INSIDE

Goals-Based Investing and Rethinking the 60/40 Portfolio

The traditional 60/40 investment portfolio—once a reliable strategy for balancing growth and stability—is facing significant challenges in today’s economic climate. With persistently high interest rates, inflationary pressures, and volatile equity markets, both bonds and stocks are underperforming, undermining the model’s effectiveness. Bonds no longer provide the safety net they once did, and equity gains are increasingly concentrated in a few tech giants, raising concerns about diversification. As a result, investors are turning to alternative assets, structured products, global diversification, and more dynamic asset allocation strategies. While the 60/40 model isn’t obsolete, it requires thoughtful adaptation to remain relevant in this new financial landscape.

For more on this, the benefits of goals-based investing and the use of structured notes over benchmarking to the traditional 60/40 we recommend this recent podcast by Martin:

Perspective, Portfolios, and Positioning for Q3

During a recent holiday on the Amalfi Coast, Martin found clarity away from the constant noise of markets and media, realizing how easily a jaded worldview can form amid relentless headlines and policy concerns. Despite global economic headwinds, trade tensions, and geopolitical instability, equity markets have remained resilient — highlighting the disconnect between perception and portfolio performance. This experience reinforced the importance of stepping back, staying disciplined, and focusing on long-term goals rather than reacting emotionally to short-term events. Markets, while imperfect, are forward-looking and often more rational than they appear in the moment. By maintaining a diversified, resilient investment strategy and aligning portfolios with personal goals rather than market noise, investors can navigate uncertainty with confidence and composure.

Finding Opportunity Amid Uncertainty

In response to the shifting landscape, we have made a strategic pivot toward asymmetric profile instruments which have delivered strong, risk-adjusted returns while offering downside protection and tailored exposure. For example, we’ve recently had a number of autocallable notes called away with some large yields. This includes a Canadian Blue Chip note that just paid a 20.5 per cent coupon, a Canadian Bank note that paid 20 per cent, one at 12.8 per cent, one at 12.6 per cent and another that paid 11 per cent, and a Principle Protected note that paid 8.2 per cent. We also had a monster Pipeline note with an annual 11.25 per cent coupon get called but it also had a 200 per cent participation so it paid out a whopping 75 per cent total combined one-year yield.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

July 2025: Rethinking the 60/40 Portfolio — Why Investors Should Shift to a Goals-Based Approach

In today’s market environment, the greatest threat to your portfolio may not be the market itself—but how you respond to it.

The traditional 60/40 portfolio—60 per cent equities and 40 per cent bonds—has long been a cornerstone of balanced investing. It offered a simple, effective way to manage risk and reward, with equities driving growth and bonds providing stability and income. But in today’s economic climate, this once-reliable formula is showing signs of strain.

The Cracks in the Foundation

The 60/40 model worked well in an era of falling interest rates and moderate inflation. Bonds provided a steady income stream and tended to rise in value when stocks fell, offering a natural hedge. But that dynamic has shifted dramatically.

Any market corrections since 2022 have seen both stocks and bonds experience simultaneous declines—a rare and painful scenario for investors. Interest rates have risen sharply, inflation remains sticky, and geopolitical instability continues to inject volatility into global markets. Bonds, once the cornerstone of conservative portfolios, are underdelivering, and equities are rebounding to new highs despite softening economic data.

For traditional 60/40 investors, this has been a particularly challenging period. The model has struggled to provide the downside protection it historically offered. Bonds have failed to hedge equity risk, and volatility has become more frequent—and more emotionally charged.

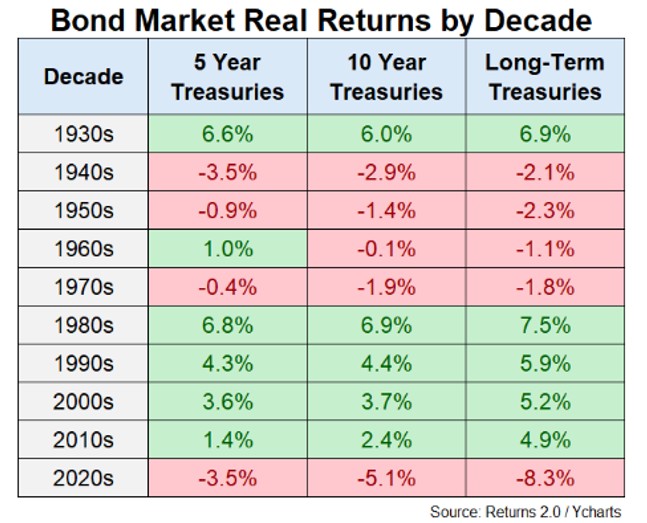

As Ben Carlson wrote in his blog “ The biggest risk for bonds is inflation because they pay you a fixed amount of income over time. You need to look at the inflation-adjusted returns to really understand how things compare over time.” And when you do the result are terrible.

The Emotional Toll of Volatility

This volatility doesn’t just affect portfolios—it affects people. Investors are becoming more reactive, more anxious, and more susceptible to the fear of missing out. They want to participate in market rallies but also demand protection from drawdowns. These are inherently conflicting goals, and managing that tension is where the real work of an adviser begins.

As discretionary money managers, the challenge isn’t just navigating markets—it’s managing expectations. The 60/40 model no longer behaves as expected, and that requires a shift in both strategy and mindset.

A Shift Toward Goals-Based Investing

That’s why many advisors are moving toward a goals-based investing framework. Rather than chasing benchmarks or the latest hot sector, the focus is on helping clients define what success looks like—whether it’s retirement income, capital preservation, or legacy planning—and then building portfolios designed to meet those specific outcomes.

This approach is especially effective in volatile markets because it removes the emotional element from investing. When clients are anchored to their personal goals rather than market headlines, they’re less likely to panic during downturns or chase performance during rallies. It reframes the conversation from “Why aren’t we beating the S&P?” to “Are we still on track to meet your goals?”

Practical Applications: Tools, Not Tricks

For example, someone nearing retirement may be concerned about missing out on the recent AI-driven rally. Rather than reallocating aggressively into tech, advisors might explore strategies such as structured income notes or dividend-paying stocks to meet their required return. This clarity helps clients stay the course and avoid unnecessary risk.

Structured products, often misunderstood, are gaining traction as powerful tools when used properly. They’re not speculative bets but goal-aligned instruments—whether it’s generating tax-efficient income, protecting capital, or smoothing returns. Since early 2021, many firms have implemented a range of structured notes across client portfolios. A recent performance review with National Bank Financial showed these notes we owned consistently delivered attractive risk-adjusted returns across various market conditions, often outperforming traditional bonds while offering built-in buffers against drawdowns.

Yes, they can be complex—but when clients understand how these notes work, what risks they carry, and how they fit into the broader portfolio, they’re far more comfortable using them.

Discipline Is the Edge

In a world where headlines change by the hour and markets swing on sentiment, the temptation to react is constant. But successful investing isn’t about reacting—it’s about responding with discipline, clarity, and purpose.

The goal isn’t to predict the future, but to prepare for it. That means building portfolios that are resilient, not reactive, and using every tool available—including innovative products like structured notes—to help clients stay on track, even when the path gets bumpy.

Because in the end, the greatest threat to your portfolio isn’t inflation, interest rates, or even a market correction. It’s abandoning your plan when it matters most. And an adviser’s job is to make sure that doesn’t happen.

Final Thoughts: Evolution, Not Abandonment

The 60/40 portfolio isn’t obsolete—but it is evolving. It still has a role to play, especially for conservative investors or those nearing retirement. However, it should no longer be viewed as a set-it-and-forget-it solution.

Today’s market demands a more nuanced approach—one that incorporates a broader range of asset classes, embraces flexibility, and is grounded in a deep understanding of macroeconomic trends. By adapting to this new reality, investors can better position themselves for long-term success, even in uncertain times.

For more on this, the benefits of goals-based investing and the use of structured notes over benchmarking to the traditional 60/40 we recommend this recent podcast by Martin:

Clarity from the Coast: Perspective, Portfolios, and Positioning for Q3

There’s something about stepping away from the noise that sharpens clarity.

During a recent holiday on the Amalfi Coast—between long walks through sun-drenched villages, generous pours of local wine, and more pasta than he cares to admit—Martin found himself reflecting not just on the beauty of the landscape, but on the internal dialogue that often goes unnoticed. Somewhere between plates of Caprese salad and glasses of chilled Aperol Spritz, he realized how much of his worldview had been shaded by a jaded lens—one shaped by relentless headlines, geopolitical flashpoints, and economically questionable policy decisions.

Fortunately, those perceptions haven’t shaped our investment decisions.

Perception vs. Portfolio

This distinction between perception and portfolio is more important than ever. Despite a backdrop of moderating global growth, escalating trade tensions, and geopolitical instability, equity markets have once again defied gravity. The World Bank’s June 2025 outlook forecasts global growth slowing to just 2.3 per cent—the weakest pace since 2008 outside of recessions. Yet markets remain buoyant, supported by liquidity, resilient earnings in key sectors, and expectations of continued central bank support.

Even with unresolved trade risks—like the looming tariff risks and rising protectionism—markets have shown surprising resilience. This disconnect between policy turbulence and market performance underscores the complexity of today’s investment landscape and reinforces the importance of maintaining a disciplined, long-term perspective.

The Power of Stepping Back

Taking time away from the markets can serve as a powerful reminder of the value of distance—not just physical, but mental and emotional. In a world saturated with noise—from the 24-hour news cycle to the endless scroll of social media and the constant hum of market data—stepping back can be an act of clarity.

Removing yourself from the daily barrage of information allows you to zoom out, recalibrate, and reconnect with the foundational principles that guide sound decision-making. It’s in these quiet moments, away from the urgency of headlines and the pressure to react, that true perspective emerges.

For us it is to ignore the noise and to stay true to the core of our investment philosophy: stay diversified, stay disciplined, and always have a plan. These aren’t just tactical choices—they’re strategic commitments to long-term thinking, emotional resilience, and purposeful action. In a market environment where noise often masquerades as insight, the ability to pause, reflect, and refocus is not a luxury—it’s a competitive advantage.

Strategy in Action

That clarity is informing how we’re positioning portfolios heading into the third quarter. While the world feels chaotic, markets have a way of finding balance—and we’re preparing for both the risks and the opportunities ahead.

Here are a few key strategies we’re deploying:

1. Structured Notes for Income and Protection

With volatility still elevated and traditional fixed income under pressure, we’re using structured notes to generate income while providing downside buffers. These are tailored to client-specific goals—whether it’s capital preservation, tax-efficient yield, or equity participation with protection.

2. Dividend-Focused Equity Strategies

We’re emphasizing high-quality dividend payers, particularly in sectors with pricing power and strong balance sheets. These companies not only provide income but also tend to be more resilient during market drawdowns. In particular, our use of the Outcome Metric Canadian Equity Income rules-based model has already yielded some excellent results.

3. Selective Exposure to Alternatives

Our NewGen Focused Alpha allocation continues to offer very attractive risk-adjusted returns with a lower correlation to large cap equities. We’re continuing to increase exposure to these areas where appropriate, particularly for clients seeking some growth and inflation protection.

4. Global Diversification with a Defensive Tilt

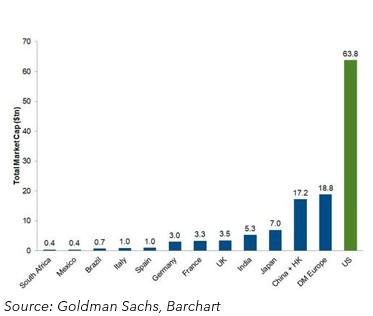

While U.S. markets have led much of the recent rally, we’re maintaining global diversification with a tilt toward defensive sectors and regions less exposed to trade tensions. This includes select opportunities in low volatility stocks and value segments of the market.

5. Tax-Aware Rebalancing

As we move through mid-year, we continue to review portfolios for tax-loss harvesting opportunities and rebalancing to maintain alignment with long-term targets—especially important in a year where gains have been concentrated in a narrow set of names.

Lessons from the Coastline

Driving along the winding roads of the Amalfi Coast, Martin was reminded of another truth: sometimes the path is narrow, the turns are sharp, and the visibility is low. But if you stay focused, trust your preparation, and don’t overreact to every bump, you’ll get where you’re going.

The same is true in investing. We can’t control the headlines. We can’t predict the next policy decision or geopolitical flare-up. But we can control how we respond. We can choose discipline over emotion, strategy over speculation, and clarity over chaos.

Navigating Q3: Finding Opportunity Amid Uncertainty

As we step into the third quarter, uncertainty remains elevated—but so does the potential for opportunity. Markets may be complex, but they are not impenetrable. With the right mindset, tools, and guidance, we believe investors can not only weather volatility but capitalize on it.

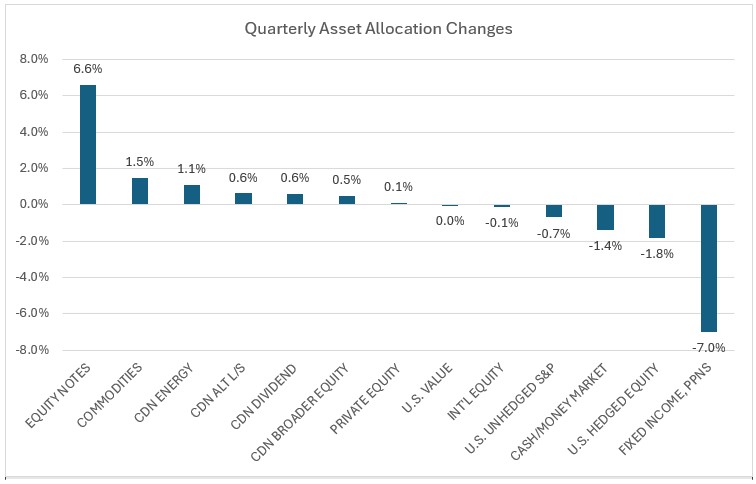

During the quarter, we made several high-conviction portfolio adjustments. A significant GIC note was called away, and we redeployed that capital into a pair of innovative accelerator look-back notes—now the fund’s largest position. One note is USD-denominated and held within the fund, while the other is CAD-denominated and allocated to individual client accounts. This shift marked a strategic reallocation from traditional fixed income into a more dynamic equity-linked structure.

These equity notes are tied to a basket of large-cap Canadian equities—including TC Energy, Enbridge, CIBC, TD Bank, Agnico Eagle Mines, and Manulife Financial—and run over a three-year term. Six months post-inception (from May), the notes will lock in the lowest point for the basket and provide 1.18x (or 1.55x for the USD note) upside participation from that level, with a 30 per cent downside buffer. This structure offers a compelling risk-reward profile: even if markets decline in the near term, investors stand to benefit from gains off the bottom with meaningful downside protection.

We also doubled our commodities exposure by adding to gold on a dip and tactically increased energy holdings ahead of the Israel-Iran standoff. This included tax-loss harvesting—selling Baytex and rotating into Vermilion Energy—and a timely switch from Cenovus to MEG Energy, which proved prescient given the subsequent takeover offer by Strathcona Resources.

Our cash position was tactically deployed early in the quarter during market weakness, and we increased our Canadian dividend exposure. The portfolio remains well-diversified and strategically hedged, with top holdings focused more on absolute return than on beta-driven market rallies.

We’ve also been redeploying a lot of autocallable notes that were called away with some large yields the last few months. This includes a Canadian Blue Chip note that just paid a 20.5 per cent coupon, a Canadian Bank note that paid 20 per cent, one at 12.8 per cent, one at 12.6 per cent and another that paid 11 per cent, and a Principle Protected note that paid 8.2 per cent. We also had a monster Pipeline note with an annual 11.25 per cent coupon get called but it also had a 200 per cent participation so it paid out a whopping 75 per cent one-year yield.

Top Ten Securities by Market Value

| Description | Weight | Strategy | Symbol |

| CDN LARGE CAP LOOKBACK $US | 6.42% | Fixed Income (Note) | JHN7757 |

| OWM OUTCOME CDN EQUITY | 5.42% | Cdn Dividend | OWM209 |

| VANGUARD VALUE ETF | 5.10% | U.S. Equity | VTV |

| BMO SY NOTE FUND | 3.99% | Fixed Income (Note) | BMO95341 |

| HEDGED US EQUITY ETF | 3.99% | U.S. Equity | HEQT |

| TDB MONEY MARKET | 3.18% | Money Market | TDB8151 |

| NBC MARATHON TLT $US NOTE | 3.17% | Fixed Income (Note) | NBC25288 |

| NEW FSD ALPHA FUND | 3.03% | Cdn Alt Equity | NEW507 |

| BMO ACALL TLT $US NOTE | 2.83% | Fixed Income (Note) | JHN18421 |

| RBC EURO STX 50 NOTE | 2.77% | Euro Equity (Note) | RBC10981 |

Asset Allocation

| EQUITY NOTES | 33.70% | CDN ENERGY | 3.80% |

| FIXED INCOME, PPNS | 24.70% | PRIVATE EQUITY | 3.40% |

| CASH/MONEY MARKET | 7.20% | COMMODITIES | 3.00% |

| U.S. VALUE | 5.10% | CDN ALT L/S | 3.03% |

| CDN DIVIDEND | 5.42% | U.S. UNHEDGED S&P | 1.21% |

| CDN BROADER EQUITY | 5.08% | INT’L EQUITY | 0.40% |

| U.S. HEDGED EQUITY | 3.99% |

Despite a cautious market backdrop, the fund continues to deliver on its long-term, goals-based mandate:

| Period | 1-Mo | 3-Mo | 6-Mo | YTD | 1-Yr | 2-Yrs | 3-Yrs | 5-Yrs |

| TWC RM BG Fund Return | 1.20% | 0.60% | 2.00% | 2.00% | 8.90% | 9.10% | 8.20% | 8.00% |

| Global Passive Balanced Return* | 2.20% | 3.10% | 3.40% | 3.40% | 9.80% | 10.40% | 10.00% | 6.10% |

CAD | Investment return as of June 30, 2025, | Global Passive Balanced 40% Vanguard Total Bond, 10% Capped S&P/TSX, 50% iShares MSCI World Index | Past returns are not indicative of future returns. TWC returns reflecting 1% fee for TRI400 unit holders, and TWR calculated at month-end.

Overall, our Risk-Managed Balanced Growth Fund has delivered returns in-line with our goals-based target returns over the longer-term. While we don’t like to compare to passive portfolios given our goals-based approach it is still useful showing the effectiveness of our strategies especially with the benefits of reducing the downside exposure which is reflected in our longer-term five-year outperformance.

As we enter into the second half of the year, we anticipate an acceleration in performance as more of our structured notes reach their payout thresholds. These instruments tend to lag in early stages of a recovery but often deliver outsized returns as markets stabilize—helping to smooth performance over time. Given their significant weight in our client portfolios, this dynamic is especially important. Some of this is already starting to take shape as we estimate the fund is up another 0.75 per cent in the first week and a half of July.

Research, reads of the month

The key to investing once you’ve built wealth

In his latest Financial Post column, Martin explores how discipline, emotional control, and a long-term perspective are the real edge in today’s volatile markets. If you’re retired or approaching retirement, this is a must-read. Read Here

Jeremy Grantham: How to predict a stock market bubble – and why NVIDIA may lead the Mag 7 crash

This week Wilf speaks to the man who has predicted some of the biggest stock market bubbles of the last 5 decades – Jeremy Grantham – who, on the day that NVIDIA hits $4trn market cap predicts that we are nearing the top of another major bubble, likening Nvidia’s success to the “guy selling shovels at the peak of the gold rush”. Striking a very bearish note on the US Magnificent 7, he discusses the pain that predicting crashes too early causes finance professionals but how private individuals have advantages as long as they step back and look at the data, as he shares his advice for investors following a legendary career. Watch Here

Latest round of Trump tariffs weigh on markets

Martin Pelletier, senior portfolio manager at Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss investing amid tariff tensions and volatility. Watch Here

Morgan Stanley – the worst decade for developed-market government bond returns

It’s been the worst decade for developed-market government bond returns in modern history, as per Deutsche Bank’s global head of economics and thematic research Jim Reid. This has pushed yields higher as governments keep selling bonds to plug fiscal gaps. The U.S. plans a net issuance of $223.2 billion in the next five weeks alone. See Here

Trouble in Japanese bond markets

Japanese 30-year yields are rising back toward all-time highs. “Concerns over fiscal deterioration are very strong,” as well as “growing fears that the government may resort to fiscal expansion in response to an economic downturn caused by tariffs,” says Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management. See Here Japanese bond market evidence shows that there is a major structural shift with consequences from the years of quantitative easing (QE), low rate policy, and now massive deficit fiscal spending. See Here

S&P 500 market breadth near the worst level this century

Only 5 per cent of S&P 500 stocks are making new 52-week highs — down sharply from 24 per cent in November 2024. Market breadth is a key indicator of the health of a rally. When only a few stocks are driving gains, it suggests fragility — if those leaders falter, the whole index could tumble. Investor caution is warranted, as this kind of narrow leadership has historically preceded periods of volatility or correction. However, historical data also shows that such weak breadth can sometimes mark a turning point, with broader participation improving over time. See Here

Yes, we’ve been here before

If you’re worried about Tech being a bubble let me remind you of Rail stocks in the 1900s which made up over 65 per cent of the U.S. stock market. See Here

APOLLO: Either the bond market are wrong or equity markets are wrong

Either the bond market is wrong, and rates must move higher due to accelerating growth. Or, equity markets are wrong, and stocks have to move lower because growth is slowing down., and rates must move higher due to accelerating growth. Or, equity markets are wrong, and stocks have to move lower because growth is slowing down. See Here

A closer look at the fall of the USD

The strength of the U.S. equity market and tight credit spreads in investment grade and high yield indicate that the dollar decline in the first half of 2025 was not driven by foreign selling of U.S. assets. Instead, the decline in the dollar was likely driven by hedging activity, as foreign investors, after decades of not hedging their U.S. investments, began hedging some of their dollar exposures. With Section 899 behind us and the U.S. Federal Reserve keeping interest rates higher for longer, dollar hedging activity is likely to slow down. – Apollo. Read Here

Stablecoins Are Becoming Major Treasury Buyers

This whole Stablecoin thing is fascinating. Stablecoins are becoming stealth buyers of U.S. debt. They already hold over $200B in Treasuries—and inflows are now moving 3-month T-bill yields by 2bps. As demand scales into the trillions, expect a steeper curve and a new front-end bond market dynamic. Read Here

Misguided policy risks

The most surprising development is U.S. President Donald Trump’s heavy reliance on treasury bills until rates fall revealing a shift away from terming out debt and toward continued use of Activist Treasury Issuance (). ATI is a term coined by economists Stephen Miran and Nouriel Roubini to describe a deliberate shift in the U.S. Treasury’s debt issuance strategy—specifically, the decision to favor short-term Treasury bills (T-bills) over longer-term bonds. This approach is seen as a way to influence financial conditions, similar to how the Federal Reserve uses interest rates or quantitative easing. Fiscal discipline also appears abandoned, with deficit reduction off the table, reinforcing a backdrop of structurally easier financial conditions and persistent inflation—favourable for equities, gold, and Bitcoin. The U.S. dollar remains under pressure, with personal observations from Europe highlighting rising costs. Nonetheless, markets are pricing in easing, driven by political pressure and expectations of the current Fed chair turning to a dovish stance, which is buoying risk assets. The idea that policymakers can lower rates to lock in cheap long-term debt is flawed—doing so would likely backfire by reigniting inflation and pushing yields higher. Read Here

Will the Federal Reserve capitulate?

The Federal Reserve’s balance sheet declined by -US$13 billion in June, to US$6.66 trillion, the lowest since April 2020. Large deficit fiscal spending has offset the reduction in the Fed’s monetary policy. Hopefully they don’t capitulate and start juicing the system as long as this deficit continues. See Here

Massive change in employment in the U.S. over the past 34 years

From Scott Galloway’s newsletter. One hell of an infographic showing the shift in the top employment spot in each state. See Here

Why Commodities Could Be the Trade of the Decade

Are commodities entering a stealth bull market? In this episode of In the Money with Amber Kanwar, Thompson Investment Partners senior portfolio manager Bob Thompson makes the case for why investors should look beyond tech and get serious about the next major cycle: commodities. Thompson explains why gold, copper, uranium, and fertilizer stocks are poised for long-term outperformance and why we may already be in a commodity bull market that most investors are missing. From underinvestment in mining to decade-long U.S. dollar cycles, he breaks down the macro forces driving this pivot and the historical parallels that suggest a major reversion is coming. Watch Here

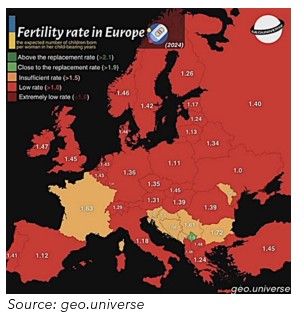

The amount of wealth leaving Canada would be eye-opening for many Canadians

Canada’s future prosperity depends on policies that reward ambition rather than punish it. We don’t just lose tax dollars when we drive away successful Canadians; we lose innovators, job creators, and the very people who can help build a better future. It’s time for leadership that sees this clearly and acts decisively. Read Here

Canada’s economy keeps growing — but Canadians aren’t feeling it.

In 2015, we ranked 6th in the world for GDP per capita. Today? 15th. Behind Ireland, Singapore, Norway, Australia — just ahead of the UK. So where is all the wealth going? See Here

On the Positive

What I could have learnt from René Girard

The French theorist admired by the US right has an important message for both sides of politics Read Here

The Comeback Is Personal

Finish 2025 with a powerful mindset. This video is a compilation of the most impactful motivational speeches from world-renowned voices like Eric Thomas, Les Brown, and David Goggins. Whether you’re rebuilding, starting over, or chasing something bigger—this is your comeback season.

Push past your limits.

👉 Watch Here

The Grind in 2025 Is Going to Be Personal

This one’s for the early risers and late grinders. A high-energy compilation designed to fuel your focus and remind you that this year is yours to take—if you’re willing to work for it.

No more excuses. Just execution.

👉 Watch Here

Your World Within – 90 seconds

A 3-hour motivational marathon from Eddie Pinero’s Your World Within, this video is all about tuning out the noise and tuning into your purpose. Perfect for deep work, workouts, or when you need to reset your mindset.

Silence the world. Amplify your vision.

👉 Watch Here

The Power of Grit – Angela Duckworth

Think success is all about talent? Think again. Psychologist Angela Duckworth breaks down why grit—passion and perseverance for long-term goals—is a better predictor of success than IQ or raw ability.

Watch this when you’re doubting your potential.

👉 Watch Here

Nothing Comes Easy

This 2025 compilation from Motivation2Study features powerful voices like Coach Pain, William “King” Hollis, and Marcus “Elevation” Taylor. It’s a raw, honest reminder that the path to greatness is never smooth—but always worth it.

When it gets hard, that’s when it matters most.

👉 Watch Here

The Mother of 10,000 Things

Written more than two thousand years ago, the Tao Te Ching is one of the true classics of spiritual literature. It is a guide to cultivating a life of peace, serenity, and compassion. Through aphorisms and parable, it leads readers toward the Tao, or the “Way”: harmony with the life force of the universe.

Watch when you need to find peace.

👉 Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca