INSIDE

The Illusion of Control: How the Fed Became the Market

U.S. Federal Reserve Chair Jerome Powell’s recent admission — that the Fed would lose control over interest rates if it couldn’t pay interest on reserves — highlights a deeper structural shift in monetary policy. The Fed has injected so much liquidity into the system that traditional market mechanisms for setting rates have broken down, leaving the central bank reliant on artificial tools to maintain control. Its balance sheet has grown so large that shrinking it risks destabilizing the financial system, and Powell’s suggestion that balance sheet contraction may soon end signals not victory, but surrender. The economy is now so dependent on central bank liquidity that any attempt to withdraw it threatens everything from gross domestic product (GDP) to asset prices. Meanwhile, the U.S. Treasury has quietly taken the reins of financial conditions, with the Fed enabling it. This isn’t just about interest rates—it’s about the erosion of trust in the system’s independence and sustainability. The real risk isn’t volatility, but the illusion that policymakers are still in control.

Modern Mechanics: Why Portfolios — Like Classic Cars — Need More Than a Tune-Up

Rebuilding a 1968 Mustang with his father taught Martin more than just mechanics — it taught him the value of upgrading legacy systems with modern solutions. That same philosophy now guides his approach to portfolio construction. With sovereign debt under pressure, bond markets in historic drawdowns, and governments increasingly treating deficits as optional, traditional fixed income strategies are no longer fit for purpose. Structured notes, gold, and modern defensive tools are today’s equivalent of disc brakes and fuel injection — designed not to win races, but to make the ride safer and more reliable. Investors must stop treating their portfolios like museum pieces. In a world where fiscal discipline is fading and central banks are losing control, it’s time to stop tweaking and start upgrading.

Disciplined Optimism in a Risk-On Market

We remain constructive but disciplined by remaining true to our consistent approach to managing risk and return. This melt-up is real, but so are the risks. Elevated valuations, policy uncertainty, and geopolitical instability require careful navigation. Our portfolios continue to emphasize: diversification across geographies and asset classes, exposure to high-quality growth and value stocks, selective positioning in international equities and currency-aware strategies, and tactical use of structured notes to manage downside risk and enhance yield.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

October 2025: The Illusion of Control: How the Fed Became the Market

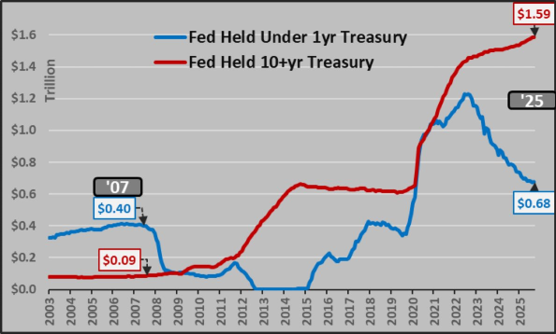

U.S. Federal Reserve Chair Jerome Powell made a revealing comment in early October: “If our ability to pay interest on reserves and other liabilities were eliminated, the Fed would lose control over rates.” While he acknowledged that the Fed’s net interest income has temporarily turned negative due to the rapid rise in policy rates, he emphasized this is “highly unusual” and expects it to return to positive territory soon.

Still, the admission is striking as it underscores how the Fed’s control over monetary policy now hinges on artificial mechanisms like interest on reserves, rather than traditional market dynamics. This shift raises important questions about the sustainability and independence of rate-setting in a system increasingly reliant on engineered tools.

Here’s why that matters: The Fed has pumped so much money into the banking system that banks now have more cash than they need. So instead of borrowing from each other, they just park their excess money at the Fed, which pays them interest. This means the usual market for overnight bank lending has dried up.

As a result, the Fed isn’t just influencing interest rates anymore, it’s setting them directly by deciding how much interest to pay on reserves. That’s what Powell means when he says the Fed would lose control if it couldn’t pay interest: without that tool, there’s no longer a functioning market to naturally set rates. The Fed has effectively become the market.

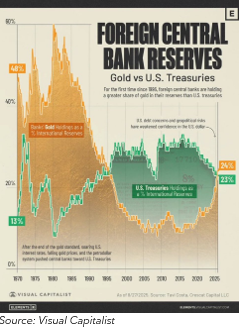

This marks a fundamental shift. Powell’s comment confirms what many have long suspected: the system is too fragile to return to the days of old. The Fed’s balance sheet has grown so large that shrinking it without triggering financial instability is no longer feasible. The U.S. central bank has essentially trapped itself, just like the U.S. federal government, which can’t roll back pandemic-era spending without political and economic fallout. The system expands, then insists it can’t contract without causing harm. That’s simply not sustainable, and the rally in gold markets is telling you this much.

When Powell says we “may be approaching the end of balance sheet contraction in coming months,” he’s not declaring success. He is signalling that the illusion of control is fading. The financial system has become so dependent on liquidity that pulling it back risks breaking key components, including credit markets.

Treasury demand and the shadow banking system

Since 2008, every expansion of the Fed’s balance sheet has been a rescue mission not just for liquidity, but also for confidence. Every attempt to shrink it has tested whether the system can stand on its own. It can’t. The U.S. economy is now fully addicted to easy money. Trying to unwind that addiction risks collapsing GDP, tax revenues, pensions, housing prices, and equity markets — all at once.

The Fed’s balance sheet no longer moves in predictable cycles, it ratchets upward with each crisis. Instead of returning to previous levels, every intervention sets a new baseline. The 2008 financial crisis introduced permanent risk insulation, the pandemic response in 2020 cemented it and now, in 2025, the Fed is quietly acknowledging that this elevated baseline isn’t temporary; it has become the new foundation of the economy.

This isn’t just about interest rates or balance sheet size. It’s about trust and how quickly that trust is eroding. The belief that the Fed can safely withdraw support is cracking. This round of quantitative tightening (QT) has already stalled regional bank lending, drained liquidity from the Treasury market and triggered a quiet funding crisis.

We’re now in a strange place: The economy doesn’t guide the Fed anymore; instead, the Fed’s own beliefs guide the economy. That’s why markets often move before policy does, as gold rallies, bitcoin tightens and real assets react before the Fed even speaks.

Powell’s words are a quiet confession: Tightening now causes more damage than easing can fix.

The “end of balance sheet contraction” isn’t a strategy, it’s surrender. Whatever the Fed calls its next move — “liquidity support,” “market operations,” or “temporary QE” — it will be another expansion. Because the alternative is collapse.

But the worst part is that the Fed isn’t acting alone. When it chose to shrink its balance sheet through runoff — letting bonds mature — instead of outright sales, it handed control of financial conditions to the Treasury. Janet Yellen understood this, and Powell enabled it. The Fed’s policy committee continues to let the Treasury keep conditions loose.

Meanwhile, the Fed’s reinvestment policy has quietly added US$200 billion in long-term Treasuries even as it claims to be shrinking its balance sheet. If the Fed stopped buying these long-dated bonds, the Treasury would have to sell them to the public, exposing the scale of the debt and likely shaking asset prices.

But policymakers won’t act. They fear the bond market. Powell even joked that talking about the balance sheet is worse than going to the dentist. Of course it is, because the truth hurts.

The Fed’s next move may not be about managing inflation or guiding the economy, it could be more about preserving the illusion that it still holds the reins. But illusions don’t last forever. Eventually, the public and markets wake up. And when they do, they’ll realize the real risk isn’t volatility, it’s the false confidence that central banks are still fully in control, even as their influence relies more on engineered mechanisms than genuine market dynamics.

Modern Mechanics: Why Portfolios – Like Classic Cars – Need More Than a Tune-Up

In his late teens, Martin and his dad rebuilt a 1968 Mustang from the ground up. It wasn’t just a bonding experience, it was a masterclass in patience, precision and purpose. He learned about the mechanics, the bodywork and the art of breathing new life into something old. But more importantly, he learned the value of modifying legacy systems with modern solutions.

They didn’t restore the car to win races, they restored it to make it safer, more reliable, and fun to drive. They added disc brakes, new suspension, fuel injection and proper seat belts to that Mustang. It was still a great drive, but a heck of a lot safer.

That same philosophy applies to portfolio construction today, especially when it comes to bonds. The old playbook is no longer working. It’s time to upgrade.

We’ve been steadily reducing our sovereign debt exposure in both Canada and the U.S., and that decision is proving increasingly prudent. The U.S. bond market is now in a historic 62-month drawdown, the longest in recorded history. Meanwhile, companies such as Microsoft Corp. have their bonds trading at lower yields than U.S. Treasuries. That’s a clear signal the market is losing confidence in government credit quality.

Here in Canada, our federal deficit is projected to exceed $360 billion between 2025 and 2028, nearly triple last year’s budget forecast. The Parliamentary Budget Officer has called this “shocking” and “unsustainable,” noting that federal debt is now growing faster than the economy, a first in 30 years. Despite job cuts in Ottawa, spending remains elevated and quickly returning to 2020 highs. What’s more concerning is the reframing of deficit spending as “investing.” That may sound politically palatable, but it doesn’t change the math.

This isn’t just a Canadian problem. Governments around the world are increasingly treating budget constraints as optional, and central banks are being asked to mop up the consequences. But the bond market is pushing back.

Meanwhile, the U.S. government entered its 11th shutdown on October 1, furloughing about 800,000 federal employees and leaving another 700,000 working without pay. This has created a data vacuum that will make it even harder for the Federal Reserve to steer monetary policy. The U.S. deficit remains between six per cent and eight per cent of GDP, with interest payments now consuming 14 per cent of the federal budget. The Treasury’s reliance on short-term debt adds rollover risk at higher rates, a dangerous game in a rising rate environment.

This isn’t a temporary dislocation; it’s a regime shift. Investors must adapt to a world where fiscal discipline is eroding and traditional safe havens are no longer safe.

Gold markets are already taking notice, with prices pushing past US$4,000 an ounce. Think of gold as your financial EKG: It’s warning us that a heart attack may be looming. And what do governments do? They keep loading up on carbs (deficit spending) and say everything’s fine because they’ll take statins (cut rates). But the bond market isn’t buying it.

That’s why we’ve replaced our bond exposure; not with corporate bonds, which are trading at credit spreads near 27-year lows, but with structured notes. These instruments offer asymmetrical payoff profiles, embedded downside protection and the ability to generate income in volatile markets. They’re like the disc brakes and fuel injection we added to that Mustang: modern solutions for legacy risks.

Structured notes have allowed us to maintain exposure to market upside while protecting against downside volatility. They’ve been particularly effective in this environment of persistent higher rates — albeit coming down a bit — fiscal uncertainty, and geopolitical tension.

We believe investors need to stop treating their portfolios like museum pieces. Just because something worked in the past doesn’t mean it’s safe today. Bonds used to be the seat belts of a portfolio but now, many of them are fraying under the pressure of poor fiscal management and distorted monetary policy. It’s time to upgrade. Not just tweak. Not just rebalance. Upgrade.

We’re entering a new era, one where fiscal discipline is fading, market signals are flashing red and traditional risk management tools are losing effectiveness. Investors need to rethink their approach. Structured notes, gold, and modern defensive strategies are no longer niche, they’re necessary. We’re not just managing money, we’re modifying legacy systems to make them safer, more reliable, and built for the road ahead.

Performance and Asset Allocation – Disciplined Optimism in a Risk-On Market

We came across a recently that struck a chord: “One of the major cheat codes in life is learning how to master the graceful exit.” Whether it’s leaving a party, a conversation, or an opportunity, there’s power in saying, “This has been wonderful, but I need to go.” No drama, no excuses, just a clear, kind departure.

That concept feels especially relevant now. Since spring, liquidity has returned as the Federal Reserve subtly shifts toward easing, fueling optimism. Yet cracks are forming: U.S. regional banks remain stressed, private credit markets are wobbling, and gold — despite recent weakness — is still up double digits year-to-date, signalling uncertainty.

Globally, conditions are deteriorating. France faces sovereign debt issues, the UK’s tax policy has triggered an exodus of 16,500 millionaires, and Germany’s industrial output is sliding. Canada contends with stagnation, inflation, and political gridlock — all while jobs are lost under U.S. tariff pressure.

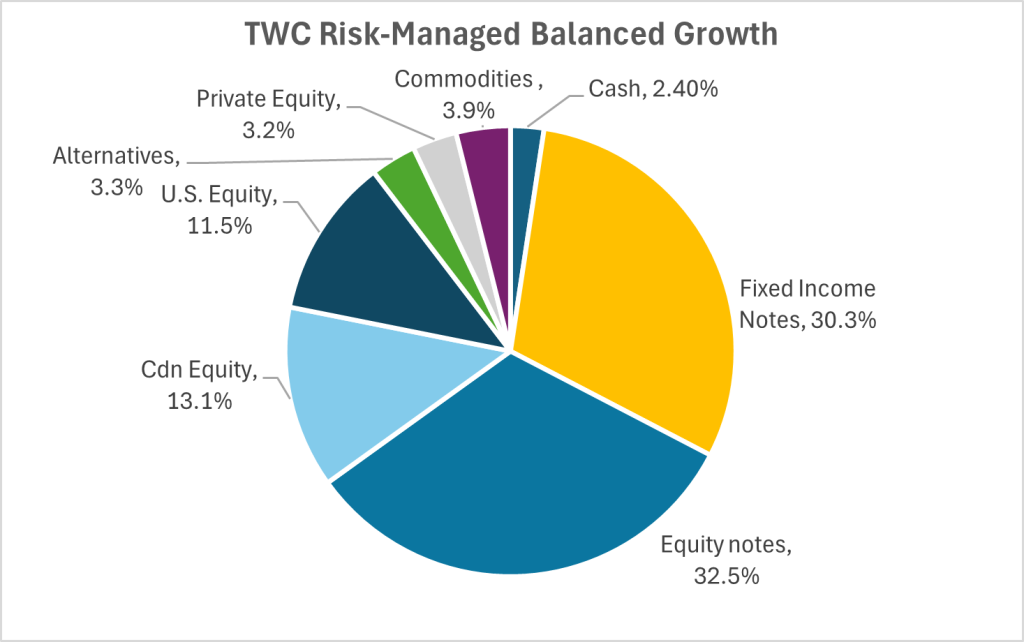

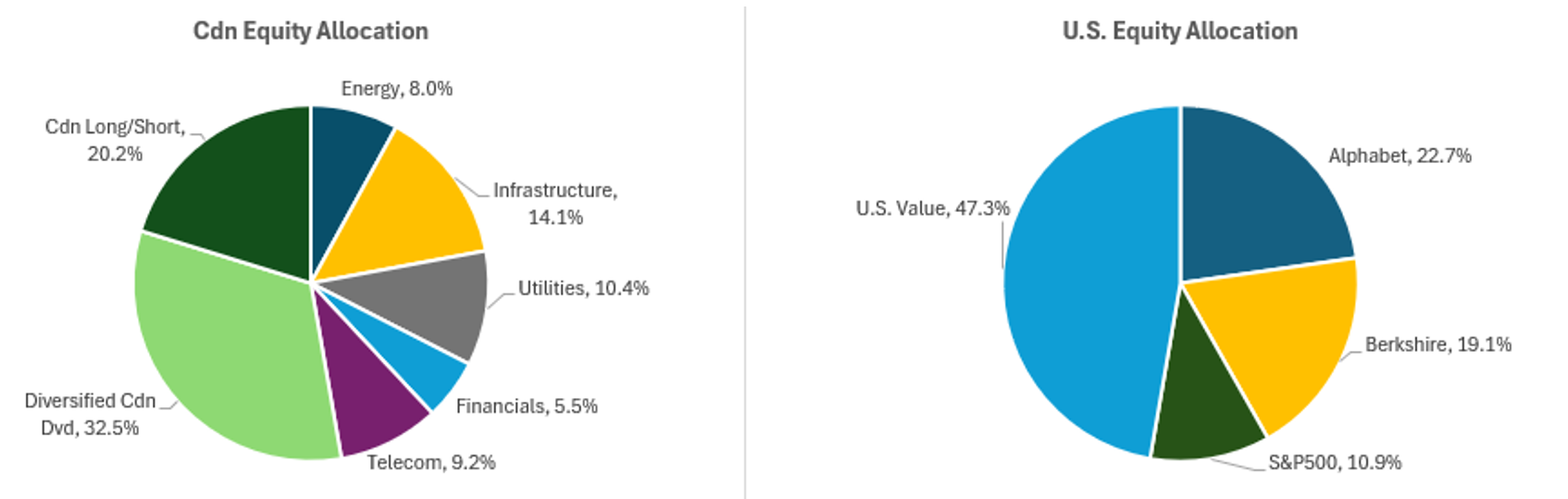

Rather than exit entirely, we rebalance. Traditional fixed income offers little refuge, so we’ve replaced most bond exposure with principal-protected structured notes and monthly contingent notes with deep barriers for downside protection and yield. We also maintain exposure to the BMO Strategic Fixed Income Yield Fund, which uses interest rate swaps, credit default swaps, and currency forwards to hedge risk and enhance returns. In early October, Martin met with BMO Global Asset Management leadership and TD’s trading desk to review derivative strategies and hedging on structured notes.

On equities, we’re evaluating low-cost put protection for S&P 500 exposure. In Canada, we’ve significantly reduced oil and gas holdings, favouring defensive sectors like telecom, utilities, and infrastructure — names such as Telus (T), Canadian Utilities (CU), WSP Global (WSP), and Brookfield Infrastructure (BIPC) for stability and cash flow. For growth, we remain confident in NewGen’s Focused Alpha Fund, which excels in Canadian small- and mid-cap opportunities. Martin recently met with the fund’s managers to review positioning, including junior miners.

Last Tuesday’s sharp sell-off in gold and silver — the largest daily decline since April 2013 — was overdue after an overbought run. We view it as a healthy pullback and an opportunity for those underweight; we added to positions.

Finally, cash remains critical. As notes are called, we’re shoring up liquidity to preserve flexibility and optionality when opportunities arise.

Bottom line: The market may still be partying, but now is the time for a graceful exit from certain exposures — not abandoning ship, but rebalancing, protecting gains, and positioning for what’s next. When the music stops, those who exit with discipline will be best prepared to re-enter with strength.

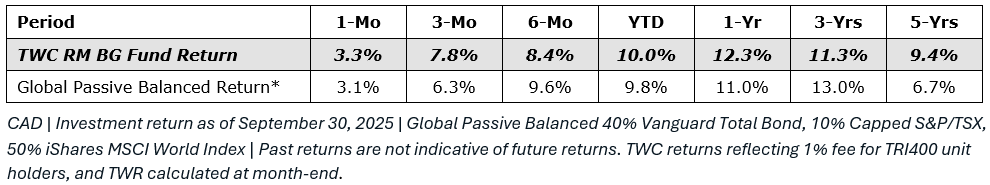

Our disciplined approach has delivered results. The TWC Risk-Managed Balanced Growth Fund is up 10 per cent year-to-date, slightly ahead of our global passive balanced index at 9.8 per cent. Over five years, we’ve achieved an annualized 9.4 per cent — well above our six to eight per cent goals-based target — compared to 6.7 per cent for the passive benchmark.

Our barbell allocation — structured notes replacing fixed income, Canadian dividend exposure, tactical trades in gold, and U.S. equities like Berkshire Hathaway and Google — has driven performance while managing risk.

Looking ahead, we remain constructive but disciplined. Elevated valuations, policy uncertainty, and geopolitical instability demand careful navigation. Our portfolios emphasize diversification, high-quality growth and value stocks, selective international exposure, currency-aware strategies, and tactical hedging. We’re participating in this rally with purpose — not blind optimism — anchored in fundamentals, risk management, and client goals.

Research, reads of the month

In today’s market, where performance is increasingly driven by a handful of mega-cap names, stock picking has never been more critical. Concentrated markets present opportunities for active managers to uncover undervalued companies outside the index heavyweights, consider the divergence between the “Magnificent Seven” and the rest of the S&P 500, or the overlooked gems in international markets.

To strengthen our capabilities in this area, we recently welcomed Steve Rowles to our team. Steve brings deep international experience from institutional asset management roles in Hong Kong and Singapore, and most recently managed a $500 million private client portfolio here in Canada.

Steve was recently featured on BNN Bloomberg, where he shared insights into some of the stocks he favours in today’s environment.

S&P’s downgrade of France’s credit rating sanctions political instability

“The American financial analysis firm downgraded the country’s sovereign rating from AA− to A+ on Friday, taking markets by surprise by doing so outside its previously announced schedule.” Read Here

Has the Debt Spiral Started?

“Why the U.S. debt cycle is reaching a breaking point, how AI and geopolitics are accelerating structural change, and why we could be witnessing the endgame of the fiat era.” Watch Here

Understanding the Secured Overnight Financing Rate (SOFR)

“SOFR is supposed to be a market-based rate, derived from actual transactions in the repo market. But in today’s environment, where banks are flush with reserves and don’t need to borrow, the volume of true interbank lending has collapsed.” Read Here

U.S. Credit Spreads drop to lowest level since 1998

This will continue as long as the Fed keeps the liquidity flowing. See Here

Deutsche Bank: Growth of ChatGPT’s Paying Users in Europe Has Stalled

“There’s no doubt AI will change the world and boost productivity. But the path to profit remains unclear. The real challenge isn’t the algorithm — it’s the business model.” Read Here

Alibaba Cloud claims to slash Nvidia GPU use by 82% with new pooling system

“Alibaba Group Holding has introduced a computing pooling solution that it said led to an 82 per cent cut in the number of Nvidia graphics processing units (GPUs) needed to serve its artificial intelligence models.” Read Here

1929

“Andrew Ross Sorkin’s new book “1929” has wild details of Winston Churchill YOLO trading US stocks before The Great Depression”: He traded £400,000 a week on margin at one point. He was in New York on “Black Monday” in October 28, 1929. It took years “to recover from financial losses but eventually clawed it back with publishing deals (his largest financial windfall was a book deal for his WWII memoirs).” Read Here

Druckenmiller on the 2000s Tech Bubble

“I made a lot of mistakes, but I made one real doozy. So, this is kind of a funny story, at least it is 15 years later because the pain has subsided a little. But in 1999 after Yahoo and America Online had already gone up like tenfold, I got the bright idea at Soros to short internet stocks. And I put 200 million in them in about February and by mid-March the 200 million short I had, lost $600 million on, gotten completely beat up and was down like 15 percent on the year. And I was very proud of the fact that I never had a down year, and I thought well, I’m finished.” Read Here

No markets don’t always go up

There have been extended periods of little to no returns and even negative on a real basis. See Here

I Bought $250,000 Worth of Physical Nickels

“No, that’s not a typo. That’s 5 million coins. 55,000 pounds of American metal stacked in boxes from a local bank vault — an asset the government literally can’t print anymore.” Read Here

The New Gold Rush

“Gold rush in Vietnam as people storm shops to buy and sell the yellow metal, which now trades at over $4,300 per ounce.” Watch Here “What happened in 2009 that made central banks change from net sellers to massive buyers of gold? It makes one think.” See Here “The Gold/S&P 500 Ratio – Does This Look Like a Bubble to You? Current value is -0.45 SD below its 55-year average.” See Here Gold outperfoming S&P 500 ETF (SPY) “since it launched in 2004 is mind-melting.. flies in the face of so much conventional wisdom.” See Here “This is wild…from a State Street study of investors with $250K+ in total assets, Millennials have more gold in their portfolios than Gen X or Boomers…” See Here “What if stock market gains were measured in gold instead of dollars? As John Authers notes, ‘Denominate U.S. stocks in gold rather than dollars, and they’ve been in decline since the dot-com bubble burst 25 years ago. Stocks elsewhere have done even worse.’” See Here

Global energy stocks see largest net selling in four months as crude drops

“Hedge funds significantly slashed exposure to energy equities in the last week as crude prices fell to multi-month lows, as it extended a selloff that has shaken commodity-linked sectors, according to Goldman Sachs Prime Services.” Read Here

Private Equity, Credit — Lawsuits and Leverage

The redemption queue for Fiera’s infrastructure fund is now $700-million and things have gotten tense, with Fiera Infrastructure and its former head suing each other. Read Here “A key thing to remember about private loans is the leverage multiple; these loans are never 1:1, but rather 10:1, 15:1, 25:1, or 50:1. The higher tiers of leverage are not provided directly by the issuing bank & post-issuance they are not classified as exposure to said bank, the ‘counterparty’ exposure on said loan is transferred to the purchasing entity, once subscribed to the issue.” Read Here

Canada, the duct-tape nation

“These myths cast Ottawa-centric governance as uniquely noble, ignoring the fact that the Prairies were settled not by Laurentian salons but by waves of immigrants — especially Eastern Europeans and Scandinavians — hacking farms out of unforgiving soil…Canada survives not because of a single consensus, but because of successive patchworks — provisional fixes layered on top of one another. It is duct-tape politics.” Read Here

Canada ‘not yet’ a reliable energy supplier, says Indian high commissioner

“Amid efforts to rebuild the long-fraught relationship with India, that country’s new high commissioner says Canada is ‘not yet’ a reliable supplier of conventional energy, namely oil and gas.” Read Here

The Developer, The Pre-Sales, The Irish Buyers, The Vendor Take-Back and It All Blows Up

“I get some of wildest Real Stories you can imagine drop in my lap but this one takes the PRIZE. A Real Estate Disaster Story for the ages.” Watch Here Canadian Real Estate Resembles US Bubble, Investors See Major Risk Event. Read Here

Property ownership may be in doubt in Richmond, B.C. “City of Richmond is telling homeowners that the ‘status and validity of their ownership’ is in doubt because a Vancouver Island band said their great grandparents once fished there.” Read Here

How Canada got immigration right for so long — and then got it very, very wrong

“Canadian immigration was stable, popular and uncontroversial. But a series of changes after 2015 broke the national consensus, and the system.” Read Here

From BC Bud to Ecstasy, Meth, and Fentanyl

“How Canada’s Vast Landscape and Permissive Laws Were Progressively Exploited by Chinese and Mexican Cartels.” Read Here “Canada is flooding New Zealand with meth. From 2020 to 2024, New Zealand seized more meth from Canada than from any other country in the world — 1,200 kilograms with an estimated street value of about $350 million.” Read Here

The smartest age in life may be 55 to 60 — not in your 20s

“Raw cognitive abilities, such as processing speed and memory, often peak early in life. Athletes typically hit their prime before 30, mathematicians make major breakthroughs by their mid-30s, and chess champions rarely stay dominant past 40. However, a new research reveals that overall psychological functioning—including personality traits, judgment, and emotional intelligence—peaks much later, between ages 55 and 60.” Read Here Maybe it’s because the older you get you realize that that a wondering mind is an unhappy mind? Read Here

Escaping Competition and the Most Important Decision

You can escape competition through being authentic. Watch Here What is the most important decision you can make in your life? See Here

Here’s how you know someone is highly intelligent

The three toughest words “I was wrong” but also the most powerful. Watch Here

1999 was the peak of modern culture and progress

“This clip from the Matrix explains: Why was 1999 selected as ‘the peak of your civilization’? Because as soon as we started thinking for you it really became our civilization.” Read Here

Power of Purpose

A recent study found that having a strong sense of purpose in life can significantly reduce the risk of cognitive impairment, even for those with a genetic predisposition to dementia.

- 28% lower risk of cognitive decline

- Benefits span across ethnicities and education levels

- Comparable impact to leading Alzheimer’s drugs — without the cost or side effects

This perspective is powerfully reinforced by Viktor Frankl, the renowned psychiatrist and Holocaust survivor whose book “Man’s Search for Meaning” remains a cornerstone of modern psychology. Frankl’s philosophy, known as logotherapy, teaches that our ability to find meaning in adversity and to focus on what we can control is a vital source of psychological strength.

In investing, as in life, grounding our decisions in purpose and meaning helps us maintain perspective during uncertainty and market turmoil. Frankl reminds us that, even when circumstances are beyond our control, we retain the freedom to choose our attitude and response. By letting go of the past whether through reflection, therapy, or intentional practice, we free ourselves to make better decisions in the present.

Wondering where to start? Whether it’s family, work, faith, or helping others, purpose is a powerful, accessible tool for brain health. So let’s invest in meaning — not just markets. See Here

If life gets shorter, like a roll of toilet paper, why do we work so long?

Peter Lynch: “If you’re lucky enough to be rewarded in life to the degree I have, there comes a point at which you have to decide whether to become a slave to your net worth by devoting the rest of your life to increasing it or to let what you’ve accumulated begin to serve you.” The bottom line is we need to stop waiting; stop deferring joy; stop assuming we have unlimited time. Read Here

A reminder that for every winner there is a loser

Losing really sucks therefore it is important to remember to be gracious if you happen to be on top because one day you won’t be. Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca