INSIDE

Know thy Ego

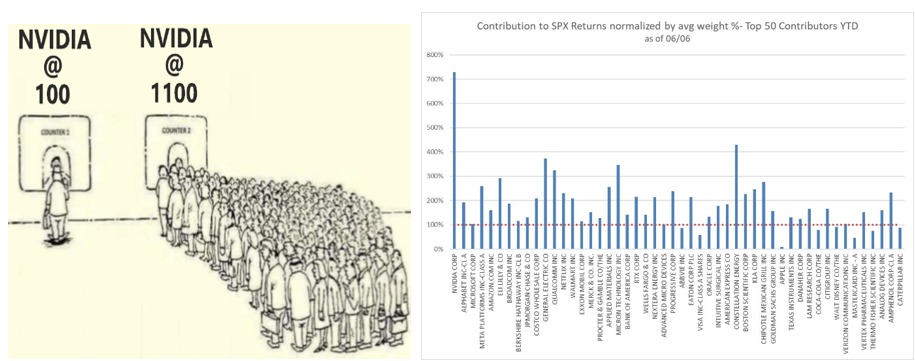

Investors are FOMO chasing like never before thanks to the likes of Nvidia and mega tech and why the S&P 500 may be a dangerous thing to be benchmarking to at the moment.

Bonds and the 60/40

If you’re thinking of buying bonds and going back to the 60/40, think again or at least know the risks.

Market Strategy and Positioning

We review our tactical positioning in today’s market environment and show some of the recent trades we’ve undertaken that we are excited about heading into the second half of 2024.

June 2024 – bond traps and taxation

Welcome to this month’s Market Strategy. Markets continue to be led higher by the American powerhouse Nvidia and other mega cap tech while bullish bets on the broader global economy have fallen to decade lows if oil speculators provide any indication of what’s ahead. Meanwhile, asset managers are going all-in on the falling interest rate trade by shorting the U.S. dollar and buying U.S. treasuries. This has pushed the U.S. Dollar Index (DXY) down nearly 2 per cent and 20-year treasuries up over 3 per cent in May.

Interestingly, at the end of May the S&P TSX is up only 3.2 per cent this year while the FTSE Bond Universe is down 1 per cent and the CAD/USD is down 2.3 per cent. The good news is that our strategies are delivering returns closer to international markets for our clients despite being holding a decent weighting to Canadian stocks.

Looking ahead, we’re hearing lots of chatter from pundits and advisors about buying bonds despite what has proven to be an ongoing classic value trap. According to Charlie Bilello, Chief Market Strategist at Creative Planning, over the past seven years, nearly all the annualized gains in the 60/40 U.S. stock/bond portfolio have come from the stock side, with the S&P 500 gaining approximately 11.6 per cent per year versus around 0.8 per cent per year for bonds.

We do think interest rates will be headed lower but more likely will fall faster in jurisdictions outside the U.S. which is already starting to happen with the first cuts seen in Canada and the European Union in the first week of June. These regions don’t have the luxury of being the world’s reserve currency, and as a result need to cut rates and increase taxes to finance their large deficit spending.

There is also the risk that U.S will continue to flood the market with debt issuance keeping their interest rates higher for longer. Therefore, it isn’t as easy as it sounds when it comes to calling the end of the bear market in bonds as there is currency risk that needs to be managed along with duration risk. We just don’t see many advisors addressing this but we sure are for our clients.

Finally, we take a deeper dive into our strategic asset allocation along with some of the more notable trades we executed during the past few weeks that we are excited about heading into the second half of 2024. We’ve also been quite busy with tax planning and reviews and so please reach out to Morgan if you have any questions on your portfolio(s) and if we can help.

Hope you enjoy this month’s edition and keep investing wisely!

![]()

Creating the ego-less portfolio

Being the risk managers we are, we’re often asked what the least-risky, highest-reward strategy we’ve ever deployed is. The answer is quite simple: it’s a strategy that is much more than investing, one that also works in running a business and in the daily interactions of our lives.

The biggest roadblock is one we regularly place in front of us: our ego. There are entire religions and myriad self-help books dedicated to this topic and yet we stubbornly double down on our dualistic view of the external world, not realizing the true nature of what’s in front of us.

As a result, we perceive the world as if it is purposely acting for or against us, when it has nothing to do with us at all most of the time. This is called fighting the market when investing. Therefore, whenever something bad happens, we often go to the “poor me” or “blame them” default, instead of searching for the opportunity in the misfortune, or at least using it as a means to self-evaluate and correct our situation.

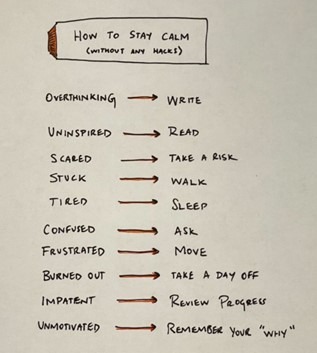

We have found it very helpful during such times to take a step back and realize that for the most part, things happen for you, not to you. This is what the true nature of karma is: a bump in the road that wakes you up and allows you to stay on the road toward your ultimate destination, instead of hitting the ditch and getting stuck.

The smartest business owners we know have a skill set that puts their egos out of the way of success. They don’t take things personally, quickly adapt and choose the path that allows them to scale. At times, this means giving up owning a piece of their pie in order to make it a substantially bigger pie.

We took on this approach ourselves back in 2020 by partnering with Wellington-Altus, handing over the keys to our pipes and plumbing and greatly expanding what we call our fun box by spending more time on what we love doing, which is managing portfolios and working directly with clients on achieving their financial objectives.

This meant putting our ego out of the way and seeking help in the areas of our business that are critical, but not within our best skill set. Sure, Craig and Martin no longer have a fancy self-imposed title, but going back to our roots as portfolio managers means our clients are much better off and our practice is multiple times larger. We’re also having a heck of a lot of fun again doing what we truly love.

We’ve also been trying to do the same when investing. It isn’t about proving the market wrong but getting out of the way and layering in downside protection in the event we’re wrong. Moving to a goals-based investment approach has been especially helpful, as it means we no longer have to try to beat the market, and instead focus on achieving each client’s financial goals while minimizing the risk as much as possible.

Deploying structured notes as a fixed-income and equity-income replacement has been one area that has greatly assisted us with this. We have read criticism from those whose egos have prevented them from looking at notes as a tool to improve a portfolio’s return. In the end, it is about the client achieving their targets and not about your particular investment approach or internal models.

We see this all the time with the battle between those deploying passive exchange-traded funds and criticizing active managers, value versus growth, etc., when it shouldn’t be about them, but rather the client. Being agnostic really helps put one’s ego in check. Instead of getting angry at that bump in the road, you can adjust course and realize it isn’t about you but getting those in the car with you to their ultimate destination. You can either make excuses or progress — not both.

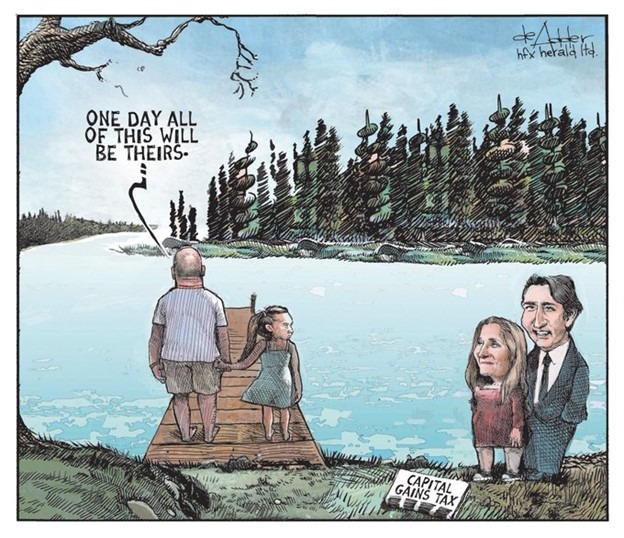

Taxation and the mobility of capital

A few summers ago, Martin took his family to a fantastic role-play production on an actual train from 1905 in Calgary’s Heritage Park. The play reenacts what it was like to come to Alberta from Montreal as a homesteader receiving land from Canadian Pacific Railway Co. What made this special was that it could very likely have been the same train his grandfather was on when he was just three years old.

His family moved here because there just weren’t the same kinds of opportunities for them in Quebec after spending generations there as direct descendants of the first Pelletiers — Guillaume Pelletier, Michelle Mabille, and their 14-year-old son Jean — in the spring of 1641. It was a hard life, but they set their roots and planted seeds of opportunity on this free land to lay the foundation for subsequent generations.

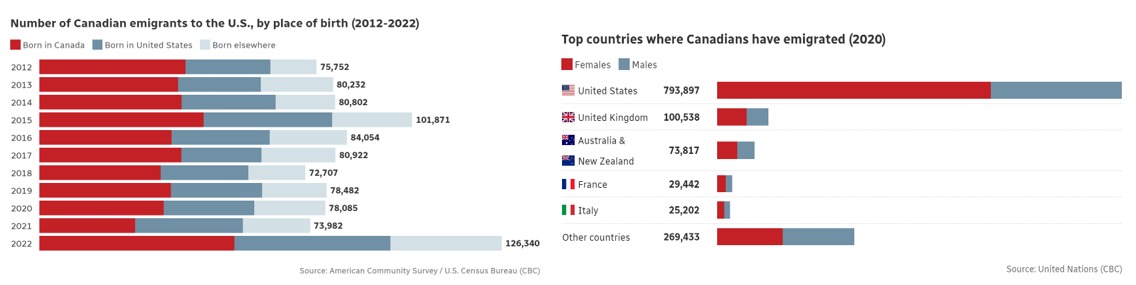

That’s why it saddens us to see Canadians leaving the country for many of the same reasons. In 2022, emigration from Canada to the United States reached a 10-year high, with 126,340 people leaving the country, a whopping 70 per cent increase over the past decade, according to data compiled by the CBC.

This could be just the early stages of a mass exodus of Canadians, as we are currently receiving numerous calls from entrepreneurs, doctors and farmers asking about options to relocate following the numerous tax changes targeting them first in 2019 and again this year.

Instead of pointing fingers and making excuses, a good portfolio manager should always be looking at their own results and trying to figure out what went right so they can do more of it with future capital allocations and what went wrong so they can do less of it. So, let’s do the same thing with our economy to try to figure out why so many people are leaving or preparing to leave.

Let’s start with economic productivity. Since 2015, Canada has seriously lagged the United States in terms of gross domestic product per capita. Provincial labour productivity figures rank in the bottom quartile when compared against American states. Meanwhile, the fastest-growing sector in the country is now the federal government.

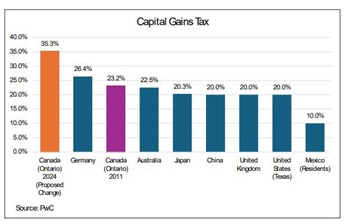

Foreign direct investment has turned negative, meaning capital is flowing out of the country, leaving Canada’s wealthy as the sole remaining source of capital for economic investment. But the Trudeau government has decided this is the time to increase capital gains taxes on them. How will this help motivate them to deploy capital into the economy?

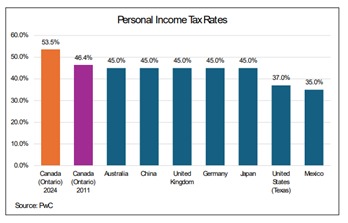

According to PricewaterhouseCoopers International Ltd., the proposed capital gains tax in Ontario is now 35.2 per cent, up from 23.2 per cent in 2011, and about 10 to 25 percentage points above many major countries, including Germany, Australia, Japan, China, the United Kingdom, the U.S. and Mexico.

Then there’s the personal tax rate on Canadians living in Ontario and making more than $246,752 at 53.5 per cent, which Trudeau has increased from the 46.4 per cent charged in 2011. This puts their tax rate at seven to 18.5 percentage points higher than Australia, China, the U.K., Germany, Japan, the U.S. and Mexico.

One problem with this is that the minimum income required to qualify for a mortgage on the average house in Canada is roughly $200,000. As a result, only those who the Canadian government calls the wealthiest for tax purposes can qualify to buy a home here.

Instead of acknowledging the problem, Calgary’s mayor recently said the prospect of never owning a home and becoming a forever renter is a liberating experience. Perhaps I should be liberated from my property tax bill, which Martin recently opened to discover that it has doubled from the previous year despite doing zero renovations.

Our politicians need to be reminded that Canadians have plenty of options and they no longer need free farmland to motivate them. Significantly lower housing prices, fewer taxes, greater access to health care, better education, less crime, more opportunities for employment and overall better affordability for their kids’ future will more than do the job. That’s a train or plane many Canadian families are now seriously considering taking setting the stage for another role play but this time taking place in an American museum.

For our clients considering undertaking such a change for their family we have assembled a global network of tax experts including an offshore full multi-family office service to assist us helping you evaluate whether this is the right next step forward. Please reach out to Martin for further details.

Tactical positioning and performance update

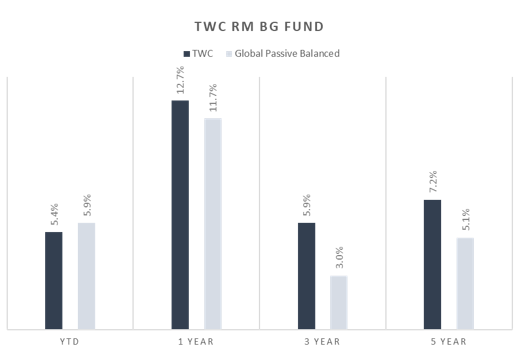

Interestingly, at the end of May the S&P TSX is up only 3.2 per cent this year while the FTSE Bond Universe is down 1 per cent and the CAD/USD is down 2.3 per cent. Our underweight bonds and overweight structured notes continues to pay off with our TWC Risk-Managed Balanced fund gaining 1.5 per cent in May, bringing our year-to-date performance up to 5.4 per cent slightly below our global passive balanced benchmark (40% Vanguard Global Bond, 10% S&P TSX, 50% MSCI Global Equity) that is up 5.9 per cent.

CAD | Annualized investment return as of May 30, 2024| Global Passive Balanced 40% Vanguard Total Bond, 10% Capped S&P/TSX, 50% iShares MSCI World Index | Past returns are not indicative of future returns. TWC returns reflecting 1% fee for TRI400 unit holders, and TWR calculated at month-end.

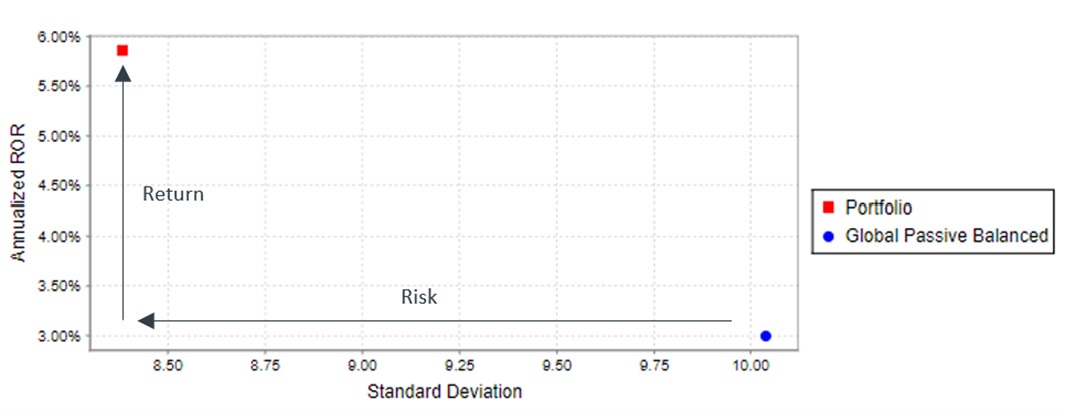

Overall, we started adding notes nearly four years ago into the fund and client portfolios as a fixed income and equity income replacement. As per below, you can see the annual return and standard deviation of the fund over the past three years versus a global passive benchmark.

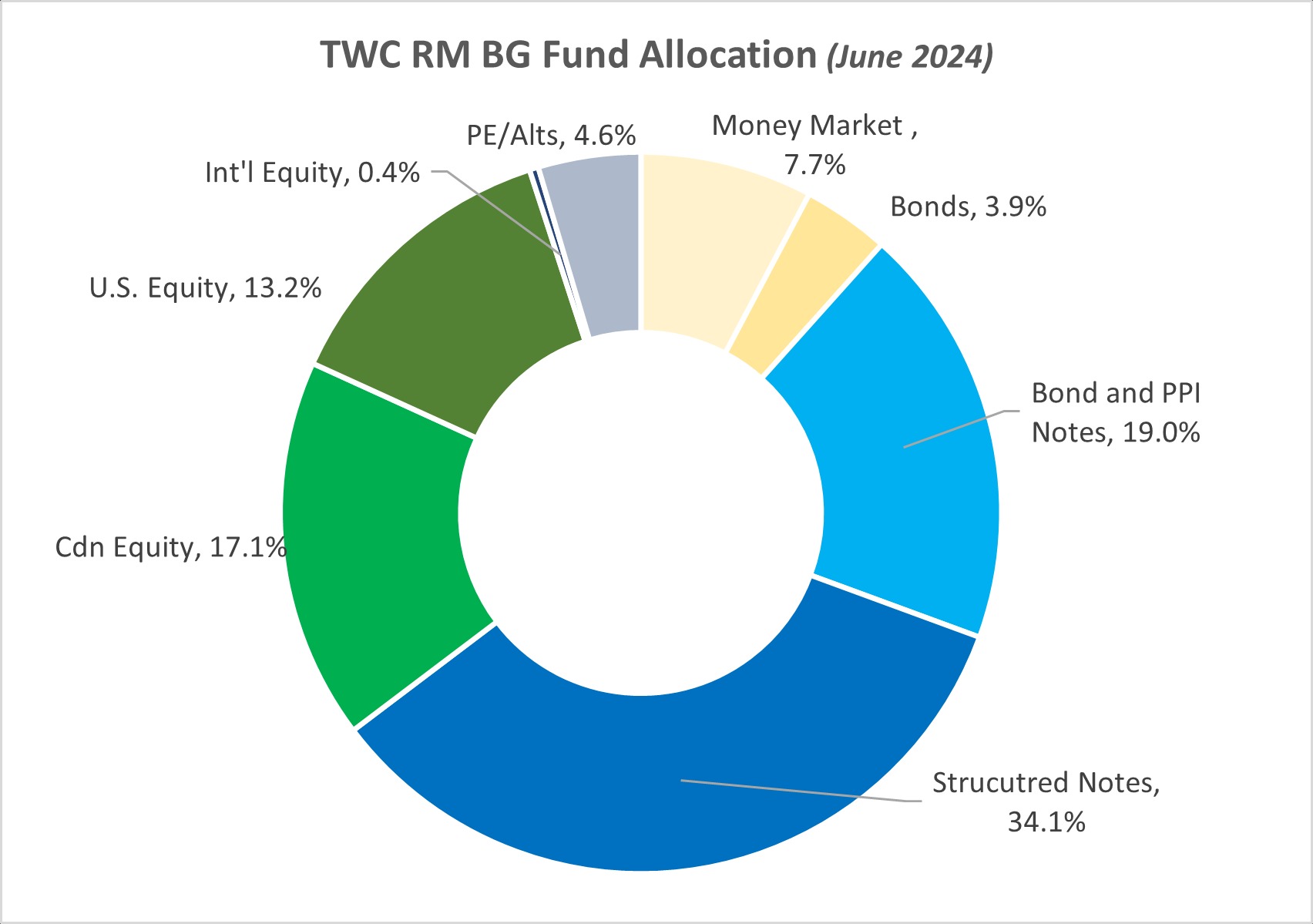

Currently, we’re running about 8 per cent cash and money market paying about 5 per cent in interest, 4 per cent in U.S. floating rate bonds paying nearly 6 per cent, 4 per cent in a 1.2 times 20 Year Treasury note with 20 per cent downside protection (our recession hedge),12 per cent in fixed income structured notes with 100 per cent principal protection and yields ranging from 7.0 to 8.22 per cent and about 3 per cent equity tracking principal protected notes.

Overall, we believe that government bonds will continue to do poorly in this macro environment and the inverted yield curve means longer dated bond investors are not being compensated for risk. GIC rates are fine, but they are not very attractive looking out past one year.

We recently put together a 10-year linear note paying a fixed 7% annual yield, no equity benchmark and CDIC insured. We then did one in U.S. dollars with a fixed 6.85 per cent yield payable each year unless called away, and U.S. dollar 12-year linear paying 8.25 per cent.

On the equity notes of interest undertaken during the quarter we did one on Enbridge, Emera, and TC Canada. It will pay a 11.25% coupon once called (call terms annually, 3 stocks collectively have to be above 0 per cent in share price return). Once called, get an incremental +200 per cent of any positive return – i.e. if basket up 20 per cent next year, note pays 51 per cent return. This is an excellent replacement to a yearly auto callable note on Canadian pipelines that we did last year get called. The index return was 9.29 per cent and our clients will be receiving a 16.70 per cent coupon.

We made no changes in the quarter to our equity positions and remain overweight energy and Canadian sectors to benefit from falling rates including infrastructure and utilities. We remain long the S&P 500 but hedged with a 20 per cent downside buffer in the event markets correct prior to year-end.

In the Media

Martin Pelletier is an investment pro columnist for the Financial Post. His columns can be read here every Monday afternoon as well as his active Twitter feed.

BNN Bloomberg. Don’t see a lot of growth potential for banks: senior portfolio manager. Martin Pelletier, senior portfolio manager for TriVest Wealth at Wellington-Altus Private Counsel, joins BNN Bloomberg to share his outlook on the markets and how to navigate amid uncertainty. Watch Here

Toronto Today. Greg spoke with Martin Pelletier, is a Chartered Financial Analyst and senior portfolio manager at Wellington-Altus Private Counsel Inc. about the Bank of Canada interest rate announcement. Listen Here

BNN Bloomberg. Outlook for Canadian vs. U.S. economy. Martin Pelletier, senior portfolio manager for TriVest Wealth at Wellington-Altus Private Counsel, joins BNN Bloomberg to discuss the latest on the markets, and how the Canadian economy compares to the U.S.’s in the current climate. Watch Here

What we’re Reading

Canadian politics and taxation. Six major business groups say 20 per cent of Canadians will be impacted directly over the next 10 years from Trudeau’s capital gains tax change, not the 0.13% they’re claiming. Doctors, farmers, small business owners…so many hard-working Canadians. According to this piece in the National Post, “triumph is all that matters to Freeland, and she is willing to stake her reputation on it, as well as the peace, order and good government of Canada.” Read Here Look at this chart and ask yourself how making capital providers who are already leaving to pay more taxes is going to help the economy? See Here

Affordability concerns are driving global political change. Persistent large fiscal deficit spending and accelerating affordability issues are primary drivers of this sea change.

Over the past two weeks we’ve seen:

– New Zealand to reverse ban on oil / gas exploration

– New York indefinitely postponing congestion fee

– US raises fuel economy standards less than proposed

– Green parties lose vote share in European elections

However, many politicians still just aren’t getting this as people ask themselves if they’re worse or better off under their leadership and the answer is plain and simple. Read Here

Some insightful thoughts by @profgalloway on our youth. There is something bigger here that our generation needs to realize. Watch Here

Time for some good news: the world isn’t ending. There are so many bears out there on the state of the global economy. Things are more than ok, economies for the most part are holding up fine, and yes, still growing. See Here International travel is set to see the biggest surge. That’ll grow by 9.7% this year with huge increases in Asia, Europe and North America. International flights from Asia should climb by 23% but there are substantial gains almost everywhere according to Bloomberg. See Here And yet, sentiment on oil is as bad as it was back in 2014 when Saudis flooded the market with oil and went after U.S. shale. See Here

Want to grow economies and save the planet? Here is a hint: go nuclear. Yes, it’s that simple. One chart says it all. See Here

Warren Buffet’s Berkshire Hathaway buying more OIL. Berkshire Hathaway purchased an additional 2.57 million shares of Occidental Petroleum’s common stock between June 5 and June 7, according to a U.S. securities filing. The investment amounts to over $150 million, increasing Berkshire’s stake in the energy company to about 250.6 million shares. See Here And guess what, there is zero risk premium in oil prices at the moment. See Here

Are EVs no longer the disruptive force many thought they were going to be? Gone are the times when Tesla sold every car it could build fresh out of the factory. We’re now at the point where the company has actually made too many vehicles. The automaker is obviously aware of this, slashing prices on popular models like the Model Y as inventory piles up. Buyers aren’t biting though and now the automaker has so much unsold inventory that, as Sherwood News reports, they’re being stored in lots that can be seen from space. Read Here

Reading the data. Excellent thread here on the divergence of “the reality” (hard data) and the “perception of reality” (soft data) of the U.S. economy that is widening ahead of the election by our friend Jim Bianca. Read Here

Perception vs. reality. Nearly three in five Americans wrongly believe the U.S. is in an economic recession, and the majority blame the Biden administration, according to a Harris poll conducted exclusively for the Guardian. Read Here

10-year yields and oil prices. Oil traders trying to send prices back down before the election and signaling a massive drop in 10-year yields. But be careful on this trade, very careful. Crazy how U.S. stocks are setting new all-time highs and unemployment at lows and yet this. How long can it last? See Here

Fidelity strategist, Jurrien Timmer on the market and baseball. The current bull market cycle is 20 months old and produced a 53% gain. By historical standards there seems to be life left for this bull, given the median 30 months and 90% gains that’ve been produced over the past 100 years or so. We might only be in the 5th inning. See Here

Who is in your driver’s seat? Benchmarking yourself to others is the path away from happiness as it allows envy and jealousy and feelings of unworthiness to take control of the wheel. Do your own thing, set your own goals, be flexible, don’t be weighed down by the mistakes of yesterday as second chances keep coming as do breaths in the present moment. Change your mindset and watch what happens next. See Here

Some deeper perspective on the extreme market concentration risk. The equal-weighted S&P 500 relative to the S&P 500 index has now fallen to its lowest level since March 2009. This year (up to the end of May), the S&P 500 has gained about 10 per cent while the equal-weighted index rallied just 3 per cent. At the same time, Magnificent 7 stocks have rallied over 50 per per cent. Since the ratio peaked in February 2023, the S&P 500 is up ~29 per cent compared to a 7 per cent gain of the equal-weighted index. Meanwhile, the top 10 per cent of US stocks now account for ~75 per cent of the S&P 500, the most since the 1930s’. See Here

Nvidia. Did you know that the company accounts for approximately 43 per cent of the S&P 500’s gain this year? See Here The top 3 companies in the S&P 500 (Microsoft, Nvidia, & Apple) now make up 19.7 per cent of the index, the highest concentration on record with data going back to 1980. See Here

The bond trap is loaded and ready. According to TD Securities, the flow of cash into bonds is accelerating as the rate-cutting cycle gets underway. Global bonds received a 24th consecutive week of inflows, and the 2nd-strongest since July 2021, at $17.8 billion. EU government bonds had the strongest inflows since Feb. 2023. That said, watch this excellent interview by Andy Constan especially if you’re thinking of adding to your bond positions.

Bonds have been rallying on falling growth. Are we in a period where the driver of asset prices is the direction of growth? Then, what does it say about stocks? Both assets can’t rally so he is short bonds. Bond prices have significantly supply coming, and inflation may not be done yet. Watch Here

Then there is this interview with Rick Santelli who still thinks long rates end up in double digits longer term, but we might hit the threes first. The risk is that eventually overwhelming Treasury issuance and inflation will pressure the long end back up. Watch Here

Canada and Europe are a lot alike in many ways. Take a look at how our currencies have been moving together against the U.S. dollar. See Here

Canada just recorded biggest drop in FDI in 14 years. Canada recorded one of the largest declines in foreign direct investment (FDI) ever in the first three months of this year, a drying up of capital flows that will stoke worries about the nation’s underlying economic fundamentals. Foreign direct investment into Canada fell by $3.4 billion in the first quarter, according to data released by Statistics Canada on Thursday. It’s the largest one-quarter decline since 2010. Canadian direct investment abroad, meanwhile, jumped higher to $32.6 billion in the quarter — a number that is well above the historical average. Read Here

Feds’ decision to delay capital gains tax changes a ‘Ponzi scheme’: Wiseman. The former head of Canada’s largest pension plan says the federal government’s decision to delay the implementation of proposed changes to the capital gains tax was made to collect additional tax revenue in the near term. Mark Wiseman, the former chair of AIMCO and former CEO of the Canada Pension Plan Investment Board, told BNN Bloomberg in a Monday interview that if the government wanted to take a principled-stance on capital gains, the tax would already have been implemented. Watch Here

By raising capital-gains tax, Ottawa gores the wealthy and middle class together. As Canadians we have a choice. We can be a nation of dreamers, driven to build lives and communities by taking risks, or we can continue our slide toward less innovation, declining productivity and a lower standard of living.

U.S. commercial real estate risks. About $1.7 trillion, or nearly 30 per cent of outstanding commercial real estate debt, is expected to mature from 2024 to 2026. Most of this debt is going to need to reprice during this time at a time when office values have fallen about 34 per cent from the 2021 peak. Read Here A NYC office building at 321 W. 44th St. is set to be sold for less than $50 million, a 67% discount from where it was sold in 2018. Read Here

On the Positive

It isn’t us and the environment it’s just us. So remember where we come from, what we’re part of and what’s important in life.

We need a lot more stories like this. 400 students gather outside the home of their cancer-stricken teacher to sing for him. He passed away 10 days later. Watch Here

Cat rescue and prisons. As planned, for good behavior, prisoners were allowed to take cats for guardianship. An important point: these poor homeless animals were waiting for euthanasia because they could not find owners. Thus, the prison authorities decided to take them in. As a result, harsh prisoners became calmer and kinder. Moreover, the convicts even began to work harder to earn new toys and sweets for their furry cellmates. Watch Here

Love makes the world go round. Enjoy life like this fine gentleman enjoys his whiskey. Watch Here

Crocodiles or logs? Listen to the other side of an argument, especially when there is the risk of getting eaten as you persist in proving them wrong. A great lesson on life and investing. Watch Here

How are you allocating your $86,400? Imagine this: If you had $86,400 in an account and someone stole $10 from you. Would you be upset and throw all the remaining $86,390 away in hopes of getting back at the person who took your $10? Or move on and live? Remember that you have 86,400 seconds each day. Don’t let someone’s negative 10 seconds ruin the remaining 86,390.

Let’s never forget. Andy Rooney landed on the beach of Normandy days after D-Day, 80 years ago today. In 2004, he shared a firsthand account of “a day unlike any other.” “It’s hard for anyone who has been in a war to describe the terror of it to anyone who hasn’t,” he said.

Perfection is impossible. Focusing on the shot in front of you not behind you will help you win not just in sport but also in the game of life.