INSIDE

A rollercoaster of a year in markets

What a rollercoaster year it’s been for global markets. Equity indices around the world were shaken earlier this year as escalating U.S. tariff tensions triggered waves of uncertainty. In a dramatic turnaround, however, equity markets have surged back into positive territory this month. The U.S. government’s more conciliatory tone recently towards China provided long-awaited clarity on its trade stance, reinvigorating risk appetite and boosting investor confidence. Major indices responded with strong gains, reversing much of the earlier damage and investors have come plowing back into stocks.

Finding balance, being adaptable and focusing on quality

This growing divergence between equity markets and defensive bond markets underscores the complexity of today’s macroeconomic landscape. In such times portfolios built on quality, balance, and adaptability will be best positioned to weather any sudden storm that appears and capitalize on the eventual recovery. Rather than chasing yesterday’s leaders, investors might consider using the recent rallies as opportunities to strategically rebalance should this prove to be a large structural shift taking place.

The heart of a company is its people

The heart of a company is its people, which is why it’s so important to pay attention to how management treats their employees. A top-down, authoritarian approach driven by ego creates a toxic environment that can be really damaging and can lead to excessive stress and a heart attack. Thankfully, there are companies out there that truly value their employees, and their commitment to fostering a positive culture leads to incredible success and a healthy organization.

May 2025: You always have options

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

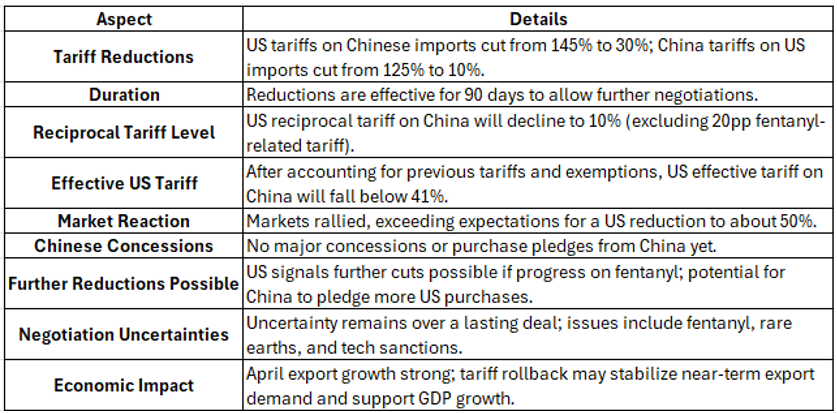

What a rollercoaster year it’s been for global markets. Equity indices around the world were shaken earlier this year as escalating U.S. tariff tensions triggered waves of uncertainty. Sharp declines and heightened volatility left investors scrambling for direction amid fears that a prolonged trade war could undermine global economic growth.

In a dramatic turnaround, however, equity markets have surged back into positive territory this month. The U.S. government’s more conciliatory tone recently towards China provided long-awaited clarity on its trade stance, reinvigorating risk appetite and boosting investor confidence. Major indices responded with strong gains, reversing much of the earlier damage and investors have come plowing back into stocks.

In April, retail investors purchased a record US$40 billion in U.S. exchange-traded funds and single stocks, more than double the monthly average seen in 2024, according to JPMorgan Chase & Co. data. The Vanguard S&P 500 ETF saw an inflow of almost US$21 billion last month, the largest in its history and the fifth largest for any ETF ever on a monthly basis. As investors make bets on short-term market fluctuations, zero days to expire options now account for roughly 60% of total S&P 500 options volume, a new all-time high.

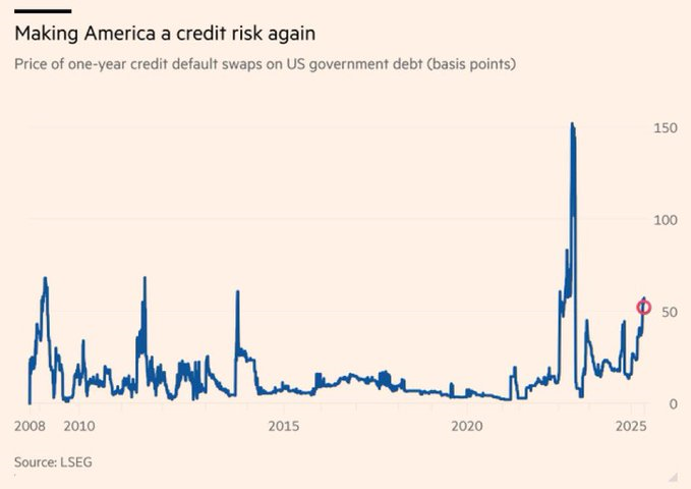

Yet while equity markets embraced the rebound, the bond market is telling a more cautious story. The U.S. 10-year Treasury yield climbed back above 4.5 per cent, signalling persistent concerns around sticky inflation, ongoing fiscal excess, and the possibility that interest rates could remain elevated longer than expected.

This growing divergence between equity markets and defensive bond markets underscores the complexity of today’s macroeconomic landscape. Investors are navigating a crosscurrent of shifting policy signals, geopolitical developments, and central bank uncertainty. It’s a market that rewards adaptability more than certainty.

Understandably, many investors may feel tempted to head to the sidelines and wait for more clarity. But doing so runs the risk of missing out should equity markets prove correct in pricing in easing trade risks and resilient economic growth.

The truth is, no one knows for sure what comes next—despite the endless stream of bullish or bearish takes from market pundits.

This is a time when we need to take a lesson from one of the greatest investors of all time, Warren Buffett. At the Berkshire Hathaway annual shareholder meeting two weekends ago, Buffett, who announced he would step down as chief executive at the end of the year, offered some sound advice:

- Markets don’t always go up;

- Check emotions at the door when investing, as you require the right temperament. Adapt to the world and don’t expect the world to adapt to you;

- The world makes big mistakes; the more sophisticated the market becomes, the more extreme and unpredictable events happen.

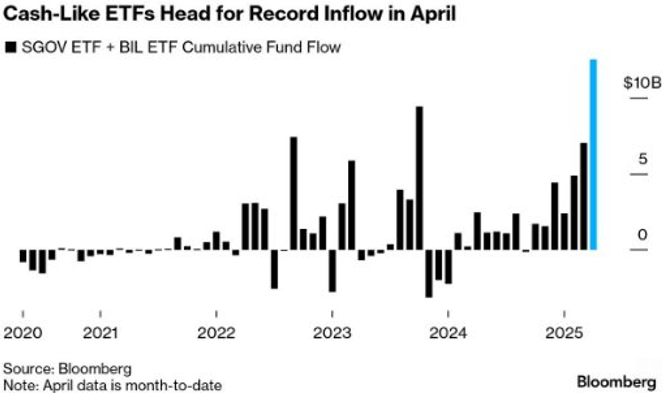

That said, Warren Buffett is now sitting on enough cash to buy any of the companies below the Top 24 in the S&P 500. In total, Berkshire’s cash position has soared to a record nearly US$348 billion in the first quarter, more than tripling over the last three years. He isn’t alone, as money market fund assets under management have hit a record US$7.4 trillion, reflecting about 15 per cent of the S&P 500’s market cap, up from 13 per cent in February. Over the past two years, total money market assets have risen by more than US$2 trillion.

Instead of trying to guess where the broader equity market is going to go in the near term, we think it’s better to ask yourself what Buffett, with his long-term outlook, would do. Many may not know this but Warren Buffett is a big believer in options in creating investments with assymetrical payoff profiles.

In the early 2000s, Buffett sold put options on companies like Coca-Cola and Wells Fargo—businesses he already liked. He collected millions in premiums without ever having to purchase the stock in some cases. From 2004 to 2008, Berkshire Hathaway wrote over $37 billion worth of long-term index put options on global stock indices (like the S&P 500, EuroStoxx 50, FTSE 100, and Nikkei 225) with maturities ranging from 15 to 20 years. Buffett collected $4.9 billion in premiums upfront for doing so.

During the Global Financial Crisis, Buffett made a legendary deal by investing $5 billion in preferred shares of Goldman Sachs, yielding 10 per cent. More importantly, he received warrants (essentially long-dated call options) to buy 43.5 million shares of Goldman at $115. When the dust settled and Goldman rebounded, Buffett exercised those warrants for massive profit earning him over $3 billion in gains.

While we occasionally impliment options trades within our TWC Risk-Managed Balanced Growth fund, we also make extensive use of structured notes which is another way of undertaking options within a portfolio. The difference being since note returns are taxed as income we try to make use of them within tax-sheltered vehicles like RRSPs and TFSAs, often allocating up to 100 per cent in our clients’ registered accounts. These strategies also offer the ability to customize outcomes depending on market conditions—something traditional investments struggle to provide.

For instance, in today’s environment, we recently partnered with a Canadian bank’s capital markets division to create an “accelerator note” with a unique look-back feature. The note references a basket of large-cap Canadian stocks such as TC Energy, Enbridge, CIBC, TD Bank, Agnico Eagle Mines, and Manulife Financial etc., and runs over a three-year term. Six months from now, it will lock in the lowest point for the basket since inception and provide 1.18x the upside from that level for the remainder of the term—plus a 30% downside buffer from that locked-in low. In other words, even if markets decline sharply over the next few months, investors could benefit from gains off that bottom with significant downside protection.

We’ve also issued a similar note in U.S. dollars with even more compelling terms—1.55x the upside, thanks to higher U.S. interest rates.

Structured notes can also serve as compelling bond alternatives for income-seeking investors. One strategy we’ve used recently is a “contingent income” note on Canadian utility stocks, offering a 7.52% annual yield with monthly payments, as long as the index stays above a 30 per cent downside barrier. Even if that barrier is breached, investors don’t lose their full principal but are protected by a tiered buffer below that level.

Of course, higher yields are available through more aggressive notes, but this typically involves accepting either more volatile indices or lower downside protection.

Ultimately, we find these notes provide clients—and ourselves—with peace of mind. We’re not forced to predict which market narrative is correct. Instead, we structure portfolios with tools that can flex with the environment, balancing growth and protection while remaining aligned to individual risk tolerance.

As this market continues to send mixed signals, the key for investors is staying flexible and forward-thinking. It’s great to have tools that help us achieve our target returns with embedded downside protection, especially in today’s uncertain climate. While the path ahead may remain bumpy, having strategies designed to respond dynamically to market conditions helps us stay invested—and more importantly, stay confident—in the journey.

Thank you for reading, and please feel free to reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

Market Strategy and Asset Allocation

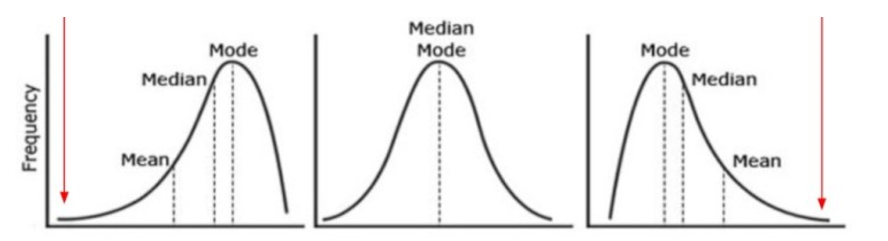

As retail investors are betting on a return to what we’ve witnessed in the past two years via U.S. markets leading the charge, we still think there remains fragility with the potential for downside tail risks. Much will depend on how macroeconomic and geopolitical variables evolve, particularly in the weeks and months ahead and so it’s important to remain vigilant, flexible and prepared.

In such times portfolios built on quality, balance, and adaptability will be best positioned to weather any sudden storm that appears and capitalize on the eventual recovery. Rather than chasing yesterday’s leaders, investors might consider using the recent rallies as opportunities to strategically rebalance should this prove to be a large structural shift taking place.

Here are some capital allocation considerations.

- Bonds, traditionally viewed as safe havens during downturns, remain challenged by persistently high U.S. yields, reflecting concerns about the government’s expanding fiscal footprint. A falling dollar adds to the complexity, encouraging capital repatriation from global investors. We currently own this segment of the market via our BMO Strategic Fixed Income fund, and some notes that we’ve created on long-dated U.S. Treasuries that are now yielding approximately 5 per cent. We also classify principal protected structured notes as fixed income for risk purposes, bringing our total bond weighting ranging from 20 to 25 per cent within our Risk-Managed Balanced Growth fund.

- Structured notes are drawing increased interest, particularly for registered accounts where tax efficiency is a concern. These instruments allow investors to participate in market upside while mitigating drawdown risk, making them very appealing in volatile environments. In total, we currently hold approximately 25 to 30 per cent of our fund in equity-focused notes including monthly contingents, yearly auto calls, accelerators and boosters.

- Global diversification is another viable path. ETFs such as iShares MSCI Japan Value and iShares MSCI EAFE offer exposure to markets that are less influenced by America-centric economic and political developments. These regions may present more favourable valuations and policy backdrops. We have recently been adding to our international holdings such as the Vanguard Global Dividend Fund (VIC200).

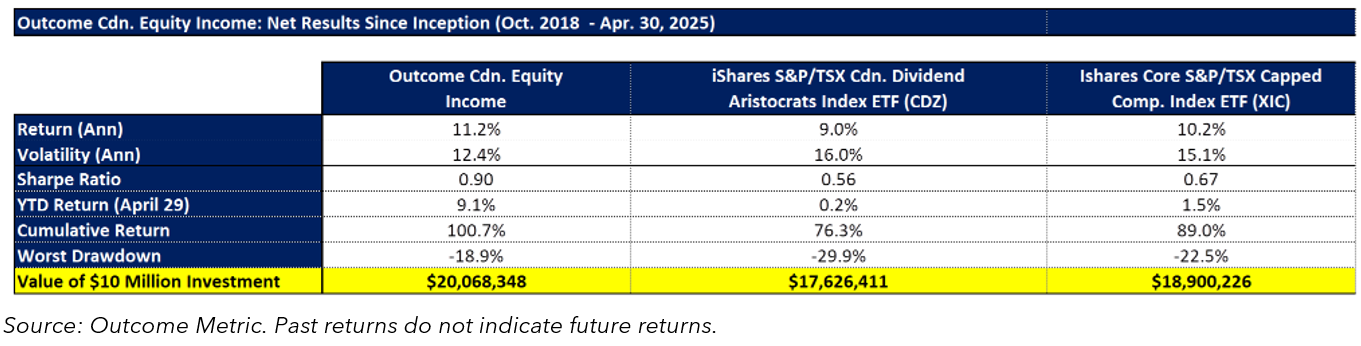

- Domestic resilience offers yet another layer of defence, such as Canadian dividend companies. For example, we are quite pleased with our position in Outcome Metric Asset Management’s Canadian Equity Income Fund that has gained 9.1 per cent year-to-date to the end of April, driven by holdings such as Alamos Gold Inc., Wheaton Precious Metals Corp., Franco-Nevada Corp., Finning International Inc., Waste Connections Inc., and Metro Inc. — companies with defensible margins and sectoral strength.

- Energy sector watch: The oil and gas industry is currently at a political crossroads in Canada. A shift in the federal government’s position could potentially eliminate significant regulatory headwinds. Additionally, if U.S. shale output peaks sooner than anticipated, Canadian producers, known for their cost efficiency and long-life assets, may see significant renewed investor interest. “On an inflation-adjusted basis, there have only been two quarters since 2004 where front month oil prices have been as cheap as they are today…we are at a tipping point for U.S. oil production at current commodity prices.” That said, we are exercising caution choosing to reduce some positions on strength while holding some core midcap names that are heavily oversold in our opinion.

Overall, we still have an 8 per cent cash position in our TWC fund still leaving us with plenty of dry powder. Canadian equity remains at 12.5 per cent, followed by a 11 per cent weighting in U.S. equities. This is rounded out by a 3 per cent weighting in alternatives, a 3 per cent weighting in private equity and a 1.5 per cent weighting in direct commodities.

The key takeaway is that we remain vigilant, flexible and prepared via our asset allocations. Rather than overcommitting to short-term narratives or lagging signals, a measured approach that blends technical awareness with macro insight and global diversification will prove more durable.

Research, reads of the month

“Best way to get Americans excited about a 30% import tax? Freak them out with a 145% one first” – @TimothyDooner

Understanding the scale of unfolding bond crisis

Martin Pelletier, senior portfolio manager for Trivest Wealth at Wellington-Altus Private Counsel, shares his analysis of the bond crisis unfolding. Watch Here

The bond market is no longer a passive player—it’s now a driver of global risk.

Investors who adapt early will be best positioned to navigate what could be a very turbulent road ahead. Read Here

Navigating the ‘toughest market in years’: Pelletier

Martin Pelletier, senior portfolio manager at Wellington-Altus Private Counsel, on how to navigate what he describes as the ‘toughest market in years’. Watch Here

JPMorgan, Dimon on bond markets

I am not a buyer of credit today. Watch Here

The price of credit default swaps on U.S. Government Debt is rising to its highest level since 2023 and one of the highest levels since 2008

Analysis of the U.S. stock market and S&P 500

Martin Pelletier, senior portfolio manager for Trivest Wealth at Wellington-Altus Private Counsel, shares his analysis of U.S. stock market and S&P 500. Watch Here

BMO hikes dividend despite higher loan loss provisions

Martin Pelletier, senior portfolio manager for Trivest Wealth at Wellington-Altus Private Counsel, shares his analysis of earnings results from Canadian banks. Watch Here

Apollo: The bubble in AI valuations was simply the result of a long period with zero interest rates.

With upward pressures on inflation coming from tariffs, deglobalization, and demographics, interest rates will remain high and continue to be a headwind to tech and growth for the coming years. See Here

U.S. policy chaos

It has already damaged the economy, by undermining confidence and forcing companies to postpone capex and hiring. That was the story of Q1. But the real recession risk comes from lower earnings over the summer, and how the corporate sector responds. Read Here

U.S. China trade deal summary

This is a big risk for Canada

Hedge funds now absorb approximately 40 per cent of Canadian government debt issuance. If non-bank investors stop buying our debt or demand higher rates, there is significant upside pressure to debt service costs, further eroding Canada’s fiscal position. Read Here

The Bank of Canada is worried, very worried

60 per cent of Canadians face soaring mortgage rates soon. Job cuts looming. Defaults ready to move higher. Credit? Drying up fast. Watch Here “A severe and long-lasting global trade war could push the rate of mortgage arrears beyond levels reached in the 2008-09 global financial crisis”

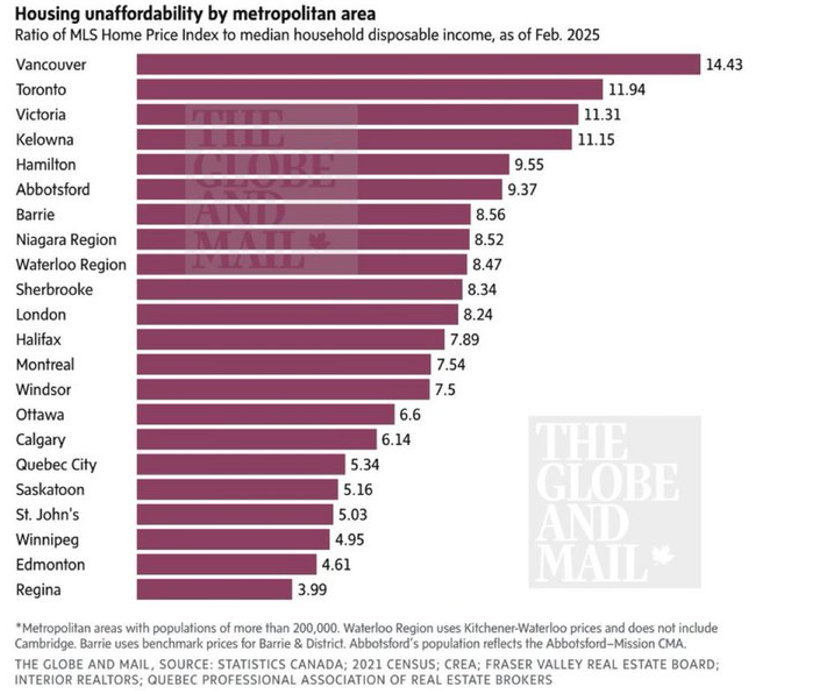

Canadian real estate market correction?

Toronto real estate prices fall below $1 million, sales at 1990s Crash Levels – Better Dwelling. Read Here Homebuyers are starting to find deals in what’s shaping up to be one of the toughest spring seasons for the Toronto housing market in more than a decade. A four-bedroom property near Toronto’s scenic Riverdale Park sold for nearly $100,000 (US$71,670) less than the asking price. A semi-detached home in the Trinity Bellwoods neighborhood went for almost $50,000 less than the listing. Near the edge of Lake Ontario, a buyer snagged a duplex for nearly $60,000 less. And such price cuts have become the norm. Read Here Prominent Vancouver real estate firm Rennie has laid off about 25% of its head office staff, reducing its head count to 92 employees. Read Here This is shocking, dollars and per cent loss for most of the cities in the GTA from February 2022 peak to April 2025. Source TRREB. See Here

Meanwhile….

Have a look at what $700k Canadian will get you in Thailand Watch Here And what $785k will get you in Texas. Watch Here

Is Canada becoming the new Europe?

B.C. is on track to become a net importer of electricity in 2025, buying it from the U.S., for the third consecutive year Read Here

Hey Mark Carney, perhaps it’s time for a visit to Norway?

Norway parliament orders restart to frontier oil and gas exploration licensing. Read Here

The power of dividends

For more on the power of dividends and some stocks to watch, we spoke to a great group of investors including Martin Pelletier (4:30 minutes in). Watch Here

Playing the long-game

Warren Buffett explains his approach to investing in this 34 second clip and its powerful. Watch Here

U.S. Earnings revisions

Downward earnings revisions for S&P 500 firms have spiked to levels not seen since the pandemic or the Global Financial Crisis. See Here

Nobelist Milton Friedman on tariffs: “Any half-baked graduate student can give you 1/2 a dozen special cases for tariffs… The trouble is, that those arguments don’t work in practice. In practice, we put on the WRONG tariffs in the WRONG places in the WRONG way.” Watch Here

China tech revolution. BYD is constructing a massive factory covering 130 square kilometers, larger than cities like San Francisco or Paris. This facility will include homes, shops, schools, and soccer fields for 100,000 workers and their families, resembling a whole town. The goal is to produce over 1 million electric cars annually. Watch Here BYD just unveiled its DiSus-Z Intelligent Suspension System, debuting on the Yangwang U7. See Here Tim Cook explains why Apple chooses China for manufacturing. Watch Here

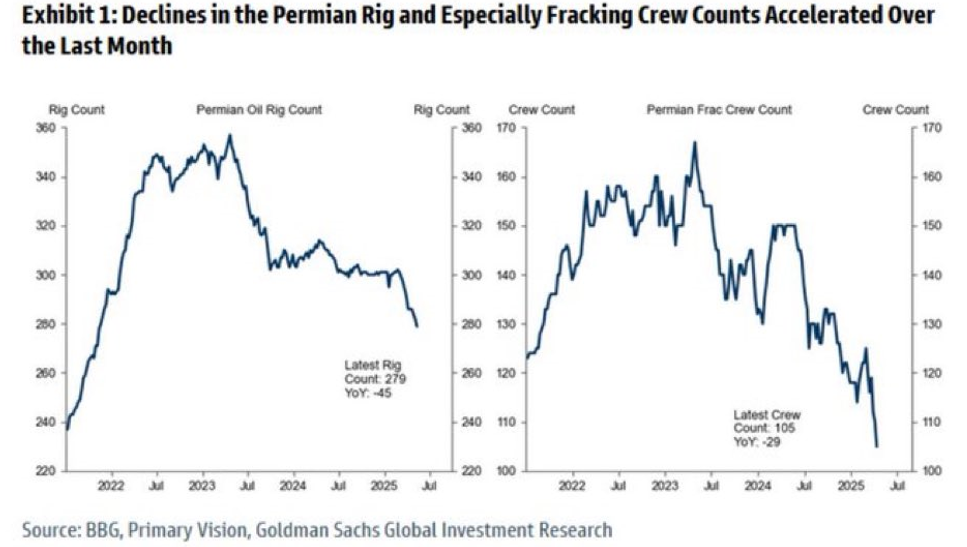

U.S. shale peaking?

“It’s just going to be painful,” said Dan Pickering, chief investment officer at energy-focused financial services firm Pickering Energy Partners. “What comes next, and we’ve already heard whispers of this, it will be slowing down of drilling activity, releasing frack crews.” Read Here When an oil well produces excess associated natural gas while its oil output declines, it typically indicates that the well is maturing or nearing the end of its productive life. Associated natural gas is the gas dissolved in crude oil under pressure, and as the pressure decreases, more gas is released. See Here Drill, baby, drill doesn’t work at $50-a-barrel. See Here Real-time U.S. crude oil production data pegs April at ~12.7 million b/d. That’s -950k b/d from the consensus average for Q2. See Here

Strathcona makes stock-and-cash offer for MEG Energy

Martin Pelletier, senior portfolio manager for Trivest Wealth at Wellington-Altus Private Counsel, shares his analysis of Strathcona’s takeover offer for MEG. Watch Here

On the Positive

“To be properly wicked, you do not have to break the Law. Just observe it to the letter.” – Anthony de Mello

5 people-orientated factors to look for when choosing who to work for or invest in

The heart of any successful company is its people, which is why it’s so important to pay attention to how management treats their employees. We’ve seen firsthand how struggling companies often mistreat their workforce, using fear to keep people in line. That top-down, authoritarian approach driven by ego creates a toxic environment that can be really damaging. If you find yourself in a similar situation, please know that you have options and that your life can improve significantly but you have to take the risk of finally leaving that hostile atmosphere behind. Thankfully, there are companies out there that truly value their employees, and their commitment to fostering a positive culture leads to incredible success. You deserve to work in a place that respects and empowers you. Read Here

You want to seek out people who will teach you

I’ll walk into a room at Citadel and I guarantee you I will not be the smartest person in the room. Watch Here

Something should have gone differently

Being right is the poor man’s version of self-worth Watch Here

The emperor has no clothes

In 2021, Italian artist Salvatore Garau sold an invisible sculpture for £13,000 ($18,000) providing the buyer with a certificate of authenticity to confirm its existence. See Here

Being a gentleman

This is something every young man should watch. Watch Here

Perception vs. perspective

What is the one spy trick people can use to improve their life instantly? Watch Here

A beautiful encounter

Two years ago, crossing from Martinique to Florida, in the middle of nowhere…. Watch Here

Doggie train

This 80-year-old retiree noticed that people were abandoning their dogs near his farm, so he took them in and built a train to take them out for rides. Watch Here

Prenups and divorce

“I’ve done probably hundreds, if not thousands of prenups over 25 years. I think that maybe there were 5 people that I did their divorce after they had a prenup.” Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca