Blog Posts

Phew….September’s Over

September is historically the worst month of the year and this year didn’t disappoint. Wait, yes it did. The TSX Composite was down about -3.7% and the S&P 500 was down about -4.9%. Year to date, Canada was only up about 0.8%. The S&P 500 and NASDAQ have vastly outperformed Canada and the Dow Jones Industrial Average. What’s next?

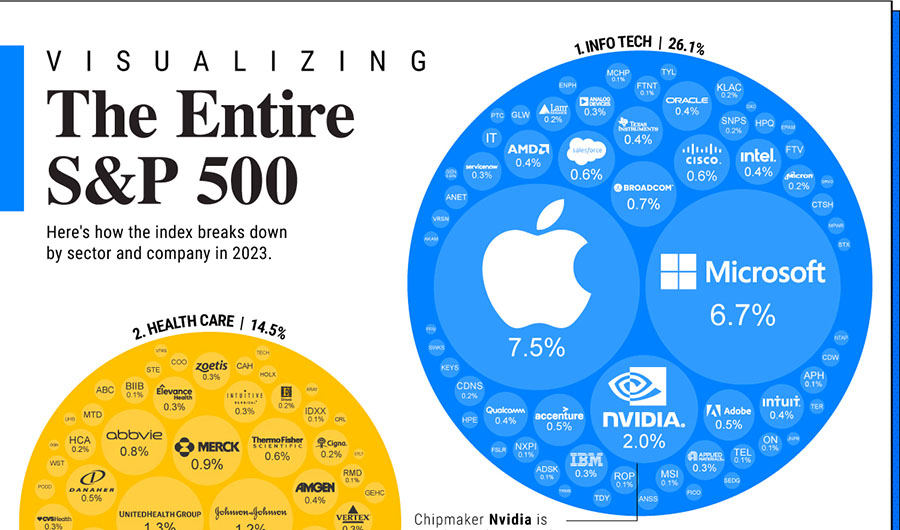

Visualizing the S&P 500

Clients sometime ask about the S&P 500 and whether or not they are or should be invested in it. The S&P 500 is an index of the largest 500 companies in the Unites States stock market, the largest market in the world. Together, S&P 500 companies hold $7.1 trillion in assets and account for close to 80% of available market capitalization.

All About the Fed

All the economic news is currently about what “the Fed” will or won’t do next. Raise rates, lower rates, or take a pause. But what does that mean exactly and how does it relate to your investments? Let’s break it down.

Structured Notes

Principal At Risk (PAR) structured notes are the most complicated instruments we recommend to clients. We are breaking them down for you this month and giving you a couple of examples of ones that some of you have owned. Structured notes can work in a portfolio as an alternative to fixed income.

Naming Your Executor: Friend or Pro?

A key element of estate planning is choosing an executor, someone you trust to carry out the instructions in your will. To ensure that the administration of your estate is completed efficiently and economically, it’s important to carefully evaluate your needs and choose your executor wisely.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

© 2025, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.