INSIDE

The Road to 2026: Liquidity, Inflation, and Market Strategy

Liquidity is the defining force as both corporations and governments lean heavily on leverage. Tech giants, once cash rich, are issuing record debt to fund an artificial intelligence (AI) arms race, while U.S. fiscal policy relies on short-term Treasury issuance, raising systemic funding risks. Near-term, a dovish U.S. Federal Reserve pivot and Japan’s stimulus inject liquidity and fuel carry trades, but policy uncertainty looms with potential Federal Reserve friction and U.S. midterm election politics. A weaker U.S. dollar favours hard assets like gold, while the K-shaped recovery deepens wealth divides, amplifying volatility. Canada faces recession risk beneath resilient headlines, constrained by policy inertia. Traditional bonds remain vulnerable to sovereign risk premiums, making structured notes and defensive strategies more attractive. In this environment, discipline matters: stay invested, pair risks, prioritize balance-sheet strength, and prepare for policy swings and liquidity shocks.

Navigating Debasement and Delivering Results

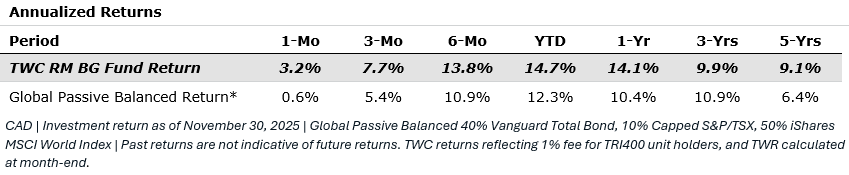

Overall, the portfolio adjustments we made during the spring correction delivered strong results in the second half of the year, outperforming both our goals-based targets and passive benchmarks. In total, we posted a 14.7 per cent return year-to-date in the fund compared to 12.3 per cent for the Global Passive Balanced benchmark. This brings our five-year annualized return to 9.1 per cent, well ahead of passive returns of 6.4 per cent. Our disciplined approach, combined with the strategic changes we implemented in late 2019—including the active use of structured notes as a fixed-income replacement—has significantly improved our upside capture without sacrificing downside protection.

Key Risks Heading into the New Year

As we move into 2026, markets face a complex web of vulnerabilities that could reshape liquidity, policy, and asset pricing. U.S. midterm elections and potential shifts in Federal Reserve leadership may alter the reaction function at a critical juncture. Treasury supply dynamics and stress in money-market plumbing—repo rates and dealer balance sheets—pose systemic funding risks. Meanwhile, tech-driven private credit is rapidly replacing traditional bank intermediation yet remains untested through a full default cycle. Geopolitical flashpoints from Ukraine to Taiwan, coupled with evolving trade frameworks like the Canada–United States–Mexico Agreement (CUSMA), add layers of uncertainty. Finally, sovereign funding pressures—linking deficits, issuance, term premia, and currency stability—represent a structural challenge that could reverberate across global markets.

Discipline Over Drama

Staying invested is essential in these types of markets—market timing often proves costly, as those who went to cash in late 2022 missed three years of strong gains. Instead of chasing macro calls, focus on pairing high-beta positions with low-risk counterparts and favour companies with strong balance sheets, consistent cash flows, and disciplined capital allocation. Extend risk management beyond equities: avoid stretching for yield in credit, plan for policy volatility, and maintain liquidity buffers. Carry trades and leveraged strategies can unwind quickly, so keep hedges and optionality ready. In short, discipline—not prediction—should guide portfolio construction in 2026.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. Wishing you a Very Merry Christmas and all the best over the New Year.

December 2025: Preparing for Policy Shifts

Key Themes for 2026: Liquidity is the defining force as both corporations and governments lean heavily on leverage. Tech giants, once cash-rich, are issuing record debt to fund an AI arms race, while U.S. fiscal policy relies on short-term Treasury issuance, raising systemic funding risks. Near-term, a dovish Federal Reserve pivot and Japan’s stimulus inject liquidity and fuel carry trades, but policy uncertainty looms with potential Federal Reserve friction and U.S. midterm elections politics. A weaker U.S. dollar favours hard assets like gold, while the K-shaped recovery deepens wealth divides, amplifying volatility. Canada faces recession risk beneath resilient headlines, constrained by policy inertia. Traditional bonds remain vulnerable to sovereign risk premiums, making structured notes and defensive strategies more attractive. In this environment, discipline matters: stay invested, pair risks, prioritize balance-sheet strength, and prepare for policy swings and liquidity shocks.

- Liquidity dominates: Corporate and sovereign leverage are reshaping market dynamics.

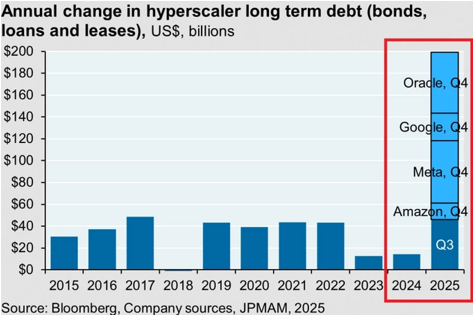

- Tech giants shift from cash to debt: AI CapEx boom drives US$200 billion in new issuance.

- Government funding stress: Short-term U.S. Treasury supply risks repo volatility.

- Near-term tailwinds: Federal Reserve pivot + Japan stimulus fuel liquidity and carry trades.

- Policy friction: Federal Reserve unity under pressure; curve steepening likely.

- Hard assets shine: U.S. dollar weakness supports gold and silver.

- K-shaped recovery persists: Wealth gaps widen, fueling political and market volatility.

- Canada walks a tightrope: Limited room for cuts; recession risk under the surface.

- Fixed income caution: Sovereign risk premium rising; structured notes favoured.

- Playbook: Stay invested, pair risks, favour durability, plan for policy swings, watch liquidity.

Liquidity & Leverage: The New Shape of Market Risk

Large U.S. technology platforms—once defined by fortress balance sheets—are leveraging up to fund AI. In 2025, Microsoft, Amazon, Alphabet, and Meta collectively poured an estimated US$380 billion into AI infrastructure, a ~50 per cent jump in two years. To finance this, they tapped debt markets for roughly US$200 billion of new issuance, lifting combined interest-bearing obligations to about US$1.35 trillion, roughly quadruple the level a decade ago. These companies remain exceptional operators, but the systemic role they play has changed: they are net consumers of liquidity, not just sources of it. That shift increases macro sensitivity to funding costs, credit spreads, and policy surprises.

Governments are on a parallel track. The U.S. continues to run crisis-like deficits despite decent growth, leaning heavily on short-tenor Treasury bills to minimize near-term financing costs. That strategy works—until it doesn’t. An oversupply at the short end can push repo rates higher, transmit stress through dealer balance sheets and money markets, and raise the cost of leverage across asset classes. In that scenario, the Federal Reserve would likely be forced to absorb excess issuance, restoring liquidity but risking the perception of a renewed, quasi-accommodative stance and complicating its inflation-fighting credibility.

Near-Term Tailwinds: A Liquidity Pulse Into YearEnd

As 2025 closes, we see a compelling setup for risk assets. The Federal Reserve just announced a 25 bp Fed cut as core producer prices cool and officials signal room for “near-term adjustment.” Meanwhile, Japan’s ¥21.3T fiscal package, paired with vigilance on foreign exchange (FX) stability, sustains USD/JPY near a familiar intervention zone and encourages the yen carry trade—borrowing at ultra-low Japanese rates to deploy capital into higher-yield assets abroad.

Together, these forces can inject global liquidity and supercharge a Santa Claus/New Year rally, especially as institutions rebalance and chase benchmark performance. The carry flow is powerful—but path-dependent: if funding spreads widen or FX volatility returns, those easy profits can evaporate quickly. Enjoy the tailwind, but position for the crosscurrents that await in 2026.

Policy Dynamics: Internal Friction and Market Signaling

The Federal Reserve’s internal balance matters. Speculation that a Trump-aligned voice (e.g., Kevin Hassett) could join the Board raises the prospect of more visible dissent. If four governors lean hawkish while a new voice advocates aggressive easing, consensus could slow, guidance could blur, and rates volatility could rise. Markets prize policy coherence; any perceived fragmentation tends to lift term premiums and steepen the curve as bond investors push back against excessive easing, pricing higher long-run inflation and fiscal risk.

That said, we recommend listening to our friend Joseph Wang, former senior trader at the Federal Reserve, for his thoughts on this and how the U.S. administration is responding. It is an excellent listen.

Currency & Hard Assets

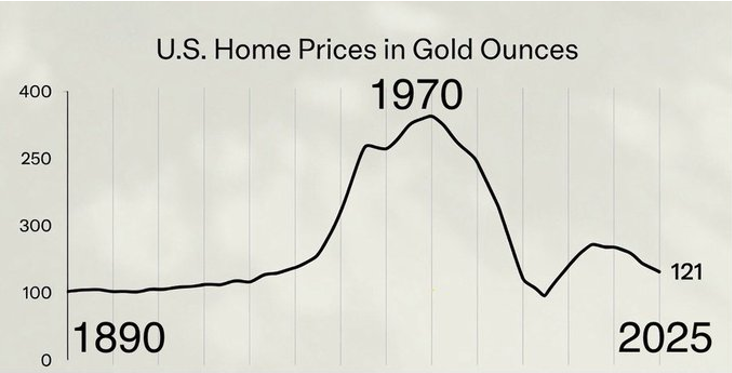

Sustained fiscal expansion, policy uncertainty, and funding frictions weigh on the U.S. dollar. In that environment, gold and silver typically benefit. Both performed well in 2025; some optimism is priced in, but the trade likely persists until we see clear policy normalization—more likely after the U.S. midterm elections.

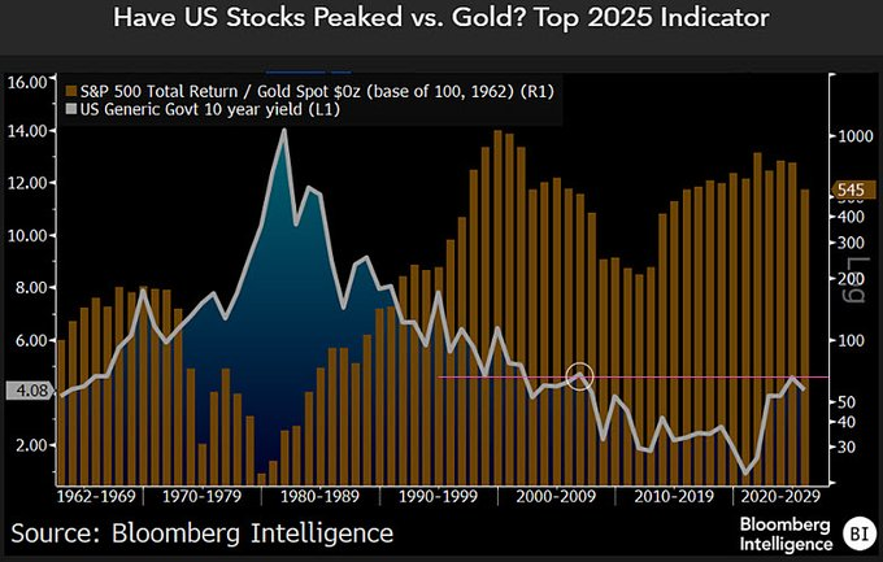

In particular, gold outperformed equities in 2025, consistent with expectations—but its strongest annual gain since 1979 was a surprise and may hint at a deeper shift. Historically, such outsized performance often precedes post-inflation deflationary cycles, where falling yields and tightening liquidity dominate. Evidence is already visible in China, with 10-year government bonds yielding around 1.85 per cent, and charts suggest U.S. Treasuries could potentially follow a similar path. In short, gold’s rally may be less about inflation hedging and more about markets bracing for a deflationary turn.

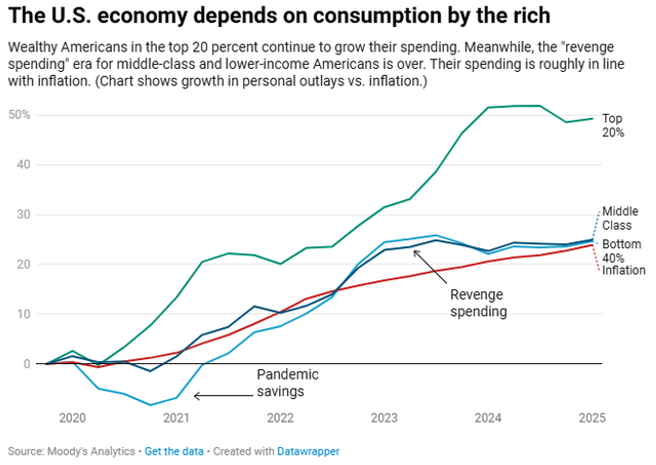

The Macro Lens: A K-Shaped Reality

The K-shaped recovery is no longer a post-pandemic anomaly—it has become a structural feature of the global economy. At the top end, capital-rich sectors and high-income cohorts continue to thrive, buoyed by asset appreciation, access to cheap leverage, and the ability to monetize technological disruption. Meanwhile, lower-income households face a very different reality: stagnant wages, rising living costs, and limited access to financial assets. This divergence is widening the wealth gap and eroding the traditional pathways to upward mobility.

The consequences extend beyond social commentary. Fraying social contracts are spilling into politics, fueling populism and increasing the likelihood of abrupt policy swings around taxation, regulation, and redistribution. These shifts can reshape corporate margins, alter sector leadership, and inject volatility into markets that once relied on predictable policy frameworks.

From an investment perspective, this is not just sociology—it is market plumbing. Distributional tensions influence consumption patterns, capital flows, and risk premia. Luxury goods and high-end services may see resilient demand, while mass-market segments struggle. Multiples for companies exposed to discretionary spending at the lower end could compress, while firms serving affluent consumers or offering essential goods may command scarcity premiums. In short, the K-shaped recovery creates a bifurcated investment landscape where process and adaptability matter more than static forecasts.

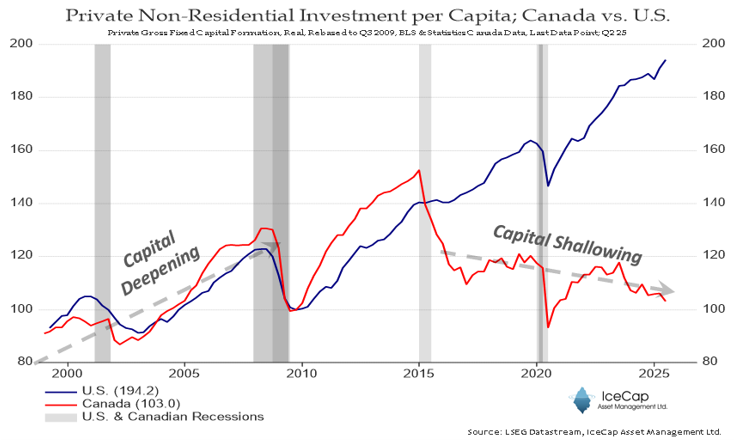

Canada: Tightrope Walking

The Bank of Canada (BoC) enters 2026 in a precarious position. Its primary objective is to maintain currency stability while avoiding unnecessary rate cuts that could undermine the Canadian dollar. With the U.S. Federal Reserve signaling potential easing, the BoC faces pressure to respond—but doing so too aggressively risks widening interest rate differentials and triggering capital outflows. This balancing act is complicated by mixed economic signals: headline data suggest resilience, yet beneath the surface, cracks are forming. Consumer spending is slowing, housing affordability remains under strain, and household leverage is near historic highs. These vulnerabilities heighten the risk of a shallow recession, even as policymakers project optimism.

Ottawa’s reliance on top-down stimulus—large-scale infrastructure spending and targeted subsidies—has delivered limited returns in past cycles. Structural reforms aimed at tax relief, regulatory simplification, and productivity enhancement would likely yield more sustainable growth than another round of multi-billion-dollar projects. Until such measures materialize, investors should prioritize companies with defensive moats, strong balance sheets, and reliable dividend streams. These attributes provide insulation against policy uncertainty and cyclical weakness, offering stability in an environment where macro conditions can shift abruptly.

Fixed Income & Alternatives: Defensive Innovation

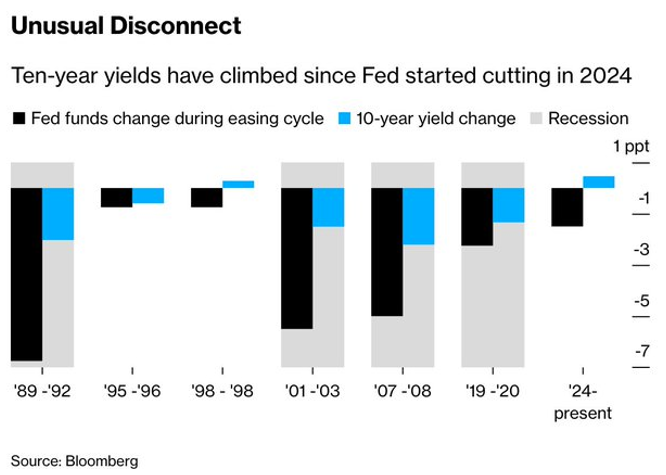

Traditional duration still looks challenged if fiscal expansion remains elevated; a sovereign risk premium can creep into nominal Treasury yields. One notable distortion: Microsoft paper occasionally pricing through comparable-maturity U.S. Treasuries—a signal of sovereign credit anxiety and abundant demand for top-tier corporate cash flows.

Consequently, we see bond markets that keep pushing back even as the Federal Reserve began cutting rates back in September with long-term yields rising instead of falling. Ten-year Treasuries climbed to 4.1 per cent, and 30-year yields jumped over 0.8 per cent, defying the usual pattern where cuts pull long rates lower. Why? Markets had priced in cuts early, and with inflation still at 2.8 per cent core Personal Consumption Expenditures (PCE), investors see risk in aggressive easing. The term premium has surged nearly a full point as bondholders demand extra compensation for inflation uncertainty and ballooning federal debt.

This creates a paradox: the Federal Reserve cuts to ease borrowing costs, but rising long yields push up mortgages, credit card rates, and corporate financing—signaling the Federal Reserve is losing control of the curve. Bottom line: the bond market doesn’t believe inflation is tamed, and higher long-term yields reflect skepticism about policy credibility and fiscal sustainability.

As a result, we continue to favour structured notes with defensive features—tools that let us shape payoff profiles, buffer drawdowns, and preserve upside amid volatility—over a blunt reach for yield in lower-quality credit.

Key Risks to Monitor

As we move into 2026, markets face a complex web of vulnerabilities that could reshape liquidity, policy, and asset pricing. U.S. midterm elections and potential shifts in Federal Reserve leadership may alter the reaction function at a critical juncture. U.S. Treasury supply dynamics and stress in money-market plumbing—repo rates and dealer balance sheets—pose systemic funding risks. Meanwhile, tech-driven private credit is rapidly replacing traditional bank intermediation yet remains untested through a full default cycle. Geopolitical flashpoints from Ukraine to Taiwan, coupled with evolving trade frameworks like CUSMA, add layers of uncertainty. Finally, sovereign funding pressures—linking deficits, issuance, term premia, and currency stability—represent a structural challenge that could reverberate across global markets.

- U.S. midterm elections and potential changes at the Federal Reserve, including leadership and reaction functions.

- U.S. Treasury supply and money-market plumbing (repo, dealer balance sheets).

- Tech-driven private credit replacing bank intermediation—powerful, but still untested through a full default cycle.

- Geopolitics (Ukraine, Taiwan, Venezuela) and trade architecture (CUSMA adjustments, potential bilateral drift).

- Sovereign funding pressures—the systemic risk that links deficits, issuance, term premia, and FX.

Our Playbook: Discipline Over Drama

Staying invested is critical—avoid the temptation to go all-in on cash. Investors who exited markets in late 2022 missed three consecutive years of strong gains, a reminder that timing the macro is alluring but usually costly. Instead of trying to predict every twist, focus on deliberate risk pairing: every high-beta exposure should sit alongside a low-risk counterpart to dampen left-tail outcomes. Favour durability over momentum meaning owning companies with strong balance sheets, repeatable cash flows, and disciplined capital allocation consistently outperform those chasing growth at any cost. In volatile environments, resilience is a competitive advantage.

Risk management extends beyond equities. Be cautious with duration and credit spreads; stretching for yield can backfire when spreads gap wider. Build portfolios for policy volatility by pre-planning responses to rate shifts, tax changes, and regulatory surprises—execution speed is an edge. Above all, watch liquidity like a hawk. Carry-trade profits and leveraged strategies can evaporate overnight if funding stress emerges. Maintain a playbook that includes hedges, cash buffers, and optionality to navigate sudden shocks. In short, discipline—not prediction—should drive portfolio construction in 2026.

Risk-Managed Growth: Navigating Debasement and Delivering Results

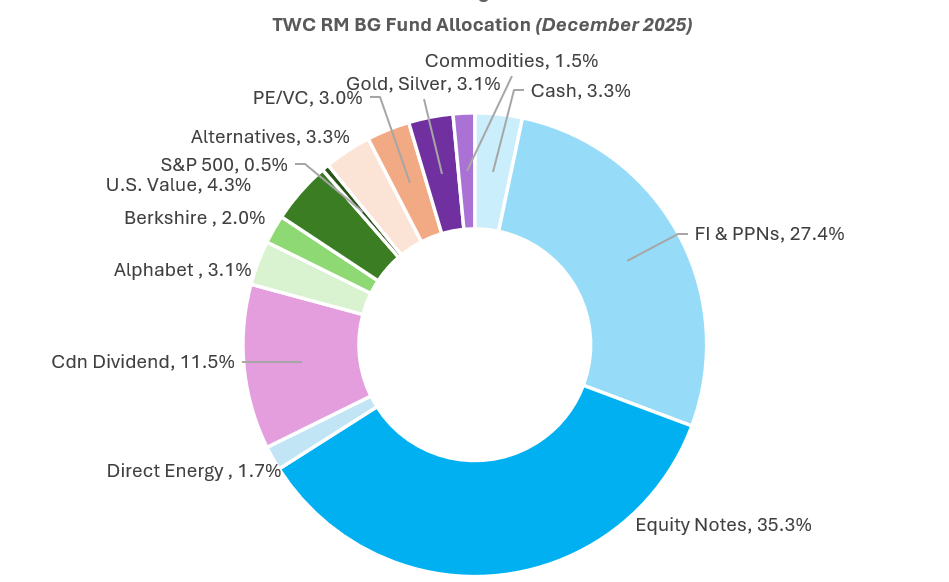

The majority of our clients own units of our TWC Risk-Managed Balanced Growth fund, and/or have similar strategies directly within their accounts. Equity markets delivered a mediocre November, however, our fund had one of the strongest months in its history thanks to strong gains in our larger positions in gold, Alphabet, and mid-cap energy including Baytex and Vermillion.

Overall, the portfolio adjustments we made during the spring correction delivered strong results in the second half of the year, outperforming both our goals-based targets and passive benchmarks. In total, we posted a 14.7 per cent annual return in the past 12 months in the fund compared to 10.4 per cent for the Global Passive Balanced benchmark. This brings our five-year annualized return to 9.1 per cent, well ahead of passive returns of 6.4 per cent. Our disciplined approach, combined with the strategic changes we implemented in late 2019—including the active use of structured notes as a fixed-income replacement—has significantly improved our upside capture without sacrificing downside protection.

Looking ahead, the core of our strategy is deployed at a 60 per cent weighting to structured notes, with a focus on low-risk fixed income underlying assets or principal-protected notes (PPNs) with 100 per cent embedded downside protection paired with twin-win notes offering gains in both up and down markets. This remains at the higher end of our desired range, and as notes come due, we will likely be shoring up our cash positions heading into 2026.

Overall, 2025 showcased the strength of our active, risk-managed approach. By combining innovative strategies such as principal-protected notes (PPNs) and structured notes with tactical equity positioning and alternative investments, we delivered resilience and growth in a challenging market. As we look ahead to 2026, we remain focused on protecting capital, capturing upside, and positioning the TWC Fund for long-term success.

Research, Reads of the Month

“When the canary dies, don’t blame the bird—blame the mine.” – Unknown

U.S. National Security Document

The U.S. government released its National Security Document which has profound global implications. It can be . While Canada was absent from the document there are some important potential implications:.

- Ottawa’s Euro-Atlantic orientation and support for Ukraine may clash with Trump’s agenda.

- Canada risks being treated like Europe: elite-driven, needing “course correction.”

- U.S. pressure likely on Arctic sovereignty, critical minerals, and China exposure.

- Tariffs framed as foreign policy tools, not just trade irritants.

- National Security Strategy signals reduced flexibility for Canada’s China engagement; alignment with U.S. economic-security strategy will be demanded.

“Trump’s National Security Strategy (NSS) ends Canada’s security discount: Stephen Nagy for National Security Journal.” Here “Trump’s NSS: A Warning to the World, a Threat to Canada.” Here “What Trump’s New National Security Strategy Means for Canada’s China Policy and Indo-Pacific Engagement.” Here “Trump’s Terrifying New Security Doctrine Turns Canada into a Target.” Here

Market bubbles, lessons from history and guidance for investors

We love these updates by Oaktree Co-Chairman Howard Marks, and given his positioning as someone looking in on equity markets he often provides a common sense, non-dualistic approach that is often lacking in today’s environment. Read Here

FOMC

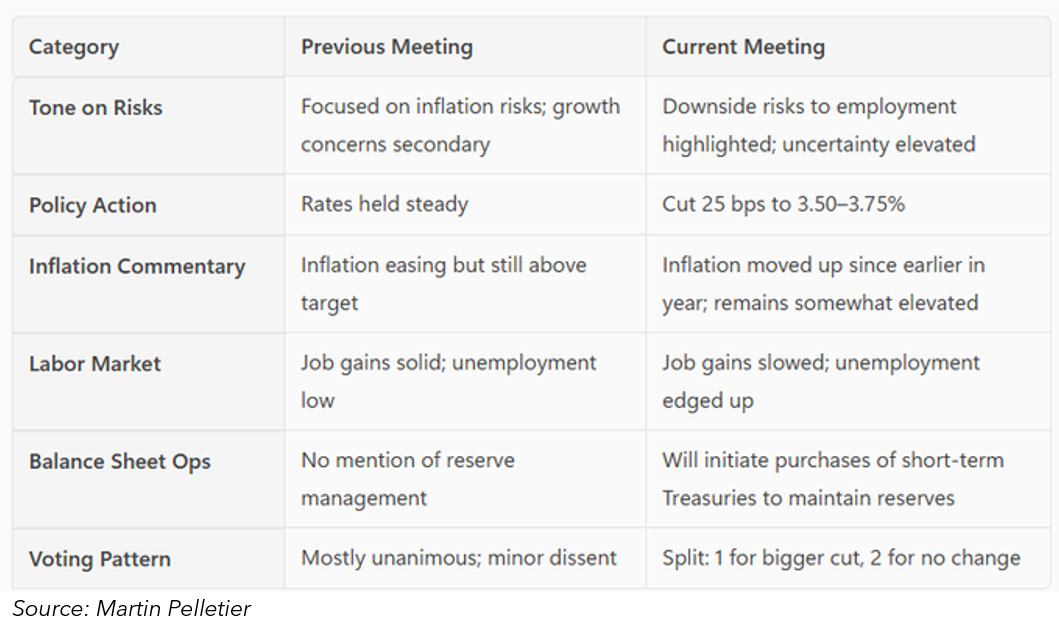

The U.S. Federal Reserve cut rates by 25 points. Here is a summary of the key differences from last month. Martin was also recently on the Unusual Whales XSpace speaking on the FOMC meeting. Listen Here

Tariffs having zero impact on S&P 500 companies

Despite tariff headlines, S&P 500 operating earnings surged 22 per cent over last year, the strongest since late 2021. “S&P 500 profit margins rose to 13.6 per cent in the 3rd quarter, their highest level in history.” This underscores how global firms adapt and why policy shocks don’t always translate into earnings shocks. See Here and Here

Debasement should be the focus not just inflation

If Americans had gold as a currency and not the U.S. dollar, then guess what, there wouldn’t be an affordability issue. This is a debasement problem that is finally coming to light. Those who don’t own assets have been hurt, and don’t have a chance other than depending on low rates and much higher leverage.

Martin Pelletier joins BNN Bloomberg to provide an outlook on the markets

Martin highlighted some strategies via BNN Bloomberg. From a strategic standpoint, he mentioned trimming positions in January and looking at some new ideas such as $ZWB, or a partial sector rotation moving some of last year’s strong banking stock gains into names like $ENB, $T. Watch Here

“Martin Pelletier: An Alberta pipeline promise, not a pipeline plan

As Ottawa and Alberta signed a memorandum of understanding on a proposed bitumen pipeline that could move a million barrels a day from the province to Asian markets through a B.C. port, Canadians are watching closely. Industry leaders and the Alberta government were quick to celebrate the announcement as a breakthrough. After years of friction with Ottawa, it feels like progress and a chance to move long-stalled projects forward while securing concessions including regulatory relief, power infrastructure, and carbon compliance flexibility.” Read Here or Here

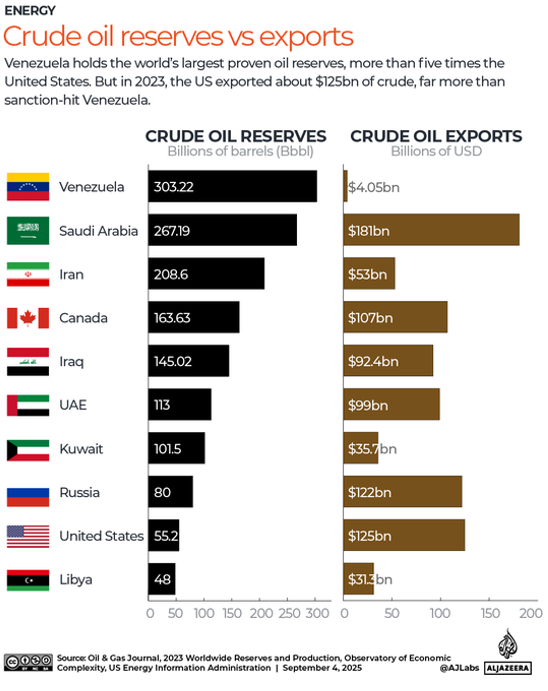

China taking advantage of weaker pricing to stockpile more oil

“China’s November crude oil imports reach highest daily level in 27 months.” Read Here

“Venezuela has the world’s most oil: Why doesn’t it earn more from exports?

Venezuela holds the world’s largest proven oil reserves, more than five times more than the United States.” Read Here

“OPEC just made oil market history.”

Martin was invited to an exclusive analyst conference call with His Royal Highness Prince Abdulaziz bin Salman bin Abdulaziz Al Saud, Minister of Energy of Saudi Arabia and Chairman of OPEC+, and His Excellency Haitham Al Ghais, Secretary General of OPEC. Martin’s biggest takeaway is that this is a big step in increasing transparency around output capabilities and compliance among its members to reinforce their focus on being the agent of stability in global oil markets.

At the 40th OPEC and non-OPEC Ministerial Meeting on November 30, participating countries approved a mechanism for third party verification of Maximum Sustainable Capacity (MSC) across all Declaration of Cooperation members. These verified MSC figures will serve as a reference for 2027 production baselines. No oil producing organization has ever done this before. Read Here

The power of a disciplined process and aligning portfolios with long-term goals and values

“Life will always test your values. Whether through the noise of social media, the churn of political decisions or the relentless pace of markets, the world rarely aligns perfectly with what we believe. So what do we do when we can’t change the circumstances around us? “We set boundaries. Not as walls of isolation, but as frameworks for protecting our well-being, preserving our integrity and providing inner peace in the midst of the chaos.” Read Here

“Liberals ignoring the ‘economics of scarcity’ could mean more taxes are coming

The details of the Government of Canada’s revenues and expenses for the fiscal year ending March 31, 2025, as per the 2025 Public Accounts of Canada documents, do not make for a light read, but it’s interesting for tax geeks such as me and should be for all Canadians. It’s important to know that the financial reports are prepared using generally accepted accounting principles for government organizations, or as it is appropriately called, Public Sector Accounting Standards (PSAS) as issued by the Public Sector Accounting Board of CPA Canada.” Read Here

Private-Credit Fears are Based on Four Myths

One of the world’s largest private equity managers and private lenders, Apollo CEO Marc Rowan, tells you that there is nothing wrong in private credit markets but let’s take the other side of that trade. Apollo’s framing downplays real conflicts and systemic risks tied to its dual role as both largest private equity manager and major private credit lender. While Rowan emphasizes that most assets are investment grade, Apollo and peers still control significant slices of leveraged lending, often to companies they own or influence. This creates inherent conflicts of interest: underwriting standards, pricing, and covenant flexibility may favour portfolio companies over investor protections. Moreover, the claim that risk migration from banks to insurers makes the system safer ignores liquidity dynamics as insurance balance sheets are long-term, but if rates spike or credit spreads blow out, these institutions can still face mark-to-market pressure and policyholder withdrawals. Finally, transparency for private lenders doesn’t equal transparency for the broader market; regulators and investors lack the same visibility, making aggregate risk harder to assess. In short, Apollo’s narrative understates concentration risk and governance challenges in a market where the largest players wear multiple hats. Read Here

Tea Leaves

“I called it the three I’s — immigration, interest rates, and inflation — that were killing American people. Close the border — promise kept. Interest rates are down, and the 10-year bond, again the best year since 2020, and inflation led by energy prices is going to roll next year.” This U.S. administration will do everything in its power to keep this narrative going heading into U.S. midterm elections. This means weak oil prices are a focus, as well as pushing the Federal Reserve to cut rates. Fiscal deficit spending will continue parallel. All are very supportive to equity markets. Watch Here

Read the book 1929: Inside the Greatest Crash in Wall Street History—and How It Shattered a Nation

“In Seoul, South Korea, cryptocurrency trading is an E-sport where competitors buy and sell derivative markets against each other in tournaments.” Watch Here

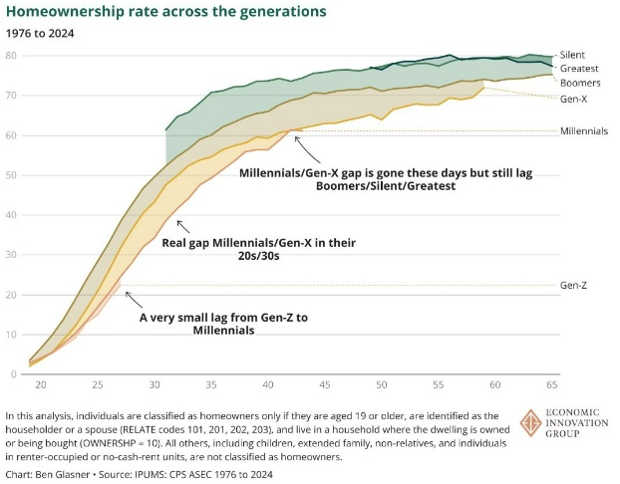

Pay Attention to Demographics

Once when Martin was a young whippersnapper analyst, he got to do a road show with an energy advisor under former U.S. president George W. Bush. He told him that when a country has a large percentage of its young people unable to earn a living and benefit economically, either you fix that problem or risk them tearing up the country. Ironically, he was talking about oil producing middle eastern countries at the time, and now its developed countries that this is happening to. Read Here

On the Positive

This Christmas season, take time to talk to someone you don’t know. A security guard, janitor in your building, a server, store clerk, uber driver, etc. and acknowledge them as an equal. Genuinely care. And you might be surprised at what you find out, and maybe you will make a difference in their life. That everyone matters. Everyone is your brother or sister. Share the love! Have a wonderful Christmas holiday.

Forget Happiness, Be Grateful – by Martin Pelletier

Gratitude is often underestimated in its ability to transform perspective, especially during times of uncertainty or loss. A friend of mine recently shared a mantra born from grief: “Forget happiness, be grateful.” It struck me because happiness can feel elusive—conditional on circumstances we can’t always control—while gratitude is a choice.When we focus on what remains rather than what’s missing, we anchor ourselves in resilience. Heading into a new year, markets will swing, policies will shift, and life will throw curveballs, but gratitude creates stability where volatility exists. It reminds us that progress, relationships, and even challenges are privileges, not guarantees. In a world obsessed with chasing “more,” gratefulness says, “enough.” And that mindset doesn’t just change how we feel—it changes how we lead, invest, and live. Listen Here

Envy and Jealousy

“Listen to Charlie’s grandmother when looking at your portfolio and stop comparing to everyone else. There is power in doing your own thing, especially when markets running hot.” Watch Here

Read the book The Master and His Emissary

“Or simply watch this 10minute video on one of the most powerful right brain thinkers of modern times. SERIOUSLY watch it and take notes. Some great tips.” You can thank us later. Watch Here

Setting Boundaries

Lower your expectations for human nature as a collective and put up boundaries protecting yourself. Be positive within your reality and make sure to keep those moats full. Watch Here

What Real Freedom Looks Like

“Detachment is freedom and yet we do the opposite, relinquishing our happiness to the opinions of others.” Watch Here

The Future of Man

Pierre Teilhard de Chardin saw life as a journey of convergence, a movement toward greater unity and consciousness, what he calls the Omega Point. Our days are not random; they are steps in a divine process. Each act of kindness, each moment of clarity, adds to the noosphere, a growing sphere of thought and love that draws us all that much closer to our creator. It moves us from a reflection to the source, out of the nothingness that is constantly trying to imprison us through attachment. Purpose is not found in isolation but in connection—between science and faith, between self and others, between time and eternity. As you start your day tomorrow, walk with awareness that you are part of something vast and sacred. And find peace in each step with the Universe. Read Here

That’s quite the walk-about!

“Karl Bushby, a British ex-paratrooper who set out in 1998 to walk around the world, is on the final stretch of his 27-year-long trek home, and trying to cope with social media pressure in a world that has changed profoundly.” Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

Wellington-Altus Private Counsel is registered as a Portfolio Manager in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland & Labrador, Nova Scotia, Northwest Territories, Nunavut, Ontario, PEI, Quebec, Saskatchewan, Yukon and an Investment Fund Manager in Alberta, Manitoba, Ontario, and Quebec.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca