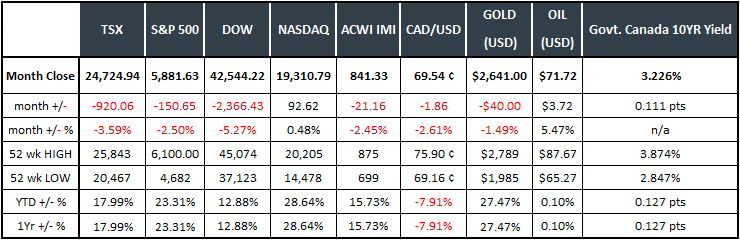

Last Month in the Markets: December 2 – 31, 2024

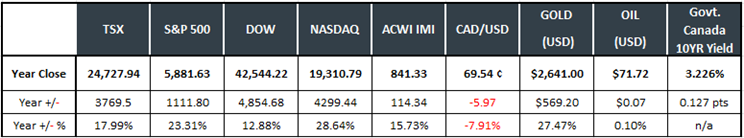

Last Year in the Markets: January 2 – December 31, 2024

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in 2024?

Last year was productive for equity investors, with Canadian and American indexes delivering remarkable returns for the second consecutive year. The TSX beat its 2023 performance by 10 percentage points, the S&P 500 fell just 1 per cent behind last year’s stellar results, as did the Dow Jones Industrial Average (DJIA), and the NASDAQ more than doubled the DJIA performance in 2024.

The first quarter of 2024 was a steady climb after the first week, a short stumble in April was quickly recovered and a three month rise was followed by a one month decline from mid-July until early August. After another short dip in September, equity values rose steadily and delivered strong results to the end of December.

Highlights of economic events that contributed to market performance in 2024:

January 18

U.S. equities were assisted by a legislative advance, when the U.S. Congress approved another stop-gap spending bill to keep the federal government operating until the beginning of March. CBS News

January 24

The Bank of Canada held its policy interest rate, the overnight rate steady at 5 per cent, the Bank Rate at 5.25 per cent and the deposit rate at 5 per cent, while continuing its program of quantitative tightening. “Global economic growth continues to slow, with inflation easing gradually across most economies. While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment.” “Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.” BoC release and MPR

February 9

The S&P 500 breached and closed over 5,000 points for the first time in its history. After closing over 4,000 points in April 2021, it took nearly three years to reach the next millennium. Much of the U.S. gains can be attributed to the growing sentiment that the U.S. Federal Reserve (the Fed) may have achieved a soft landing of slowing growth and inflation, but not placing the economy into a recession.

February 22

The NASDAQ jumped 3 per cent, largely driven by Nvidia, the U.S. computer chip manufacturer at the forefront of the artificial intelligence industry. Nvidia released an optimistic forecast of earnings that projected a threefold increase in quarterly revenue. Its 2023 fourth quarter revenue was $22.1 billion, a 265 per cent increase from Quarter 4 of 2022. Nvidia’s share price jumped 16 per cent on the day, and its value breached $2 trillion and pulled the NASDAQ along with it. CNBC and Nvidia NVIDIA press release

March 19

Domestically, Canadian consumer inflation continued to moderate as the Consumer Price Index (CPI) rose 2.8 per cent on a year-over-year basis in February, down from 2.9 per cent in January. Groceries contributed to the small decline, while gasoline prices offset the dip after rising 0.8% for the month. The slowing of inflation was positive news for consumers and, eventually, borrowers since interest rates were raised to temper and reduce price increases. The Bank of Canada did not indicate the timing of rate reductions. StatsCan release CBC and BoC

April 25

The latest real GDP data from the U.S. Bureau of Economic Analysis (BEA) showed that annualized economic growth slowed to 1.6 per cent in Q1 2024, down from 3.4 per cent and 4.9 per cent in Q4 and Q3 of 2023, respectively. Slowing GDP growth relieves pressure to maintain current interest rates if it leads to lower inflation levels and lower job creation. BEA release, CNBC and GDP

April 30 to May 1

April transitioned into May with the Fed interest rate announcement. Markets awaited confirmation that the Fed would keep interest rates unchanged, and the Fed did not disappoint analysts. The federal funds rate stayed in the range of 5.25 to 5.5 per cent. The Fed will also slow the pace of reduction of its securities holdings, which should reduce liquidity in the system. Fed release Fed release

May 24

The S&P 500 earnings season neared completion, with 96 per cent of companies reporting. 78 per cent delivered a positive earnings surprise, and 61 per cent achieved a positive revenue surprise. FactSet Insights Q1 2024.

June 5

The Bank of Canada reduced its policy interest rate, the overnight rate, by 25 basis points to 4.75 per cent. The rate had been at 5 per cent since July 2023, and this was the first reduction since March 2022 as our central bank fought against domestic consumer inflation. According to the announced press release “The Bank’s preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum.” It also included, “With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive.” CBC News and BoC

July 15

A massive computer outage caused by a software upgrade by cyber security company, CrowdStrike, disrupted capital markets in addition to fouling transportation networks. The tech-heavy NASDAQ lost approximately 3.5 per cent during the third week of the month after six weeks of gains.

July 24

The Bank of Canada lowered its overnight rate by 0.25 per cent (25 basis points) to a target of 4.5 per cent and released its latest Monetary Policy Report. According to the Bank of Canada announcement, “The Bank’s preferred measures of core inflation are expected to slow to about 2.5 percent in the second half of 2024 and ease gradually through 2025.”

August 30

August concluded with less than positive news. U.S. inflation, as measured by the core Personal Consumption and Expenditures price index (PCE) increased 0.2 per cent in July and 2.6 per cent in the past year. This news contributed to a decline in equities for the first week of September based on the belief that the Fed might act conservatively with its rate reductions. BEA PCE release CNBC and PCE

September 25

Oil prices dropped as Saudi Arabia abandoned its $100 per barrel target. The Saudis announced that they would maintain production levels and seek to regain market share with lower prices, which was good news for consumers and companies relying on petroleum prices. FT and oil

October 23

The Bank of Canada cut its policy rate another 0.5 per cent (50 basis points). After three 0.25 point cuts and this 0.5 point cut, the overnight rate had been lowered to 3.75 per cent from its peak of 5 per cent. The rate cuts contributed to the lowering of year-over-year inflation, which sat at 1.6 per cent according to the most recent StatsCan release.

The Bank of Canada also released its quarterly Monetary Policy Report outlining its rationale behind its rate cut and expectations for the economy, employment and inflation. BoC rate announcement Monetary Policy Report CBC and BoC rate cut

November 5 to 8

A decisive election win was the best result for equity investors. A Republican-controlled Senate and House will facilitate the confirmation of federal appointees and the passing of laws. President-elect Donald Trump promised an extension to his 2017 corporate tax reductions, reduced government spending and decreased regulation, which should encourage positive corporate results and increased values. NBC News and markets Global News election results CNBC on elections and markets

December 16

Canadian news centred on politics and inflation. Monday brought the federal government’s Fall Economic Statement. The deficit rose to $61.9 billion, far above the most recent projection of $40 billion. Chrystia Freeland resigned as Finance Minister and calls for an election and the resignation of Prime Minister Justin Trudeau intensified. FES and CBC FES and CBC (2) Fall Economic Statement

In November the Canadian CPI rose 1.9 per cent on a year-over-year basis, down from 2.0 per cent in October. Slower price growth was broad-based with the deceleration mostly caused by prices for travel tours and mortgage interest costs. However, grocery prices rose nearly 20 per cent since November 2021. During the month of November, prices were flat after rising 0.4 per cent in October. StatsCan CPI release