INSIDE

From Roads to Data Centres: The New Infrastructure Trade

The convergence of fiscal and monetary liquidity is fueling an infrastructure supercycle. Governments are deploying massive capital into nation-building projects to counter deglobalization and economic fragility, while central banks are keeping capital cheap—supporting long-duration equity sectors like technology and digital infrastructure. We’re positioned to benefit from both angles: WSP Global offers growth exposure to Canada’s fast-tracked infrastructure agenda, with a record C$16.6 billion backlog and strong Environmental, Social, and Governance (ESG) alignment. Brookfield Infrastructure provides a defensive income stream, with 70 per cent of revenues inflation-indexed and a booming data infrastructure segment. Meanwhile, we’re tactically trading long-duration bonds via structured notes to capture short-term rate moves without excessive risk. Liquidity is the tailwind—but vigilance is key.

The Fed, the Deficit, and the Dollar: A Brewing Storm

Three converging risks are reshaping the macroeconomic landscape: the U.S. is running persistently high deficits, the Federal Reserve’s independence is under political threat, and there’s a growing risk of a shift toward Modern Monetary Theory (MMT)-style policies. Together, these forces could destabilize bond markets, weaken the U.S. dollar, and drive inflation higher. Gold is surging as a safe haven, while equities face valuation pressure. Investors should prepare by shifting toward real assets, inflation hedges, and global diversification.

Avoiding Unforced Errors in this FOMO Market

We had a somewhat busy August and September trading for clients. Besides replacing the numerous structured notes that were called away, we reduced down our energy exposure and boosted our infrastructure and telecommunication holdings. Overall, we’ve been applying the investment philosophy of Charles D. Ellis, renowned author of Winning the Loser’s Game, to our current investment strategy. Ellis, who compared investing to amateur tennis, famously argued that investing is not about hitting winners, but about avoiding unforced errors and consistently returning the ball over the net.

Please reach out to any of our team members should you have any comments or questions about markets, your portfolio or just wanting to catch up. All the best, and keep investing wisely!

September 2025: From Roads to Data Centres: The New Infrastructure Trade

The Infrastructure Supercycle

As we head into the fall, two major themes are dominating the investment landscape: fiscal spending liquidity and central bank liquidity. Together, they’re creating a powerful tailwind for select sectors and asset classes especially long-duration equities like tech.

Technology stocks have continued access to an incredibly low cost of capital via falling interest rates and Fed induced liquidity. This will continue to fuel massive capital expenditures on digital infrastructure. On the other side, governments around the world are running large deficits and deploying massive capital into infrastructure. This isn’t just about roads and bridges, it’s about nation-building, economic resilience, and strategic autonomy. Infrastructure spending is being used to soften the impact of tariffs and deglobalization, especially through the reshoring of supply chains, domestic manufacturing, and logistics hubs.

This is creating an infrastructure supercycle trade.

For context, projects that global infrastructure spending will exceed C annually by 2025, with long-term needs estimated at $200 trillion over the next 30 years. That’s a staggering figure, and it’s creating enormous opportunities for companies that are well-positioned to deliver the engineering, design, and execution required to meet this demand.

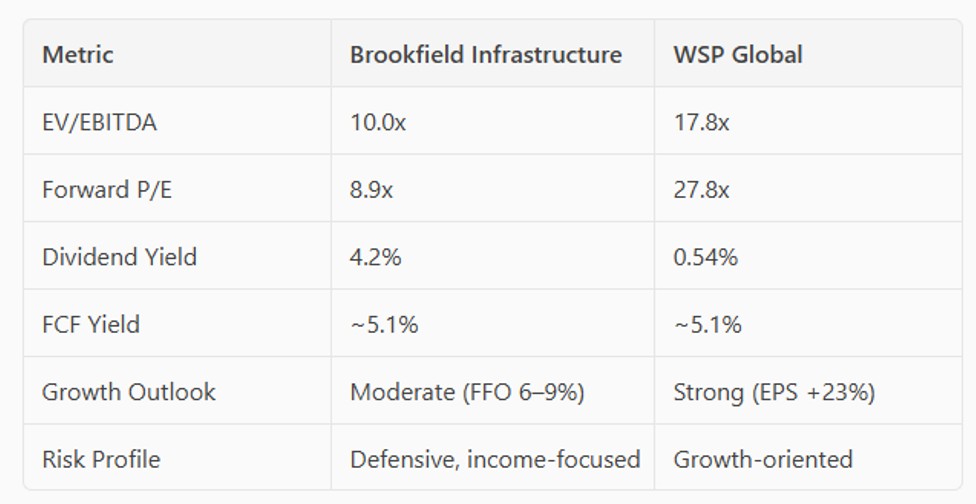

We’re playing this from a few angles for our clients. We recently established a position in WSP Global Inc. (TSX: WSP). It’s a C$37 billion Canadian engineering powerhouse operating in over 40 countries, but with strong regional teams here in Canada. We see WSP as a direct play on the Carney “nation-building” agenda, which includes fast-tracked infrastructure projects aimed at unlocking over $60 billion in economic value.

The company currently boasts a record $16.6 billion backlog, representing 11.3 months of future revenue visibility. It’s growing revenue at nearly 20 per cent year-over-year, and 60 per cent of its revenues are tied to sustainability goals, a key differentiator in today’s ESG-conscious environment. WSP is also backed by major Canadian pension funds like CDPQ and CPP Investments, which adds another layer of institutional confidence.

In short, WSP is a growth trade in a sector that’s just beginning to accelerate. It’s a rare combination of scale, specialization, and strategic alignment with government priorities.

Our other position in this segment of the market is more of a falling rate, value trade on Brookfield Infrastructure Partners (BIPC). The stock is down fairly flat over the past 12 months, which we believe presents a value opportunity, especially in a falling interest rate environment where it will directly benefit given the higher amount of leverage being deployed.

Brookfield is a global leader in essential infrastructure, with assets spanning utilities, transport, midstream energy, and data infrastructure. What makes it particularly attractive right now is that 70 per cent of its revenues are inflation indexed, providing a stable and defensive income stream.

Its data infrastructure segment, which includes fibre networks, telecom towers, and data centres, grew funds from operations (FFO) by 50 per cent, reflecting the surging demand for digital infrastructure. In a world increasingly reliant on artificial intelligence (AI), cloud computing, and real-time data, this segment is poised for continued growth.

Brookfield also has a disciplined capital recycling strategy, selling mature assets and reinvesting into higher-yielding opportunities. This approach enhances long-term returns while maintaining balance sheet strength. For income-focused investors, BIPC also offers a 4.2 per cent dividend yield, 3 to 4 per cent growth inflation protection, and exposure to long-term secular growth, all at a discount.

Central Bank Liquidity: A Tactical Bond Trade

On the monetary side, central banks are loosening policy, and we’re watching the long end of the bond market closely. We believe yields could come down temporarily, creating a tactical opportunity in long-duration bonds. One way we’re expressing this view is through the iShares 20-Year Treasury Bond ETF ($TLT). It’s a potential short-term trade that could benefit from falling yields. However, we’re cautious about holding it long term.

Why? Because if the U.S. Federal Reserve falls under political influence, and sovereign debt levels continue to rise, we expect bond vigilantes to push back. That could lead to a sharp reversal in yields and a repricing of risk across fixed-income markets.

To manage this risk, we’re using options and structured notes with embedded downside protection and near-term upside participation on long-dated bonds instead of owning them directly. This allows us to tactically benefit from rate movements without taking on excessive duration risk.

Final Thoughts

Liquidity is the lifeblood of markets and, right now, it’s flowing from both fiscal and monetary sources. By focusing on infrastructure plays like WSP and Brookfield, and tactically navigating the bond market, we’re positioning portfolios to benefit from both growth and defense.

As always, we remain vigilant. Liquidity can be a powerful tailwind but it can also mask underlying risks. That’s why we’re combining macro awareness with bottom-up fundamentals, and using some structured strategies to manage downside volatility.

The Fed, the Deficit, and the Dollar: A Brewing Storm

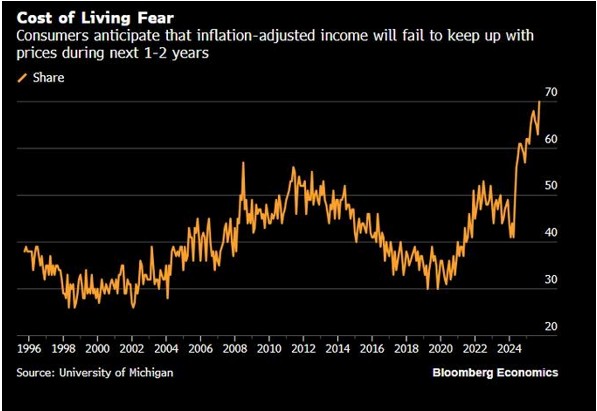

There’s a growing sense that the macroeconomic puzzle is beginning to take shape. While it is already stirring concern in the U.S. bond and housing markets and contributing to weakness in the U.S. dollar, the equity market has so far remained largely unaffected.

Overall, we are watching three powerful forces converge, each with the potential to destabilize U.S. and possibly global financial markets and reshape the investment landscape.

First, the U.S. fiscal deficit continues to run unchecked. Even outside of recessionary periods, the government is operating with deficits in the range of six to eight per cent of gross domestic product (GDP). To manage the mounting interest costs, the Treasury has leaned heavily on issuing short-term debt, flooding the market with supply. This strategy may offer temporary relief but it exposes the government to rollover risk and leaves bond investors demanding higher yields to compensate for inflation, fiscal uncertainty, and the sheer volume of issuance. The bond market is beginning to push back, and long-term yields are rising in response.

Second, the independence of the Federal Reserve appears to be under threat. U.S. President Donald Trump has made clear his intention to exert control over the Fed, most recently with his attempt to remove Governor Lisa Cook and his public criticism of Chair Jerome Powell. If Trump is able to install loyalists on the Fed Board, he could secure a majority by early 2026. This would mark a dramatic shift in how monetary policy is conducted. Rate decisions could become politically driven, with pressure to cut aggressively even in the face of rising inflation and long-end yield spikes. The Fed’s credibility, long anchored in its autonomy and commitment to price stability, would be at risk and markets could push back with added volatility and uncertainty.

Third, there is the risk that this turns into the early stages of a pivot toward MMT-style policy. In this scenario, the Fed begins to monetize deficits directly, buying Treasuries to cap yields and support fiscal expansion. Yield curve control returns and direct purchases of mortgage-backed securities resume. Interest rates are held artificially low to ease debt servicing costs and sustain government spending. While this may seem like a pragmatic solution in the short term, history offers sobering lessons about the dangers of fusing fiscal and monetary policy under a centralized authority.

Consider Weimar Germany in the early 1920s where the government printed money to pay war reparations and fund deficits. Hyperinflation spiralled out of control, prices doubled every few days, and the mark collapsed. The trauma of that period still shapes Germany’s obsession with price stability today.

More recently, Turkey under President Recep Tayyip Erdogan experienced similar dynamics. Erdogan insisted that low interest rates would reduce inflation, defying economic orthodoxy. The central bank lost independence, governors were fired for hiking rates, and . The Turkish lira collapsed and even after orthodox reforms were introduced, investor confidence remained fragile.

Japan’s experiment with yield curve control offers a more nuanced example. The Bank of Japan capped long-term yields to support fiscal sustainability and public debt ballooned past 260 per cent of GDP. The yen held up due to safe-haven demand and capital repatriation but when inflation returned the unwinding was painful and destabilizing.

If the U.S. follows a similar path, its dollar could face serious consequences. The loss of Fed independence could erode global trust in the dollar’s role as a reserve currency. Capital flight from Treasuries would then drive up long-term yields, worsening debt dynamics. Inflation-driven depreciation would become a real risk, especially if MMT-style monetization kicks in. Volatility would surge as markets struggle to price risk in a politicized monetary regime.

Gold is already responding to this uncertainty and is near record highs at around US$3,500 per ounce, with forecasts pushing toward $4,000 by mid-2026. Gold is no longer just a hedge, it has turned into a performance asset. Investor unease over Fed independence and a weakening U.S. dollar is driving demand. Central banks, particularly in emerging markets, are buying in size. For some perspective, foreign central banks now own more gold than U.S. Treasuries for the first time in almost 30 years. Gold exchange-traded fund inflows and futures volumes are also breaking records, signalling that gold is becoming a core holding in portfolios seeking both safety and upside.

U.S. equities are caught in a crosscurrent. In the short term, fiscal stimulus and AI-driven productivity gains are supporting earnings and GDP growth. But over the longer term, higher inflation and rising long-term yields should decrease valuations that are currently at very elevated levels. Rate-sensitive sectors such as technology and real estate may underperform, while investors shift toward inflation-resilient businesses and real assets. Energy, commodities, and infrastructure would become favoured sectors should the market adjust to a new regime.

Putting the pieces together, it’s clear that we may be entering a new era of risk. Fiscal dominance, political interference, and unconventional monetary policy are converging to reshape the global investment landscape. Government bond markets are weak, housing is caught in the crossfire, and the U.S. dollar’s supremacy is no longer guaranteed.

Investors must adapt. Real assets, inflation hedges, and global diversification aren’t just tactical plays, they’re strategic imperatives. The puzzle is coming into focus. The question now is whether portfolios are positioned for what it reveals.

Strategic Asset Allocation and Positioning

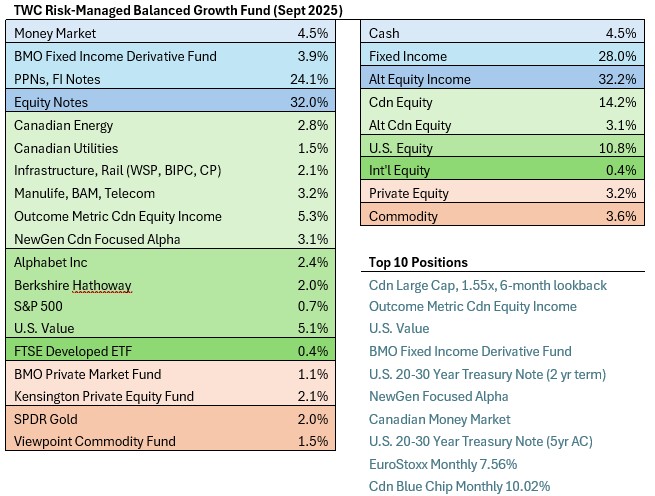

We had a somewhat busy August and September trading for clients. Besides replacing the numerous structured notes that were called away we reduced down our energy exposure, and we boosted our infrastructure and telecommunication holdings.

More specifically, we closed out of MEG Energy locking in a nice 54 per cent gain on the position within the fund. We then redeployed a portion of the proceeds into the Global X Canada Telecom ETF (RING:TSX) on the thesis that the entire sector has been oversold and will benefit from falling interest rates given their higher debt-levels, thereby increasing profitability. We then invested the remaining proceeds into Whitecap Resources (WCP:TSX) as we think it has among the highest-calibre internal inventory bases among companies of its size and a management team, paired with a strong balance sheet, well suited to manage near-term oil price volatility. That said, overall we have taken a meaningful drop in our oil and gas exposure, down to just 2.8 per cent, as we do see some seasonal weakness, paired with OPEC, that seems keen once again on putting a stranglehold on U.S. shale.

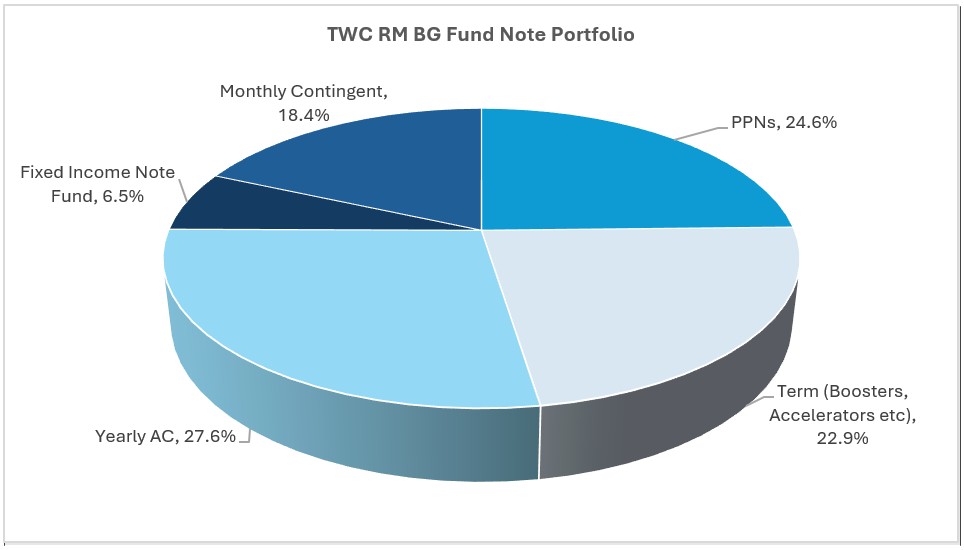

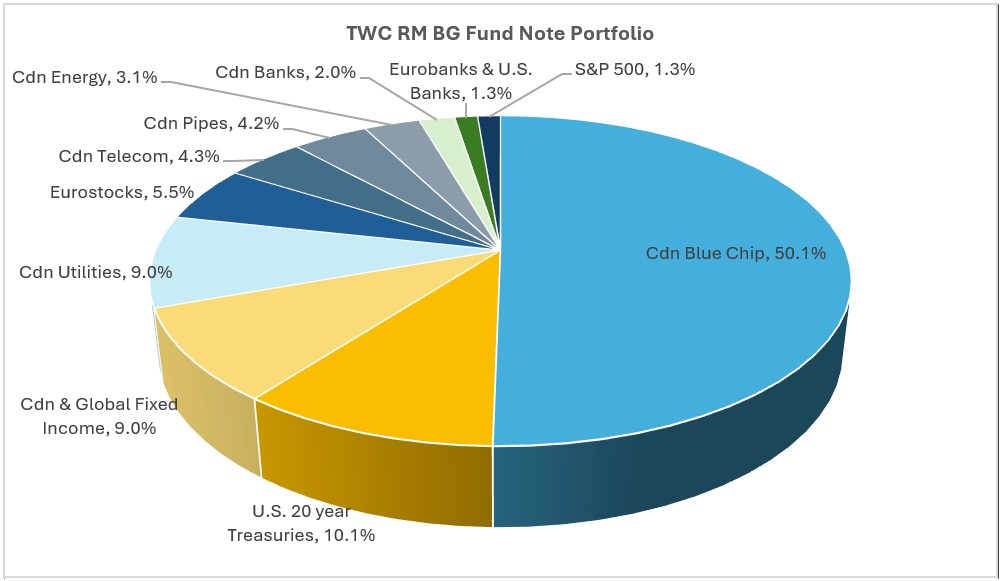

This month, we also take a deeper dive into our structured note portfolio held within the fund. About 25 per cent of the note portfolio is paying out income on a monthly basis, with 28 per cent on a yearly basis as an autocall. The weighted average yield on the yearlies, monthlies, and some of the principal-protected notes (PPNs) is 7.2 per cent. About a quarter of the note portfolio is 100 per cent downside protected with a 46 per cent weighted average downside barrier. On the asset class side, we are taking a barbell approach with half of the notes indexed to a well-diversified index of Canadian blue-chip stocks complemented by nearly 20 per cent in defensive fixed income notes. The other 30 per cent is indexed to individual sectors such as banks, energy, utilities, and pipelines, with a small weighting to the S&P 500 and Eurostocks.

Overall, we’ve been applying the investment philosophy of Charles D. Ellis, renowned author of Winning the Loser’s Game, to our current investment strategy. Ellis, who compared investing to amateur tennis, famously argued that investing is not about hitting winners, but about avoiding unforced errors and consistently returning the ball over the net. In our case, that means avoiding excessive risk, staying disciplined, and focusing on long-term compounding rather than chasing short-term gains. It’s a strategy built on patience, precision, and consistency, and it’s served us well in navigating volatile markets while staying aligned with our clients’ goals. From a performance standpoint, this approach has delivered strong results.

As of August 30, 2025, our fund is up 6.5 per cent year-to-date, now in line with our Global Balanced Passive Index (10 per cent S&P/TSX TR; 50 per cent MSCI Equity ETF; 40 per cent Vanguard Global Bond). Over the past five years, we’ve generated an annualized return of 8.25 per cent, outperforming the benchmark’s 5.9 per cent and landing comfortably within our goals-based target range of 6–8 per cent. It’s a testament to the power of disciplined investing—returning the ball, staying in the game, and letting the score take care of itself.

Research, reads of the month

Deficits and more deficits

The U.S. federal debt is on a trajectory that could reshape the global financial landscape. According to the Congressional Budget Office (CBO), gross federal debt is projected to reach a whopping US$150 trillion by 2055, up from roughly $34 trillion today. That equates to $1.6 million per American household, compared to the current $274,000. The debt-to-GDP ratio, a key measure of fiscal sustainability, is expected to climb to 169 per cent, far above the historical average of 69 per cent over the past 50 years. See Here

The U.S. may have devised a crypto scheme to erase its massive debt at the world’s expense

The U.S. is now trying to rewrite the rules of the gold and cryptocurrency markets. Remember the size of their debt—US$35 trillion. These two sectors (crypto and gold) are essentially alternatives to the traditional global currency system. Read Here

Anatomy of Two Giant Deals: The U.A.E. got chips, and the Trump team got crypto riches

A lucrative transaction involving the Trump family’s cryptocurrency firm and an agreement giving the Emiratis access to AI chips were connected in ways that have not been previously reported. If this is true, this is the largest public corruption scandal in the history of the United States. Read Here

Are bonds really risk-free?

The U.S. Bond Market has now been in a drawdown for 61 months, by far the longest in history. Watch Here

UK tried the same. 16,500 millionaires said no thanks and are leaving

Zohran Mamdani, Democratic nominee for the 2025 mayoral race, says he would try to persuade New York City’s top earners to stay “in part by showing them that asking them to pay more in taxes would increase even their quality of life.” Watch Here In 2025 alone, an estimated 16,500 millionaires are expected to leave the UK, taking £66 billion in investable assets with them and all of the tax revenue for the government. This outflow is more than double that of China and ten times that of Russia. Read Here

Empty rooms taxation

Leftist governments can either cut spending or increase taxes. It’s against their nature to cut spending and so have to increase taxes. But in many cases, they can’t do so on income levels as have already reached a maximum threshold, taking over half of a person’s income. And so they look for stealth taxes such as Australia’s proposed empty room tax. Read Here

Capitalism for big firms, risk for everyone else: Why the investment landscape needs a reset

“Martin Pelletier: A handful of mega corporations wield outsized influence over markets, policymaking and even national economies.” Read Here

The Trudeau bill has come due

“Don Drummond, a former high-ranking executive with the Department of Finance and chief economist at TD Bank, said Canadian governments do not seem to grasp the severity of Canada’s productivity problem and how that directly affects the standard of living. The Trudeau years left the Canadian economy in ‘terrible shape,’ Drummond said, and it doesn’t look so far like his successors have the courage to take the bold steps that are needed.” Read Here

Yes, there is a business case for Canadian oil and gas

“European Parliament President Roberta Metsola says there is a market in Europe for Canadian oil and gas, and signaled European Union nations may be willing to pay a higher price for Canadian conventional energy, as member states work to divest further from Russian energy.” Read Here “Oil exploration capital has been shrinking at an alarming rate since peaking in 2013. Combined exploration capital for 10 oil companies have shrunk 71%, from $37.6 billion in 2013 to a mere $10.8 billion in 2024.” See Here

A Cautionary Tale: The IEA now calls for more investment in oil

The International Energy Agency (IEA) published a report entitled, The Implications of Oil and Gas Field Decline Rates, that states, “If current levels of production are to be maintained, over 45 million barrels per day of oil and around 2 000 billion cubic metres of natural gas would be needed in 2050 from new conventional fields.” Read Here

Cracks forming in Canadian private real estate market

The Canadian private real estate fund market is undergoing a significant unwinding, marked by a wave of redemption restrictions or “gating” across several major funds. This trend has emerged as rising interest rates and declining property valuations have strained liquidity and investor confidence. Read Here “What If A Condo Developer Destroys Their Own Pre-Construction Buyers? Starts Selling Units For 39% LESS Than It Sold The Units 5 Years Ago? Well, it appears to be happening. Oakville Ontario Developer who sold Pre-Construction to Buyers at $1100 sqft now $675 sqft.”

The looming advisor shortage in US wealth management

McKinsey estimates that we are about to enter a massive shortage of wealth management advisors in the U.S. With the looming retirement boom and one of the largest transfers of wealth in history through inheritance, younger folks are simply not ready to manage these assets.

On the Positive

The power of art

“Bill Murray talks about the painting that stopped him from taking his life after being asked if there were a moment how art has made a difference in his life. Watch until the end to see the painting.” Watch Here

As a neurosurgeon I care a lot about road safety.

By now you’ve probably seen Waymo’s stunning safety results (like 91% fewer serious crashes). But they didn’t just publish data headlines. They released the raw CSV files and data dictionaries.

I did a much deeper analysis. A fascinating story emerges when you analyze how they’re achieving this.

This isn’t incremental improvement — it’s categorical. We’re looking at the potential elimination of traffic deaths as a leading cause of mortality.

The opposite of belonging is fitting in

“I’m a researcher, storyteller, and Texan who’s spent the past two decades studying courage, vulnerability, shame, and empathy.” Watch Here and if you like, Read Here

Priorities

“There is no Valhalla at the top of Rock Mountain.” Watch Here

You cannot change the world, but you can change how you perceive it.

While we cannot directly control external events or the behaviour of others, we do have agency over our thoughts and feelings. Changing perception involves adopting a different mindset. For instance, viewing challenges as opportunities for growth can lead to resilience and a more positive outlook.

Our perception directly affects our happiness. By focusing on gratitude, learning, and acceptance, individuals can cultivate a more fulfilling life. Recognizing that we can change our perception fosters a sense of empowerment. Instead of feeling victimized by circumstances, we can choose how to respond, which can lead to a greater sense of control and personal growth. Take responsibility for your perceptions and, in doing so, empower yourself to lead more fulfilling lives amidst an unpredictable world. Read the book. It’s a life changer. And Watch Here

Thanks for visiting

To find out more about the TriVest team and how we manage wealth, follow us on Twitter, LinkedIn or Facebook . Please email us if you want to find out more about our services.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss. This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors and any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This report may contain links to third-party websites. WAPC is not responsible for the content of any third-party website or any linked content contained in a third-party website. The inclusion of a link in this report does not imply any endorsement by or any affiliation with WAPC.

Structured Notes are not suitable for all investors. The notes do not pay dividends, and any dividends paid on the underlying constituent’s may not factor into the return calculation that determines your return. The protection and potential augmented returns on these notes are only available when held to maturity. These notes do not offer any protection if they are sold before the maturity date. If sold before the maturity date, returns may be positive or negative. These examples are for illustrative purposes only and should not be construed as an estimate or forecast of the performance of the Index or the return that an investor might realize on the Notes.

Wellington-Altus Private Counsel Inc. (WAPC) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

All trademarks are the property of their respective owners.

© 2025, Wellington-Altus Private Counsel Inc. ALL RIGHTS RESERVED.

NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca