Answer: Pretty much everything

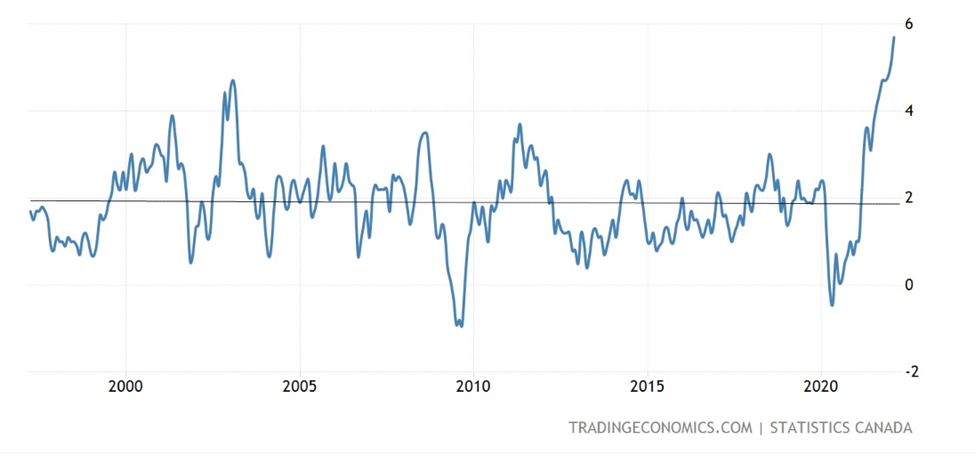

Wow, like most, we got a pretty good shock this past weekend at the gas pump and the grocery store. Inflation in Canada is at a whopping 5.7%. The Bank of Canada’s (BOC) 2% target rate seems to be way in the rear-view mirror and to add insult to injury, the BOC boosted interest rates by 0.50% last week…make it stop.

We have now emerged from COVID-induced inflation to conflict-induced inflation and the bad news is the central banks, including the BOC, have no way to control those factors. The good news is that at some point, inflation will inevitably come down to more reasonable levels but in the short term, likely the next 6 to 12 months, it’s going to persist. As an FYI, the long-term average of inflation is about 2% which is consistent with the BOC target. Against this background, we can explore what inflation really is and what it does.

Here’s the Thing

Current inflation, as a number, really doesn’t mean much. What central bankers attempt to do is control expectations. It is the expectation of inflation that creates the real problem. Look at it this way: if you are considering a major purchase, specifically one which causes you to borrow money and you thought that the price of the item would be more expensive a year from now, you might be tempted to buy it now before the price goes up. This increase in overall demand then creates its own spiral and actual prices and inflation go up even further. The only lever that the BOC really has to influence (read not directly affect) interest rates is to boost the overnight lending rate as they did last week. By raising rates, the cost to borrow increases with the hope that higher rates will curtail demand and hopefully inflation.

If the expectation of inflation diminishes then eventually, and only eventually as measured in months, will inflation come down and it will become less expensive at the pump and the grocery store. Central bankers around the world are now embarking on a series of rate hikes to mitigate expectations and lower inflation. As mentioned above however, governments including our own have no real immediate mechanism to lower the price of oil and gas or groceries – so we will just have to wait out the next few rounds of rate hikes so that the expectation of inflation goes away and with it the actual inflation rate.

How is this a Good Thing?

Typically, higher inflation is an indication of a healthy and growing economy. Demand is good and so companies are receiving orders and making money. This tends to bode well for the stock markets, however less so for bond markets with rising interest rates. Historically, from the initiation of rate hikes stocks do well for quite some time, often up to two years. It is only when the rounds of increases stop or worse, decline, that stocks begin to suffer. Central bank easing is commensurate with a weaker economy and therefore weaker stock prices. This is not the case at the moment. In the short term, as much as it hurts at the pump and the grocery store, people are working, wages are increasing (wage inflation), and the economy is strong.

As always, if you want to discuss, give us a call.

Photo Credit: Credit: Photo by Ru . on Unsplash

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

© 2022, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.