INSIDE

Market timing, speculation and investing considerations

When investing in high growth segments like U.S. tech, it is imperative to get the timing right otherwise you risk exposing your portfolio to excessive volatility. While this is fine for younger investors averaging into the market with their savings, this may not be the case for those who are retired and looking to protect and grow their wealth that they built up by risk taking in their career or business over their working lifetime.

Some cracks are starting to show with the risk of seasonal weakness

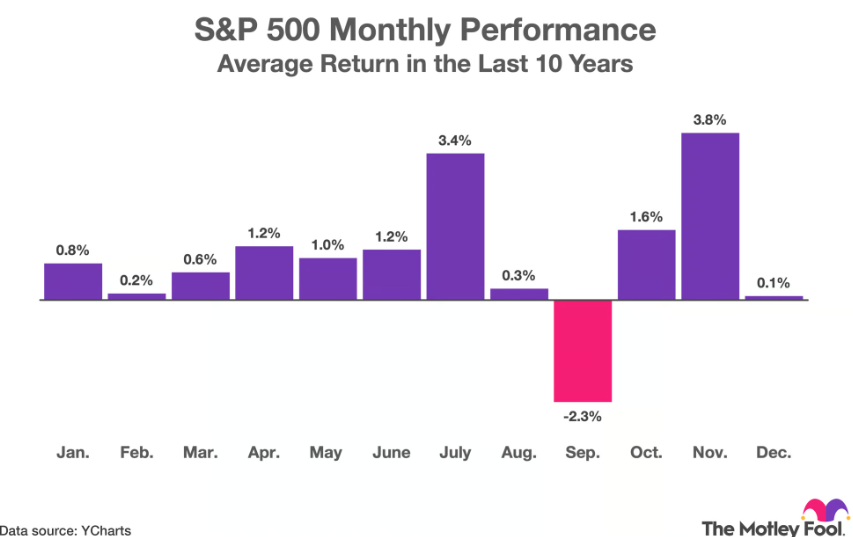

Looking ahead, we are also entering a period of seasonal weakness. The S&P 500 has fallen 2.3 per cent on average in September over the past 10 years, marking the only month with negative returns, according to calculations by the Motley Fool. The average return in September since the Second World War has been minus 0.8 per cent, with the VIX spiking an average of 10 per cent over the past 33 years.

Update on our strategic positioning

It may not hurt to take advantage of the current level of complacency in the event this monster trade unwinds like it almost did a few weeks ago. Our approach resulted in a bit of near-term underperformance against passive strategies this year, still to the upside, but our conservative strategic positioning has allowed us the luxury of not having to worry as much as others who are all in on equities or even those deploying the traditional 60/40 strategy. By preventing large drawdowns and the associated risks of emotion entering the investment decision-making process, investors can increase the odds of meeting their specific financial goals and objectives.

September 2024

“The individual investor should act consistently as an investor and not as a speculator” – Benjamin Graham.

Welcome to this month’s Market Strategy. In this edition we share some strategies that we think are very well suited for a broader equity and bond market that is starting to show some cracks as we head into a period of seasonal weakness. Fortunately, having downside protection embedded within our client portfolios hasn’t cost much as we have been doing quite well capturing roughly 80 per cent of the rally this year as measured by TWC Risk-Managed fund against our global passive index (60 per cent Global Vanguard bond, 10 per cent S&P TSX TR, 30 per cent MSCI Global Equity).

Looking ahead, there seem to be two dominant camps out there, one that is recommending investors buy the dips especially in the tech-heavy S&P 500 while others are quite pessimistic, calling for a global recession and selling those susceptible sectors like energy, materials and consumer discretionary.

We, on the other hand, are doing neither by maintaining our position that the U.S. economy is chugging along just fine, albeit with a slower pace of growth. That said, other economies like Canada are likely close to being in a recession which is being masked by record levels of immigration. This explains why most of us feel worse off from pre-pandemic levels as cost-of-living prices remain 30 to 40 per cent higher while our incomes haven’t caught up.

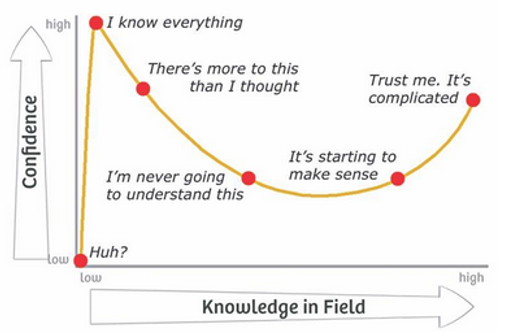

Overall, we’ve found that perma-bears tend not to make any money, failing to see the opportunities when they arise. However, being overly bullish can add a lot of risk into one’s portfolio especially when it’s geared more towards speculation and so you better get it right on the entry and exit—something that we think is nearly impossible to do.

Those advisors brave enough to position a large weighting to tech names such as Nvidia have been handsomely rewarded, rapidly growing their books by attracting new client accounts based on this performance. However, this has come with extreme levels of volatility such as what we witnessed a short few weeks ago with the yen carry trade unwind.

The problem is if you are a conservative investor and get the timing wrong, it could be quite costly to your hard-earned wealth. We love illustrations and recently came across this one showing that if you retired in 1999 with a $1 million portfolio and went all into the U.S. equity market while taking out $50,000 per year to live, that portfolio would be down to only $300,000 today. If you did the same but with a portfolio 25 per cent into stocks, 25 per cent into long-term bonds, 25 per cent cash and 25 per cent gold, you would still have $1 million.

We’re not saying today is another 1999, although many areas certainly feel that way. However, there is always the risk of FOMO chasing yesterday’s returns that may not be there tomorrow. Our diversified, risk-managed style takes a different approach, one that is geared more towards capital preservation during market corrections, upside capture during rallies, and trying our best to minimize the risk of emotion entering in the investment decision-making process.

Having a reduced portfolio volatility is very helpful in achieving this. So please read on for some of the latest strategies we’ve deployed that we are quite excited about heading into the remainder of the year. Also, Martin recently provided some market updates via BNN Bloomberg that can be watched here,and here along with this one by stockpick.

No one knows what lies ahead, but it’s important to do a good old-fashioned gut check every once in a while, to see if you are truly comfortable with adding excessive risk in your life and portfolio. There is value in doing your own thing and having the confidence that you don’t have to beat everyone else.

As summer comes to an end, and we get back to work and our kids to school, it gives us all a chance to keep investing wisely today for an even better tomorrow.

Hey, let’s be careful out there

There are no doubt a lot of good things to talk about when it comes to the stock market these days, as equity markets and especially the S&P 500 and tech-heavy Nasdaq have surpassed all expectations despite the recent blip.

Even bond markets have performed well, pushing yields lower and pricing in multiple cuts, leaving investors wondering how much room there is for further appreciation. Overall, all signs are pointing to exercising a bit of caution over the remainder of the year.

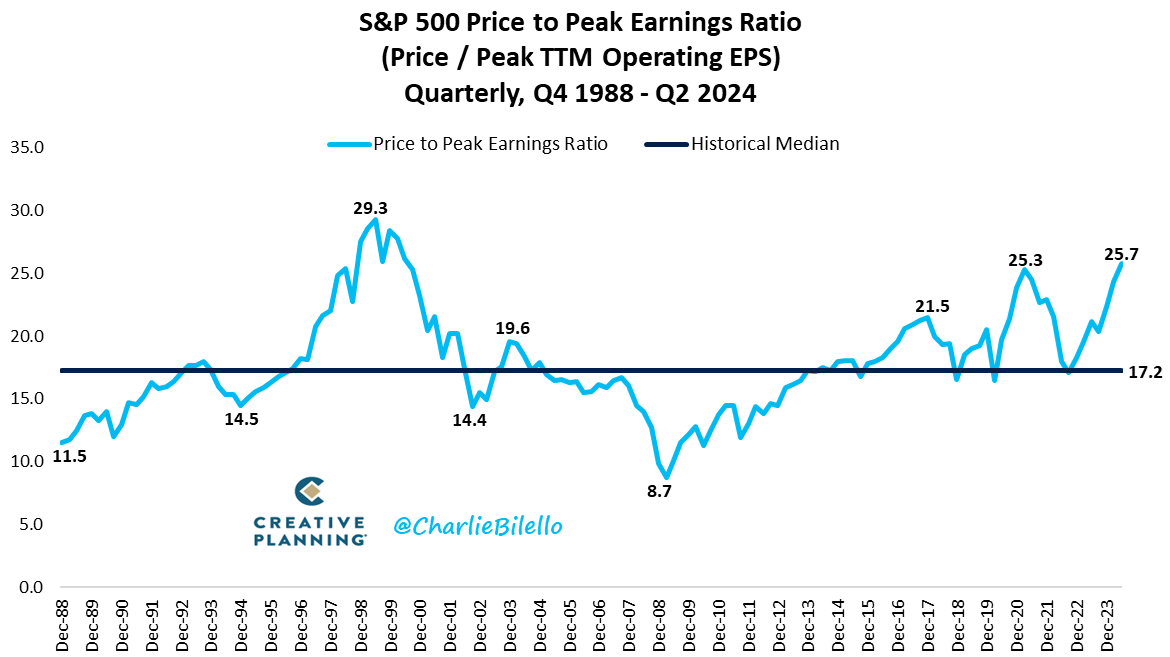

From a valuation standpoint, U.S. equity markets are looking very stretched. The S&P 500’s price-to-peak-earnings ratio has moved up to 25.7, its highest level since 2000 and 49 per cent above the historical median, according to Charlie Bilello, chief market strategist at Creative Planning LLC.

The S&P 500 is also trading at 2.9 times sales, nearly double the historical median and approaching its peak valuation in the fourth quarter of 2021. Topdown Charts Ltd.’s euphoriameter, a measure of forward price-to-earnings, VIX and bullish sentiment, is now at its highest level on record.

Looking ahead, we are also entering a period of seasonal weakness. The S&P 500 has fallen 2.3 per cent on average in September over the past 10 years, marking the only month with negative returns, according to calculations by the Motley Fool. The average return in September since the Second World War has been minus 0.8 per cent, with the VIX spiking an average of 10 per cent over the past 33 years.

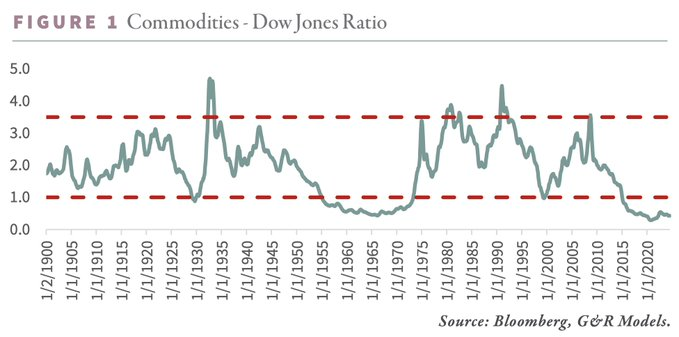

At the same time, investors are positioning for economic weakness in other sectors, pushing commodities to their lowest level since the 1930s when measured against the Dow Jones industrial average. Commodities such as WTI oil near-month contracts are down 12 per cent over the past 12 months, while copper near-month contracts are up only six per cent.

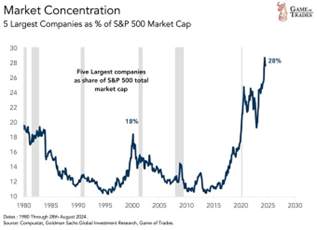

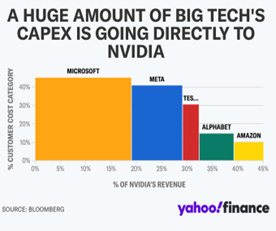

Meanwhile, everyone has been herding into U.S. tech, making it among one of the most crowded trades of all time. The five largest companies make up 28 per cent of the S&P 500, the highest in more than four decades. This is also the case even within the top companies in the index. For example, 45 per cent of Nvidia Corp.’s revenue comes from just four companies, Microsoft Corp., Meta Platforms Inc., Alphabet Inc. and Amazon.com Inc., according to Bloomberg research.

It may not hurt to take advantage of the current level of complacency in the event this monster trade unwinds like it almost did a few weeks ago. Our approach resulted in a bit of near-term underperformance against passive strategies this year, still to the upside, but our conservative strategic positioning has allowed us the luxury of not having to worry as much as others who are all in on equities or even those deploying the traditional 60/40 strategy. By preventing large drawdowns and the associated risks of emotion entering the investment decision-making process, investors can increase the odds of meeting their specific financial goals and objectives.

More specifically, we’ve been positioning defensively via our option overlay on our U.S. equity position through put purchases financed by covered calls while continuing to extensively use structured notes, especially as a bond replacement. For example, we just did one on the iShares 20+ Year Treasury Bond ETF, where we get a 14.5 per cent coupon should the exchange-traded fund (ETF) make any positive gains above zero per cent in 12 months.

We also like Canadian dividend companies such as utilities that are going to benefit from falling interest rates and the spread between their U.S. counterparts. For example, as at last Tuesday, the U.S. Utilities Select Sector SPDR Fund ETF is up 28 per cent over the past 12 months, while the Canadian iShares S&P/TSX Capped Utilities Index ETF is up only eight per cent.

Taking a deeper look within these exchange-traded funds in the global infrastructure space, Florida-based NextEra Energy Inc., which encompasses more than 14 per cent of the U.S. Utilities Select Sector SPDR Fund, is up 25 per cent over the past 12 months as at last Tuesday, while Brookfield Infrastructure Partners LP, which is also a holding of ours, is 16 per cent of the Canadian iShares S&P/TSX Capped Utilities Index ETF, but up only nine per cent.

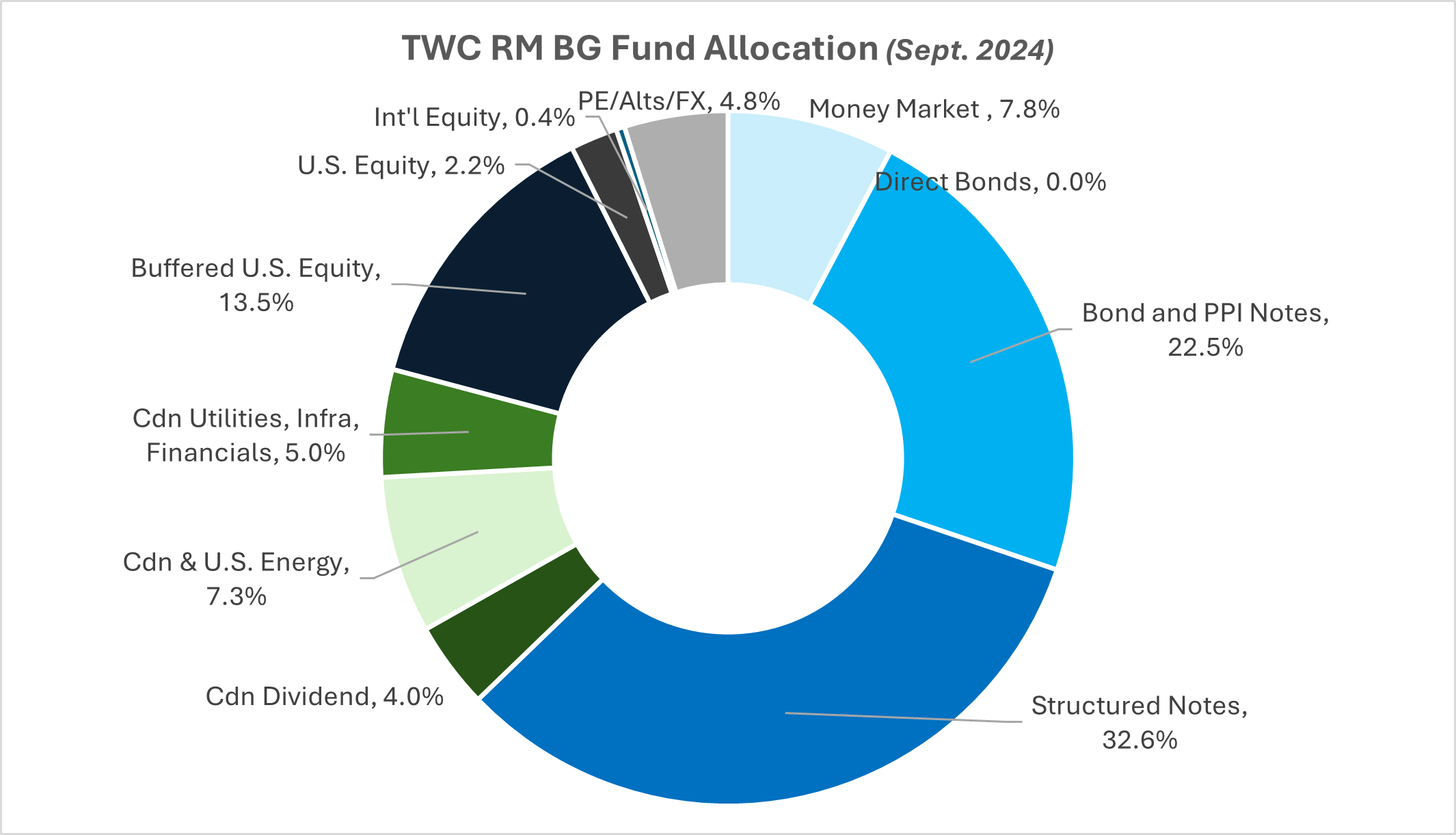

Our tactical positioning

Currently, within our TWC Risk-Managed Balanced Growth fund, we’re running about 8 per cent cash and money market paying about 4.75 per cent in interest, took our floating rate bond exposure down to zero and replaced with structured notes including a 1.2 times 20-Year Treasury note with 20 per cent downside protection (our recession hedge) and a 14.5 per cent yearly auto-callable on the same underlying. Our 22.5 per cent fixed income structured note exposure is made up of 100% principal protected notes. Some of these notes will pay out based on a shift in the yield curve – so for example, if Canadian or US yields are lower in a year, the note closes out and pays a coupon ranging from 7.0 to 8.5 percent. Other notes are based on equity indices, which we classify as fixed income due to lower risk as they are 100% principal protected.

We also have a 33 per cent weighting to equity structured notes, generating some fantastic yields with embedded downside protection ranging from 25 to 50 per cent. Some of the yearly auto-callables we’ve written over the past year to two years are continuing to get called away, locking in some strong double-digit returns along with some monthly contingents that have been generating 8 to 12 per cent annual returns with most outperforming their underlying equity indices. We have taken these and shored up our cash levels for the fund and clients to take advantage of what we think could be seasonal weakness in the last quarter of the year.

We’ve broken out the Canadian equity exposure as per above. Earlier in the year we sold our passive iShares S&P TSX Composite High Dividend ETF and replaced it with a 4 per cent weighting to the Outcome Metric Canadian Equity Income fund being run out of Toronto and have been very pleased with its performance. We have maintained our 7 per cent weighting to energy primarily dominated by positions in Suncor, Cenovus and Canadian Natural Resources. The remaining 5 per cent is held in individual positions such as Manulife Financial, Brookfield Infrastructure, Canadian Utilities, and Canadian Pacific.

We have a decent weighting to U.S. equity markets but have buffered it via put spreads protecting the downside through to December and January made nearly costless via covered call writing. We also added a position in the Simplified Hedged Equity ETF which is a layered buffered ETF strategy divided into the 3-month rolling put spread, collars. We talked with the ETF manager about the strategy and entered a position shortly thereafter.

What we’re reading

Speculation vs. investing. Nvidia is trading at a higher price to sales (P/S) multiple today than Microsoft was during the peak of the DotCom bubble and why it won’t last. Read Here Never invest in the next big thing. See Here And look at the average holding period of U.S. stocks. See Here

Is the bond trade over? Former Brevan Partner Jonny Matthews has once again bet against the recession trade by shorting bonds. Watch Here

It’s Been 790 Days… The longest yield curve inversion in history started in 2022 and it ended today, what happens next? See Here

U.S. stocks getting very crowded. U.S. Households now have 42 per cent of their financial assets in stocks. That’s the highest percentage on record with data going back to 1952. See Here

Concentration risk? Nearly half of Nvidia’s revenue comes from just four mystery whales each buying $3 billion–plus. Read Here

U.S. labour markets and debt service considerations. A good take by our friend Bob Elliott, former CIO of Bridgewater. Read Here When considering debt service, it’s important to think about cashflows and who is paying for what? Business and households have not been impacted in the short term by rate increases, because their debt is long term and at a fixed rate. 25 per cent of government debt is on a floating rate basis, and the debt service on that has risen, but the increase of that debt service has mainly gone to non-GDP producers (Pension Funds, Retirees, Fin Firms). Re-shoring stimulates growth and inflation. Listen Here

Flat oil prices. Crude prices back to roughly where they stood in 2019 in inflation-adjusted terms. See Here Meanwhile, “if every new car sold in the world in 2035 were electric, oil demand in 2050 would still be 85 million barrels per day. That’s the same as it was in 2010.” Read Here

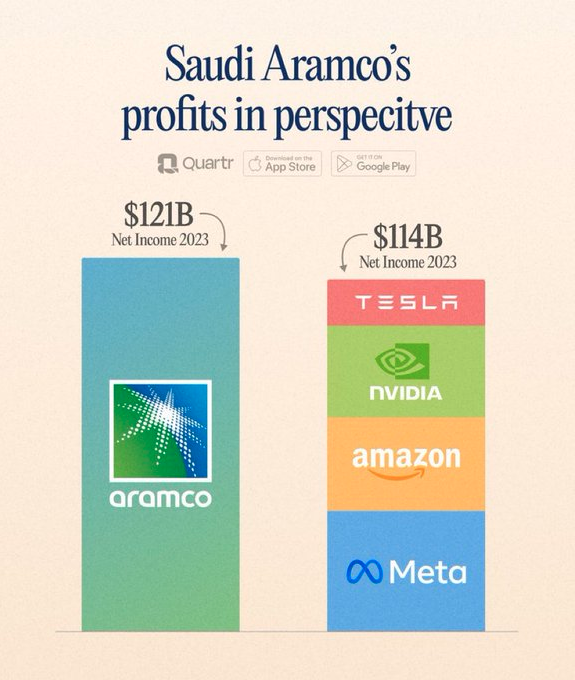

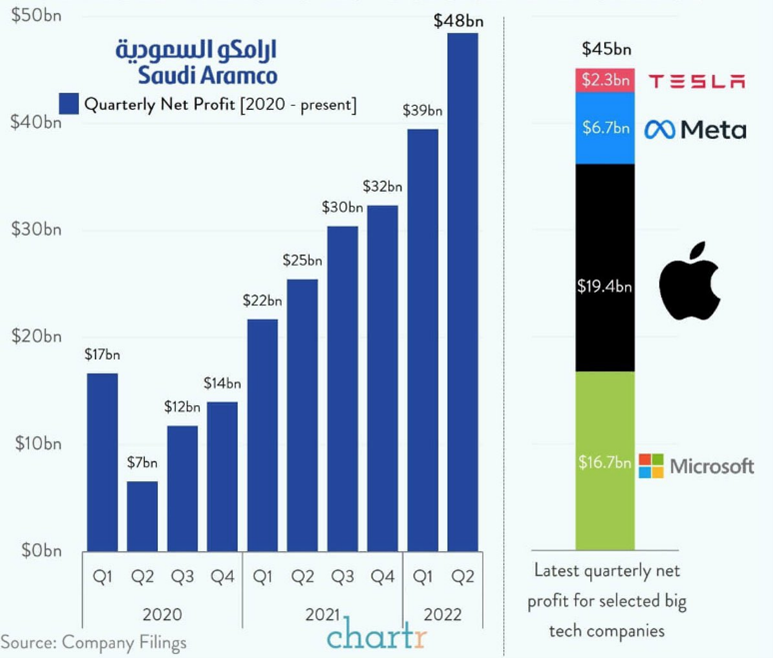

Source: Saudi Aramco’s profits in perspective Source: Saudi Aramco Big-Tech

Oh Canada. Canada’s GDP grew by 1.1 per cent between the fourth quarter of 2022 and 2023, while its population grew by 3.2 per cent. That means GDP per capita is now falling at 2 per cent annually. Zero economic growth in more than six years. See Here

The economic gap between the Canadian and American economies has now reached its widest point in nearly 100 years. The U.S. is on track to produce nearly 50 per cent more per person than Canada will. This stunning divergence is unprecedented in modern history. Read Here

Also, did you know that one in four Canadians now work for the government? See Here

Short squeeze rally in the CAD ahead? Speculators build largest short Canadian Dollar position in history. See Here

Inflation adjustments. ‘In gold terms, the S&P 500 is exactly where it was in August 1971. The significance of that date is that it was the moment when President Richard Nixon severed the dollar’s link to gold.’ Read Here

Commodities once again a hated trade, but is it an opportunity? Hedge funds turn bearish on commodities for the first time in more than eight years. See Here But here is an interesting contrarian take by Jared Dillian. Read Here

On the Positive

Sage advice from Albert Einstein and a wise captain

Dostoevsky. A lifetime of wisdom in one paragraph. Read Here

Mother nature. Although, this is apparently three videos turned into one, it sure made our day. Hope it does the same for you. Watch Here

Love heals. Michelle Rukovitzin, 21, was left in a coma for three months after being shot multiple times by Hamas, with doctors uncertain if she would ever recover. Since waking up she has been wheelchair bound as she struggles to adjust to her life-changing injuries. Throughout the ordeal, her boyfriend Rinat has stayed by her side. He has now proposed to her, with Michelle saying yes. Watch Here

What an amazing ride. Sometimes we catch the ride of a lifetime, so make sure you see it through to the end. Watch Here

Canadian taxation. One Toronto restaurant switches the names of the menu so you can write them off as a business expense. See Here

The restaurant wine grift. Watch this the next time you go out for dinner. Watch Here

And please remember that…

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook. Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2024, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca