Credit: Rachel Scott Smith

Siriusly, It’s Hot Out There!

In the dawn’s twilight, before the Sun had risen, the ancient Greeks were already scanning the sky for the rising of Sirius, the star named after Orion’s dog. When Sirius, the brightest star in the night sky, decided to show up fashionably late in July or August, the Greeks took note—believing its dazzling light, paired with the Sun’s already intense rays, was the cosmic equivalent of turning the thermostat up to 11. These “Dog Days of Summer,” as they were called, were seen as a time of lethargy, ill winds, and probably a good excuse to avoid anything resembling effort. Today, while we might not fear these days, they’re the perfect time to seek shade, enjoy the comforts of the cottage, and take a moment to reflect on the year so far. And what a year it’s been!

Stocks to the Moon!

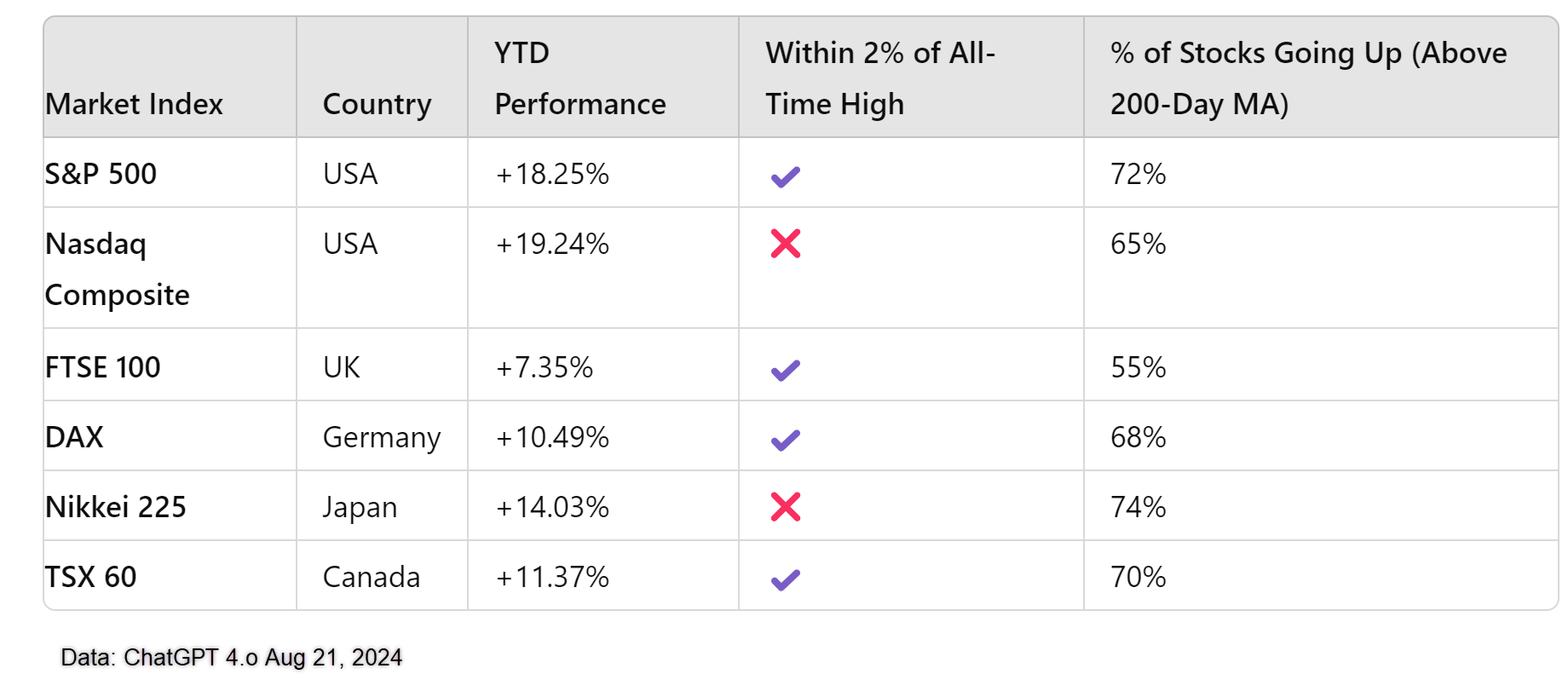

source: ChatGPT4

It hasn’t just been Sirius rising—stock markets have been shooting for the stars, making new all-time highs in many places. Even bonds, which have been nursing a two-year hangover, are starting to perk up now that central banks are dialing down interest rates. Markets wobbled a bit in early August, but we held on, and our optimism has been rewarded. Sometimes the best thing to do is nothing—or if you’re Rumble, have a siesta.

After the Dog Days of summer…what comes next?

As fun as it is to reminisce, investors like us are always looking ahead (even if we’re not quite looking to the stars). With a U.S. Presidential Election year upon us, what should we expect?

Three Lessons from History

- Central Banks Are Cutting Rates: If we can dodge a recession, these rate-cutting periods often provide some of the best returns for both stocks and bonds; especially for high dividend-paying companies. But remember, all bets are off if the economy stumbles.

- Election Year Bullishness: Historically, U.S. Presidential Election years have been kind to stocks, regardless of who wins. The third quarter can be a bit bumpy, but the fourth quarter tends to be a sweet spot.

- Inflation Is Easing: Inflation is moderating, and we’re even seeing signs of disinflation out of China. In Canada (if you exclude shelter cost) inflation was just 1.6% last month. Who knows? We might be surprised by how low interest rates could go.

One Caveat

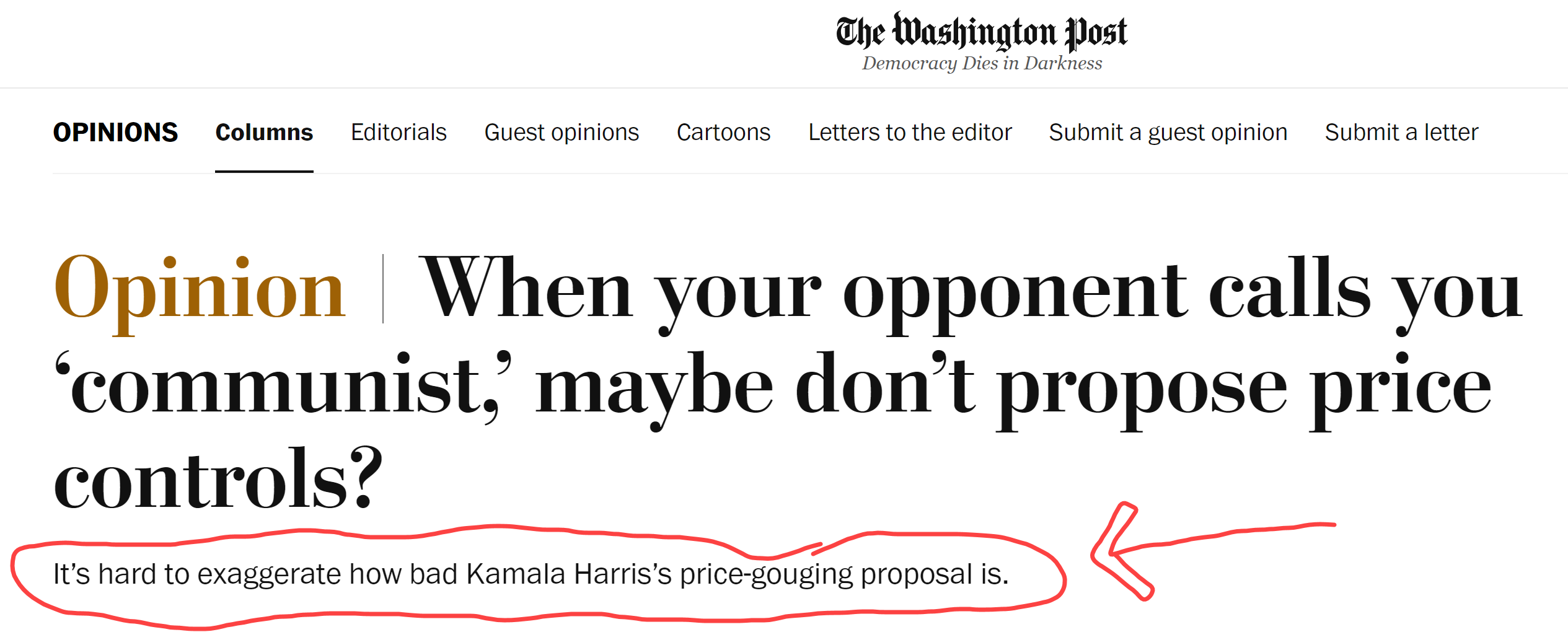

While geopolitical and recession risks are always lurking (and perhaps more than usual right now), there’s a new risk worth discussing. The Democrats seem to be pivoting from Bidenomics to a more extreme left stance, advocating price controls and much higher taxes (even on unrealized capital gains). The left-leaning Washington Post editorial board was shocked and dismayed, summing it up with a headline that says it all…

No politics here—after all, price controls were first implemented by Nixon, a Republican. It was a terrible idea then, and it remains one now.

But what about U.S. fiscal spending? I had hoped that both presidential candidates would dial back the enormous deficit spending of the Biden presidency (currently at 7% of GDP). But early signs from Harris’s platform suggest otherwise. The key risk is that irresponsible spending could reignite inflation, undoing the painful progress of the past two years.

But that’s a story for another day—for now, kick back, enjoy the shade!

Glen