While Canadian leaders and media outlets have been hyperventilating over President Trump’s latest tariffs, the TSX and Loonie have shrugged off the news. The drama in Ottawa might suggest an existential crisis, but markets tell a different story.

Watching the spectacle unfold last weekend, I hoped somebody would give them a paper bag to breathe into (and maybe to put over their heads)!

“Just breathe!”

Markets Hate Surprises—So Why Aren’t They Reacting?

So, what gives? Why aren’t investors panicking alongside the politicians? Let’s unpack why markets remain calm in the face of tariff turmoil—and what that means for your portfolio. We start with an obvious question—why were our leaders and media surprised? Trump’s tariff plans weren’t exactly a well-kept secret.

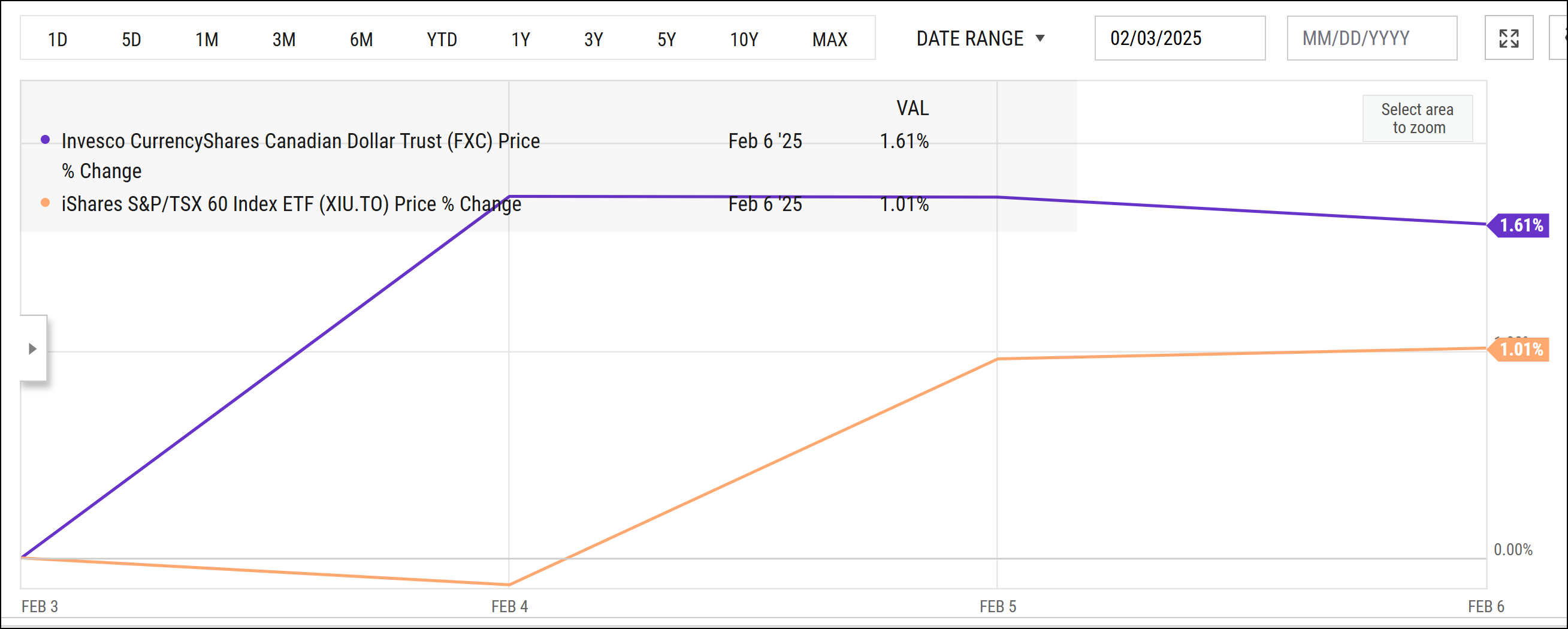

Markets generally don’t like surprises, and so market participants discount risks in advance. It appears that may be the case here as well. We can assess that by checking in on how the TSX and the Loonie reacted to last week’s ‘shocking’ Monday’s Tariff Panic.

Reality Check: TSX and Loonie Stay Strong

Look away dear readers, the horror!!

YCharts.com © 2025 YCharts, Inc. All rights reserved.

Wait what? The Canadian dollar, in the face of “existential tariff risks” is (checks notes) was higher on the week—at least as of the time of writing, the TSX 60, has increased 1%!

Pundits, politicians and investors who expected an “earth shattering Kaboom”, are looking a little silly at this point. Let’s be clear, the tariff risk hasn’t disappeared, it’s only been delayed. On the other hand perhaps markets have already largely discounted the risk. Let’s consider why that might be true.

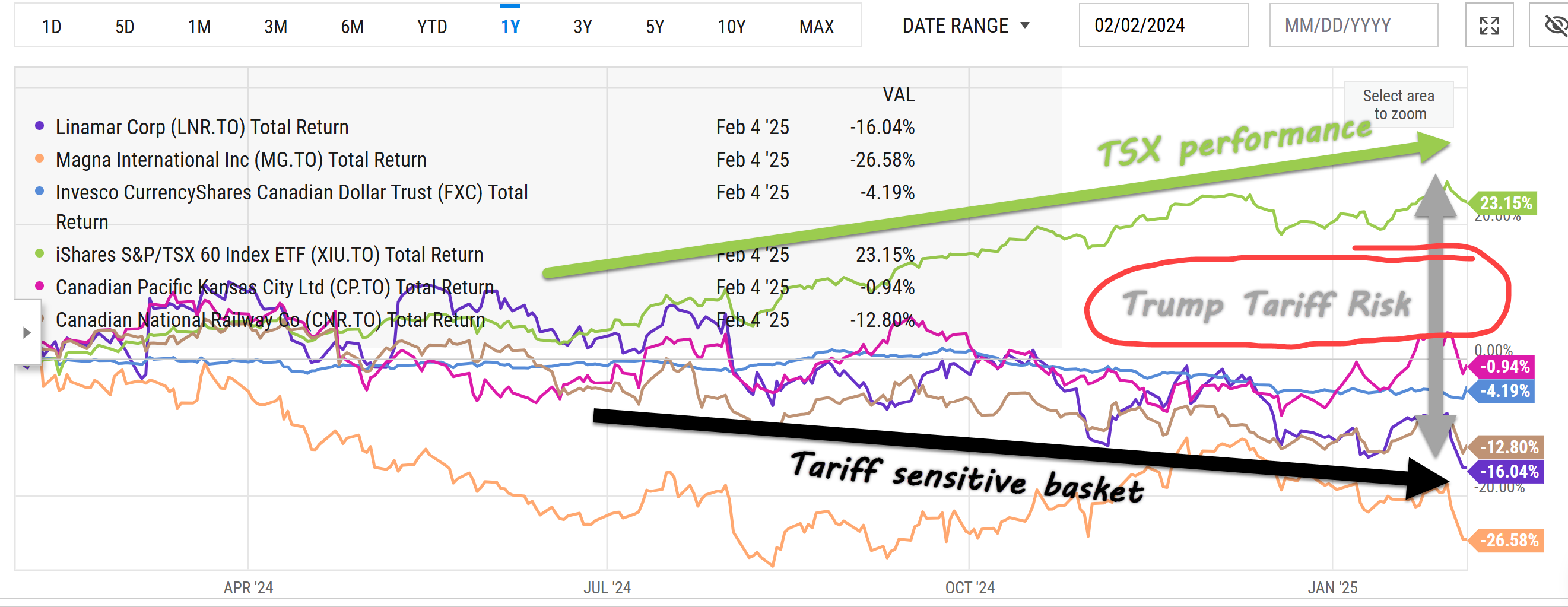

How Investors Anticipated Tariff Risks

For starters, the markets may have already anticipated a rough ride for some industries. The Canadian dollar has taken a 7% tumble since the mere hint of electoral uncertainty, while key sectors—from rail companies to oil and gas, and even major players in the automotive industry—have seen declines ranging from 10% to 30%. These early moves suggest that investors, always forward-looking, quickly priced in the likelihood of a tariff hitting Canadian exports.

The chart below is busy—but I wanted to show that tariff sensitive stocks like rails and car company’s have materially diverged from the overall TSX performance over the past year even as the Loonie has landed. That’s the market discounting risk.

YCharts.com © 2025 YCharts, Inc. All rights reserved.

To put an exclamation point on this—consider that the TSX 60 recorded a new all-time high just last week. This may run counter to the current mania but, believe it or not we’re currently in a bull market.

source: StockCharts.com

Stay Focused: Why We Invest in Stocks

This might be a good time to remind ourselves of why we invest in stocks in the first place. Higher returns. Why do we expect higher returns? As compensation for accepting the uncertainty of risk. There’s a fancy word for that “the Equity Risk Premium”. That is premium to the guaranteed rate of bonds that equity holders expect to earn for putting up with the anxiety of market volatility.

My take? Breathe. You’re earning your equity risk premium! This reaffirms our approach of staying the course and focusing on fundamentals rather than reacting to headlines.

Watch the Video: Tariff Tension Hits Canada

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen

PS: Yesterday CBC reported that Internal Trade Minister Anita Anand announced that interprovincial barriers (that are reported to be equivalent to 21%) could be removed in a month. Imagine the irony if Trump’s tariff threats prompted Canadian politicians to act after years and years of inaction!