Click here to download this article as PDF.

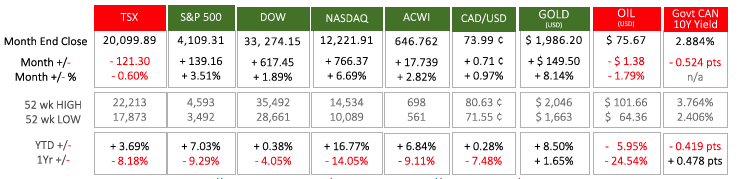

Last Month in the Markets: March 1st – 31st, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in March?

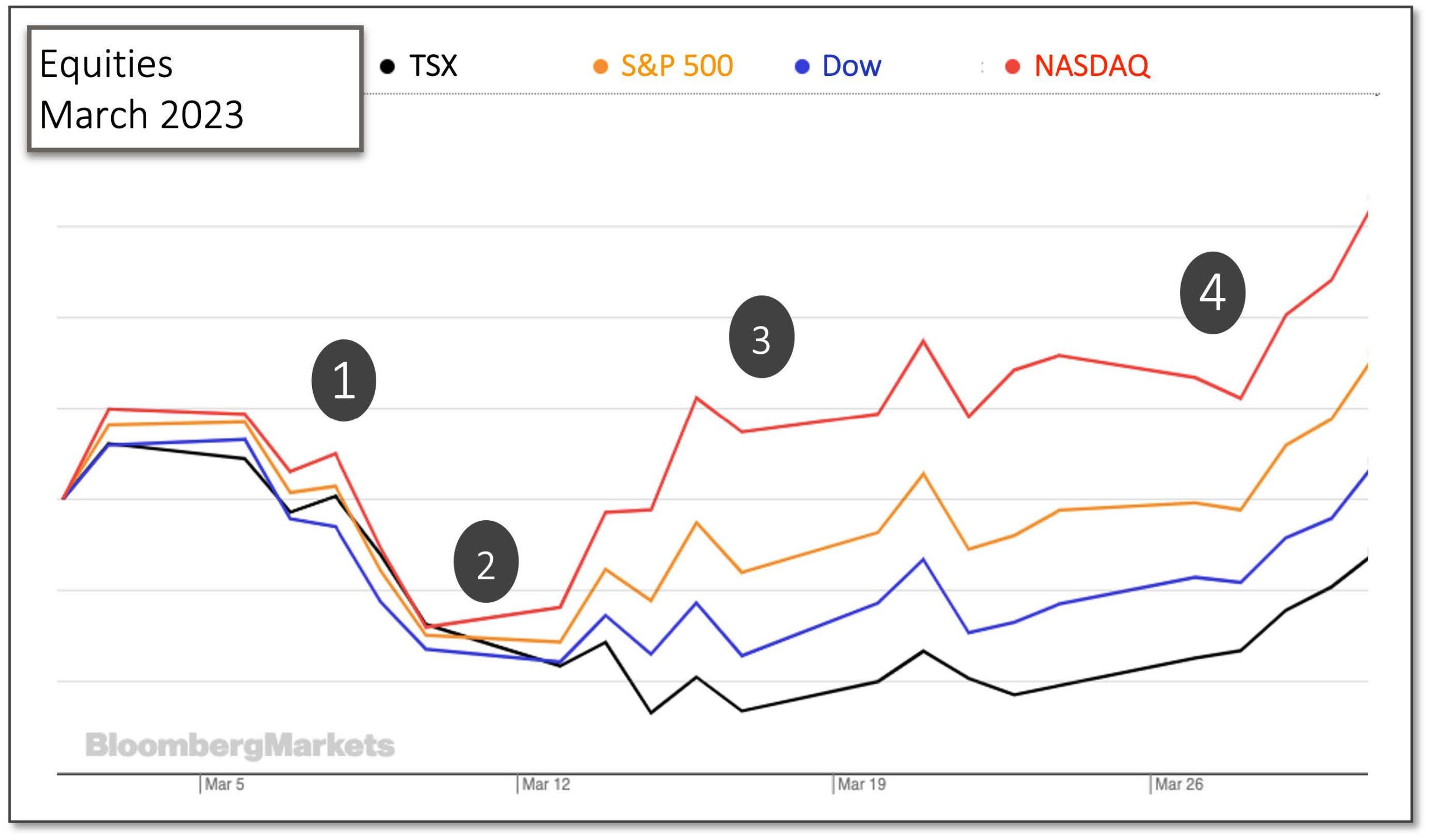

Last month was difficult to endure for investors concentrated in North American equities, especially those with significant holdings in financial services, which includes many Canadians. By the end of March, the TSX finished almost where it began the month, and the U.S. equities indexes rose 2 to 6½ percent.

Rates of interest and inflation continued their influential roles, but the failure of two U.S. banks, concern over many more institutions, and a Swiss government-led acquisition of Credit Suisse by UBS consumed most of the attention as markets rose, dropped swiftly, and then steadily regained (or improved) their position.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

March 2023 will be remembered more for its turmoil than the results posted by month-end:

- On March 7th, U.S. Federal Reserve Chair, Jerome Powell, testified in Washington where he reiterated the central bank’s commitment to reduce inflation to the target of 2%. Coupled with the strength of the U.S. economy, “which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” Despite the other good news for the economy (employment, GDP), continuing to increase interest rates can lower the value of equities as the fear or likelihood of recession increases. Watch Powell video

- Much attention has been paid to the effect on consumers from rising interest rates, but financial institutions can be exposed, too. As short-term rates rise, and banks are forced to pay current rates on deposits, their long-term investments at lower rates of return can cause a narrowing of margins. A confidence-crisis and bank-run resulted, and regulators in California shut down Silicon Valley Bank on March 10th. This led to additional scrutiny and wider worries for bank solvency and was amplified when the FDIC shuttered Signature Bank on March 12th. The confidence crisis in banking triggered a decline for equity indexes. SVB Fallout Spreads

- Equity markets began a tentative recovery after the U.S. Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation added increased protections for depositors and introduced a new borrowing facility to allow banks to meet short-term cash Joint release

- The effects of increasing interest rates were not limited to the United States. The nascent recovery was imperilled when Credit Suisse was exposed and was rescued by UBS under very generous conditions. The deal was brokered by the Swiss government to protect depositors, some investors, and the Swiss banking The reputation of Swiss bank security and discretion could be damaged further as Switzerland’s Attorney General has launched a criminal investigation into the takeover. Swiss investigation CS/UBS

- As the failures, takeovers and concerns for banks continued so did the analysis and reflection. The growing sentiment is that many of the most at-risk banks had problems with managing traditional assets, not complicated derivatives, and were largely exposed to interest-rate-risk. As government institutions stepped-in to protect depositors and reassure investors share prices have begun to respond CNBC and bank contagion

What’s ahead for April and beyond in 2023?

Although the risk and issues for banks seem to be easing, the health of the financial sector will likely play a significant role for markets. As Jerome Powell stated during his press conference following the interest rate decision on March 22nd, it is expected that lenders will raise requirements, which will limit access to capital in the marketplace. This will allow banks to either hold cash for liquidity or increase income through higher rates.

Central banks will continue to monitor overall economic growth (Gross Domestic Product), employment, as well as inflation. Inflation growth has ebbed and has begun to decline, if only slightly, yet remains far from the shared target of 2%. The next scheduled interest rate decisions from the Bank of Canada, Federal Reserve and European Central Bank are April 12, May 3, and May 4, respectively.

BoC monetary policy Fed monetary policy ECB monetary policy

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge