Click here to download this article as PDF.

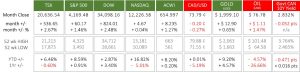

Last Month in the Markets: April 3–28, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in April?

Last month demonstrated the resiliency of equity markets. After a quick rise to begin the month, North American indexes suffered a hiccup. The indexes then repeated this same pattern twice before the month ended successfully for most. The NASDAQ finished the month where it began, but the TSX, S&P500 and Dow each increased by 2.7%, 1.5% and 2.5%, respectively.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

April 2023 may be remembered more for its turmoil than the results posted by month-end:

- Early in the month, Federal Reserve Bank of Cleveland President Loretta Mester indicated that the federal funds rate had more upward movement needed to quell inflation. The spectre of rising rates leading to a recession continued to threaten equity markets at the beginning of the month. Watch Fed President Mester here

- At 8:30 a.m. EDT on April 12 the U.S. Bureau of Labor Statistics released consumer inflation data for March. Prices last month rose 0.1%, while the year-over-year rate was measured at 5.0%. The annualized rate remains stubbornly above the Federal Reserve’s target of 2% annual price increases. Markets showed that heightened inflation leading to additional monetary policy moves to slow demand, including more interest rate rises, are possible. The belief that rates will rise again is not universally held at the Fed, and the differences of opinion are also contributing to market confusion.

a. About two hours later, the Bank of Canada (BoC) released its interest rate announcement, also, on April 12. For the second consecutive time, the Bank did not change its policy interest rate, holding the target for the overnight rate at 4.5%. BoC projections have Canadian consumer inflation falling to about 3% in the middle of 2023 “because of lower energy prices, improved supply chains and restrictive monetary policy,” which is already in-place. BLS release; Bloomberg and Fed rate increases; BoC release. - April 25 did not start well for equities as all indexes dropped close to 1% in the first hour of trading. By end of the month those short-term losses had been reversed. Two key economic indicators were released last week in the U. S., Gross Domestic Product (GDP) and Personal Consumption Expenditures (PCE) price index. Total economic output, GDP, grew at an annualized rate of 1.1% for the first quarter of 2023, which is below most estimates. GDP grew at a rate of 2.6% in the final quarter of 2022, and 2.1% for all of 2022. PCE, which is the Federal Reserve’s preferred indicator for inflation rose 4.2% in March, down from February’s 5.1%. The current period exceeded estimates of 3.7%. The result of these two items was a strong uptick for equities by the end of the week. It appears that the economy is slowing, and inflation is softening (not as much as projected or desired), which alleviates some pressure from the Federal Reserve to continue raising interest rates. CNBC GDP & PCE; BEA PCE release.

What’s ahead for May and beyond in 2023?

Not much has changed in the past year since central banks began raising rates to lower demand in their fight against inflation. The path of inflation and efforts to control it will continue to have the largest impact for investors.

The next significant event for markets will likely be the Federal Reserve’s interest rate announcement on May 3. The prediction that the Fed will deliver a “one and done” (one more interest rate increase before pausing and/or lowering rates) continues to be supported. The delivery of recent economic news for GDP and PCE supports this policy.

The Bank of Canada has paused rate increases for its last two announcements, and the Fed is likely to pursue this strategy relatively soon. Wednesday will be an important day for equity investors.

The European Central Bank (ECB) also has an interest rate announcement scheduled for May 4th, 2023. The implication from the ECB is not as important for most Canadian investors, but actions in Europe will be interpreted for North American firms and their investors.

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge