“There’s a lot of uncertainty around how this is going to impact the global economy”

Since U.S. President Donald Trump unveiled his “Liberation Day” tariffs to the world this week, the oilpatch isn’t feeling a whole lot of salvation.

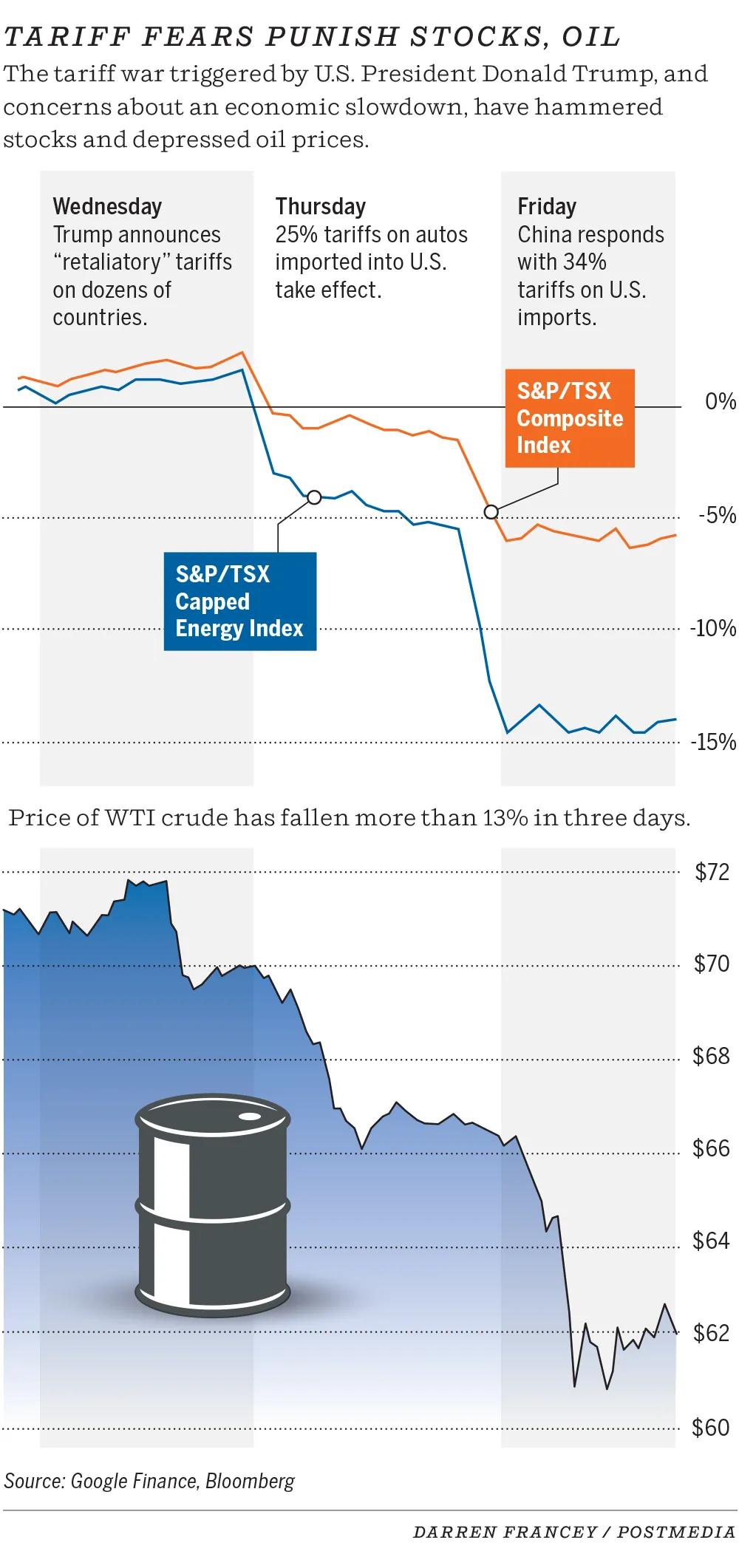

Benchmark U.S. crude prices have fallen by almost 14 per cent since Wednesday. Canadian oil and gas stocks are off 15 per cent.

And while Canadian energy exports aren’t being hit by American tariffs, there’s still plenty of fallout from the U.S. trade war.

“People are hitting the sell button first and asking questions later,” said Martin Pelletier, senior portfolio manager at Wellington-Altus Private Counsel in Calgary.

“There’s a lot of uncertainty around how this is going to impact the global economy and obviously that’s going to drive commodities and demand for commodities, especially oil.”

On Friday, West Texas Intermediate (WTI) crude futures fell by almost $5 to close just below US$62 a barrel.

On the Toronto Stock Exchange, shares in MEG Energy dropped 12.5 per cent on Friday, Vermilion Energy fell 15.6 per cent and Baytex Energy was down 17 per cent.

“The market is fearful of the unknown. It’s uncertain,” said Paul Colborne, CEO of Calgary-based petroleum producer Surge Energy, which decreased 11 per cent.

“I am surprised by the severity of it, but I do think crude bounces back.”

Equity markets around the world recoiled as China announced Friday it would respond to the latest U.S. tariffs with its own levies.

Equity markets around the world recoiled as China announced Friday it would respond to the latest U.S. tariffs with its own levies.

In the U.S., the S&P 500 decreased six per cent and the Nasdaq fell 5.8 per cent, while the S&P/TSX Composite Index dropped by 4.7 per cent.

The latest market turmoil began after Trump unveiled plans Wednesday for a 10 per cent tariff by the U.S. on all imports, and additional “reciprocal” tariffs on about 60 trading blocs or countries.

Expectations of retaliatory tariffs from other countries has sparked consternation of an economic slowdown, or possible recession, in the world’s largest economy.

J.P. Morgan chief economist Bruce Kasman increased the odds of the United States facing a recession to 60 per cent, if a trade conflict is sustained.

While Canada avoided seeing reciprocal tariffs from the U.S., it still faces previously announced levies on the auto, steel and aluminum sectors.

The country “is not out of the woods,” ATB Economics wrote in a note.

“What has happened is the trade war has gone global,” ATB chief economist Mark Parsons said in an interview.

“We see a much larger indirect hit via weaker global growth, including increased risk of a U.S. recession. And because the trade war has gone global, you are starting to see the global market reaction affecting commodity prices.”

In Alberta, with an energy-powered economy that relies on exports, the upheaval is being closely watched. The Alberta government’s new budget projects a $5.2-billion deficit.

A relatively low Canadian dollar and shrinking of the price differential between WTI and Western Canadian Select crude should provide some buffer to the industry and provincial coffers, say analysts.

The price discount for Western Canadian Select oil closed at US$10.35 a barrel on Friday, according to ATB Capital Markets.

Almost all Alberta oil and gas will not face any U.S. tariffs as it’s compliant with the Canada-United States-Mexico Agreement.

Rory Johnston, founder of the Commodity Context newsletter, said strong global demand for heavy crude, sufficient transportation capacity and no tariffs on Canadian oil are all helping to reduce the price differential.

As for broader oil markets, Johnston said Trump’s tariffs and OPEC’s tripling the pace of planned production increases for May led to a “sentiment-based rout” for oil prices this week.

Finance Minister Nate Horner during a news conference at the Alberta legislature in Edmonton in March. David Bloom/Postmedia

“There is significant churn in global markets right now, and oil prices are not immune,” Alberta Finance Minister Nate Horner said in a statement.

“We are monitoring the situation and expect that oil prices will eventually stabilize. It is too early to say what the medium- to long-term effects will be on the province’s finances or the job market.”

Statistics Canada reported Friday the province lost 15,000 jobs in March — after seeing large gains near the end of last year — while the unemployment rate increased to 7.1 per cent. Employment levels across the country dipped by 33,000 for the month, while Canada’s jobless rate increased slightly to 6.7 per cent.

Economists and the Bank of Canada have warned recently that companies are delaying hiring and making investment decisions until there is more clarity about the trade situation with the U.S.

As for oil markets, the decision by OPEC+ members to bring back more oil output caught many observers by surprise, given the concerns surrounding economic growth and demand.

“The tariff sell-off in the stock market is probably bigger than the OPEC situation from a psychological viewpoint, but from a physical viewpoint, the OPEC decision is probably bigger,” said Phil Flynn, senior analyst with the Price Futures Group.

“The market is going to be very well supplied.”

At this point, Colborne doesn’t expect major shifts by the industry because of lower energy prices — at least not yet — noting Surge and other producers have hedged some of their oil sales at higher prices.

“If it stays in this range, I think you’re going to see a pullback on capital spending,” he added.

“But when you look at supply-demand and the fact that low oil prices will actually stimulate the economy, I think it’s pretty short term.”

Chris Varcoe is a Calgary Herald columnist.