INSIDE

Understanding risk and how it is influenced by human emotion when investing

As we enter the last quarter of the year, there is a lot of euphoria thanks to some very strong performance in global equity markets. During such times of complacency, we think it’s worth revisiting the importance of risk management—as the old saying goes “the best time to buy insurance is when you don’t need insurance.”

Some alternatives to low-rate GICs worth exploring

A structured note is similar to a bond issued by a Canadian bank and so it is backstopped by their credit rating. Like GICs, there are many different terms and interest payments. The benefit from notes over GICs is the higher level of interest, and the ability to sell them before maturity. Both are taxed as income.

A closer look at energy markets

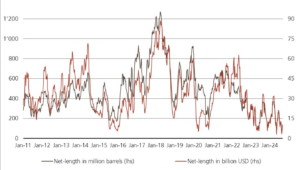

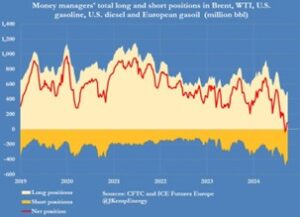

We are astounded by the level of bearishness in oil markets fuelling duelling narratives around China weakness, OPEC troubles, discord in the Middle East and the effects all this has on oil prices. For some perspective on the magnitude, the non-commercial net position is currently at levels lower than seen during the depths of the COVID-19 shutdowns. We therefore take a look to see what this means for those investors brave enough to retain their positioning.

Update on our strategic positioning

From a macro perspective, we think market participants got way ahead of themselves selling down the U.S. dollar too far and pushing down longer-term yields on increased expectations for interest rate cuts. That trade is starting to unwind as more US, economic data comes out showing that inflation isn’t done yet (via the recent U.S. Consumer Price Index (CPI) numbers), and the U.S. economy is stronger than many expect.

October 2024

“Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate return.” Charlie Munger

Welcome to this month’s Market Strategy. In this edition we share our latest views on the market along with how we’re positioned strategically.

As we enter the last quarter of the year, there is a lot of euphoria thanks to some very strong performance in global equity markets. During such times of complacency, we think it’s worth revisiting when the importance of risk management—as the old saying goes “the best time to buy insurance is when you don’t need insurance.”

However, let’s back it up a bit and take a closer look at what risk really is. It really isn’t portfolio variability or standard deviation but rather the permanent loss of capital. One of the main reasons this can happen is because of human emotion, which is directly correlated with volatility.

“I define risk as the chance of permanent capital loss adjusted for inflation. Volatility, I believe to be just price changes based on market perceptions of risk. Risk does not equal volatility.” Bruce Berkowitz, founder of Fairholme Capital Management in Florida.

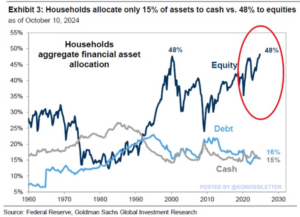

One of the most common flaws is to want what others have, leading to performance chasing and going all-in on whatever segment of the market is doing the best. In today’s environment, this is quite rampant. It has reached the point where U.S. households now hold 48 per cent of their assets in equities, the highest since the 2000 dot-com bubble peak.

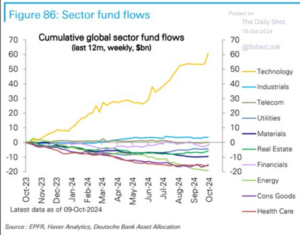

Looking back over the past 12 months, cumulative global sector fund flows have almost entirely gone into just one sector: technology. Traders have also built the largest U.S. Equity Futures position in history, according to Goldman Sachs.

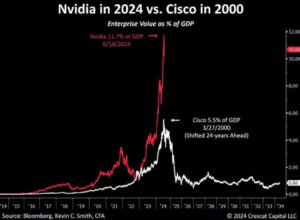

Investment advisors and fund managers find they cannot stray too far from whatever is leading the charge, resulting in less and less diversification. For example, did you know that just one stock, Nvidia, accounted for 22 per cent of the gains in the Bloomberg 500 (a proxy for the S&P 500)? Taking this a step further, U.S. households therefore have 11 per cent of their household gains driven by just one stock. Let that sink in for a moment.

“Nvidia, $NVDA, now has a market cap that equals 11.7% of the total US GDP. To put this into perspective, even at the peak of the Dot-com bubble, Cisco’s market cap equaled just 5.5% of US GDP. In other words, Nvidia is now worth more than DOUBLE what Cisco was worth at its peak, as a % of GDP. Over $10 TRILLION of market cap has been created since AI-hype began. Markets are betting that AI truly is the next big thing.” @KobeissiLetter

The problem is when such a crowded market unwinds, and it ultimately will, loss aversion kicks in and when investors can’t take it anymore, they start selling, potentially triggering a permanent loss of capital.

Fortunately, there are alternative options that money managers can deploy that offer downside protection in such events, but this means being willing to give away some of the upside capture. This isn’t too sexy when it comes to feeding into investors’ fear-of-missing-out (FOMO). Why would you invest anywhere else, including alternatives, when the tech-heavy U.S. market has performed so well?

The investing world isn’t that binary, as there are many different paths an investor can take, and our job as money managers is to be their guide. This often includes helping protect them against themselves, especially those who just don’t do well with seeing large swings in their portfolio.

This is why we’re huge fans of the goals-based investment approach, whereby we set a return goal specific to a client’s financial objectives while trying our best to minimize the standard deviation from this targeted mean annual return. So, for example, this may be as low as 5 to 7 per cent, if that makes the client happy and protects a large portion of the capital they’ve built over many years of hard work.

This means, at times, exploring strategies using alternative investments.

Martin recently was a guest speaker at the Canadian Association of Alternative Strategies & Assets (CAASA) event in Vancouver last week. The conference provided an overview of liquid and illiquid investments, how they might perform for investors, and how they can be used in a portfolio setting, including a discussion around risks and their use in portfolio construction.

We have made use of both private debt and private equity instruments. Both are illiquid investments focused on delivering consistent longer-term returns targeting superior alternatives to similar public markets. Additionally, because they are not marked to market on a daily basis like public markets, there can be less variability in that allocation, resulting in less of an emotional reaction from the investor. (However, this doesn’t mean you shouldn’t stay on top of what is happening within those investments).

Interestingly, we’ve even seen some family offices (the wealth management firms of wealthy families) take this a step further as a multi-generational capital preservation strategy. They may purposely lock in some of their wealth, such as direct investments in operating companies, real estate or even land.

Finally, we make extensive use of structured notes, which could be considered liquid alternatives, and have made an excellent replacement for our fixed income and bond allocation, where those segments of public markets have performed poorly. For example, we just recently did a 100% principal protected note that is eligible for CDIC Deposit Insurance and will track 1.85 times the upside of the Solactive Canada Select Large Capitalizations 64 AR Index (comprised of the Solactive Canada Select Large Cap Index TR).

Thanks for reading, and please feel free to reach out to any of our team members should you have any comments, questions about the markets, your portfolio or just want to catch up. All the best, and keep investing wisely!

![]()

Downsizing doesn’t mean low-rate GICs

Retirement brings for many the need to simplify. And a trend in paring down has even hit close to home within our own families and client families.

In retirement it’s natural to want to remove the stress that comes with owning a single-family home. The most common decision is to sell and move into a condominium, which, in theory, makes a lot of sense. However, relinquishing the management of one’s home to complete strangers can bring its own anxieties.

One option is to join the condo board. I tried this once and all it did was massively ramp up the level of stress once I saw how poorly things were being run. The stuff I’ve witnessed would send shivers down your spine and truly make for a great horror movie.

The most common issue is poor financial decisions being made by others, leading to big consequences for everyone, including huge monthly condo fees, or worse, a special assessment and a massive cash call.

For example, Martin’s parents and in-laws finally decided to call it a day, unlock all of their equity and become renters. This gave them tremendous freedom, both financially and emotionally. No more calls for cash, no more excessive condo fees, no more property tax hikes, no more rude and secretive condo board members and, if an appliance quits working, oh well, call the landlord and get it fixed.

How to invest the proceeds from a home sale

The primary issue with that decision is how to invest the proceeds from the sale in a low-risk manner that will generate enough income to pay for the rent without drawing down the principal. This is because interest rates are falling and expected to continue falling. Therefore, the go-to GIC laddering strategy of the past no longer works unless you can make a paltry 3.5 per cent long-term rate work for you, or stomach the pain of locking in at such a pathetically low rate.

Luckily, we have found a solution that is working very well for our clients, including our own family members: using structured notes with embedded downside barriers, some of which are even CDIC insured and 100 per cent principal protected, that have been able to generate yields well in excess of longer-term GICs.

Structured notes as alternates to GICs

A structured note is similar to a bond issued by a Canadian bank and so it is backstopped by their credit rating. Like GICs, there are many different terms and interest payments. The benefit from notes over GICs is the higher level of interest, and the ability to sell them before maturity. Both are taxed as income.

For example, we came across a recent note being issued by a Canadian bank that is quite similar to a GIC in that it is fully protected. It will pay a floating rate of CORRA (the Bank of Canada’s Canadian Overnight Repo Rate Average) plus a spread of 0.96 per cent paid out quarterly. As at the beginning of October, the 2024 CORRA is an annualized 4.30 per cent plus the spread, resulting in a 5.26 per cent rate, which is significantly higher than GIC rates.

Then there is a note on Canadian blue-chip stocks with an annualized 5.04 per cent. Coupons are paid out on a monthly basis as long as these stocks don’t fall more than 15 per cent. If they do, you miss the coupon payment each month that it remains below this threshold. The term is seven years, although you can still sell at any time, and the principal is 100 per cent protected.

For a little bit more risk, there is a note on the Canadian banks that will pay an annualized 6.3 per cent coupon paid out monthly as long as the Canadian banks don’t fall below 50 per cent and stay there. It has a seven-year term, but these notes have a callable feature, meaning they will be bought back and closed out should the underlying index—Canadian banks, in this case—rise higher than 10 per cent any time after the initial 12 months. They, too, can also be sold any time prior to maturity.

These are all pretty low risk notes, similar in nature to GICs. However, there are notes out there varying in levels of downside protection with yields ranging from seven to 10 per cent that we think make excellent investments within a well diversified note portfolio for long-term investors looking for near-term income, including Martin’s own family.

So, downsizing or living a simpler life in retirement doesn’t have to mean giving up control over how you live to strangers, if that makes you uncomfortable. All you have to do is find the right financial solutions to avoid the condo board.

A professional advisor can be an excellent resource and should be consulted before making any investment decisions. Structured notes are not suitable for all investors. These examples are for illustrative purposes only and should not be construed as estimates or forecasts.

A closer look at energy markets

We are astounded by the level of bearshiness in oil markets fuelling duelling narratives around China weakness, OPEC troubles, discord in the Middle East and the effects all this has on oil prices. For some perspective on the magnitude, the non-commercial net position is currently at levels lower than seen during the depths of the COVID-19 shutdowns.

We find it quite frustrating that almost every time there are some positive developments around the commodity a mainstream media article hits the market with speculation around OPEC erasing any gains made. For example, in late September, China announced a significant stimulus program, sending its stock market rocketing higher. Before this move had time to impact oil prices, on its heels came a Financial Times article, hinting at OPEC troubles and the cartel potentially abandoning its oil price targets.

This is problematic because one of the main stories that has been overhanging oil markets is economic weakness by China, which is being addressed with a bazooka-sized US$114 billion stimulus injection by the Chinese government. For some perspective on its magnitude, China’s total stimulus package is estimated to be about US$1.07 trillion this year, or equivalent to 6 per cent of the country’s GDP in 2024. And yet, it seems that suddenly this large component of the bear narrative no longer matters, with the focus once again being put on OPEC’s troubles.

Then, just one week later, Iran—one of the largest oil producers in the world—attacked Israel with 180 missiles and Israel responded by announcing it is considering attacks on Iranian oil rigs and nuclear sites. Oil prices moved higher but soon gave back all of those gains upon yet another OPEC-themed piece, this time by the Wall Street Journal. This article cited unnamed sources saying that Saudi Arabia warned oil prices will drop to US$50 a barrel if OPEC members do not stick to agreed-upon production cuts.

OPEC immediately responded on X, claiming this WSJ piece was “completely fabricated.” But it was too late as the damage was already done with algorithms quickly initiating a sell-off in global oil prices.

We took a look at whom these narratives might benefit. The current U.S. government has a lot to gain by keeping oil prices down, as it impacts consumers and affordability. There is an election coming up in a month and lower oil prices would be a huge benefit to the average voter.

Bjarne Schieldrop, chief commodities analyst at Swedish firm SEB Research, sums it up perfectly in the Telegraph when he says: “More Americans live from hand to mouth, on the margin. If they suddenly have an additional outlay for gasoline, they are extremely hurt. And you cannot take the bus there, you have to use your car. It will be negative for (presidential candidate Kamala) Harris.”

For those brave enough to be sticking to the fundamentals, we came across this excellent piece on U.S. shale production. “U.S. shale oil is only going to get more expensive to produce and will be at the top of the global cost curve in the next decade.”

Meanwhile, Leo Tolstoy, one of greatest and most influential authors of all time, famously said that “the two most powerful warriors are patience and time.” Therefore, while there may be a short-term influence from a certain narrative, over the longer-term there is a return to the truth and to underlying fundamentals.

Our tactical positioning

From a macro perspective we think market participants got way ahead of themselves selling down the U.S. dollar too far and pushing down longer-term yields on increased expectations for rate cuts. That trade is starting to unwind as more U.S. economic data comes out showing that inflation isn’t done yet (via the recent U.S. CPI numbers), and the U.S. economy is stronger than many expect. Look at the DXY (dollar index) that has gained over 3 per cent and the TLT ETF representing 20-year plus Treasuries losing over 3 per cent since the end of September.

This is just another reason why we’re currently zero weight bonds choosing to replace that exposure via structured notes. We completely agree with billionaire investor Stanley Druckenmiller when he recently said that “the golden rule he has always had is the 10-year should trade around where nominal GDP is, which is 5.5 per cent. So, the risk reward to me is being short bonds.”

Our 25 per cent fixed income structured note exposure is made up of 100 per cent principal protected notes, some of which are on equity indices and some that will pay out based on a shift in the yield curve. For example, if Canadian or U.S. yields are lower in a year, the note closes out and pays a coupon ranging from 7.0 to 8.5 per cent. We also introduced a recent addition of the BMO Strategic Fixed Income Yield fund. We conducted a thorough due diligence on the fund prior to its launch and thereafter including speaking with the actual portfolio managers.

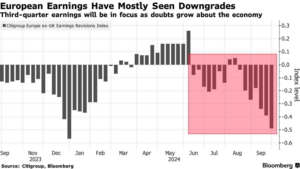

From a currency perspective, we’re also short the euro and have a near zero weight to Europe, Australasia and the far East (EAFE) markets. While the real gross domestic product (GDP) growth rate for the U.S. in 2024 is expected to be 2.8 per cent according to the International Monetary Fund most of Europe is well under one per cent, with the United Kingdom expected to come in at 0.5 per cent, Germany at 0.2 per cent and France at 0.7 per cent. You can see this in the recent number of downgrades in European corporate earnings.

Our equity exposure is therefore weighted to North America with a 16 per cent allocation to the U.S. S&P 500 and a bit in the Russell 2000. Over 80 per cent of this is hedged with downside put protection which we believe is prudent given how cheap this insurance cost us and the lack of tail risks being factored in post the upcoming November 5 U.S. presidential election.

We like Canadian dividend companies with yields averaging 5 per cent but earnings per share (price-earnings ratio (P/E)) multiples averaging closer to 16 times. This compares to a whopping 24 P/E times south of the border in the broader S&P 500, albeit the Russell 2000 has a similar multiple with only a 1.2 per cent yield. Therefore we have a near 5 per cent total weighting to this segment complemented by another 5 per cent in interest-rate sensitive sectors like Canadian utilities ($CU,$XUT), infrastructure ($BIPC), and financials ($MFC, $BAM). We also have a 6.5 per cent weighting to Canadian energy primarily in the large caps ($CNQ, $SU and $CVE) complemented by a few mid-caps ($TVE, $BTE, $VRN, $WCP).

Research, media, and reads of the month

Investment strategy for Canadian dividend stocks. Martin Pelletier, senior portfolio manager for TriVest Wealth at Wellington-Altus Private Counsel, says Canadian energy trade looks attractive. Watch Here

Oil market performance review. Martin Pelletier, senior portfolio manager for TriVest Wealth at Wellington-Altus Private Counsel, joins BNN Bloomberg and talks about oil market performance review. Watch Here

Bear market in bonds. For the first time in 22 years, bonds are yielding more than stocks. Read Here

Or overly bull market in equities? Goldman Sachs: equity index valuations in the U.S. market are at the top of their longer-term range on other valuation metrics. See Here

Canadian interest rates. 5 of 6 big Canadian banks see jumbo rate cut after surprisingly soft inflation Read Here

Collecting expectations. Sometimes it has nothing to do with fundamentals but rather the collective forward view of future financials impacting the ultimate terminal value multiple. See Here

The 60/40. “Lost decades” of no returns are more common than you think. See Here

The good old “cash on the sidelines” bit now being pulled out. If you think the stock market is expensive right now, there is still a lot of cash that isn’t participating yet. If you’ve got time on your side, then I would say buckle up and jump in before all that other cash that’s sitting there starts to. Read Here

U.S. market cap vs. GDP share. There is a significant mismatch between the US equity market capitalization compared to the rest of the world and the US GDP relative to global GDP. See Here

David Einhorn (Q3 letter). “We will avoid calling this market a bubble, and simply observe that the dividend yield is low and the P/E ratio is elevated despite corporate earnings being cyclically high, if not top-of-cycle.” Read Here

A closer look at earnings. Looking at the large cap S&P 1500 universe, if one excludes just the top 10% of companies, profits are flat. And if you exclude the top 50%, then profits are falling sharply. See Here

Markets move in cycles. The stock market is no exception and rolling real returns show it in action. Read Here

An unbiased view from the FedGuy. While he was bullish on stocks the last 2 years, he is now more cautious. A lot of uncertainty ahead with a depreciating currency, dovish policy, and large fiscal deficit spending. Watch Here

The Balance Sheet recession. Richard Koo devised the “balance sheet recession” theory to diagnose Japan’s decades of economic malaise. He says China now faces its own balance sheet recession on a *massive* scale. Watch Here

U.S. interest rates and the Fed. The current cycle has marked the longest the Fed has held rates at its peak before cutting. See Here

Insuring Cyber trucks? GEICO is Terminating Insurance Coverage of Tesla Cybertrucks, Says “This Type of Vehicle Doesn’t Meet Our Underwriting Guidelines” Read Here Insurers balk at battery fires and write-offs. Average electric car insurance costs rose 72 per cent in the year to September, compared with 29 per cent for petrol and diesel models, according to Confused.com Read Here

Crude oil and commodities Chevron sells oil sands and shale assets in Canada for $6.5 billion (in cash) to Canadian Natural Resources Ltd. Read Here Commodities are the cheapest they’ve been vs. the S&P 500 since the 1970s. See Here

Biden and Iran. Biden’s secret support for Iran America is far from Israel’s best friend.

Oil stocks incredibly cheap. The U.S. energy sector (oil & gas) relative valuations have reached their second cheapest level vs the S&P 500 in the past 40+ years. See Here

Canadian oil and gas deals. Martin shares our thoughts on the Canadian Natural Chevron deal via CBC Calgary. Listen Here

Quality investing, monopolies, and moats. Martin was a featured speaker on this educational X space hosted by Unusual Whales. Listen Here

On the Positive

The world’s rarest commodity

Performance vs. Trust. So many organizations fail because they go all in on performance. But there is a negative correlation with trust and toxicity, which can destroy companies. Watch Here

Exercise your imagination. There can be so more than just shadows. Watch Here

All it takes is to realize we’re all connected. Open your eyes and when you see someone in need act. Watch Here

Jessica Campbell makes her official debut as the first female coach in NHL history. Watch Here

A master class at 20. At aged 20, Daniil Trifonov plays Liszt’s Mephisto Waltz No. 1 during the 2011 International Tchaikovsky Competition, where Trifonov was awarded first prize. Watch Here

It’s just love. Love’s sensational. A farmer couldn’t attend his aunt’s funeral so he put out heart-shaped food for his sheep so that “she could see it from heaven. This heart that I’ve done for my auntie, it certainly seems like it’s had a bit of an effect across Australia. She would be proud as punch to see so many people smiling and enjoying the heart I’ve made for her. It’s just love. Love’s sensational.” Watch Here

Thanks for Visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook. Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2024, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca