INSIDE

Digesting the U.S. election and what it means to markets

We believe markets will continue to push higher into December, bolstered by president-elect Donald Trump’s win. It’s a return to “risk-on” sentiment for the time being. The markets like what they are seeing from this new administration and so do Wall Street banks with Goldman Sachs estimating a 4 per cent boost to corporate earnings from planned tax cuts. Additionally, as long as central bank liquidity remains abundant—and with a fresh boost of it from the tempered U.S. Federal Reserve—the markets will likely continue their upward trajectory.

Update on our strategic positioning

While the election results have certainly shifted the market mood, it’s essential to stay disciplined and strategic. The risk-on sentiment could carry us through December, but navigating these markets requires careful positioning. By sticking to our process and adjusting our portfolios as needed, we believe we can capture the upside while managing risk effectively.

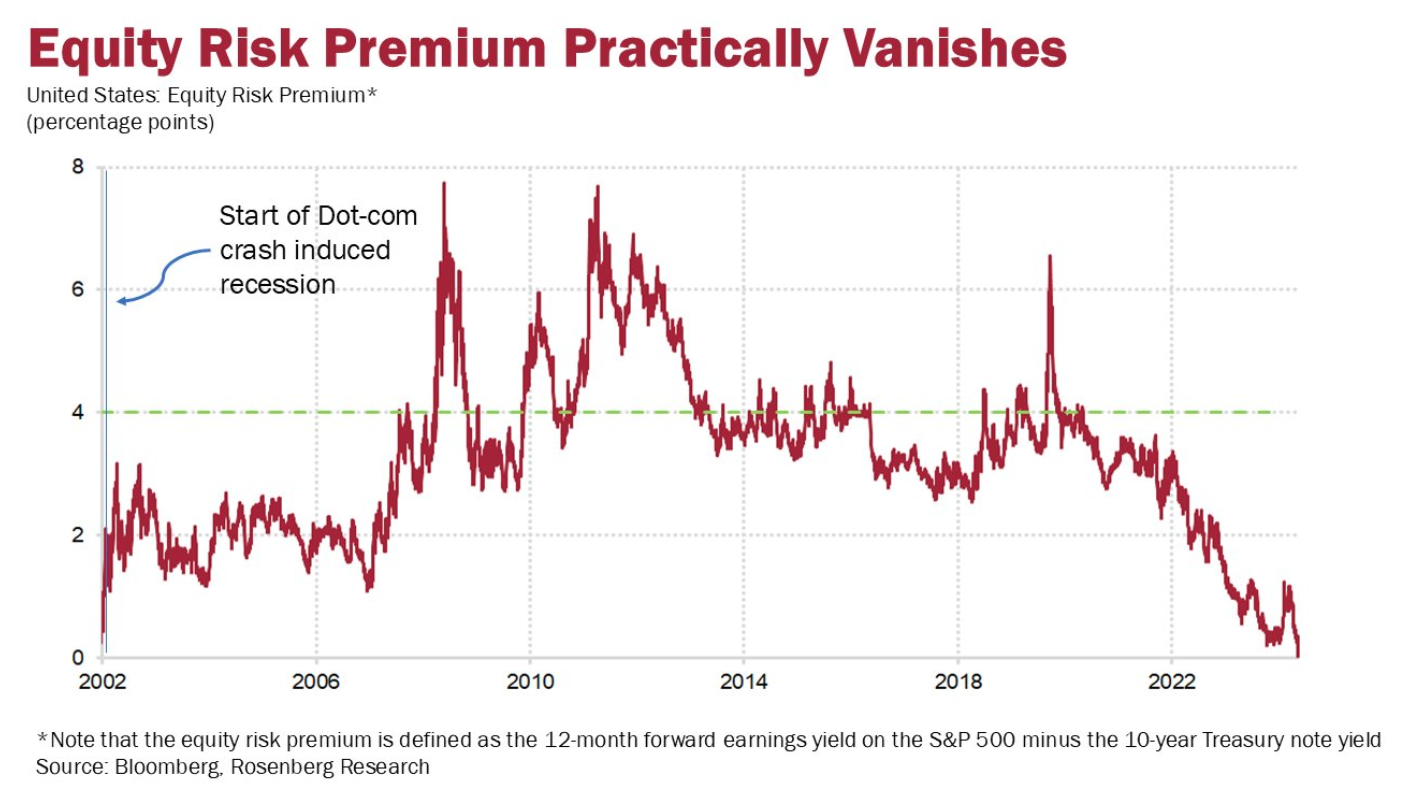

Investors are now paying markets to take on risk, something not seen in a very long time

According to David Rosenberg, the latest move in bond yields means we are just now 10 basis points away from the Equity Risk Premium shifting negative. This means investors are willing to PAY to take on equity risk instead of getting paid to. This hasn’t been seen since the 2000 tech bubble.

Understanding portfolio volatility and pattern of returns

Downside protection is imperative because when you lose money you have to generate a higher return to make it back. So with a loss of 30 per cent, you need a gain of about 43 per cent to get back to even, a loss of 40 per cent needs gain of about 67 per cent to be made whole and if you lose half your money you need to double what you have left to get back to where you started. When taking out money from your portfolio, the pattern of returns can have an even greater impact on the terminal value of your portfolio.

November 2024: DIGESTING THE U.S. ELECTION

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically. More specifically, the next few weeks are going to be important as we just had a major change in US politics and a recent Federal Open Market Committee (FOMC) meeting with a 25-basis point rate cut.

Bigger Picture: Navigating Post-Election Markets

Before the election, we had concerns about declining earnings growth and stretched valuations, prompting us to sound the alarm bells and take steps to de-risk our portfolios in recent weeks. With Donald Trump’s victory, the question is: Were we premature and wrong to be cautious?

For now, we believe markets will continue to push higher into December, bolstered by Trump’s win. It’s a return to “risk-on” sentiment for the time being. The markets like what they see from this new administration and so do Wall Street banks with Goldman Sachs estimating a 4 per cent boost to corporate earnings from planned tax cuts. Additionally, as long as central bank liquidity remains abundant—and with a fresh boost of it from the tempered Federal Reserve—the markets will likely continue their upward trajectory.

That said the same can’t be said for bond markets as the U.S. government’s rising debt issuance—coupled with the fact that the Fed can no longer purchase these bonds—means rates will need to stay higher to attract buyers. The Fed has been cutting rates on the short end of the curve, but this will be offset by seeing higher rates on the long end as a means to attract investors to fund the large and persistent US deficit. As a result, bonds may continue to be a “dead money” trade, offering little return unless they serve as an insurance policy in the event of a recession which we think is still very low probability, at least south of the border.

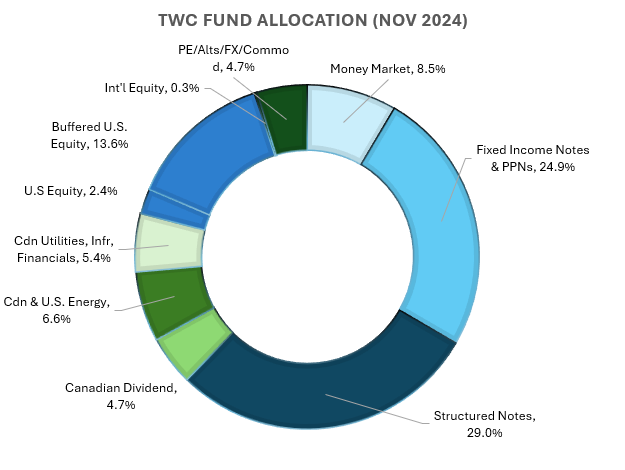

So, while the market is still risk-on, it’s crucial to remain vigilant, have a clear investment process and stick to it. For instance, we’re maintaining (not reducing) our core positions in U.S. equities but taking some of the upside off the table by paying for hedges, such as put protection. We’re also keeping our overweight positions in interest-rate-sensitive sectors in Canada, which have performed well. Additionally, we remain overweight on U.S. dollar exposure and have replaced traditional fixed income with better-performing structured notes.

More specifically, our TWC Risk-Managed Balanced Growth fund still managed to grow 10.3 per cent this year despite only being 33 per cent long global equities. This is just shy of the Global Passive Balanced (40 per cent Vanguard Global Bond, 50 per cent MSCI Global Equity, 10 per cent S&P/TSX Composite) return of 11.7 per cent.

While not sexy, this positioning is enabling us to generate strong returns without placing our eggs all in one basket per-se as U.S. equity indices are overly concentrated in just one trade and one stock—artificial intelligence/Nvidia.

Strategic Positioning: Where We Stand

Near-term bullish on energy: Under a Trump administration, we’re bullish on near-term oil prices. Trump’s hardline stance on Iran, which was given more leniency under the previous administration, will likely result in tighter oil supply. Canada’s energy sector, meanwhile, has shrugged off Prime Minister Justin Trudeau’s government’s production cap, as it’s unlikely to hold in the long term given the expectation of a change in government. Canadian producers, however, will do well as long as oil prices remain stable, and they’ll benefit from a rising U.S. dollar. Key names we own in the sector include Canadian Natural Resources (CNQ), Suncor (SU), Cenovus (CVE), Tamarack Valley Energy (TVE), and Baytex (BTE).

Small-Cap and hedged U.S. equities: We’re maintaining a tactical position in the Russell 2000 index, having sold calls to generate income to be used to buy puts to create a defined risk range. This approach helps us lock in potential gains while protecting against downside risk. We’ve done something similar with the S&P 500, using the Simplifi HEQT ETF as part of our hedging strategy.

Still like Canadian defensives: For defensive exposure, we own the Canadian utilities sector, which remains a solid play in this environment. We continue to hold the $XUT ETF as part of our strategy to capture stable, defensive returns.

Be very careful with bonds: When it comes to bonds, we remain cautious. While Canadian bonds might be relatively safe, they’ll likely lose ground due to currency depreciation. To mitigate this, we’ve replaced our traditional bond exposure with structured notes, which offer better performance potential and a more flexible risk-return profile.

In summary, while the election results have certainly shifted the market mood, it’s essential to stay disciplined and strategic. The risk-on sentiment could carry us through December, but navigating these markets requires careful positioning. By sticking to our process and adjusting our portfolios as needed, we believe we can capture the upside while managing risk effectively. For those wanting to get into more details, Martin provided a few recent updates via BNN Bloomberg that can be watched here and here.

In summary, while the election results have certainly shifted the market mood, it’s essential to stay disciplined and strategic. The risk-on sentiment could carry us through December, but navigating these markets requires careful positioning. By sticking to our process and adjusting our portfolios as needed, we believe we can capture the upside while managing risk effectively. For those wanting to get into more details, Martin provided a few recent updates via BNN Bloomberg that can be watched here and here.

Thanks for reading, and please feel free to reach out to any of our team members should you have any comments, questions about markets, your portfolio, or just wanting to catch up. All the best and keep investing wisely!

![]()

Understanding patterns of return and portfolio volatility

“The devil appeared to a monk disguised as an angel of light, and said to him, ‘I am the angel Gabriel, and I have been sent to you.’ But the monk said, ‘Are you sure you weren’t sent to someone else? I am not worthy to have an angel sent to me.’ At that the devil vanished.” – Benedicta Ward

When it comes to life, I truly believe the greatest evil among us is pride. It is the root of so much damage as evident by what we’ve been witnessing in Ottawa and the resulting economic damage being done.

Pride is also very destructive when it comes to investing as it motivates us to take risk when we really shouldn’t just because we’re not satisfied until we’re beating someone else.

Unfortunately, the investment industry knows the power of this and harnesses it to secure your business. We are currently seeing a plethora of marketing pieces by fund managers and advisors alike selling their performance over the past two years while downplaying what happened in 2022 like it was a forgotten period.

This is a shame as the real value of an investment manager can be seen in years like that one. This is because it takes real skill to manage risk alongside return and touting performance numbers delivered during a bull market does little to demonstrate that.

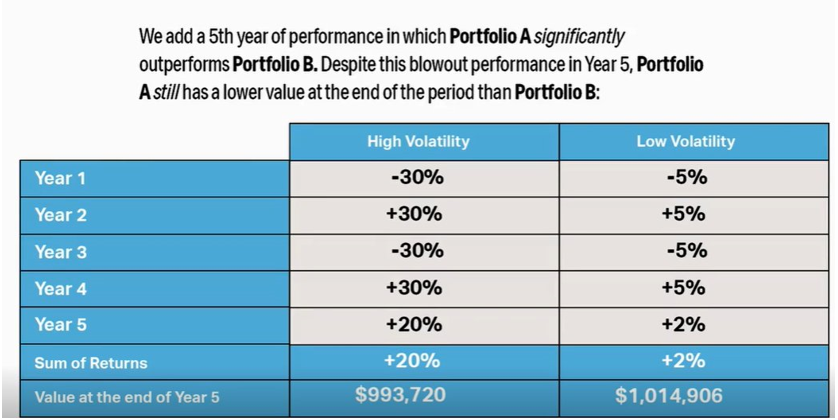

Our friends over at Outcome Metric Asset Management recently provided an excellent overview of the importance of understanding the relationship between risk and return. They show two portfolios with dramatically different return profiles and yet the one with a significantly higher sum of returns generated a lower portfolio value.

Source: Outcome Metric Asset Management

Downside protection is imperative because when you lose money you have to generate a higher return to make it back. So, with a loss of 30 per cent, you need a gain of about 43 per cent to get back to even, a loss of 40 per cent needs gain of about 67 per cent to be made whole and if you lose half your money you need to double what you have left to get back to where you started.

When taking out money from your portfolio, the pattern of returns can have an even greater impact on the terminal value of your portfolio.

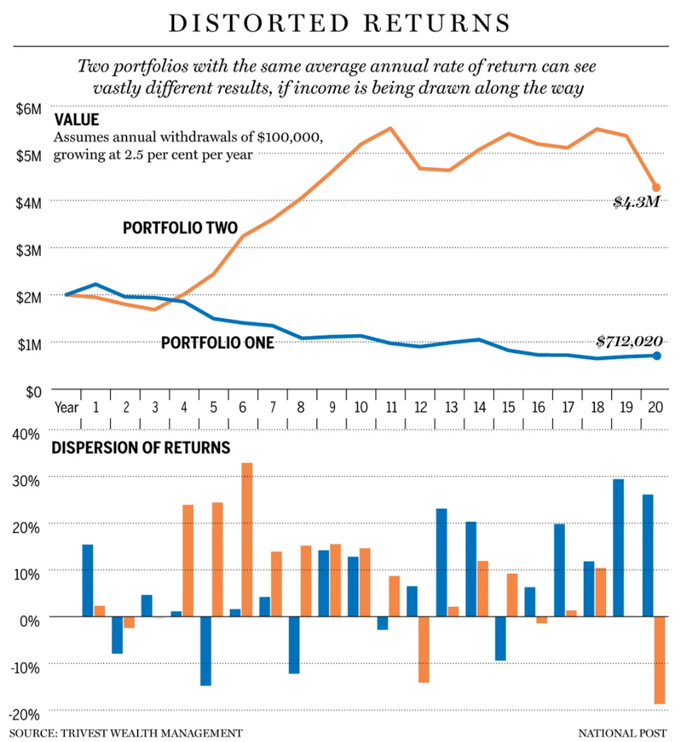

For example, the following chart reflects two $2 million portfolios with the same 6.8 per cent annual compounded return (randomly generated) over the 20-year period. However, Portfolio 1 experiences more negative returns in the early years with positive returns being back-end weighted versus the opposite for Portfolio 2.

Now, let’s assume both of the aforementioned portfolios maintain their same annual compounded 6.8 per cent return, but each make an annual distribution beginning in Year 1 at $100,000 (5 per cent spend rate), growing 2.5 per cent per annum (for inflation) with total distributions amounting to $2,554,000 in each portfolio.

Notice that Portfolio 1 has a terminal value of only $712,000 at the end of Year 20 compared to Portfolio 2 that is substantially higher at $4.3 million. Therefore, two portfolios with the same annual compounded return will have drastically different outcomes to their estate simply because of the pattern of returns.

This is something never talked about during raging bull markets. Instead, many are looking at the S&P 500’s return and plowing into it and its heavily weighted stocks like Nvidia that are dominating the index. It’s hard to blame them as we just had a year where the S&P 500 has closed at an all-time high 50 times where on average it has done so only 18 times each year.

With the change out in the U.S. government, there are a lot of positive factors that could push U.S. markets that much higher and there is no shortage of market strategists telling you that. And so you better get on board otherwise you will be left behind and miss out on another year of strong returns!

We think this is already starting to impact asset managers as those not keeping up to the hottest stocks or segments of the market will risk losing clients and therefore add risk into portfolios at the wrong time on fear of missing out.

This is why we’re fans of goals-based investing as it isn’t about beating everyone else or whatever is the top performing index but rather designing a portfolio to meet targeted desired value while minimizing the ups and downs along the way. Boring isn’t sexy, it won’t let you brag to your friend, but it does get the job done—and that’s the bottom line.

A closer look at risk and how it changes with market conditions

When it comes to understanding risk, there really is only one true definition. It isn’t portfolio variability or standard deviation but rather the permanent loss of capital. One of the main reasons this can happen is because of human emotion, which is correlated with volatility.

We define risk as the chance of permanent capital loss adjusted for inflation. “Volatility, I believe to be just price changes based on market perceptions of risk. Risk does not equal volatility.” — Bruce Berkowitz, founder of Fairholme Capital Management in Florida

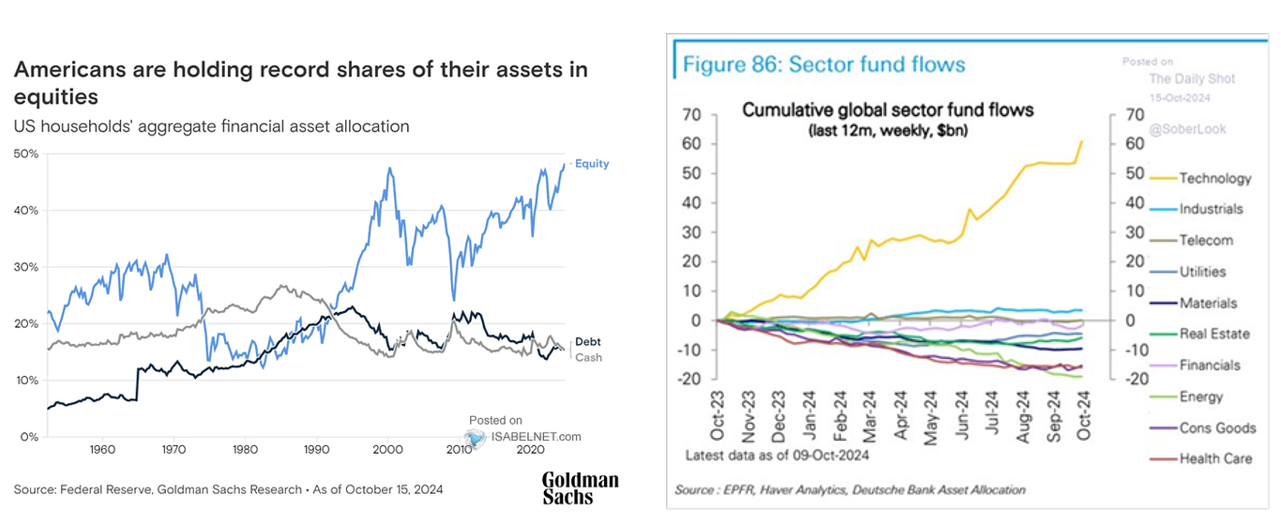

One of the most common flaws is to want what others have, leading to performance chasing and going all-in on whatever segment of the market is doing the best. In today’s environment, this is quite rampant. It has reached the point where U.S. households now hold 48 per cent of their assets in equities, the highest since the 2000 dot-com bubble peak. Traders have also built the largest long U.S. Equity Futures position in history, now worth more than $300 Billion,

Looking back over the past 12 months, cumulative global sector fund flows have almost entirely gone into just one sector: technology. Traders have also built the largest U.S. Equity Futures position in history, according to Goldman Sachs.

According to David Rosenberg, the latest move in bond yields means we are now just 10 basis points away from the Equity Risk Premium shifting negative. This means investors are willing to PAY to take on equity risk instead of getting paid to. This wasn’t seen since the 2000 tech bubble.

For those wondering what this means, normally investors “get paid” to take risk by moving away from risk-free assets like US Treasuries and buying equities. Today, its the opposite—investors are walking away from risk-free assets that pay MORE than risk assets like stocks. So essentially, they are paying to take on risk, which is not normal and indicating something is broken.

The problem is that investment advisers and fund managers have strong incentives not to stray too far from whatever is leading the charge, resulting in less and less diversification. For example, did you know that just one stock, Nvidia Corp., accounted for 22 per cent of the gains in the Bloomberg 500 (a proxy for the S&P 500)? Taking this a step further, U.S. households therefore have 11 per cent of their household gains driven by just one stock. Let that sink in for a moment.

Fortunately, there are alternative options that money managers can deploy that offer downside protection in such events, but this means being willing to give away some of the upside capture. This isn’t too attractive when it comes to feeding into investors’ fear-of-missing-out (FOMO). Why would you invest anywhere else, including alternatives, when the tech-heavy U.S. market has performed so well?

The investing world isn’t that binary, as there are many different paths an investor can take, and our job as money managers is to be their guide. This often includes helping protect them against themselves, especially those who just don’t do well with seeing large swings in their portfolio.

Adding some Worcestershire sauce into portfolios?

We recently read that the three toughest things a person can say are: I was wrong; I need help and Worcestershire sauce. All kidding aside, I think one of the most important things people can do is to remain on the path of self-improvement by quickly acknowledging their errors, seeking out why they happened and learning from them so that they can minimize the probability of another occurrence.

If you happen to be an expert in a particular field, it doesn’t make you immune from this. It is actually the opposite with the greater accountability. There is the expectation of a higher standard of excellence, which cannot happen without humility, self-discovery and doing everything you can to remove emotional biases from the decision-making process. This is where having a formal process and sticking to it really helps.

Take for example, the recent U.S. election. Among the top 10 so-called political experts, only two forecasted Donald Trump as the winner. You may ask, how did they get it so very wrong? Well, when it comes to politics, and the type of emotionally charged campaign we just witnessed, it’s not hard to see that happening.

It’s no different in the investment world, even as portfolio managers we get things very wrong. Martin recently looked back at the CFA Institute’s January Calgary CFA Forecast Dinner where he was one of the featured panelists. One of the bigger calls he made was that gold prices would remain fairly flat and there would be a meltdown in speculative assets, like crypto and bitcoin in particular. Oh boy, these were some terrible calls, with gold being up over 22 per cent this year and bitcoin over 100 per cent.

Our thesis at the time was based on gold having a negative correlation with the U.S. dollar (it had that relationship for two solid years prior) and we were bullish on the dollar simply because of the widening economic disparity between America versus other G7 nations. Interestingly, the U.S. dollar did appreciate, but so did gold prices on mounting geopolitical unrest and central bank buying. Unfortunately, we sold our gold positions too early and missed out on one heck of a trade.

We’ve never really been able to get our head around the value offering of cryptocurrency, other than as a leveraged way of owning the U.S. tech space. This is clear via its direct movement alongside the Nasdaq stock market, which we also thought was ahead of itself at the beginning of the year.

We certainly never expected the continued monster run of Nvidia Corp., which now dominates U.S. equity portfolios. The Trump win last week was the icing on the cake, sending both Nvidia and Bitcoin higher. But look at the S&P 500 and the Nasdaq compared to one stock Nvidia and ask yourself just how risky are broader U.S. markets?

While we got some big calls wrong, looking back, would we have done anything differently?

Fortunately, what saved our bacon is that it isn’t in our philosophy to make large binary bets on the market, or certain segments of the market, as our goals-based approach prevents us from doing so. This frees us from the tremendous pressure of having to outperform whatever is the hottest performing sector and the risk that comes with getting it wrong. That said, we recognize the importance of having some volatility in our portfolios to maximize the upside capture while trying our best not to compromise the downside protection.

Looking back on the year, this philosophy and approach served us well, as, while we got some calls wrong and missed out on some big winners like Nvidia, we didn’t miss our targets with strong returns for our clients. This is because we maintained our core positions in U.S. equities but gave away some of the upside via the cost of hedges (put protection), overweighted interest rate-sensitive sectors in Canada that have done very well, overweighted our U.S. dollar exposure, and replaced our fixed income with better performing structured notes.

In conclusion, prior to the election, we were somewhat worried about declining earnings growth compared with stretched valuations and so were sounding a few alarm bells and derisking our portfolios over the past few weeks. Based on Trump winning the presidency, were we premature and wrong about this? Only time will tell, but I know one thing for certain, and it’s that I know how to say Worcestershire sauce.

Research, media, and reads of the month

Trump 2.0 and bond markets. At a high level, the Republicans are priming the economic pump with an expansionary and pro-growth agenda. The consensus is that these policies are inflationary at a time when the economy is strong, and inflation is still running hot. The natural conclusion is that this could influence the Federal Reserve’s decision-making. Read Here

The U.S. deficit and interest rates. What is happening with U.S. government spending? Pro-growth fiscal spending as a percentage of government expenditures dropped to 45 per cent, the lowest in at least 40 years. This is well below the 50-55 per cent pre-pandemic average. In other words, 55 per cent of government spending now goes to unproductive areas such as net interest payments, Social Security and Healthcare. A rapid increase in interest payments has been a major driver of this trend over the last 3 years. Interest payments as a share of federal revenue have doubled since 2021 and hit 17.9 per cent in Q3 2024, the most since 1993. See Here

A great take on the Fed and U.S. bond markets by Fidelity Strategist Jurrien Timmer. “If there is one thesis that I have high conviction in for the coming years, is that the US is on a path towards fiscal dominance. With the Fed and other central banks no longer the buyer of first and last resort, it seems plausible that the term premium might rise in the months and years ahead.” Read Here

Also, another good take on X. I expect the long end of the curve will continue to rise and treasury holders demand payment for their portfolio allocation. Counter-intuitively, a recession makes this problem worse, as the private sector is not able to absorb the issuance organically. A booming economy will keep rates in check. Read Here

The risks of a politicized Fed. This is from a friend of ours, Joseph Wang, former head trader at the Fed. Politics drives emotion and emotion drives bad decisions. Removing politics means reducing the probability of making bad decisions. Read Here

U.S. multiples. The US is now trading at a record price-to-earnings (P/E) premium to MSCI World ex US of almost 60 per cent and represents 73.65 per cent of MSCI World market cap, also a record high. See Here Did you know that the average P/E ratio of the top 10 companies in the S&P 500 is almost 50? See Here When measured on a price-to-sales the U.S. equity market is the most expensive since the peak of the Dot Com Bubble. See Here

Funny how this happens.

Meanwhile, our parent company’s Chief Market Strategist: 7,000 S&P target, 17% upside from here. Top picks Nvidia and Bitcoin. Watch Here

Markets priced in $MSFT and $META to perfection. Scary times when stocks like these selling off on decent quarters. The problem is how much does one pay for decelerating growth? Watch Martin’s interview Here

Inflation. Wall Street focuses on the rate of change within inflation, but Main Street feels inflation cumulatively. We can see the massive divergence between the two as the rate of change slowed, but families are still dealing with much higher bills than they were before 2020. See Here and See Here

Just 24 per cent of homebuyers are currently first-time buyers, the lowest in at least 45 years. This percentage has more than HALVED since 2010, according to the National Association of Realtors. To put this into perspective, before the 2008 Financial Crisis, the average was ~40 per cent. See Here

Japanification of markets. Did you know that the Bank of Japan (BoJ) now owns nearly 80 per cent of the country’s exchange-traded funds (ETFs) and 7 per cent of the entire Japanese stock market, according to Morningstar and the Tokyo Stock Exchange data. Moreover, the BoJ holds nearly 55 per cent of the Japanese government bonds. Read Here and Read Here

Trump 2.0 and Canada. A good update from our friend Kim Moody discussing what Trump 2.0 could mean to Canada’s tax landscape from a competitive standpoint. Read Here

Canada GDP per capita took a dive in every single Canadian province in 2023. Not just a few bucks, but by hundreds of dollars in real terms. B.C. goes to the front of the class for best 10-year performance overall. For the prairies, a lost decade. See Here Canada was also slightly richer than Montana in 2019. Now it is just poorer than Alabama. Read Here

In the past decade, our real per capita GDP, now 27th in the world, is only 73 per cent of the American level, the biggest gap since 1950. The International Monetary Fund (IMF) says we have the eighth least affordable housing market among 58 countries. Our health system, a key part of Canadian identity, is one of the most expensive in the world and ranks poorly in terms of quality, with burned-out staff, long wait times and poorly integrated services. Read Here

What the heck is going on in Canada? Martin was featured in the Edmonton Journal on why he has suddenly become more vocal speaking out about the Trudeau government especially since their attack on small business, their carbon tax contributing to an affordability crisis, their capital gains tax changes targeting the few remaining capital providers in the country, and now this production cap. This is on top of the numerous scandals. Read Here

Guilbeault’s oil and gas cap shows how out of touch he is. It’s time not just to scrap the cap, but the government that came up with it. Read Here Peter Tertzakian is probably the most respected economist and thinker in the Canadian oil & gas sector. With the announcement for an emissions cap imminent, he makes the case for why layering more convoluted and punitive carbon policies is a mistake. Read Here

Trudeau goes after Canadian small business yet again. CFIB has just learned government plans to tax the long-delayed $2.5 billion carbon tax rebate for small business. Read Here

Trudeau not sold on “business case” for European LNG. However, Europe just came out publicly that it wants to buy North American LNG. The U.S. all to happy to sell it to them, which is quite the opposite to the views out of Ottawa. This is a huge, missed opportunity to change the world with both improving political and environmental outcomes. Watch Here

An excellent update on oil markets. Despite historic lows in global oil inventories and record-high demand, the energy market remains clouded by concerns about future balances in 2025. In this episode, Eric Nuttall breaks down the forces behind these dynamics and provides insight into what may lie ahead for energy markets. Watch Here

TV viewership and demographics, is TV seeing its last days? The median age of podcast listeners is less than 40 while median age for TV network viewers are 68 to 78 years old. See Here And Global News is ‘on the brink’ amid declining revenues. Read Here

Trevor Tombe: What Trump’s tax plan means for Canada. Canada will need to respond. Our economies are too interconnected and capital too easily mobile. The total value of cross-border investment approaches $2 trillion, and a loss in tax competitiveness could mean a smaller Canadian economy, lower business investment, higher prices, and other ills. Read Here

Canadian dollar weakness. The Canadian dollar hits 4-1/2-year low near 1.40 a U.S. dollar Read Here There’s a lot of discussion about the Loonie falling against the mighty Dollar, but the Loonie is down against the Swiss Franc, British Pound, and even the Euro. See Here

U.S. Tariffs. Deutsche Bank’s George Saravelo ranked the countries that are likely to be hardest hit by potential US tariffs, based on their economic reliance on US trade and potential scope of new levies. The top three hardest hit: Mexico, Vietnam and Canada. See Here

The U.S. Economic Optimism Index soars to highest level in more than 3 years. See Here Meanwhile, the S&P 500 will average annual returns of just 3 per cent over the next decade, per Goldman Sachs. See Here And this crazy chart on the S&P versus earnings outlook. See Here The S&P 500 price gains have also diverged from the earnings revision breadth. Read Here

On the Positive

Risk management 101. Full send or no send. Watch Here

Zooming in. Remember folks, tomorrow is another day Watch Here

This is someone’s daughter. Not sure if this is being done at our safe injection sites but it looks like a great idea. Watch Here

Lessons they’ve learned in life. This short clip is outstanding.

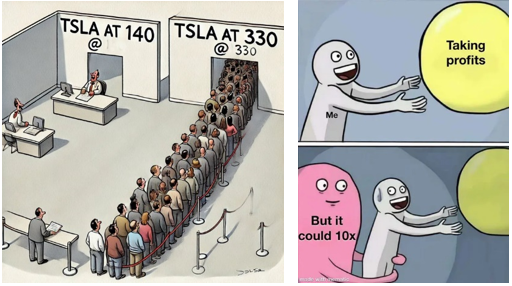

1) one of the important decisions you make in life is who you marry

2) you can never sell too early after big wins.

3) don’t let anger drive you to litigate, move on.

Never trust a computer you can’t throw out a window- Steve Wozniak

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2024, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca