A freight train of a punch connected square on his nose, fireworks exploded behind his eyes, blinding him, freezing time, and turning his legs into jelly. This unranked, washed up, has-been of a boxer should have gone down but, out of the brain fog a single word emerged from his jumbled mind, “No!” James Braddock, an unranked, injury prone fighter, working as a longshoreman in the port of Hoboken said “No.” Refusing to give up, he wiped the blood from his face and went back to work. He went on to do it again in four more consecutive fights before contending for the Heavyweight Championship in 1934.

During the worst of the Great Depression, when hope was a distant dream, James Braddock emerged as the hero the working poor needed. He was the quintessential “everyman”, rising from gruelling hardship, fighting not just for a championship but for the enduring spirit of every soul crushed by hard times. When he won the heavyweight title, this underdog earned the moniker by which he is still known – the Cinderella Man.

source: Wikipedia

If financial markets are a battle, July featured a comeback story similar to Cinderella Man’s! For many months now the undisputed champion of the markets has been the world’s largest companies – Big Tech. Arrogant and brash they have thumped all contenders, particularly the hapless small cap stocks, financials, and utilities, month after month – until July 2024, that’s when the story changed.

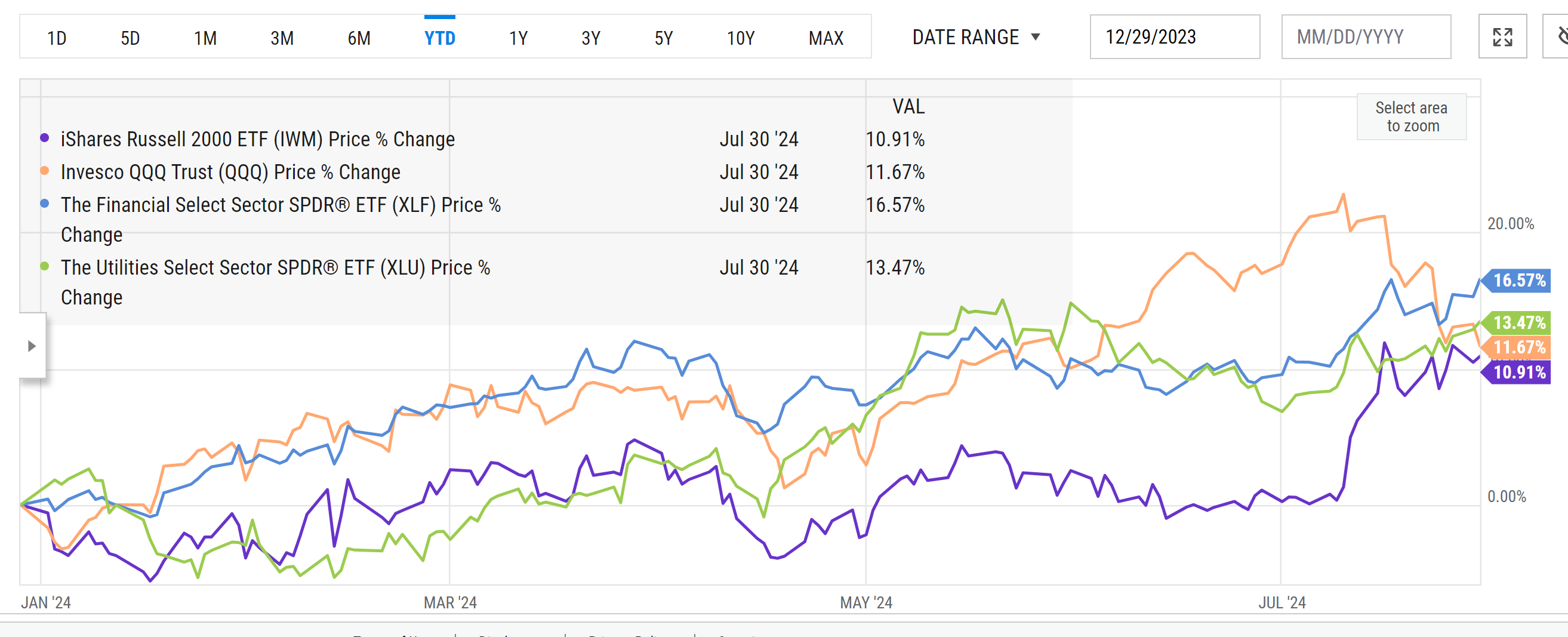

Here’s the tale of the tape:

source: YCharts.com

Amazingly, small cap stocks (purple) pulled themselves off the canvas even as the tech-heavy Nasdaq (orange) nose-dived. In the process, investors also developed a new infatuation with financials (blue) and even utilities (green). Trends were relatively similar (if less extreme) in Canada. Just like the Cinderella Man story, this is a story you and I can feel good about!

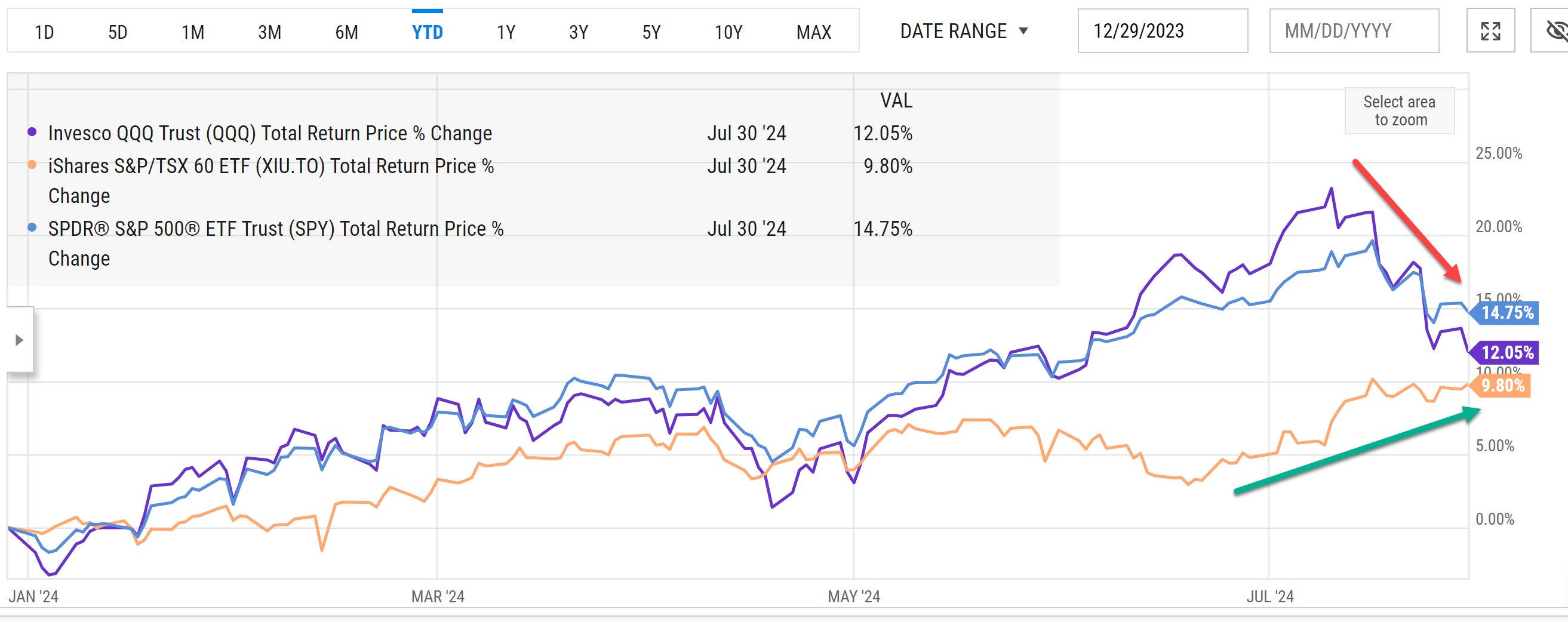

Canadian stocks were on the canvas leaving Canadian investors feeling left out. Now the S&P/TSX 60 is beginning to close the gap. More importantly, the Canadian stock market is, once again, making new all-time highs led by the Canadian banks.

source: YCharts.com

This change is less a passing of the baton as it is a catching up with technology shares. We like to see lots of stocks from different sectors advancing when the stock market rises. It increases the likelihood that the growth in stocks is reflecting changing conditions in the economy (or at least the expectation of changing conditions in the economy) as opposed to “herding behaviour.” For months now, sceptics have been warning of imminent disaster as tech “went at it alone.” Now with much broader participation in the rally those sceptics need to find something new to worry about.

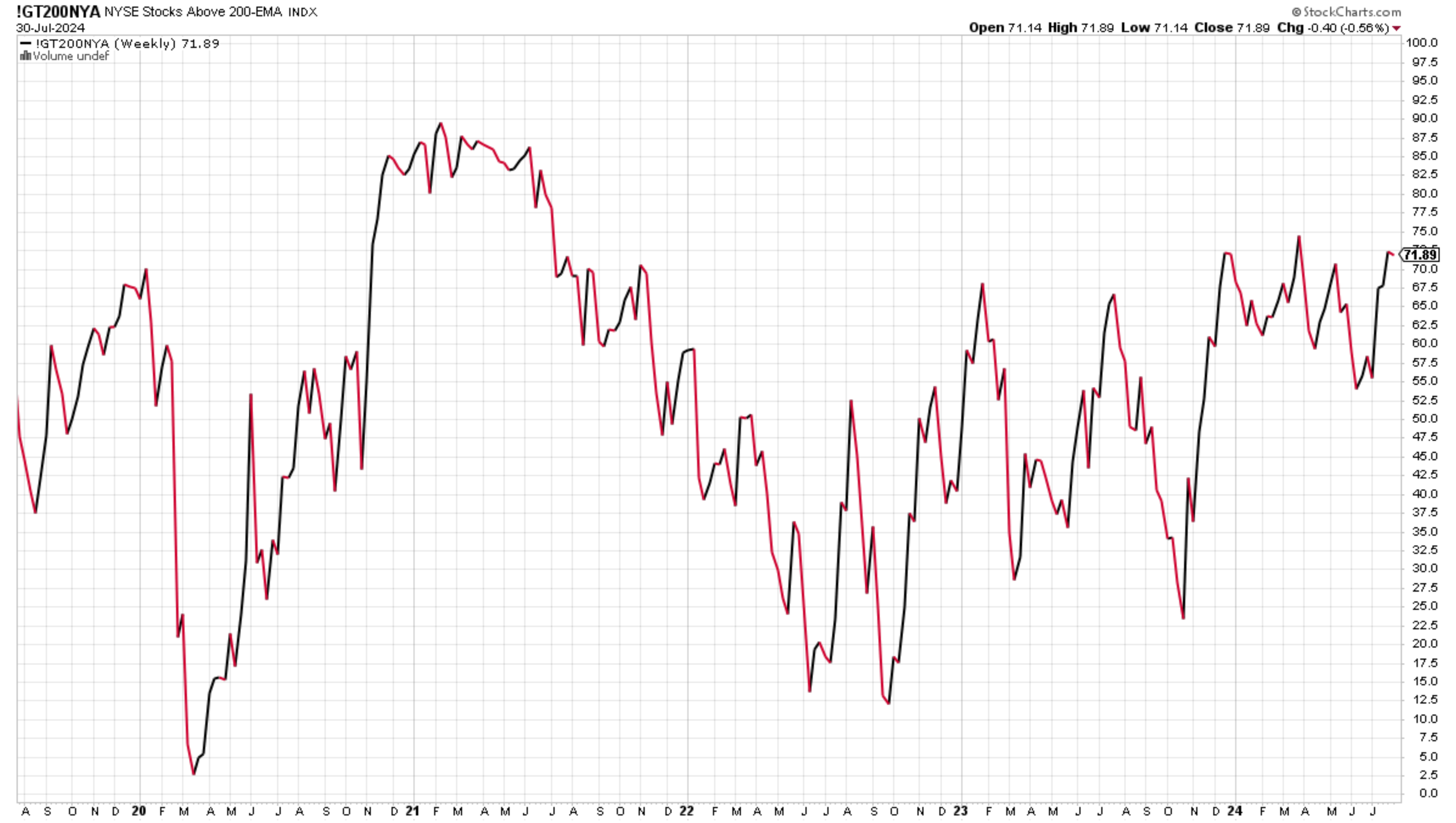

Currently, over 70% of U.S. stocks are trading above their long term moving averages. This is a sharp recovery from approximately 55% a few months ago. In Canada the number is over 80% above their long-term moving averages!

source: StockCharts.com

So, with Canadian banks and utilities finally recovering can Canadian investors enjoy the rest of the summer with nothing to fear? Sadly no. In fact, those travelling to the U.S. for a family vacation will be paying more, because the loonie doesn’t have the same grit that the Cinderella Man had.

source: StockCharts.com

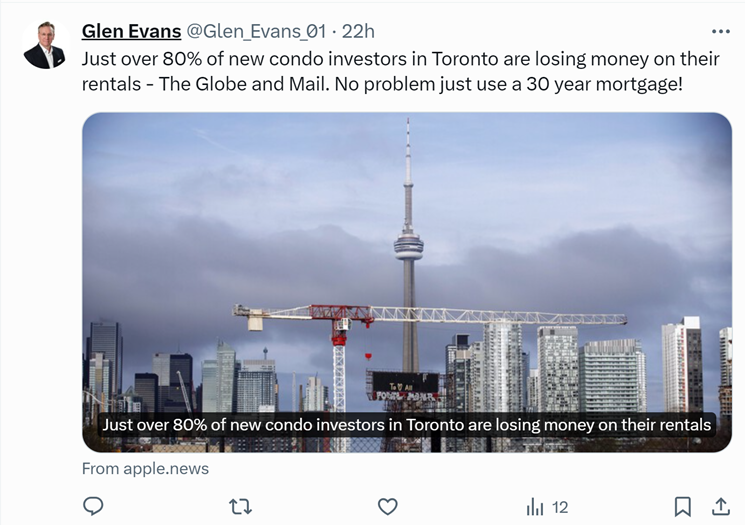

Ironically, the Loonie’s weakness is actually a benefit for Canadians investing in the U.S. Indeed, so far this year the Loonie has fallen over 4%. This is another reason for Canadians to diversify outside of Canada. Our anemic growth prospects relative to our neighbours, as well as a housing affordability crisis that is now morphing into a condo-crash (see Tweet below), suggests that the Canadian economy is materially weaker than the U.S. If that is true, it implies that the Bank of Canada will have to cut rates further than the U.S. Broadly speaking that will make the Loonie less attractive in comparison. I expect that the $0.72 cent level will not hold.

https://twitter.com/Glen_Evans_01/status/1818296869845368899

Overall, July’s performance underscores a couple of timeless investment truths:

- Diversification both among sectors and geographically helps smooth out the extremes of the market.

- Like the Cinderella Man, investors need grit to hold during periods of underperformance, to get up off the canvas and stay in the fight.

Watch the Video: July 2024 Update

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Briana and I will be here – ducking and weaving!

Enjoy the rest of your summer.

Glen