A Big Milestone: One Year With Wellington-Altus

Evans Family Wealth celebrated our 1 year anniversary with Wellington-Altus last week! Time really does fly when you’re having fun. We are so thankful for your support on our journey. Our move has been a tremendous success and we owe it all to you.

What’s New: Communication and Content Like Never Before

We couldn’t be happier with our decision—we hope you’ve noticed the increased communication cadence we’ve been able to achieve in our new digs!

- Monthly performance reports for Advisor Managed Account performance.

- Weekly video commentary to support our “Good News!” newsletter.

- Our social media presence is exploding—be sure to follow us on LinkedIn, Meta and Youtube.

- Our WealthCare Podcast aims to provide monthly, long form discussions.

- Our website has been completely overhauled with more features to come… look for online calculators in the next month or so!

None of this would have been possible without the incredible support of Wellington-Altus Private Wealth. It’s so refreshing to work with colleagues who are genuinely aligned with our growth goals.

Market Mayhem: Has President Trump Blinked?

Turning to markets; the Trump Administration’s chaos has rattled the world over the past two months, prompting hysterical over-reactions and forecasts of imminent doom. Unburdened by principals or the need to be consistent, President Donald Trump has reversed himself again and again—suggesting that his tariff demands are more theatre than fact.

Maybe that’s why financial markets have bounced. In this environment, it’s just as fool-hardy to blow the “all-clear” whistle as it is to fear-monger. As I have said, the easiest way for President Trump to torpedo his administration and shred his legacy is to sleep walk America into a tariff driven recession.

He is well aware that he risks not just a midterm shellacking but also losing the support of the Senate for his emergency powers. Simply put, Trump needs some “wins”. The path for him to bring about a “golden age” for America has dramatically narrowed with his reckless brinksmanship. I’m not naive enough to expect normalcy to return—but it is in Trump’s interest to avoid an “own-goal” recession.

Investment Strategy in Volatile Times: Why Standing Still Is a Move

Recent events appear to confirm our investment strategy, which can best be summed up by this twist on the conventional saying of “don’t just stand there—do something!” With headline risk as high as it currently is, it seems improbable that investors will be able to time entries and exits successfully. For instance, if the administration announces a trade deal with India I’d expect further substantial moves higher in the stock market.

That said, the longer the negotiations drag on the greater the risk that the stock market will retest and perhaps undercut the April low. For what it’s worth, I believe that we have seen the low:

Charts courtesy of StockCharts.com

The Long-Term View: Equities Still Lead the Way

Over the next 10 years, I remain convinced that despite President Trump’s chaos we are on the cusp of a remarkable period of productivity growth analogous to the Industrial Revolution driven by artificial intelligence (AI). That future favours equities over bonds—its math.

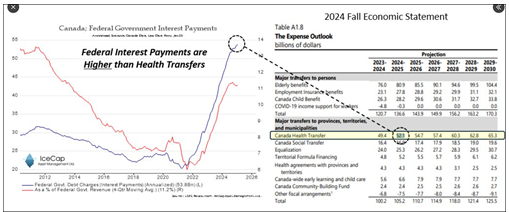

The staggeringly high deficits proposed by both of Canada’s leading political parties are another reminder that nothing stops the money printing and mounting debt of western governments. That implies inflation which is not friendly for bonds. Worse, Federal Interest Payments are already higher than Health Transfers. Now imagine adding another $225 billion to the debt over the next 4 years with no end of deficits in sight.

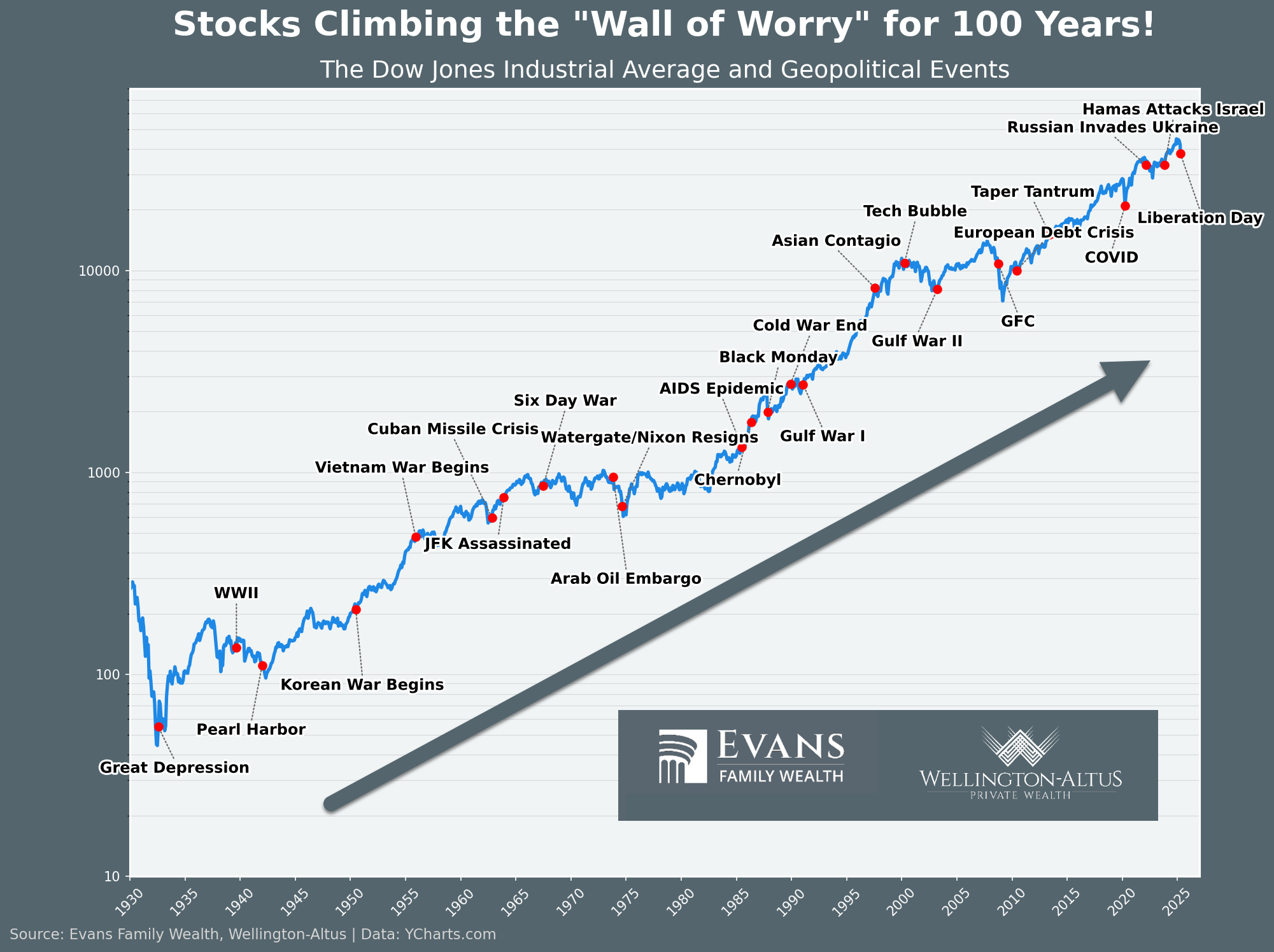

The Biggest Risk Is Fear—Not the Market

The greater opportunity is always in equities. The biggest risk to participating in this future is being shaken out by fear. I’ll keep this chart up to date as a reminder to us that equities have been climbing the “wall of worry” of 100 years!

Together, we’ll emerge from this current chaotic moment. We’ll do it together.

Glen