earners fall behind. The gap between financial wealth and real-world affordability is widening, fueling political polarization and economic fragility.

Central Banks Are Hedging — So Should Investors

Global central banks are not passive observers; they are actively hedging against fiat erosion. For four consecutive years, they have purchased over 1,000 tonnes of gold annually, signaling a structural shift toward hard assets. Gold now represents a growing share of reserves as countries diversify away from U.S. Treasuries as gold’s share of global reserves to 23 per cent, surpassing both the euro and yen When policymakers themselves are buying gold, it’s clear: debasement risk is real. Investors should take note. The debasement trade means allocating to assets that cannot be printed — gold, silver, commodity producers, and infrastructure. These preserve real value when fiat currencies are structurally compromised.

The Bottom Line

Powell’s comment that we’re “near the end of balance sheet contraction” wasn’t a victory lap; it was an admission that the system can’t handle much more tightening. Every attempt to shrink the Federal Reserve’s balance sheet has ended in stress. Every expansion has been a rescue mission. The next move won’t be about inflation or growth — it will be about preserving the illusion of control while quietly reintroducing liquidity. Unless fiscal discipline returns, the Federal Reserve may have no choice but to monetize deficits.

The Federal Reserve’s grip may be slipping but for markets, the real question is: what replaces it? However that’s a problem for late 2026. Until then, enjoy another round of liquidity, moving markets higher, and the debasement trade remains very much in effect.

Canada’s Hidden Fiscal Risk: Why Investors Shouldn’t Be Fooled by the Numbers

Canada’s fiscal picture is far worse than it appears on the surface, and we at TriVest Wealth Counsel worry that regular Canadians and foreign investors may be shocked when they do some digging into last week’s federal budget. Despite a change in leadership earlier this year, the government is doubling down on “generational investments” without introducing new revenue sources, resulting in a projected C$78.3 billion deficit, a staggering $36 billion increase from the 2024 Fall Economic Statement.

The budget outlines $500 billion in new private sector investment and $89.7 billion in net new spending over the next five years, offset by $60 billion in cuts over five years, primarily through reductions in the public service.

To justify this ballooning deficit, the government points to Canada’s low net debt-to-GDP ratio, claiming it stands at 13.3 per cent, the lowest in the Group of Seven major economies (G7). The government also touts that this puts it at the lowest deficit-to-GDP ratios in the G7, second only to Japan, arguing that this strong fiscal position enables Canada to respond to global challenges. However, this narrative relies heavily on a controversial accounting approach.

According to the Parliamentary Budget Officer (PBO), the government’s net debt figure includes the substantial assets of the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), which are uniquely structured compared with other G7 nations.

The government knows full well that these assets may significantly reduce Canada’s net debt figure but they are not available to the federal government to service its debt. Instead, the PBO considers them as earmarked for future pension obligations and they are managed independently. Including them in net debt calculations assumes they could be liquidated to pay off government liabilities, an assumption that doesn’t hold in practice without jeopardizing retirees’ benefits. Therefore, when adding this back in, Canada’s true debt-to-GDP on a gross basis is over 43 per cent.

This accounting approach leads to a distorted picture when comparing Canada’s debt to other countries and therefore is a critical blind spot in sovereign risk analysis. When measured by gross debt, which includes all liabilities without subtracting financial assets, Canada ranks fifth highest in the G7 and seventh worst among 32 advanced economies, according to the Fraser Institute think tank.

Canada’s decentralized fiscal structure significantly complicates international debt comparisons. Unlike unitary states such as France, Japan, or the United Kingdom where most public services are funded and managed centrally, Canada delegates substantial fiscal responsibilities to its provinces. These include core services such as health care, education, infrastructure, and social programs, which in other countries are typically funded through the central government’s budget.

As a result, provinces carry significant liabilities that are often excluded from international comparisons focused solely on federal debt. This omission also creates a misleading picture of Canada’s true sovereign credit risk. When provincial debt is included, Canada’s gross debt-to-GDP ratio jumps to approximately 113 per cent, placing it among the highest in the G7 and within the 10 most indebted advanced economies globally. For context, France’s credit rating was recently downgraded with a debt-to-GDP ratio of 116 per cent.

Ignoring provincial debt in global comparisons is akin to evaluating France’s fiscal health without accounting for its regional governments, or assessing Japan’s without its prefectures. But in Canada’s case, the provinces are not just administrative units; they are fiscally autonomous entities with their own borrowing powers, budgets, and long-term obligations. This makes their debt structurally and economically relevant to Canada’s overall credit profile.

In short, excluding provincial debt from sovereign analysis understates Canada’s fiscal exposure, misguides investors, and distorts comparisons with countries that centralize their public spending. For a true apples-to-apples assessment of sovereign risk, Canada’s provincial liabilities must be included.

Looking ahead, the fiscal trajectory is deeply concerning. Debt servicing costs are accelerating, crowding out other spending priorities and increasing vulnerability to future rate hikes. The government’s reliance on deficit financing without corresponding revenue measures suggests a structural imbalance that could persist for years.

Compounding this issue is Canada’s position as the most indebted household sector in the G7 and, according to the International Monetary Fund’s 2025 Financial System Stability Assessment, it ranks third worst globally, behind only South Korea and Australia. This level of leverage makes the economy highly sensitive to interest rate shocks and weakens the consumer base that underpins GDP growth. A highly indebted household sector also limits the effectiveness of monetary policy and increases the risk of a consumer-led downturn, especially with the ongoing tariff dispute with the United States.

Adding to this concern is the ownership structure of Canada’s federal debt, especially since non-resident investors own approximately 36 per cent of Government of Canada debt as of May 2025, which is far above the long-term average of 23 per cent. With ballooning deficits, poor capital efficiency, and high interest payments, Canada is at risk of a sovereign credit downgrade. We wonder what the impact will be from foreign selling, especially as the bond market is not pricing this in — at least not yet anyway. Credit rating agencies have so far maintained Canada’s high-grade status — Fitch Ratings affirmed Canada at AA+ in July 2025 — but the underlying metrics are deteriorating. A downgrade would have significant implications for borrowing costs, investor confidence, and the Canadian dollar.

As a result, we currently hold zero Government of Canada bonds, anticipating rising risk premiums, widening spreads, and potential downgrades. We strongly encourage investors to take a hard look at the fundamentals.

In our view, the combination of high household leverage, misleading debt metrics, and unsustainable fiscal policy creates a toxic mix for bondholders. Canada’s sovereign credit risk is no longer theoretical; it’s visible in the numbers and it’s being ignored. Those who continue to hold long-duration Canadian bonds may be underestimating the storm ahead.

We may eventually find ourselves longing for a return to the fiscal discipline of the Paul Martin and Jean Chrétien era, when decisive leadership helped Canada avert the 1994–1995 debt crisis. At the time, investor confidence in Canadian bonds had eroded so severely that there were moments when bond prices effectively went “no bid,” reflecting a market unwilling to purchase government debt at any price. The bond market reacted sharply to Canada’s rising debt levels, triggering a surge in yields and a liquidity crunch. In response, then finance minister Martin and then prime minister Chrétien implemented sweeping reforms. Inheriting C$42 billion in deficits, they delivered what amounted to 10 consecutive budget surpluses, cut program spending by 9.7 per cent in real terms while protecting health transfers, paid down $36 billion in debt, and maintained a $1 billion contingency cushion.

That is exactly the kind of leadership, rooted in fiscal prudence and accountability, needed today to restore investor confidence and stabilize Canada’s fiscal trajectory. Until such a time, we’re more than content to avoid buying Government of Canada bonds and funding the ongoing fiscal mess unravelling in Ottawa. For the country’s sake, we hope foreign investors don’t catch on too soon, and that this government somehow rights the ship before they do. Because frankly, I’m not sure we have what it takes to survive another debt crisis this time around.

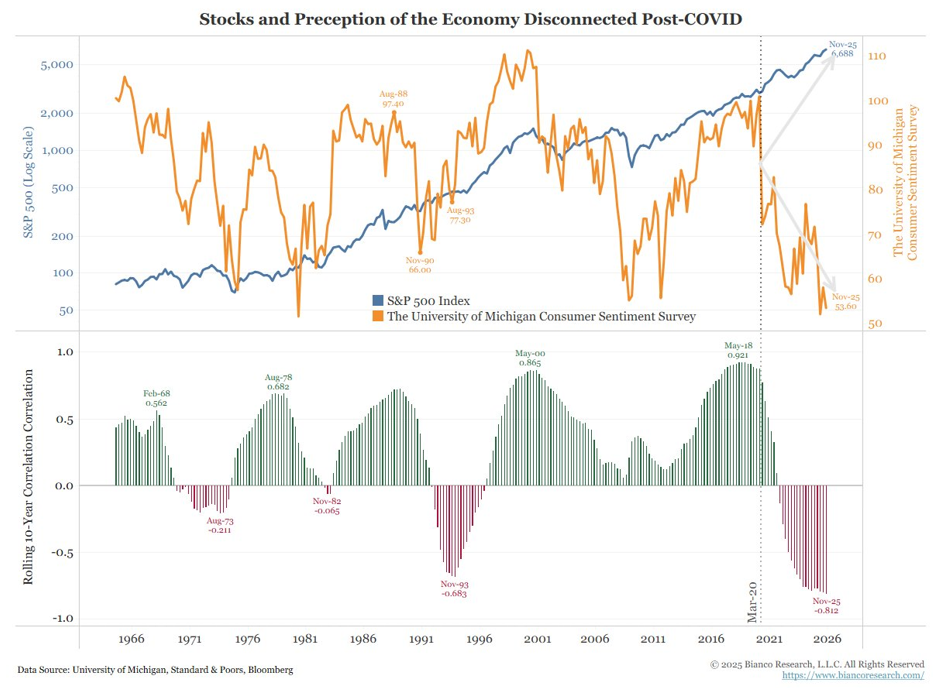

A Closer Look at the K-Shape U.S. Economy

Don’t be fooled by headline GDP numbers. The U.S. economy is experiencing a classic K-shaped recovery — where the upper leg of the “K” represents booming sectors like AI and the affluent households driving elite consumption, while the lower leg reflects stagnation or decline for the broader population and traditional industries. This divergence is creating both opportunity and risk for investors.

The United States economy in late 2025 presents a paradox. Headline gross domestic product (GDP) growth appears robust: The Federal Reserve Bank of Atlanta’s GDPNow estimate for the third quarter pegs growth at 3.9 per cent annualized. Yet beneath the surface, the picture is far less reassuring.

Economic conditions are deteriorating, according to David Rosenberg, founder and president of Rosenberg Research and Associates Inc. Rosenberg Research analysis of the Federal Reserve’s most recent Beige Book economic data for October indicated that only 18 per cent of the economy is growing, Forbes noted. That is down from 43 per cent in August and 100 per cent at the end of 2024.

So what’s driving the disconnect between positive national growth numbers and 82 per cent of America experiencing underlying pain?

The top 10 per cent are propping up consumption

Consumer spending, the lifeblood of the U.S. economy, is increasingly concentrated among the affluent. The top 10 per cent of earners (those with income greater than US$250,000) now account for approximately half of all consumer spending, up from 36 per cent three decades ago. This means economic resilience depends disproportionately on households with significant equity exposure and soaring home values.

As Ben Carlson at Ritholtz Wealth Management said, the top 10 per cent of Americans own 87 per cent of the stock market, while the top one per cent alone own half of all stocks. The bottom 50 per cent own just one per cent of the market.

The wealth divide has exploded since 2020. According to non-profit Oxfam International’s most recent numbers available: the richest one per cent captured nearly two-thirds of the US$42 trillion in new wealth created between 2020 and 2022 — almost twice as much as the bottom 99 per cent of the global population. Over the past decade, the richest had captured around half.

In the U.S., the top 0.1 per cent nearly doubled their wealth from US$12 trillion to about US$23 trillion, while the bottom 50 per cent gained just US$2 trillion combined. Today, the top 0.1 per cent controls 14 per cent of total U.S. wealth, up from nine per cent in 1990. This concentration amplifies market sensitivity: when the wealthy spend or invest, asset prices surge; when they pull back, the economy feels the shock. Their dominance in equities means monetary policy disproportionately affects this cohort and not the broader population.

Meanwhile, the bottom 50 per cent has seen its share of net worth shrink. In 1989 they held 3.5 per cent of total U.S. net worth; today, that figure is just 2.8 per cent. For these households, low gasoline prices and affordable essentials aren’t luxuries, they’re survival tools. This bifurcation is fueling political polarization, exemplified by the polling showing public support behind a far-left mayor in New York, a sign of growing frustration among those left behind.

AI spending masks economic weakness

Strip away AI-related investment, and the economy looks anemic. AI and data centre spending accounted for 92 per cent of U.S. GDP growth in the first half of 2025, even though these sectors represent only about four per cent of total GDP. Without this surge, growth would have been a mere 0.1 per cent annualized, according to Harvard economist Jason Furman.

This spending spree is not just powering GDP, it is inflating stock valuations and creating a rising liquidity tide that lifts risk assets, which is great for the small percentage of people who own the majority of the equity market.

But for those living on Main Street, the AI boom is a double-edged sword. Traditional employers are cutting jobs. United Parcel Service Inc. has eliminated 48,000 positions in 2025, far above its earlier target of 20,000, as automation reshapes logistics. Amazon.com Inc. is slashing 14,000 corporate roles, with more cuts tied to AI-driven restructuring. Target Corp. plans to cut 1,800 jobs, and General Motors Co. has announced layoffs as well.

These job losses hit middle-income earners, the very group that drives discretionary spending, and further widens the gap between economic winners and losers.

Even consumer staples giants are feeling the pressure. The Kraft Heinz Co. is feeling the effects of the broader U.S. economic slowdown in 2025, particularly in its North American operations. Despite headline GDP growth, the company has lowered its annual sales and profit forecasts, citing weakened consumer demand and persistent inflation.

In essence, Kraft Heinz’s performance is a microcosm of the broader U.S. recessionary undercurrents: headline growth driven by narrow sectors such as AI and elite consumption, while mainstream consumer brands face declining volumes and profitability. The company’s strategic pivot, including a major corporate split and aggressive promotional spending, underscores the challenges ahead in a polarized and inflation-weary economy.

What it means for investors

Don’t be fooled by headline GDP numbers. The U.S. economy is riding a narrow wave of AI-driven capital expenditure and elite consumption, while regional recessions and structural inequality deepen. This concentration creates both opportunity and risk.

Tech infrastructure plays, including semiconductors, cloud providers, and data centre REITs, remain attractive but are vulnerable to any slowdown in AI spending. Consumer discretionary tied to affluent households may outperform, while mass-market retail faces headwinds from layoffs and weak wage growth. Housing remains bifurcated: luxury markets and services catering to the wealthy may be resilient, but affordability challenges will pressure mid-tier segments.

Personally, I’m increasingly concerned about the political risk emerging from this economic divergence. The growing chasm between the economic elite and the broader population is fuelling populist movements on both the left and right, each pushing for radically different solutions — from wealth redistribution and aggressive taxation to protectionism and anti-establishment deregulation. This polarization is already reshaping fiscal policy debates, tax structures, and regulatory frameworks, and it’s only accelerating.

There is a real risk of a modern-day “let them eat cake” moment, where the economic and political elite underestimate the frustration brewing among those left behind. When the majority of Americans feel excluded from prosperity, the potential for social unrest, policy whiplash, and unpredictable election outcomes rises sharply. We’re already seeing signs of this in the form of extreme candidates gaining traction, cities electing far-left leadership, and growing hostility toward institutions.

Global investors should prepare for volatility not just in markets but in their everyday lives. Policy uncertainty, social tension, and fiscal shifts could affect everything from interest rates and capital flows to housing affordability and business investment. In this environment, portfolio resilience requires more than just diversification; it demands a deep understanding of the political landscape and its potential to disrupt economic fundamentals.

This is why we remain underweight on the consumer-heavy parts of the economy — including crude oil and gasoline — which are particularly vulnerable to weakening demand from the bottom half of the income spectrum. That said, we’re also watching for potential upside catalysts, such as the Trump administration’s recently announced US$2,000 stimulus tariff checks, which could temporarily boost consumption and sentiment heading into the 2026 election cycle.

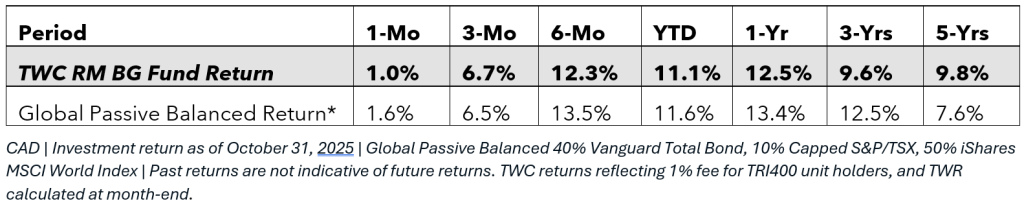

Positioned for Resilience: Risk-Managed Growth in a Debasement-Driven Market

“My largest positions aren’t the ones I think I’m going to make the most money from. My largest positions are the ones where I don’t think I’m going to lose money.” – Joel Greenblatt

The majority of our clients own either units of our TWC Risk-Managed Balanced Growth fund, and/or similar strategies directly within their accounts. The fund is fully tracking the market rally this year despite being underweight on direct equities and our bond replacement with structured notes. That said, it certainly didn’t hurt to get a 40 per cent gain in Alphabet, a 25 per cent gain in gold, and a 21 per cent gain in our NewGen Focused Alpha fund since adding them to portfolios earlier this year. We also locked in a 54 per cent gain in MEG Energy, selling it just prior to the take-over by Cenovus.

Looking ahead, the core of our strategy is deployed at a 60 per cent weighting to structured notes, half of which are on low-risk fixed income underlyings or principal-protected notes with 100 per cent embedded downside protection. This is at the higher end of our desired range, and as notes come due, we will likely be shoring up our cash positions heading into 2026.

We are maintaining a healthy weighting to Canadian dividend stocks that, due to their oligopoly nature, can preserve margins even in a tougher economic environment. Our exposure to the AI sector is via our position in Alphabet, which is offset by our more conservative allocation to Berkshire Hathaway — a company with a considerable cash position and a large weighting in Apple.

We also maintain a strategic allocation to precious metals as a hedge against U.S. dollar debasement. The dollar has declined 9 per cent year-to-date — its sharpest drop since 1973 — and we believe this is not just cyclical, but structural, much like the weakness in sovereign bonds. With the Fed expected to resume T-bill purchases amid repo market stress and central banks prioritizing liquidity over inflation control, we see this as classic debasement: expanding the money supply to finance deficits and erode purchasing power. Central banks have been leading the charge, purchasing over 1,000 tonnes of gold annually for four consecutive years. Gold now makes up 23 per cent of global reserves, surpassing both the euro and yen. We believe this trend will continue as de-dollarization accelerates and investors seek hard assets with intrinsic value.

Our exposure includes iShares Silver Trust (SLV), iShares Silver Bullion ETF (SVR) (CAD-hedged), and SPDR Gold Trust (GLD). We also hold Agnico Eagle Mines (NYSE: AEM) as it is Steve’s top gold pick — a high-conviction gold equity with strong operational performance, a solid balance sheet, and a robust growth pipeline. AEM is well-positioned to benefit from the ongoing “debasement trade” and investor rotation into real assets.

Research, Reads of the Month

Norway’s wealth tax increase,

They expected to raise $146M, led to a $448M net loss as $54B in wealth left the country, reducing tax revenue by $594M. Read Here

Tech companies are taking financial engineering to a whole new level

Once you start understanding how these companies work together, the red flags start jumping out. This is a MUST WATCH. “Brad Gerstner, an OpenAI investor, asks Sam Altman how a company with $13B in revenue can afford $1.4T in commitments. Altman’s reply? ‘Happy to find a buyer for your shares.’” Translation: No answer. Very concerning. Watch Here “SoftBank booked gains on OpenAI shares by designating VisionFund2 to underwrite the second investment tranche at US$500 billion value that SBG cannot pay and ‘created’ a Forward Derivative contract worth $8 billion (all gains) out of thin air.” See Here This JP Morgan AI CAPEX report puts AI ROI into perspective: “to drive a 10% return on our modeled AI investments through 2030 would require ~$650 billion of annual revenue into perpetuity… which equates to $34.72/month from every current iPhone user.” See Here Meanwhile, did you know that the S&P 500 equity risk premium is in negative territory? See Here

Who has the power to win the AI Race?

Since April 2020, the United States has invested over US$1.2 trillion in solar and wind energy, which together supply about 17 per cent of the nation’s electricity. For perspective, that same amount could have funded roughly 40–60 nuclear power plants, each capable of operating for up to 80 years, which is far longer than the 15–25-year lifespan of wind turbines and solar panels. Meanwhile, China has taken a different path: it now operates 58 reactors with 61 GW of capacity, has 27–30 more under construction, and approved 10 new reactors in 2025 alone. Nearly half of the world’s nuclear projects are in China, which plans to more than triple its nuclear capacity to 200 GW by 2035. This contrast underscores the stark difference in energy strategies and raises critical questions about cost efficiency, reliability, and long-term security. But also, this shows just how important energy is when it comes to determining who will win and lose in the new global AI race. See Chart Here

Stimulating Into a Bubble

“Did you see that the Fed’s announcement that it will stop QT and begin QE? While it is described as a technical maneuver, any way you cut it it’s an easing move that is one of his indicators to pay attention to in order to track the progression of the Big Debt Cycle dynamic that was described in my last book.” – Ray Dalio, American investor Read Here There is only one way to deal with record high debt loads and it isn’t pretty. See Here

Can governments keep rates where they are and keep borrowing?

Yes, Modern Monetary Theory, but that will accelerate the debasement and inflate assets so high that even 50 year mortgages won’t help. See Here

Financial engineering doesn’t just happen in capitalism

Banks in China are asking clients to take out loans and then immediately repay them, with the bank covering the interest, in a practice known as “quick-lend-and-recover.” The practice is spreading as banks come under pressure to hit government-set targets that can’t be met by real demand, according to interviews with bankers. Read Here

The Canadian Budget 2025

“You can never make the same mistake twice… Because the second time it’s not a mistake, it’s a choice.” Watch Here Earlier today on Rosemary Barton Live, Finance Minister FP Champagne was asked about our comments calling the federal budget measures on housing “disappointing”. Here is his response. Watch Here Take the time to watch this and then ponder on the top-down approach being taken by the Federal Government. “Bank of Canada official has warned of a possible ‘lower standard of living’ in Canada.” Watch Here Somehow this chart didn’t make it into the budget. Canada debt-to-GDP (%) world ranking. in the world among 208 countries. Fitch Warns Canada of Credit Downgrade. See Here “Mark Carney’s budget will make Canada the strongest economy in Eurovision.” Read Here “So tell me folks, are we leaping frogging the US yet because of Carney’s industrial carbon tax?” Watch Here

What happened to Canada’s gold reserves?

“Canada sold the remaining of its gold reserves around 2016. I asked the Bank of Canada if they wished they didn’t sell it all.” – Adam Chambers, MP, Simcoe North, Ontario Watch Here

The Death of CUSMA

We believe Trump wants a bilateral deal. Separating negotiations with Canada and Mexico. We will be the last ones to get a deal. He knows he holds all of the cards. The sunset clause in the Canada-United States-Mexico Agreement (CUSMA) agreement is set for 2036 but the deal can be effectively put on a path to termination if an extension is not agreed upon during the 2026 joint review. Watch Here

Canadian military plans to boost its ranks by 300,000

“Canadian military will rely on an army of public servants to boost its ranks by 300,000. Federal public servants would be trained to shoot guns, drive trucks and fly drones, according to a defence department directive.” Read Here

Private ownership is in jeopardy, lawyer says about Cowichan court ruling

Top law expert Thomas Isaac explains that the Cowichan ruling clearly impacts private property across B.C., contrary to those who want to downplay its effects. He says British Columbia is now “the only western economy on the planet where you can’t take indefeasible title to the bank.” Watch Here

Who do you think Venezuelan Crude is going to displace?

“Maduro Reportedly Open To Leaving Venezuela In Exchange For Amnesty And ‘Comfortable Exile’: Report. ‘If there’s enough pressure, and if there is enough candy in the dish,’ a person close to Caracas said when describing the possibility.” Read Here “The U.S. seems to be gearing for confrontation in Venezuela with the biggest buildup of American force since Iraq.” Watch Here

“A New Oil Price War Is Now Underway”

OPEC+’s surprise 137,000 bpd output hike isn’t about near-term prices — it’s about market share. As U.S. shale hits record highs, the cartel is signaling it won’t cede ground easily, even if oil drifts toward $75. Read Here

“China’s $468 Billion Energy Drive Sparks Global Oil Market Shakeup”

China’s state oil giants are pouring nearly $470 billion into domestic exploration — boosting output, stockpiling crude, and cutting import dependence. PetroChina is now the world’s top E&P investor as Beijing prioritizes energy security. Read Here

Calgary Oil & Gas Forecast Breakfast

Martin was one of the panellists at this years’ breakfast. Natural Gas Markets Look Positive: Investment Leaders. Read Here “Uncertainty In Oil Markets Persists, Investment Leaders Tell CFA Annual Breakfast.” Read Here

On the Positive

“You can never make the same mistake twice… Because the second time it’s not a mistake, it’s a choice.” — Paulo Coelho, Brazilian author

Martin’s book of the month – The End of the Modern World

Romano Guardini’s The End of the Modern World explores the profound cultural and spiritual shifts that define the transition from the modern era to what he calls the “technological age.” Guardini argues that modernity, which began with humanism and the Enlightenment, placed man at the centre of existence, emphasizing autonomy, rationality, and progress. However, this worldview is collapsing under the weight of its own success, giving rise to a new epoch dominated by technology and power.

In this technological age, power becomes the central force — not just political or economic power but the power to manipulate nature, society, and even human life itself. Guardini warns that this unprecedented power brings immense responsibility. Without a moral and spiritual framework, humanity risks using power destructively, reducing life to mere functionality and efficiency.

Guardini calls for a renewal of responsibility rooted in humility and reverence for life. He insists that technological progress must be guided by ethical principles and a sense of transcendence, lest humanity lose its freedom and dignity. Ultimately, the book is not a rejection of technology but a critique of the spiritual vacuum that often accompanies it. Guardini urges readers to rediscover meaning beyond material progress and to embrace responsibility as the defining task of the new age.

The Power of Detachment and Silence – by Martin Pelletier

I went on a silent retreat at the end of October and it was amazing. There is so much power and freedom in detachment. Cyprian Smith’s The Way of Paradox explores the mystical theology of Meister Eckhart, emphasizing that spiritual truth is discovered through paradox. Eckhart teaches that the deepest reality of God and the unity of all things cannot be grasped by ordinary logic or language. Instead, it emerges through detachment, silence, and the rhythm of opposites: going out yet remaining within, acting yet resting, speaking yet being silent.

The book explains that to find new life in God, one must “die” to the life one currently lives, not only to the will but also to thought and speech. This radical detachment opens the “eye of the heart,” allowing divine knowledge to kindle within. Eckhart’s spirituality transcends the principle of contradiction: statements can be both true and untrue, pointing to a reality beyond duality. This approach resonates with non-dual traditions like Zen Buddhism.

Central to Eckhart’s vision is the Trinity as a dynamic movement: God as speaker (Father), God as spoken (Son), and the bond of love (Spirit). Spiritual life mirrors this rhythm, pouring oneself out in the world while remaining inwardly detached.

Creation itself is paradoxical: it exists only in God’s presence, so it both is and is not. Ultimately, the way of paradox leads to union with God through continual oscillation between opposites, revealing that true freedom and divine life arise from surrender and transcendence.

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca