INSIDE

Markets looking a bit fragile here

Markets have taken an important turn over the past few weeks that only a few are picking up on. Anthony Crudele, former S&P pit trader and financial pundit, summed it up perfectly when he posted “The market is currently in a ‘good news is bad, and bad news is good’ scenario. To me, that’s a bearish environment. If the market is focusing more on rate cuts than growth, it suggests the bulls are losing steam.”

Let’s talk tariffs

Canada is facing one of its most serious threats in decades, this time from its closest ally, the United States, with President Donald Trump threatening us with hefty tariffs on our exports. Given Trump’s Art of the Deal negotiating tactic is to come out swinging and then backing off later, it makes the question of what will happen with the energy sector longer-term one major unknown, especially considering most of our exports are in the form of energy sold to U.S. refineries. When excluding oil and gas, the U.S. has a $58 billion trade surplus with Canada, not anywhere close the $200 billion number he keeps quoting.

Update on our strategic positioning

As most of you know, we prefer to take an approach that at least offers some near-term downside protection, especially when the cost of doing so is inexpensive given how overly bullish everyone is. We do this through multiple strategies, including the use of portfolio diversification, options, exchange-traded funds (ETFs), and structured products. As Howard Marks once said, “Investment success doesn’t come from ‘buying good things,’ but rather from ‘buying things well.’”

January 2025: ON BUBBLE WATCH

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

Markets have taken an important turn over the past few weeks that only a few are picking up on. Anthony Crudele, former S&P pit trader and financial pundit, summed it up perfectly when he posted “The market is currently in a ‘good news is bad, and bad news is good’ scenario. To me, that’s a bearish environment. If the market is focusing more on rate cuts than growth, it suggests the bulls are losing steam.”

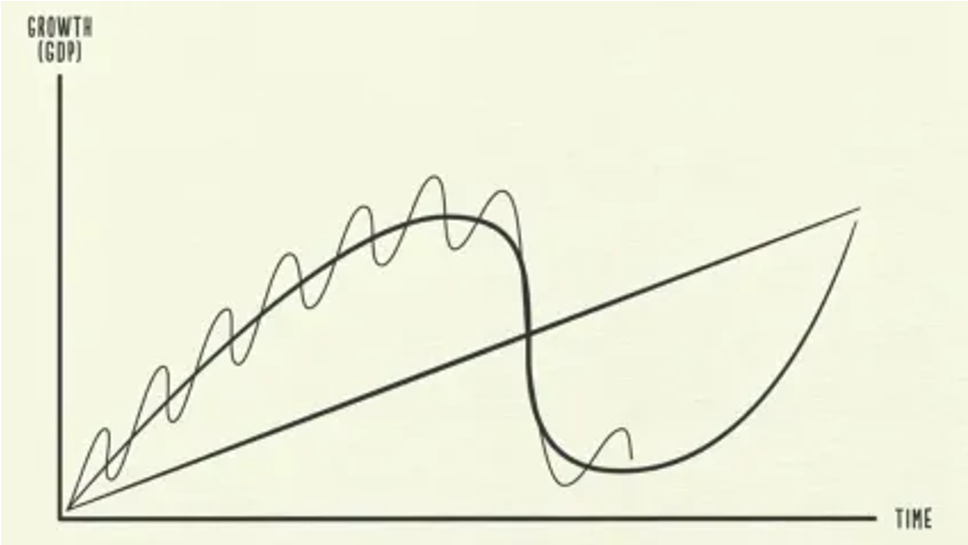

This is what we worry the market has turned into: one that is overly dependent on loose monetary policy to backstop growth assumptions, with the U.S. Federal Reserve pumping money into the markets and boosting companies’ ability to grow. This is then used to substantiate record setting valuations.

There are those who would say that “this time is different” given the quality and magnitude of the growth potential, especially from the artificial intelligence boom. This certainly has some merit. However, I think it’s worth exploring things from a historical perspective whenever I hear those four famous words.

In his recent memo entitled On Bubble Watch famed investor Howard Marks takes a look back at his years of direct market experience. While he doesn’t say there is a bubble and leaves that for us to decide, he certainly does reinforce the importance of understanding the roots of investing.

“If there’s a company for sale that will make $1 million next year and then shut down, how much would you pay for it? The right answer is a little less than $1 million, so that you’ll have a positive return on your money,” he writes.

He then goes on to explain how price-to-earnings (P/E) ratio, or multiples, value the company’s worth into the future.

“Stocks are priced at ‘P/E multiples’—that is, multiples of next year’s earnings. Why? Because presumably they won’t earn profits for just one year; they’ll go on making money for many more. When you buy a stock, you buy a share of the company’s earnings every year into the future. The price of the S&P 500 has averaged roughly 16 times earnings in the post-World War II period. “

“This is typically described as meaning ‘you’re paying for 16 years of earnings.’ It’s actually more than that, though, because the process of discounting makes $1 of profit in the future worth less than $1 today. The current value of a company is the discounted present value of its future earnings, so a P/E ratio of 16 means you’re paying for more than 20 years of earnings (depending on the interest rate at which future earnings are discounted).”

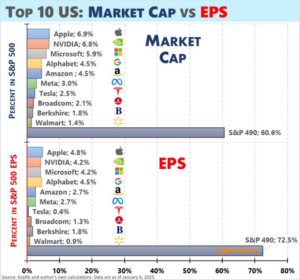

Now fast forward to today and let’s apply this to the world’s two largest companies: Apple Inc. and Nvidia Corp. Essentially, you are currently paying for well in excess of 30 to 40 years of earnings. When looking over the next decade, I have confidence in both of these companies’ ability to deliver strong earnings to creditors and investors, but we do worry about the risk of maintaining their existing multiples at the end of the decade (which has never been done before), which would have a major impact on the value of your investment.

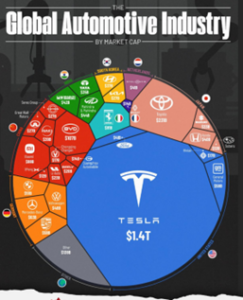

There are even pockets of exuberance where a company like Tesla Inc., the ninth largest in the world, is trading at more than 100 times earnings. It is 2.5 per cent of the S&P 500 by market cap but only 0.4 per cent by earnings. Its value represents nearly two-thirds of the entire automotive industry. Simply, ask yourself: Will two out of every three cars on the road in the next decade be a Tesla?

Marks wraps it up with a bow by highlighting a chart by JP Morgan Asset Management. It has 324 monthly observations (27 years x 12) from 1988 through late 2014 showing the forward P/E ratio on the S&P 500 at the time and the annualized return over the subsequent 10 years.

Regardless of what some pundits will tell you, there is a very strong relationship between valuations and subsequent annualized ten-year returns. Clearly, higher starting valuations consistently lead to lower returns, and vice versa. Today’s P/E ratio is noticeably in the top decile of observations, implying that when at these levels 10-year returns have been between plus two per cent and minus two per cent.

Therefore the risk of losing money gets underpriced and overpriced. Ask yourself: With history being your guide, what environment are we in today if you had to invest for the next 10 years?

This is why we prefer to take an approach that at least offers some near-term downside protection, especially when the cost of doing so is inexpensive given how overly bullish everyone is. We do this through multiple strategies, including the use of portfolio diversification, options, ETFs, and structured products. As Marks once said, “Investment success doesn’t come from ‘buying good things,’ but rather from ‘buying things well.’”

Thanks for reading, and please feel free to reach out to any of our team members should you have any comments, questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

![]()

Tariffs and the Art of the Deal negotiation tactics

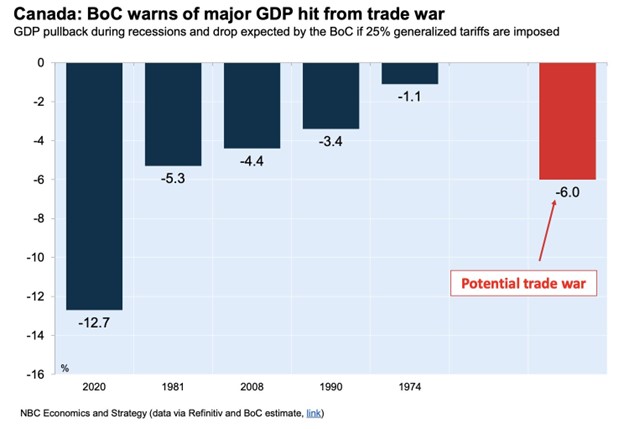

Canada is facing one of its most serious threats in decades, this time from its closest ally, the United States, with President Donald Trump threatening us with hefty tariffs on our exports. According to NBC Economics, should the full extent of his proposed 25 per cent tariffs get implemented, it could cause Canada’s gross domestic product (GDP) to contract by as much as six per cent, causing a recession deeper than in 1981, 2008, 1990 and 1974, with only the COVID-19 shut-down in 2020 being worse.

Given Trump’s Art of the Deal negotiating tactic is to come out swinging and then backing off later, it makes the question of what will happen with the energy sector longer-term one major unknown, especially considering most of our exports are in the form of energy sold to U.S. refineries. When excluding oil and gas, the U.S. has a $58 billion trade surplus with Canada, not anywhere close the $200 billion number he keeps quoting. We also sell our oil at a discount into the U.S. greatly benefiting their refineries and ultimately their consumers.

There are many things we can do and lessons to be learned from all of this but it sure would be helpful if Prime Minister Justin Trudeau hadn’t initiated the prorogation of Parliament until March, leaving our country more exposed in the face of Trump’s threats without an active legislative process.

From an energy sector perspective, we would also be in a more powerful negotiating position if only we had built out the Energy East and the Northern Gateway pipelines. Having the ability to divert approximately 60 per cent of U.S. oil imports directly to Eastern Canada and other countries would be a huge hammer to hold over Trump. The same would apply for LNG exports, selling our inexpensive natural gas to regions in need like Europe and Asia.

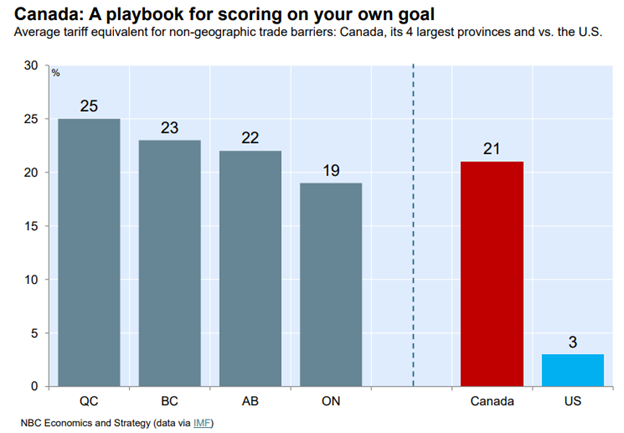

Another course of action that we can take is to get our own house in order. A recent report by National Bank citing the C.D. Howe Institute, showed that Canada’s interprovincial trade barriers are equivalent to a whopping 21 per cent tariff. This is quite shocking to think that it is more punitive to trade amongst ourselves than with the U.S.

From an investment perspective, we think any widening of the Canadian heavy oil differential and corresponding sell-off among Canadian oil producers would create an excellent buying opportunity, as we believe any tariffs on oil exports would be short-lived. In fact, we expect the Trump administration to want more Canadian crude rather than less and so any talk of pipeline expansions to tidewater would certainly help our cause.

Other areas could be exposed, such as manufacturing, agriculture and lumber, but we wonder how pronounced any tariff would be. For example, how could lumber be impacted, especially considering the substantial increased demand to come out of rebuilding Los Angeles following the fires?

The bottom line is, while this is a clear and present danger, perhaps it will lead to some much needed changes here at home. We may be looking at a change in federal government, away from one that imposed punitive policy aimed at small and medium business while expanding the government workforce by more than 40 per cent and imposed material tax increases on domestic capital sources.

This would potentially allow us to finally look at becoming a jurisdiction open for business, diversifying our markets away from just one client, including our energy sector, and breaking down trade barriers between each province.

This could, in turn, lead to an improved economy and a robust equity market that has significantly lagged the U.S. for the great part of the past two decades. This is something I’m sure most Canadians are willing to invest in.

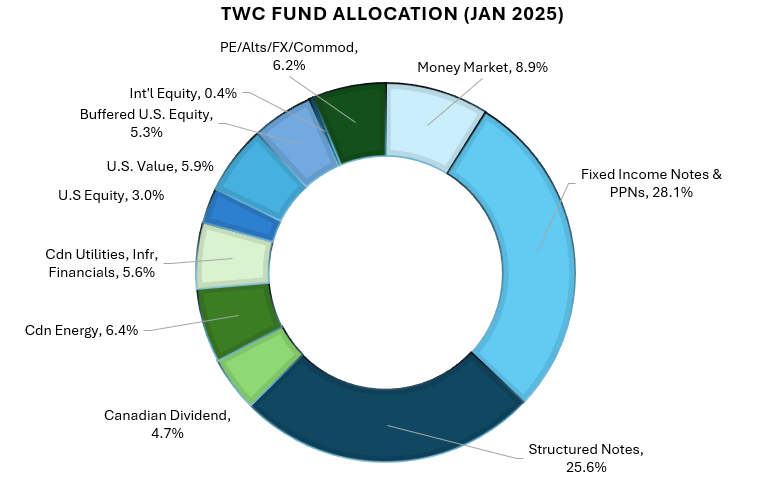

Asset Allocation and Strategic Positioning

Currently, within our TWC Risk-Managed Balanced Growth fund, our cash position is up about 1 per cent in the quarter to 9 per cent given some recent subscriptions in January, and the calling away of some of our U.S. equity exposure. We are running 28 per cent in fixed income related structured notes and 100 per cent principal protected notes, while regular structured notes on equity indices are down about 5 per cent in the quarter to 26 per cent with a number of notes called away not getting reinvested.

For example, we just did one on blue-chip Canadian stock with 100 per cent downside protection over the next 3 years with full tracking and a booster such that it will generate a minimum 25 per cent return if the underlying basket rises between 0 to 25 per cent at the end of the term. We have also been focusing in on monthly contingents with 25 to 30 per cent downside and yields ranging between 8 to 9 per cent.

On the equity side, we were just called away on our U.S. large and small cap positions given the call writes we did. We have since reinvested a large part of this taking advantage of the December sell off by deploying into another hedged U.S. equity put-spread collar, and adding more to the Vanguard U.S. Value ETF (VTV) that is dominated by solid names like Berkshire Hathaway, JP Morgan Chase, UnitedHealth Group, Exxon Mobil, Home Depot, Proctor and Gamble, and Walmart. We think this is a great risk-managed way of owning the U.S. market as this fund sold off only 3.5 per cent during the 2022 market correction.

We continue to have a decent Canadian dividend exposure in companies like the banks, pipes, and utilities all of which will benefit from falling interest rates. They also remain less correlated with the Canadian economy which is experiencing turmoil with looming tariff threats and a Federal government in disarray.

We also took advantage of the tax-loss selling by establishing a position in Telus (T:TSX), which we view as among the strongest in the beaten up telecommunications sector in Canada. We also added to positions such as Baytex (BTE) and Cenovus (CVE) in the energy sector in December on tax-loss selling weakness both of which are up nicely on some strong momentum on robust global macro fundamentals. Iran is under increased scrutiny which could prevent their sanctioned barrels from hitting the market.

Finally, we added some more commodity exposure as a protection against some of the inflationary policies out of the U.S. Trump administration and global government deficit spending. We also have made a decent gain on our short EUR position and may trigger a capital gain on this hedge.

Research, media, and reads of the month

Current opportunities in the market

Martin Pelletier, senior portfolio manager of Wellington-Altus Private Counsel, talks about existing prospects within the market.

Current leading stocks in the market

Portfolio manager Martin Pelletier breaks down what stocks are currently leading the market.

Assessing the top risks for markets in 2025

Portfolio manager Martin Pelletier shares what risks in the market he’ll be watching out for in 2025.

Could the TSX outperform in 2025?

While some investors are predicting the TSX could reach 28,000 in 2025, how likely is it to outperform? Portfolio manager Martin Pelletier explains.

“The stock market will do whatever it has to do to embarrass the greatest number of people to the greatest extent.” – Walter Deemer

The facts on trade. If you take Canadian oil out of the equation, Canada actually has a trade deficit, and the U.S. has a surplus—of $58 billion. Read Here Who’s Subsidizing Whom? Myth and Reality about the Canada-U.S. Trade Balance Read Here

Capital gains taxation. Pierre Poilievre announced that the Conservatives will reverse last June’s Liberal tax hike on capital gains. Our friend and tax expert Kim Moody recently wrote about this in his piece “Beware the risks and rewards in deciding to adopt the proposed capital gains tax rules.” Read Here

Trudeau’s prorogation. Parliament’s prorogation puts critical climate and affordability initiatives at risk. Here are a few examples of what’s on the line. Read Here

Don’t miss the Argentina trade. Listen Here for Jared Dillan’s thoughts on Canada’s “unfree” economy and the upswing in Argentina’s Markets. Lessons for Canada in Argentina’s newly freed markets Read Here

No one wants small caps. Fund Managers are now the least bullish on Small Cap stocks in history. See Here

The pros don’t care about benchmarks. David Tepper, David Einhorn and Alan Howard are three of the most successful investors of their generation. Their key funds gained 8%, 7.2% and 4.7% last year. See Here

U.S. equity markets. Bloomberg survey among strategists range from 7 to 19 per cent gains in 2025 for the S&P 500. See Here Goldman Sachs: Equities will return 3 per cent annualized over next 10 years. The distribution around their forecast ranges from -1 to +7 per cent. See Here

Goldman Sachs: The equity market is currently near its most concentrated level in 100 years. See Here WSJ: “… even if analysts’ optimistic outlook for 2025 is realized, its one-year forward earnings yield has fallen to 4.6 per cent—the same as the yield of a 5-year Treasury.” See Here The CAPE ratio currently stands in the 96th percentile of its range over the past 50 years. What does that mean for future returns? Read Here

U.S. bond markets. The Bloomberg Aggregate Bond Index has now been in a drawdown for 53 months, by far the longest in history. See Here

Mark Zuckerberg takes a bite out of Apple. “Steve Jobs invented the iPhone and now they’re just sitting on it 20 years later… so how are they making more money as a company? They do it by squeezing people” Listen Here

Ray Dalio on the clear difference between bitcoin and gold. The problem is Bitcoin increases your portfolio risk rather than decreasing it because it’s essentially a levered beta trade. That isn’t to downplay its usefulness, but it helps to understand its relationship when running a portfolio. Listen Here

On the Positive

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2024, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca