INSIDE

The Quiet Unravelling of the Post‑QE World

Like natural systems that emit faint tremors before an eruption, today’s markets are sending subtle but troubling signals. Gold’s sharp ascent and the surge in long‑dated sovereign bond yields — including Japan’s once‑unthinkable climb past four per cent — suggest deep structural pressures long set in motion by post‑2008 quantitative easing (QE) and pandemic‑era fiscal excess. With governments increasingly reliant on central banks to absorb massive debt issuance, the risk of currency debasement is accelerating, eroding purchasing power, and widening the divide between asset owners and cash holders. Demographic shifts add further strain as aging boomers may soon sell assets into a market less willing or able to leverage at higher rates. As global central banks rotate reserves out of U.S. treasuries and into gold, the need for investors to rethink traditional sovereign debt exposure becomes urgent. In our portfolios, we’ve responded by emphasizing gold, metal producers, high‑dividend moated businesses, and structured notes with built‑in protection — because in an environment where the ground is rumbling, inaction is the greatest risk.

How Your Generation Shapes the Way You Invest

Martin has been reflecting on bestselling author Scott Galloway’s idea that each generation is shaped by the era it grows up in, and sees a direct parallel in investing: before we ever choose an asset class or build a portfolio, our generational wiring influences how we perceive risk, what we fear, and how we react to uncertainty. Boomers, shaped by decades of stability and asset appreciation, often default to the playbook that worked during a long disinflationary boom, risking complacency in a shifting macro regime. Gen X, raised amid institutional skepticism, tends toward contrarian instincts that help avoid bubbles but can also lead to fighting trends that persist far longer than expected. Millennials, moulded by crises but cushioned by unprecedented policy backstops, often prefer rules-based, automated systems that offer structure yet can fail when markets break from historical patterns. And Gen Z, facing the steepest financial headwinds and feeling shut out of traditional wealth pathways, gravitates toward high-risk, high-velocity strategies that threaten their most precious advantage: time. These biases don’t determine outcomes, but they shape predictable blind spots — and the real challenge for investors is recognizing when their generational lens is quietly helping them, and when it’s quietly working against them.

TFSA vs RRSP: Putting the Right Assets in the Right Accounts

Asset location is one of the most overlooked drivers of long‑term performance, often adding a few percentage points per year in after‑tax returns simply by placing the right assets in the right accounts: the TFSA should hold high‑growth, high‑convexity assets — equities, growth ETFs, small and mid‑caps, and asymmetric structured products like principal-at-risk (PAR) or twin‑win notes — because all upside compounds tax free and withdrawals never touch taxable income; meanwhile, the RRSP is the ideal home for income‑producing, tax‑inefficient assets such as fixed income, foreign dividends, and monthly structured income notes, where tax‑deferred compounding and retirement‑rate withdrawals minimize annual tax drag. Used together, the TFSA becomes a long‑term convexity engine that harvests volatility and amplifies tax‑free growth, while the RRSP acts as a stability and income reservoir that smooths cash flows and shelters predictable yields — creating a tax‑optimized barbell that mirrors a disciplined, risk‑managed, goals‑based portfolio design.

Strong Momentum Heading into 2026

Our TWC Risk‑Managed Balanced Growth strategy continued to deliver on its mandate in 2025, with the fund returning 14.7 per cent and outperforming the 10.8 per cent passive benchmark, reinforcing its long‑term pattern of participating in strong markets while shining during corrections such as 2022 thanks to embedded downside protection. Entering 2026, we repositioned selectively: a long‑dated U.S. Treasury PAR note matured inside its barrier — effectively acting as recession insurance — allowing us to redeploy into twin‑win structured notes capable of earning returns in both rising and falling markets through asymmetric payoffs. We also realized a substantial gain on silver, rotating into gold and BHP Group to capitalize on an emerging global copper deficit expected to widen dramatically by 2040. Additionally, we exited Berkshire and moved into Honeywell, where a sum‑of‑the‑parts (SOTP) breakup is projected to unlock significant value. Looking ahead, we maintain a prudent 60 per cent overweight to structured notes — emphasizing lower‑risk indices and principal‑protected strategies — paired with convex twin‑win notes, positioning the portfolio defensively yet opportunistically for an uncertain year.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. Wishing you a Very Merry Christmas and all the best over the New Year.

January 2026: The Quiet Unravelling of the Post‑QE World

Like in nature, markets often give off subtle warning signs that something is amiss. Those signals don’t always imply a permanent regime shift, as true structural changes take years to build, much like pressure beneath a volcano. However, when the break finally comes, the eruption can be explosive and the damage catastrophic.

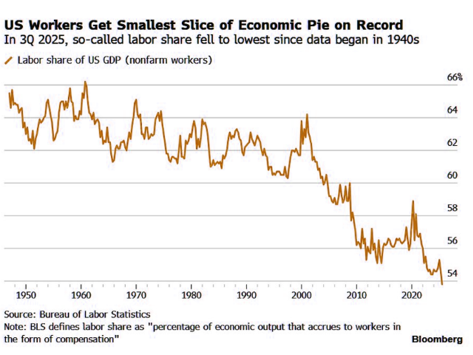

In today’s environment, we believe gold and sovereign bond markets are those early steam clouds. Gold has accelerated sharply, rising nearly 70 per cent over the past 12 months. Long dated bond yields, especially in historically low-rate countries such as Japan, have also pushed higher and in some cases set new highs. Last week, Japanese 40-year yields briefly surpassed four per cent, something previously thought impossible for a country long mired in deflationary pressure and driven by rapidly aging demographics.

In our view, the roots of this moment trace back to the post-2008 period and the introduction of quantitative easing (QE). QE unquestionably saved the global financial system, but the problem is that it never stopped once the crisis ended. Each time markets wobbled, central banks stepped back in. The strategy “worked,” as long as bond markets co-operated and kept yields low.

Then COVID hit, and governments got a taste of unlimited fiscal spending. And like QE, they didn’t stop when the emergency ended. Instead, wartime-like deficits continued, including in the U.S., where last year’s deficit reached six per cent of GDP.

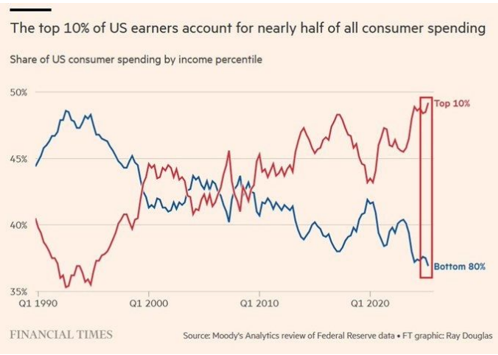

The issue now is that central banks appear close to implementing yet another round of QE not to stabilize markets, but simply to absorb the massive issuance of government debt. That’s where the real danger emerges: currency debasement. When a central bank prints money to finance deficits, the purchasing power of that currency erodes rapidly. This is why a dollar today buys roughly 81 CAD cents in Canada and 78 USD cents in the U.S of what it did in 2019.

Fortunately, those who owned assets such as housing and equities were able to offset that erosion through inflation in those asset values. Those who held cash, either by necessity or choice, have borne the brunt of the affordability crisis and have been left way behind with no way to catch up.

Adding to this complication is demographics. A large concentration of those assets is held by aging baby boomers who may soon need to sell. But the next generations are unwilling — or unable — to take on heavy leverage at today’s higher rates. If the bond market continues pushing back, we could face the worst possible combination: falling home and stock prices in an environment of ongoing debasement.

This dynamic could intensify if global governments continue reducing their U.S. Treasury holdings and reallocating reserves into gold. Momentum is already building: central banks now own more gold than treasuries for the first time in three decades.

As an investor, doing nothing is not an option. Now is an ideal time to revisit your portfolio. Start by examining your government bond exposure, especially in jurisdictions such as Canada, where the federal government holds no gold reserves and where 10-year yields near three per cent offer little compensation for the level of risk.

Commodity-based economies typically provide some protection against debasement, but Canada remains an exception. Excessive regulation and policy uncertainty have constrained the sector, with discussions still stuck at the Memorandum of Understanding (MOU) stage instead of translating into real action.

In our portfolios we have been steadily increasing gold exposure — both through physical gold ETFs and gold producers — while also adding selective positions in other metal producers such as copper, which provide additional protection against the declining purchasing power of our currency.

We don’t own a single sovereign bond. Instead, we use structured notes with substantial downside barriers and attractive yields, along with twin-wins that can generate returns if markets remain flat or even negative, while also offering amplified upside if markets continue to trend higher.

We also have been increasing our exposure to high dividend companies operating in sectors with strong competitive moats has been a resilience strategy. We like segments including utilities, infrastructure, and select telecommunications companies.

When it comes to protecting your wealth, doing nothing is the greatest hazard, be it postponing overdue portfolio changes or hiding in cash as inflation chips away at its value. As with a restless mountain, the signs are visible long before the explosion; ignore them, and you may find the volcano erupting at your feet.

How your generation shapes your portfolio — and your blind spot

Martin has been reading bestselling author Scott Galloway’s new book, and one theme he returns to is how profoundly a person’s era shapes their instincts — from career expectations to family structure to how we perceive safety and opportunity. It struck him how directly this applies to investing. Long before we compare asset classes or build portfolios, our generational wiring influences how we interpret risk, what we fear most, and how we respond to uncertainty.

Generational perspectives don’t determine outcomes, but they can certainly shape biases. The markets we grew up with — their booms, crises, and policy responses — quietly program our assumptions. As a result, different generations don’t simply invest differently; they misjudge risk in different, predictable ways. In a world where market structures and macro regimes are shifting, recognizing these blind spots has never been more important.

Baby boomers: Stability as strategy — and potential liability

Boomers came of age during one of the most extraordinary economic expansions in history. They witnessed the rise of post‑war institutions, globalization, a 40‑year decline in interest rates, and steady appreciation in housing and financial assets. Stability and continuity became synonymous with safety.

Today, boomers still control a commanding share of household wealth, reinforcing a bias toward what worked in the past: large‑cap equities, long‑duration bonds, and income strategies built for a disinflationary world.

Their risk isn’t recklessness — it’s complacency. Beliefs harden with age, and in today’s environment of inflation volatility, geopolitical fragmentation, and aggressive fiscal intervention, clinging to the old playbook can be dangerous. But reframing doesn’t require abandoning structure. It simply means loosening rigid assumptions and allowing portfolios to evolve with the regime they’re actually in, not the one they remember.

Gen X: Contrarians by nature

Gen X is often overlooked demographically, yet in investing they may be the most psychologically distinct. Raised amid rising divorce rates, declining trust in institutions, and early financial market democratization, Gen X learned independence early: do your own homework, question certainty, resist imposed rules.

This skepticism is often an advantage. It helps Gen X sidestep bubbles, resist crowded trades, and reposition ahead of turning points. But contrarianism can become a liability when “opposing the crowd” becomes the objective rather than the result of analysis.

Structural trends — whether technological or capital‑cycle driven — frequently last far longer than expected. A reflexive urge to fade them, especially without a process or decision rules, can lead to missing the market’s most powerful compounding periods.

Gen X’s risk isn’t complacency; it’s reflexive opposition. Contrarianism is a strength only when paired with humility and structure. Sometimes the crowd is wrong — and sometimes, to Gen X’s frustration, the crowd is simply early.

Millennials: Rules, systems, and the illusion of control

Millennials entered adulthood during the global financial crisis and then endured another systemic shock only a decade later. Yet paradoxically, much of their investing experience has taken place in a world of backstops: quantitative easing, fiscal stimulus, and rapid recoveries.

It’s no surprise they gravitate toward systems that promise protection — rules‑based investing, passive strategies, automated portfolios, and tightly defined processes. They were the first generation to widely adopt robo‑advice and passive indexing as their default framework.

Discipline is a strength, but overreliance on preset models can be dangerous when regimes change. When inflation returns, correlations break down, or market leadership narrows, rigid systems tend to lag — sometimes amplifying losses.

Millennials’ biggest risk isn’t emotional overtrading; it’s underreacting, staying anchored to frameworks built for a world that may no longer exist.

Gen Z: Investing without belief in the future

No generation faces a steeper starting point than Gen Z. They confront historically high housing costs, widening inequality, and living expenses that outpace wage growth. Many believe homeownership may be permanently out of reach — and even renting has become increasingly burdensome.

Layer in the promise of higher education that hasn’t always translated into stable, well‑paying work, and you get a generation that feels structurally priced out of traditional wealth‑building pathways.

When the conventional path looks blocked, risk perception shifts. Slow compounding feels irrelevant when you’re starting 10 steps behind. This has pushed many young investors toward leverage, short‑dated options, crypto, and speculative trading — strategies that promise rapid escape velocity. The irony is these carry the highest risk of permanent capital loss.

Gen Z’s biggest danger isn’t volatility, it’s path dependency: losing capital early eliminates the powerful advantage of time, which should be their greatest asset.

What this means for investors

Generational wiring doesn’t determine results, but it shapes tendencies — and those tendencies create blind spots. The key is not to abandon instinct, but to build portfolios that compensate for it.

Structure must allow for flexibility. Independence must include risk limits — and occasionally accepting the crowd’s view. Speculation must be contained within boundaries that protect long‑term compounding.

Markets don’t care how we feel about the future, but they do reward those who adapt to reality. The most important investment decision may not be what we buy, but whether we recognize when the lens we’re viewing the world through — our generational lens — is quietly working for us or quietly working against us.

Asset Location: The Silent Edge Most Investors Ignore

Most investors obsess over what they buy — stocks, bonds, ETFs, alternatives, structured notes. But the real drag on long-term performance often isn’t the security itself. It’s the account you put it in.

Choosing the right asset but parking it in the wrong account is one of the most common and costly mistakes in personal finance. Fixing it can add after-tax returns without taking a dollar of additional risk.

Two accounts dominate Canadian wealth building: the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP). They behave very differently, and once you understand their tax physics, your asset placement becomes straightforward.

TFSA: Your High-Growth, High-Convexity Engine

The TFSA remains one of the most powerful tax shelters in the world. All growth is tax free — forever. Withdrawals never show up in taxable income. And any amount withdrawn is added back to your contribution room the following year, making the TFSA behave like permanent tax-free equity on your personal balance sheet.

Because of that structure, the TFSA is the ideal home for higher growth, higher upside, higher convexity assets — anything with asymmetric payoff potential. Growth equities, small and midcap stocks, innovation-oriented ETFs, or factor tilts such as momentum and quality all benefit disproportionately when their compounding engine operates tax free.

Structured products that offer convexity — such as PAR notes, buffered growth notes, or twin-win style payoffs — fit beautifully here as well. These instruments protect the downside while maintaining upside participation, allowing volatility to work for you rather than against you. When that convexity compounds inside a TFSA, the long-term benefit is enormous. Your use of PAR structures inside the TFSA is exactly what the math supports: amplify the upside, cushion the downside, and keep every dollar of gain.

Over multiyear horizons, the TFSA becomes a convexity engine. Volatility turns from a source of fear into a source of opportunity. Rebalancing into pullbacks, accumulating high-growth assets during volatility spikes, and capturing asymmetric payoffs are all rewarded when the government is no longer your silent partner.

RRSP: The Income Shield and Tax Deferral Reservoir

If the TFSA is built for growth, the RRSP is built for tax efficiency and income smoothing. Contributions reduce taxable income in high-‑earning years. Growth compounding inside the account is tax deferred‑. Withdrawals are fully taxable, but ideally occur in retirement — when marginal rates are lower.

Because RRSP withdrawals are treated entirely as income, this account is best reserved for assets that produce yield, coupon payments, or predictable return streams. These are the types of returns you don’t want taxed annually at your marginal rate.

That includes traditional fixed income — bonds, GICs, T-bills — as well as dividend-paying foreign stocks, which often avoid U.S. withholding tax when held in an RRSP. It also includes monthly contingent income structured notes, where cash flows can be high but extremely tax inefficient if held in a taxable account.

Using the RRSP for income-producing structured notes — especially monthly or annually autocall series — is a textbook example of efficient asset location. Coupons accrue and reinvest tax deferred, and capital is returned later at what is often a lower effective tax rate. The stability of these instruments also complements the more volatile, higher upside assets stored inside the TFSA.

In practice, the RRSP becomes your stability and income reservoir. It anchors the portfolio with predictable cash flows, dampens behavioural risk, and provides dry powder for reinvestment during periods of market stress — all while the TFSA stays fully allocated to growth.

The Barbell: A Tax-Optimized, Risk-Managed Portfolio

When investors combine the TFSA and RRSP with intention, the result is a powerful barbell:

- On one side sits the TFSA, compounding tax-free growth through convexity and upside.

- On the other sits the RRSP, storing income assets where tax drag is minimized and reinvestment can occur tax deferred.

Together, these two accounts mirror the principles of a risk–‑managed, goals–‑based portfolio, a framework . One bucket drives wealth creation; the other stabilizes it. One harvests volatility; the other mutes it. And both do so with optimal tax efficiency.

The lesson is simple but impactful: The real edge in long-term investing isn’t only what you buy — it’s where you put it. Most investors overlook this. The ones who don’t quietly collect extra percentage points per year, every year, without changing their risk profile at all.

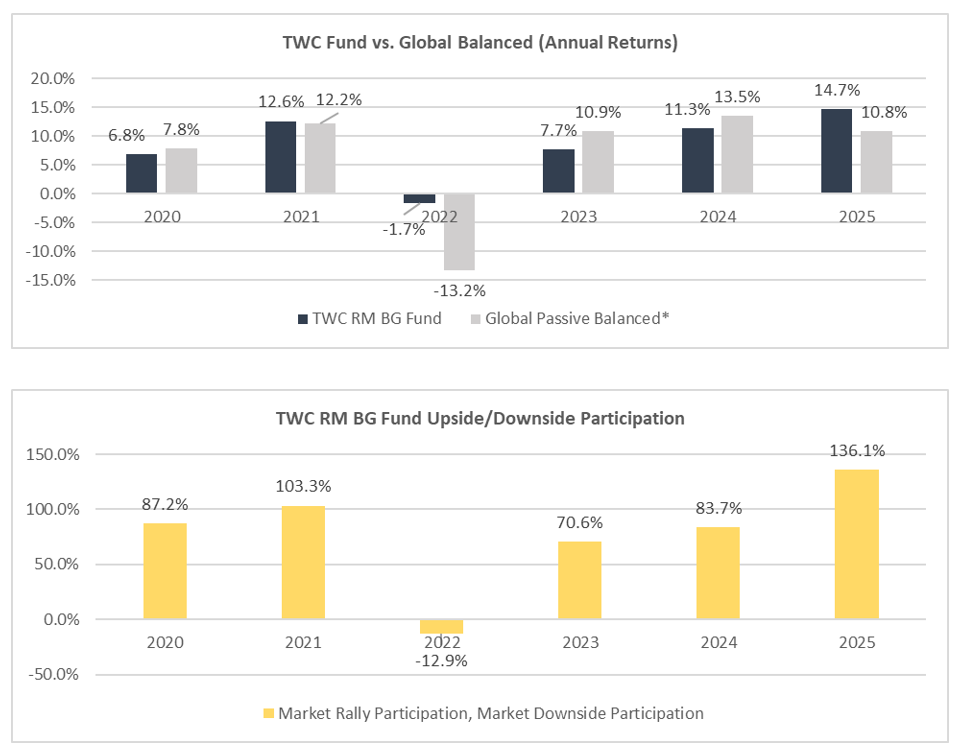

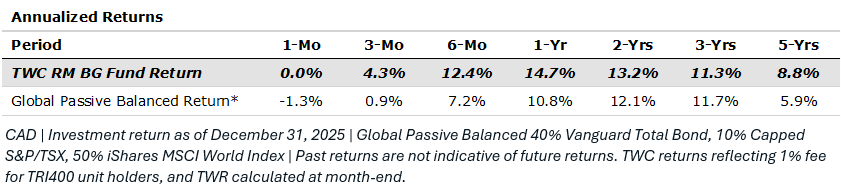

Strategy: Risk-Managed Growth in Uncertain Times

The majority of our clients own units of our TWC Risk-Managed Balanced Growth Fund, and/or have similar strategies directly within their accounts. Our fund had a solid year in the markets returning 14.7 per cent in 2025, outperforming the 10.8 per cent passive benchmark. There are years where we will underperform like 2023 and 2024 but we aim to still participate in those strong market years. There are also periods like 2025 and 2021 where we will outperform with superior returns. However, we really shine in years like 2022 where markets correct via our embedded downside protection.

As a result, this means lower downside volatility portfolios delivered average returns inline or ahead of our goals-based targets. For example, our TWC Risk-Managed Balanced Growth Fund is designed to target a 6 to 8 per cent annual return over the long-term and fortunately it has generated an 8.8 per cent annualized return. As a result of our downside protection, we’ve also managed to outperform our global passive portfolio that delivered a 5.9 per cent annualized return over the same period.

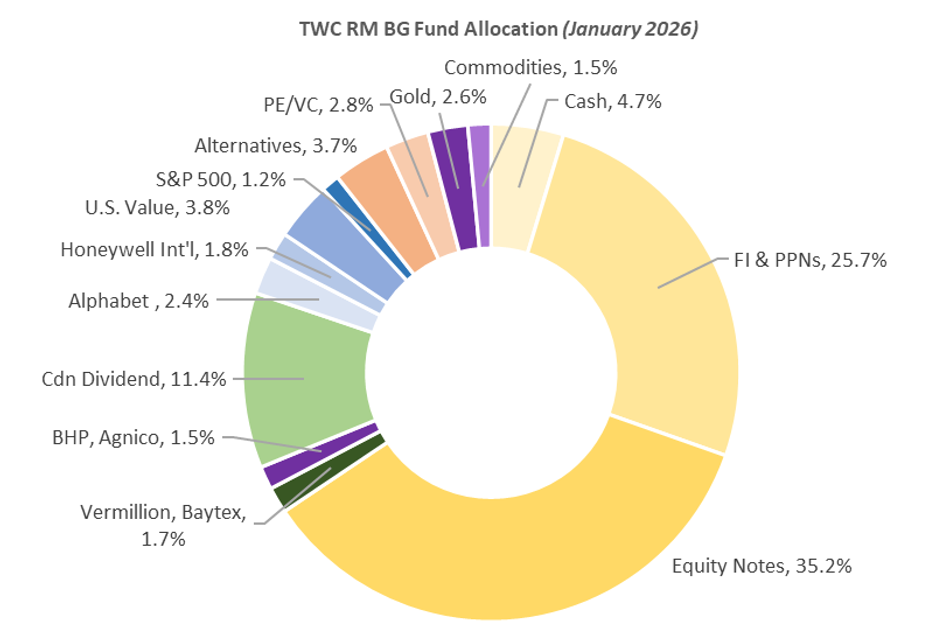

Strategically, we made a few position changes in the portfolio to start the new year. On the structured note side, we had a PAR note on long-dated U.S. treasuries come due within the downside barrier versus the actual iShares Long-term Treasury ETF that sold off 15 per cent and so we received a return of our capital. We did this trade as an insurance policy roughly two-and-a-half years ago in the event of a large economic contraction.

We’ve since reinvested those proceeds — both within the fund and for clients — into two large twin-win structured notes that can profit in both rising and falling markets. If a basket of Canadian blue-chip names declines by -0 to -50 per cent over the next three-and-a-half years, we earn a corresponding 0 to 50 per cent return; if the basket appreciates, we capture 1.60× to 1.65× the upside. We also did one with a 0 to 40 per cent range on the downside and a booster such that if these stocks are less than 27 per cent in total, you get the booster to 27 per cent return (7.6 per cent annualized) with 100 per cent tracking above it. If markets correct 0 to 40 per cent, you make that as a positive return.

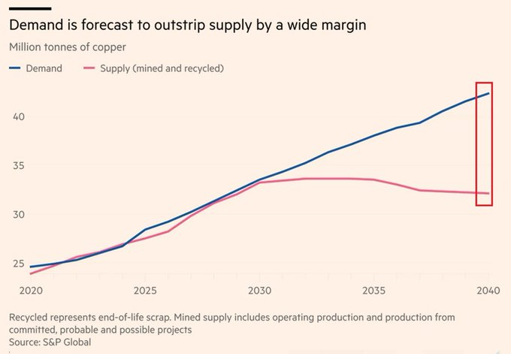

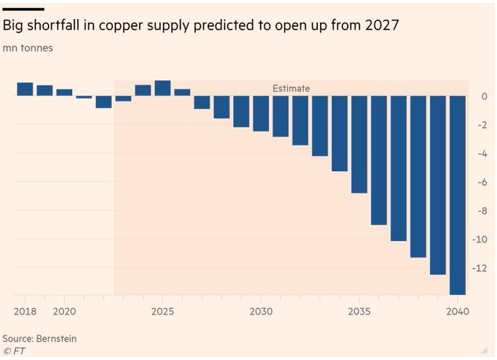

On the equity side, we exited our silver position with a substantial profit (roughly doubling our investment within the fund) and reinvested into gold and BHP Group, which is the world’s largest and most reputable copper producer. We are quite bullish on copper as the world economy is projected to face a copper deficit of 10 million tonnes by 2040, equivalent to roughly 33 per cent of current global demand.

This comes as global copper demand is estimated to surge to 42 million tonnes by 2040, from 28 million tonnes in 2025. Asia alone is expected to reflect 60 per cent of total demand growth over this time, driven by EV adoption and grid upgrades. At the same time, AI data centre copper demand is set to surge +127 per cent to 2.5 million tonnes by 2040. Meanwhile, supply is expected to peak at ~34 million tonnes in 2030 before declining to ~32 million tonnes by 2040.

We also recently exited our Berkshire position and rotated into Honeywell International, a top pick of Steve Rowles. Honeywell’s restructuring, driven by late‑2024 and early‑2025 announcements and accelerated by pressure from Elliott Investment Management, is designed to unlock substantial upside through a classic sum‑of‑the‑parts (SOTP) breakup that separates its Aerospace, Automation, and Advanced Materials divisions into independent companies. The Aerospace unit — Honeywell’s crown jewel and roughly 40 per cent of revenue — could alone exceed US in value, while the Automation business becomes a focused pure‑play leader and the high‑margin Advanced Materials division (including Solstice) is set for a value‑enhancing spin off. Activist and analyst estimates highlight the upside: Elliott projects shares reaching US$ by the end of 2026 (a 54%–84% increase), while Barclays pegs SOTP value around US, all meaningfully above pre‑restructuring levels. Although some analysts note near‑term execution risk, the overarching thesis is clear — the breakup replaces a conglomerate discount with higher multiples for more specialized businesses, positioning Honeywell for potentially transformative value creation.

Looking ahead, the core of our strategy is deployed at an overweight 60 per cent weighting to structured notes, with a focus on low-risk fixed income underlying assets or principal-protected notes (PPNs) with 100 per cent embedded downside protection paired with twin-win notes offering gains in both up and down markets. This remains at the higher end of our desired range, which we think is prudent action heading into an uncertain year.

Research, Reads of the Month

Is Your Portfolio up to the New World Order?

Canada’s economic challenges must be understood within the broader global realignment that has little to do with us, which is precisely why our vulnerabilities are growing. As British-American historian Niall Ferguson argues, the U.S. is undergoing a structural reset after two decades of distorted globalization, military overreach, and stagnating real incomes. That recalibration is driven entirely by U.S. domestic pressures, not by considerations of Canada.

Yet Canada continues to behave as if it holds strategic weight — it simply does not. Meanwhile other nations, especially the U.S., are rebuilding industrial capacity, securing resources, and attracting global capital, while Canada has spent a decade erecting regulatory barriers, fragmenting policy, and undermining competitiveness in the very sectors where we should lead. Against this backdrop, Canada is becoming increasingly unattractive for foreign capital with long‑term implications for our currency, debt markets, and geopolitical leverage.

If CUSMA fractures (a real possibility), Canada may be pushed into a bilateral deal on far less favourable terms. And turning to China is no solution; it only compounds risk.

In this environment, Canadian investors should consider reducing exposure to Government of Canada bonds and reallocating toward structured notes that offer enhanced yield and downside buffers; diversifying currency exposure by adding U.S. dollars; and incorporating precious metals as a hedge particularly given Canada is the only OECD country that sold its entire gold reserves, leaving investors to secure that protection on their own. Until U.S. midterms clarify the direction of American policy, the prudent strategy is to slow‑play major Canadian exposures and position portfolios for a world increasingly defined by industrial strategy, resource security, and strategic competition. Read Here

“Honeywell CEO says solar power is insufficient”

“They are very energy-intensive… It’s physics… Renewables remain in the mix, but it cannot bring the amount of joules we need to produce this infrastructure which is required in the world.” Watch Here

U.S. Energy Secretary: “Let’s just engage with reality. Oil, gas, and coal are what run the world. Full stop. We can’t make a wind turbine or a solar panel or a nuclear power plant without massive amounts of oil, gas, and coal. That’s how the world works.” Watch Here

“Robert Friedland on the massive copper shortage to meet future grid, clean energy and AI demand”

“We’re consuming 30m tonnes of copper a year. Only 4m tonnes of which is recycled. That means to maintain 3% GDP growth — with no [further] electrification — we have to mine the same amount of copper in the next 18 years as we mined in the last 10,000 years, combined. In the next 18 years, I’ve got to mine the same amount of copper as we mined the last 10,000 years. [This is without any new] electrification, without data centers, without solar and wind and the greening of the world economy. You people have no idea whatsoever what we’re facing.” Watch Here

Fiscal Deficits and Monetary Stimulus Addiction

The end of the USD started post-2008 and rapidly accelerated post-2020. Two decades of abusing monetary stimulus and now fiscal deficits and we’re all addicts. Those who don’t own assets have been hurt the most and they’re refusing to take on debt to continue to support home inflation and soon stock inflation because bond markets are keeping rates high due to rapidly escalating sovereign credit risk. See Here “For the first time ever, the U.S. is spending more on interest payments ($1.20T) than on national defense ($1.16T). The cost of past debt now exceeds the cost of protecting the nation.

The bill for decades of borrowing has come due.” See Here “This is what $10,000 of Gold over a 20 year difference looks like.” See Here

There were fewer births in China in 2025 than in 1776, the year the United States declared independence

“I have been posting repeatedly on X about the extraordinarily fast collapse of births across the planet: in rich and poor countries, in fast-growing and slow-growing economies, in religious and secular societies, under right-wing and left-wing governments, with high taxes and with low taxes. The pattern is universal. I knew this trend would continue. Still, the figures released this morning left me genuinely speechless. China’s government announced on Monday (see screenshot below) that births in 2025 fell to 7.92 million, a staggering 1.62 million fewer than in 2024, and that the total fertility rate has dropped to 0.93. Few economists have been more forceful than yours truly in arguing that births are collapsing, yet even I was surprised by these numbers. I was forecasting around 8.5 million births, not 7.92. To put this into perspective: if China could somehow sustain 7.92 million births per year from now on, its population would eventually stabilize at roughly 625 million, far below today’s 1.405 billion. In reality, as smaller cohorts reach childbearing age, births will fall well below 7.92 million. Hence, 625 million is a very generous upper bound, even under implausibly optimistic assumptions about life expectancy. Put differently, there were fewer births in China in 2025 than in 1776, the year the United States declared independence. I am still trying to process these numbers. This is the defining issue of our time.” Read Here

“Just returned from my first trip to China, mostly looking at the energy and robotics industries. Fascinating. Random observations, both business and general…” See Here

The four-year college degree

“Americans with four-year college degrees now account for a record 25.3 per cent of U.S. unemployment. The percentage has doubled since 2008, leaving more than 1.9 million degree-holders age 25+ currently unemployed. This is the highest level since data collection began in 1992.” See Here

On the Positive

What is Your Red Paperclip?

One of our favourite examples of creativity and persistence is the story of Canadian blogger Kyle MacDonald — the man who traded a single red paperclip all the way up to a house. On July 14, 2005, he made his first trade: a red paperclip for a fish‑shaped pen. Later that same day, he traded the pen for a hand‑sculpted doorknob.

From there, the journey took off. He exchanged the doorknob for a Coleman camp stove, then traded the stove for a Honda generator. The generator became an “instant party” — a keg, an IOU for beer, and a neon Budweiser sign. That party was traded for a Ski‑Doo snowmobile, which he then traded for a two-person trip to Yahk, B.C.

He swapped one spot on that trip for a box truck, traded the truck for a recording contract, and exchanged the contract for a year’s rent in Phoenix. That year’s rent became an afternoon with Alice Cooper, which he traded for a KISS motorized snow globe. The snow globe became a movie role. And finally, on July 5, 2006 — fourteen trades after he started — he traded that movie role for a two‑story farmhouse in Kipling, Saskatchewan.

It’s an extraordinary reminder that big outcomes often start with small, almost laughable beginnings. MacDonald’s journey demonstrates that creativity can outweigh capital, momentum builds from small actions, and value is often unlocked through story and imagination.

Whether in investing, entrepreneurship, or personal growth, the lesson is the same: start where you are, use what you have, and keep trading your way forward. It begs the question — what’s your red paperclip today?

Homeboy Industries

“Watch this clip with Jim Carrey and his speech to Homeboy Industries who serves high-risk, formerly gang-involved men and women. The power of forgiveness and inner salvation. ‘You can enter God’s Kingdom only through the narrow gate. The highway to hell is broad, and its gate is wide for the many who choose that way.’ Matthew 7:13” Watch Here

“Dangerous Ideas”

A new course just wrapped up. “Dangerous Ideas” invited students to tackle difficult and polarizing topics by debating both sides, and the students loved it — suggesting that they would rather examine and discuss ideas than be told that they’re off-limits. Read Here

The World Has Changed

“A fascinating interview with BERTRAND RUSSELL from 1952 that has him talking about his Grandfather meeting Napoleon, and about life in Europe in the 1800’s.” Watch Here

Martin’s New Read – Liturgies of the Wild

– Martin Shaw

“In Liturgies of the Wild, acclaimed mythographer, storyteller and Christian thinker Martin Shaw argues that we live in a myth-impoverished age and that such poverty has left us vulnerable to stories that may not wish us well. Drawing on the ‘ancient technologies’ of myths and initiatory rites, Shaw provides a road to wholeness, maturity and connection. He teaches us to read a myth the way it wants to be read; provides vivid retellings of tales powerful enough to carry you through life’s travails; and shows you how to gather and reshape your own thrown-away stories.” Read Here

The Long Game

“Just keep lobbing the ball over the net, then when the opponent tired go for the finish. Timing is everything. Play the long game people is often the hardest when your opponent is coming at you hard.” Watch Here

“Sweet Caroline”

“Neil Diamond who retired from touring because of Parkinson’s disease surprised the audience at the which chronicles his life and features his music with a rendition of his old classic ‘Sweet Caroline’. Audience members were blown away.” Watch Here

“Save yourself thousands in therapy.” Watch here

Men Without Chests

“Did you know C.S. Lewis predicted the modern obsession with ‘being nice’ would destroy the soul?

In The Abolition of Man, Lewis argues that when a society stops believing in objective virtue, it doesn’t become tolerant… it becomes manipulable. He calls the result ‘men without chests.’ People with appetites and intellects, but no courage, no honor, no trained moral instincts. They can calculate everything and defend nothing. Lewis saw that once we reject inherited moral law, we don’t become free. We become raw material… easily shaped by propaganda, pleasure, and fear. Modern man prides himself on compassion while quietly surrendering every standard that once gave compassion meaning. Lewis’s insight is brutal: a civilization that educates clever cowards will eventually be ruled by tyrants or technicians. Because when nothing is worth dying for, everything becomes negotiable… including human dignity.” See Here

ADHD is Closely Linked to Circadian Rhythm Dysfunction

Growing evidence suggests that targeting circadian misalignment can meaningfully improve symptoms. Read Here

Is It All Technology, or Is There More to the Story?

Young adults are spending 50 per cent less time with friends than they were 15 years ago. The pandemic didn’t help, but the trendline was already clear? Read Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

Wellington-Altus Private Counsel is registered as a Portfolio Manager in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland & Labrador, Nova Scotia, Northwest Territories, Nunavut, Ontario, PEI, Quebec, Saskatchewan, Yukon and an Investment Fund Manager in Alberta, Manitoba, Ontario, and Quebec.

All trademarks are the property of their respective owners.

© 2026, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca