While managing finances is essential to adulthood, a child’s financial education is often overlooked or taught informally. Parents have an opportunity to provide this education and intentionally shape their child’s financial literacy. This foundation develops positive habits when it comes to managing money, and one of the best tools to build these habits is an allowance.

The recommendations below are based on my experiences as a parent, in partnership with my experience in wealth management.

When should you start?

I started my son on a weekly allowance at the age of five. I made this decision based on his general understanding of money and basic math.

If you haven’t started, the best time is now.

How do you start?

Sit down with your child and explain that you want to teach them about money. Ask what they think money is, how you get it, and what it does.

Because my son was five when the allowance started it made it easier for him to count. But he needed more frequent reinforcement. At the age of eight, I started giving it monthly.

How much?

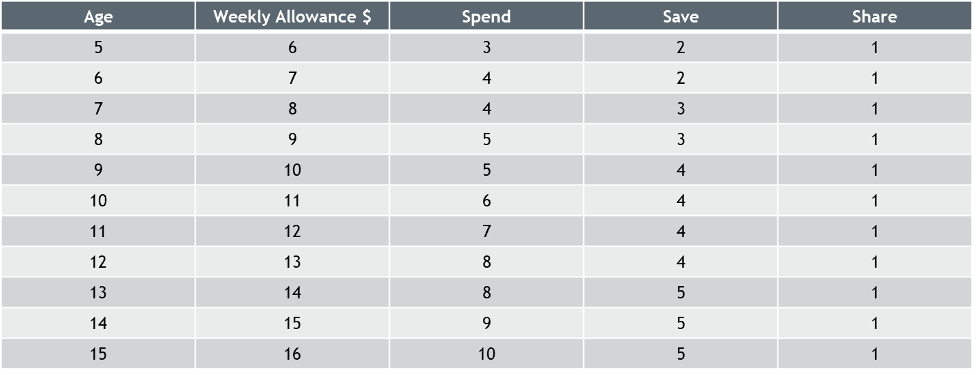

I started with an allowance of one dollar per week of age + one dollar. As my son is now ten, he receives eleven dollars a week.

The allowance can continue until 16, or when the child has started earning their own income.

The jar system

I use the jar system to allocate the funds:

Spend: These funds can be used for any purpose. We have also used the concept of the spend jar to discuss expectations for family activities. We discuss what we as parents are paying for and any expenses that our son needs to cover through his spending jar.

Save: These funds are set aside for major purchases. My son’s first save jar purchase was an air hockey table. Now that he is older, he has used his savings to purchase video games and he covered half of the cost of a new video game system. Start by having your children talk about some of the things that they would like to have, research the cost, and figure out how long it will take for them to save for that big ticket item.

Share: These funds are set aside for others. We have used the funds in this jar for charitable purposes, school fundraising initiatives, and purchasing gifts for friends’ birthdays.

I created a sample of allocation to each jar, based on age, as a guide:

Cash-flow logbook

Keep track by having a logbook for the funds coming in and out of each jar. Every entry, no matter how small, should be tracked. Your child can look back at what they have used their money for. When saving for a major purchase, you can also keep track of the time needed to achieve their goal.

What do you do as your children get older?

Changing from the jar system to a bank account may become more practical. This decision is based on your child’s maturity, with 13 years of age as a good starting point. Continuing the habit of having your child keep track of their expenses, during this shift, is important.

Key benefits:

- The jar system provides a good visual of monies available, teaching that money is a finite resource.

- The save jar teaches delayed gratification and the concept of planned spending.

- The share jar teaches them that not all money belongs to them (a great lesson in future payroll deductions).

- The logbook establishes the behavior of tracked spending and accounting for every dollar.

- You are empowering your children by giving them an opportunity to make decisions and address consequences in a safe environment.

Avoid these mistakes:

- An allowance is an educational tool and not a reward/punishment system, which can turn money into an emotional resource instead of a practical one.

- Avoid making an allowance contingent on completing chores. If a younger child wants the opportunity to earn extra money, then working for the additional funds via a special task may be warranted.

- Avoid advances. This can create bad habits and you could be setting up your child to rely on short term credit as they enter adulthood.