INSIDE

Q2 earnings

Expectations are quite strong for certain segments and weaker for others which could create opportunities.

A market out-of-balance

Everyone is chasing a U.S. equity market that is currently out-o

f-balance with breadth at it’s lowest level in over three decades.

Our tactical positioning

We review our tactical positioning in today’s market environment.

July 2024: Bronco busting Q2 earnings season

Welcome to this month’s Market Strategy. This upcoming earnings season is going to be an important one, especially given the rising gap between share price performance and the underlying fundamentals, resulting in extreme market concentration. Markets are highly imbalanced, and we hope that it can center itself with a recovery by the non-tech segments of the global market instead of a correction from the current market leaders.

For example, the median global stock trades at 15.2 times forward earnings, while it’s at 18.6 times on a non-equal-weighted basis given the heavy U.S. tech weighting, according to financial writer Mike Zachardi. This implies a modest forward real return of 6.6 per cent. Then you have the powerhouse S&P 500 that, according to Liz Young Thomas, head of investment strategy at SoFi Technologies Inc., with the three-month correlation between it and the number of stocks advancing has fallen below the dot-com bubble era low.

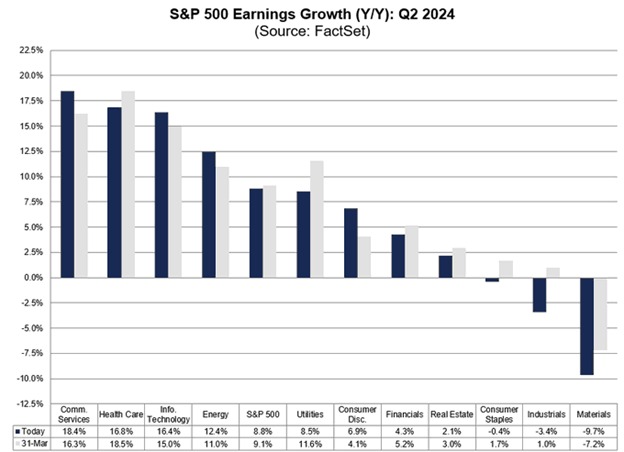

The index itself is up approximately 25 per cent from June 2023 to June 2024 and, according to FactSet Research Systems, its constituents are expected to report year-over-year earnings growth of only 8.8 per cent for the second quarter. This is slightly down from the 9.1 per cent earnings growth expectation at the end of March.

The highest growth is expected to come from communication services, health care, infotech and energy, with the weakest results coming from consumer staples, industrials and materials, but this also doesn’t translate directly into share price performance.

More specifically, the share prices of communication services (companies such as Alphabet Inc., Meta Platforms Inc. and Netflix Inc.) and infotech (companies like Microsoft Corp., Nvidia Corp. and Apple Inc.) have gained a whopping 33 and 35 per cent, respectively, over the 12 months ending in June, while their year-over-year earnings growth figures are forecasted to be up around 18.4 per cent and 16.4 per cent, respectively.

Financial services (companies such as Berkshire Hathaway Inc., JPMorgan Chase & Co. and Visa Inc.) is expected to have a 4.7 per cent gain in earnings, yet its share price is up 22.8 per cent.

Another standout has been industrials (companies such as General Electric Co., Caterpillar Inc. and Uber Technologies Inc.), which is up 13.5 per cent, yet its earnings are expected to contract 3.4 per cent from June 2023. The materials sector (companies such as Linde PLC, BHP Group Ltd. and Rio Tinto Ltd.) is up 8.4 per cent despite earnings being expected to contract 9.7 per cent.

On the other end, health care (companies such as Eli Lilly and Co., UnitedHealth Group Inc. and Johnson & Johnson) is expected to post a year-over-year earnings gain of 16.8 per cent, but share prices are up only 9.8 per cent. Energy (companies like Exxon Mobil Corp., Chevron Corp. and ConocoPhillips) earnings are expected to grow 12.4 per cent, but share prices are up only 11.4 per cent.

This all means there is an opportunity for those willing to diverge from the herd, including those chasing the tech sector and its large multiple expansion. There are companies in various sectors that are being ignored despite having half-decent fundamentals. You can do this through various means, such as an active manager who specializes in stock selection, or by creating your own index that uses passive sector exchange-traded funds (ETFs).

Overall, one thing is certain: now is a great time to deploy the use of good old-fashioned portfolio management, looking at tactical asset allocation to add value while minimizing risk. At a minimum, consider the merits of rebalancing as companies roll out their earnings in an environment where expectations are quite robust in certain segments and less so in others.

Martin recently geared up for the Stampede while providing two full BNN market segment updates on the above that can be watched here: Part I, Part II.

Hope you have a great summer, and keep investing wisely!

![]()

Rebalancing and avoiding FOMO

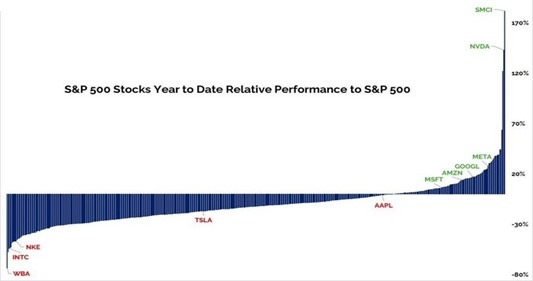

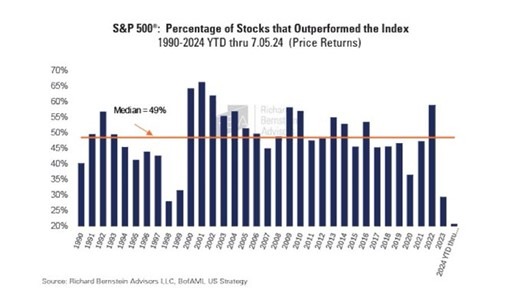

We are currently in the narrowest market in 34 years, as this year only 20 per cent of stocks are outperforming the S&P 500 vs the long-term average of 49 per cent and compares to over half of the companies on the S&P/TSX composite are beating the index this year.

Most of the gains have come from just a few names. The tech heavy S&P 500 gained 4.2 per cent (USD) in Q2, while the average stock is down -2.6 per cent, something that has only happened five times in the past three decades. U.S. small cap stocks are now down -2% on the year while large caps are up 15% the biggest outperformance since 1998.

The performance spread between the S&P 500 and S&P 500 Equal Weight index has only been higher than it is now during a small number of days in March 2000. Meanwhile, the top 10 stocks in the S&P 500 now have a market cap of US$15trillion, which represents about 34 per cent of the S&P 500. The previous record level of concentration was 33 per cent, which occurred in 1963.

Part of the reason is that earnings for the most part have come from the Magnificent-7 as the 493 other companies’ earnings for the most part have been flat to down for the past 5 consecutive quarters. In Q1, the Magnificent 7 grew their earnings by 52 per cent while the Maleficent 493 grew their earnings by just 1 per cent.

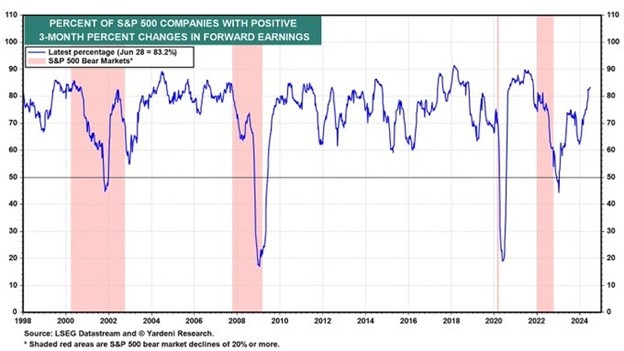

However, Q2 is expected to mark the first growth quarter in these companies. The number of S&P 500 companies with positive three-month per cent changes in their forward earnings has been increasing reaching a bull-market high of 83.0 per cent during the week of July 5.

With the S&P 500 being up 25 per cent from last year, earnings are expected to be up only 8.8 per cent but this is skewed by the Magnificent-7 boasting an expected aggregate earnings growth rate of 29.8 per cent. Excluding the Mag-7, the S&P 500 Q2 earnings growth falls to 6.6 per cent.

The big question is if this is already in share prices given the multiple expansion? The Mag-7 stock share prices are collectively up 65 per cent. Communications services and info tech sectors have gained 33 to 35 per cent over last year, more than two times estimated earnings growth.

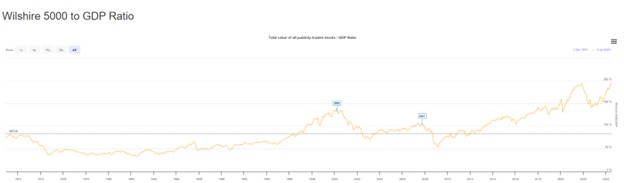

Finally, the Warren Buffett Indicator just hit 195 per cent (Willshire 5000-market-capitalization-weighted index of the market value of all American stocks actively traded in the United States to GDP Ratio), the highest level in history, surpassing the Dot Com bubble, the Global Financial Crisis, and the 2022 Bear Market.

NVIDIA: 75

Tesla: 65

Amazon: 56

Netflix: 48

Microsoft: 40

Apple: 35

Meta: 31

Google: 29

S&P 500: 29

Price to Sales Ratios

NVIDIA: 40

Microsoft: 15

Meta: 10

Tesla: 9.3

Apple: 9.3

Netflix: 8.8

Google: 7.8

Amazon: 3.6

S&P 500: 2.9

This could mean it’s a potentially dangerous situation for those chasing the tech sector and its large multiple expansion. Take a look at the 3x leveraged NVIDIA ETP that is now the most traded product on the London Stock Exchange.

However, it could also be an opportunity for those willing to diverge from the herd as there are companies in various sectors that are being ignored despite having half-decent fundamentals.

You can take advantage of this through various means, such as an active manager who specializes in stock selection, or by creating your own index that uses passive sector ETFs. We, for example, have replicated buffered ETFs. We did a put spread and a short call, and recently closed out one of the puts. This means we are fully protected on our S&P position all the way through to December.

Closer to home, high interest rates have hit certain segments quite hard, including Canadian banks, utilities and telecoms that dominate the S&P/TSX Composite index, even though we believe rates will be coming down faster here than in the U.S. The BMO Equal Weight Banks Index ETF is up only 8.8 per cent over the past 12 months (to the end of June) and the iShares S&P/TSX Capped Utilities Index ETF is down 6.1 per cent. Meanwhile, the telcos Rogers Communications Inc., Telus and BCE Inc. have been hammered, selling down 13.3 per cent, 14.2 per cent and 20.7 per cent, respectively.

We would look to reduced debt-servicing costs as a large benefit to their earnings, but the big question remains if the Bank of Canada cuts as much as they should or follows the slower pace of the U.S. Federal Reserve.

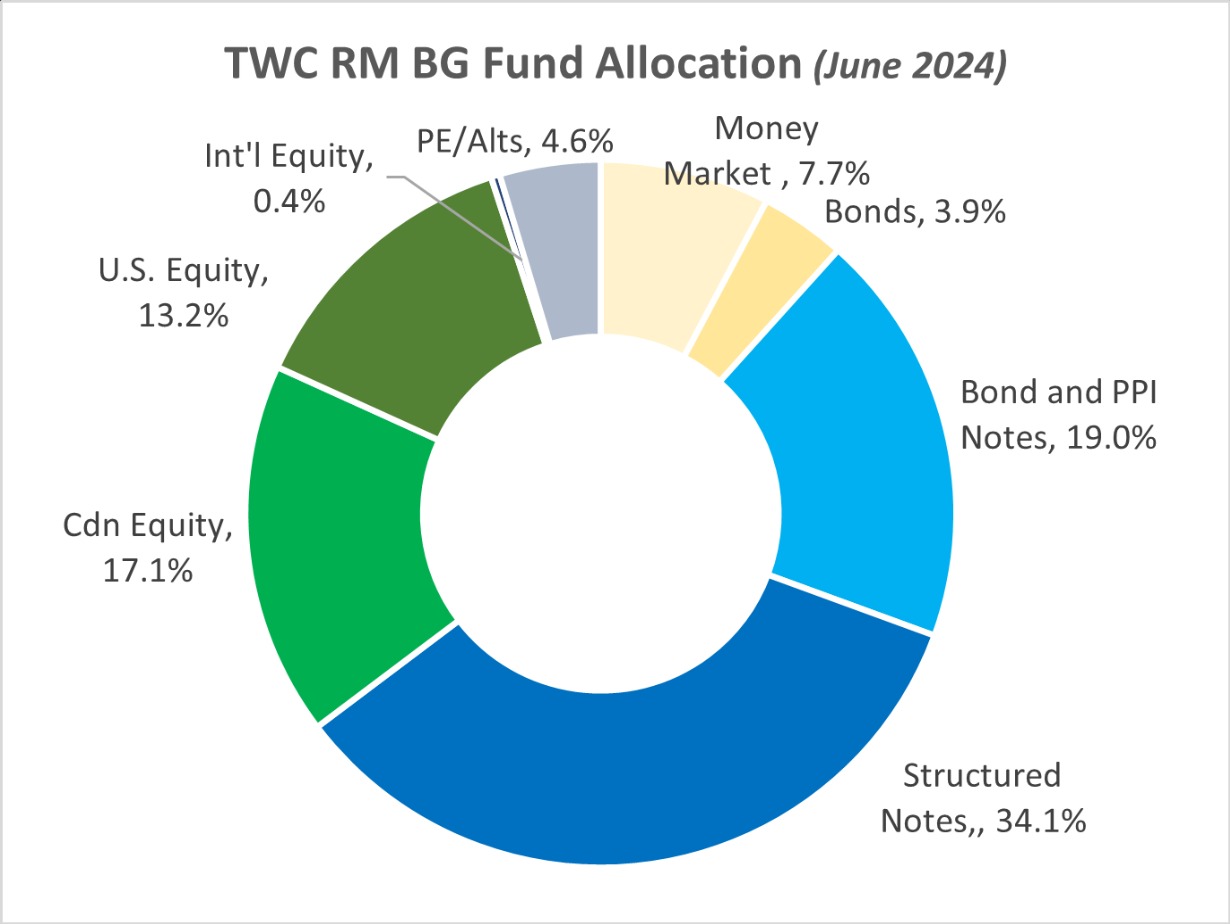

Our tactical positioning

Currently, we’re running about 8 per cent in cash and money market funds paying about 5 per cent in interest, 4 per cent in U.S. floating rate bonds paying nearly 6 per cent, 4 per cent in a 1.2 times 20-year Treasury note with 20 per cent downside protection (our recession hedge),12 per cent in fixed income structured notes with 100 per cent principal protection and yields ranging from 7.0 to 8.22 per cent and about 3 per cent equity tracking principal protected notes.

Overall, we believe that government bonds will continue to do poorly in this macro environment and the inverted yield curve means longer dated bond investors are not being compensated for risk. GIC rates are fine, but they are not very attractive looking out past one year. We recently put together a 10-year linear note paying a fixed 7 per cent annual yield, no equity benchmark and CDIC insured. We then did one in U.S. dollars with a fixed 6.85 per cent yield payable each year unless called away, and U.S. dollar 12-year linear paying 8.25 per cent.

On the equity notes of interest undertaken during the quarter we did one on Enbridge, Emera, and TC Canada. It will pay a 11.25% coupon once called (call terms annually, three stocks collectively have to be above 0 per cent in share price return). Once called, it gets an incremental +200 per cent of any positive return–i.e. if the basket is up 20 per cent next year, the note pays a 51 per cent return. This is an excellent replacement to a yearly auto callable note on Canadian pipelines that we did last year which was called. The index return was 9.29 per cent and our clients will be receiving a 16.70 per cent coupon.

We did one note on $MFC, $TRP, $PPL, $ENB, $BCE, $CM, $T, $GWO, $BNS, $TD some of which have really been beaten up. If collectively their share prices > 0 per cent in 12-months, the note gets called and a 20.5 per cent coupon paid. We did another similar one on the Canadian banks with a 11 per coupon if they are more than 0 per cent in 12-months but it has a 50 per cent downside barrier. We also did a bunch of monthly contingents with yields ranging from 7.75 to 10.32 per cent and downside barriers of 25 to 50 per cent.

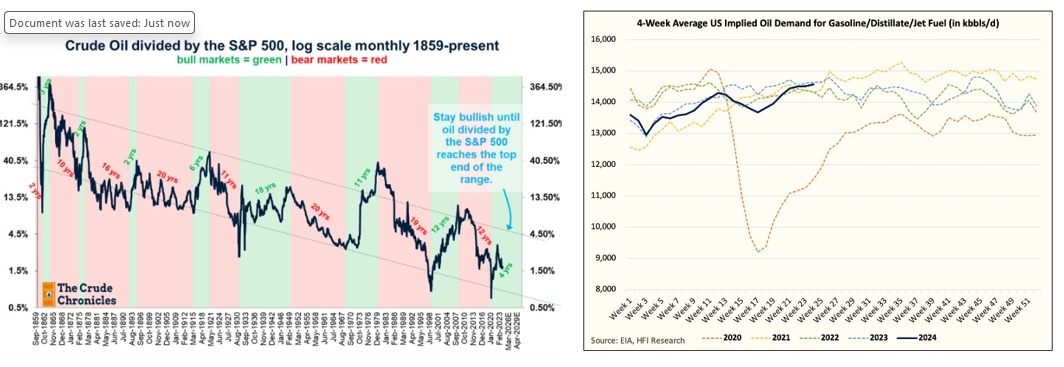

We made minimal changes in the quarter to our equity positions and remain overweight energy and Canadian sectors to benefit from falling rates including infrastructure and utilities. This includes positions like the iShares S&P/TSX Capped Utilities Index ETF. We have not sold our energy positions as there remains near-term upside from seasonal driving/travel and it is technically looking attractive compared to the broader U.S. equity market.

What we’re reading

Unlock your value by choosing where to reside, work and invest

Martin Pelletier: Investment advisers can benefit from being willing to adapt and offer services well beyond selling investment performance. Read Here

S&P 500 2024 Q2 earnings preview

Q2 aggregate earnings are forecasted to reach a new all-time high, with a current estimate of $492.8 billion (+10.1 per cent y/y, +4.4 per cent q/q). Growth expectations have only declined moderately by 40 basis points (bps) heading into earnings season, much less than the typical 300 bps downward revision we usually find. Read here

FOMO in overdrive as stock market concentration hits all-time high

Martin Pelletier: The 10 biggest stocks in the S&P 500 account for more than one third of the index, and that’s a problem for investors and portfolio managers alike. Read Here

It helps to zoom out everyone once in a while and use the right part of your brain. See Here

As in the late-1990s. Tech stocks have raced ahead of their earnings. See Here

NVDIA at its June 18 peak is worth as much as nearly 12% of the TOTAL U.S. GDP. This is 2 x larger than previous leading value to GDP holding—$CSCO in 2000. Adding in the nine other top stocks and combined they are over 60 per cent of U.S. GDP, also double that of the 2000 tech bubble. See Here

Why we’re underweight bonds

‘Growing the amount of T-bills outstanding while the Fed at the same time is doing QT increases the risk of an accident in funding markets, which is what we saw in repo markets in September 2019.’ Read Here

Javier Milei at the WEF Annual Meeting 2024

Want to fix your economy? Praise entrepreneurs. “Do not be intimidated by the political caste or by parasites who live off the state. Do not surrender to a political class that only wants to stay in power and retain its privileges. You are social benefactors. You are heroes.” Read Here

Why we’re short the euro, and thinking about shorting French bonds

The New Popular Front (NPF) in France is proposing a 90% tax on all income above €400,000. This radical measure is part of their economic program to fund social policies. The NPF, a left-wing coalition, aims to increase the minimum wage, implement price controls, lower the retirement age, and invest in the green transition and public services. Read Here and See Here

Trudeau is really scaring us and it’s not even Halloween

We get 2020 and maybe 2021 but we have to question what the Trudeau government has done in the past two years. See Here and See Here and See Here

The Canadian dream?

High housing costs has two-in-five recent immigrants saying they may leave their province (or Canada). Read Here

New Angus Reid poll finds that nearly 40 per cent of Ontarians state they are seriously considering leaving the province because of the cost of housing. Read Here

If only we had Warren in charge

“I can end the deficit in 5 minutes. You just pass a law that says any time there is a deficit of more than 3% of GDP all sitting members of congress are ineligible for re-election.” Watch Here

Deficit financing leads to higher interest rates, a lower capital stock, lower GDP, and a greater risk of a fiscal crisis

The general finding is that increasing taxes leads to lower GDP and personal consumption. Of the different tax policies examined, consumption taxes are likely to have the smallest effects on saving and work decisions and hence the smallest negative consequences on future economic growth. Read Here

How Canada became a car theft capital of the world and Vancouver the fentanyl capital of the world

Logan LaFreniere woke up one October morning in 2022 to an empty driveway. His brand new Ram Rebel truck was missing. His security camera captured two hooded men breaking into the pickup in the dead of night outside of his Milton, Ontario home, and driving it away with ease. A few months later, that very same truck appeared on a website of vehicles for sale in Ghana, an ocean and some 8,500km away. Read Here

Vancouver is gripped in an opioid crisis worse than America’s. Locals say overly liberal drug laws have sparked a catastrophe. Read Here

Canadian tax on home equity?

Is Trudeau targeting older Canadians who have paid off their homes and have the good fortune of capital appreciation? Read Here

Ed’s electric revolution

This is the perfect example of why people don’t trust their politicians. Watch Here

A recent consumer study conducted by McKinsey found that 46% of U.S. EV owners surveyed said they were likely to switch back to a gas-powered vehicle, compared to a global average of 29% of EV owners who said they would likely switch back to an internal-combustion engine. Read Here

Russia’s Crude Shipments Drop by the Most Since Ukraine Invasion

Russia’s weekly crude exports crashed by the most since before the 2022 invasion of Ukraine in the seven days to July 7, with the less volatile four-week average falling to the lowest since February. See Here

On the Positive

Marketing and Life Lessons 101

Your inner Banksy

The world really could use a lot more of this. Watch Here

Fun fact

Since its inauguration in 1964, approximately 6.4 billion people have used the Tokaido Shinkansen, aka the Bullet Train, with zero accidents and an average delay time of 0.9 minutes. Read Here

Grandma has skills

Sometimes we have a lot to learn from our elders. Watch Here

When governments push it too far

When Los Angeles banned fireworks, this is how the city’s inhabitants responded. The same thing is happening on a political level around the world. Watch Here

Hulkamania!

This kid didn’t meet Hulk Hogan, Hulk Hogan met him. Watch Here

Why does everything look that much better back then?

This is what American cities looked like a century ago (and what happened to them) See Here