Carney quietly set the bar when Brookfield Asset Management shifted south. Trump’s One Big Better Bill Act just raised it. From Shopify to CP Rail, the math now favours relocating to America. Canada can either compete on tax or prepare for the largest head‑office drain in a generation.

Carney’s Brookfield Move Was Just the Beginning

Mark Carney is a patriot and the embodiment of careful, mainstream finance. So when the firm he chaired (Brookfield Asset Management) restructured to take fuller advantage of U.S. tax rules before he became prime minister, and before Trump’s “One Big Beautiful Bill” (OBBB) even existed, it sent a clear message: smart corporate boards go where the math works. If it was prudent then, it’s almost mandatory to at least consider it now. That’s not disloyalty; it’s fiduciary duty.

OBBB: America’s New Tax Playbook Changes Everything

Think of OBBB as the U.S. saying: “Invest here. Spend here. We’ll let you keep more of the profit—right away.” Let’s consider how this might work for Canada’s largest tech company, Shopify.

- Deduct it all in year one. Shopify spent about $1.37B on R&D in 2024. In Canada, most of that gets written off over several years. In the U.S. under OBBB, it’s 100% immediate. That can wipe out roughly $300–350M of first‑year tax (≈23–25 percentage‑point swing on that spend).

- Extra break on overseas customers. Roughly 30% of Shopify’s revenue now comes from outside North America, and it’s growing. In the U.S., that slice can be taxed around 13-15% instead of ~26% here: a ~11-13 point saving on those profits.

- Less double tax on global profits. Friendlier rules for using foreign tax credits typically shave another ~2–4 points off the blended rate by avoiding “tax on tax.”

Bottom line: You don’t need a smokestack. OBBB rewards where you park your people, your code, and your profits—not where you pour concrete. Net-net, an IP-heavy firm like Shopify, can drop an effective rate from ~26% to the mid-teens and near zero in the first year of heavy spending.

Why Shopify and CP Rail Might Be Next

Now apply the same logic to a capital-heavy name like Canadian Pacific Kansas City:

- Locomotives, track tech, automation, AI logistics platforms—all can be expensed immediately in the U.S.

- CP is now a North American rail. If moving the legal home base drops taxes by hundreds of millions, the board has to examine it.

The same argument fits Magna, Nutrien, TC Energy, Couche-Tard, Thomson Reuters, CGI, Constellation Software—any company with big U.S. investment plans or large overseas sales.

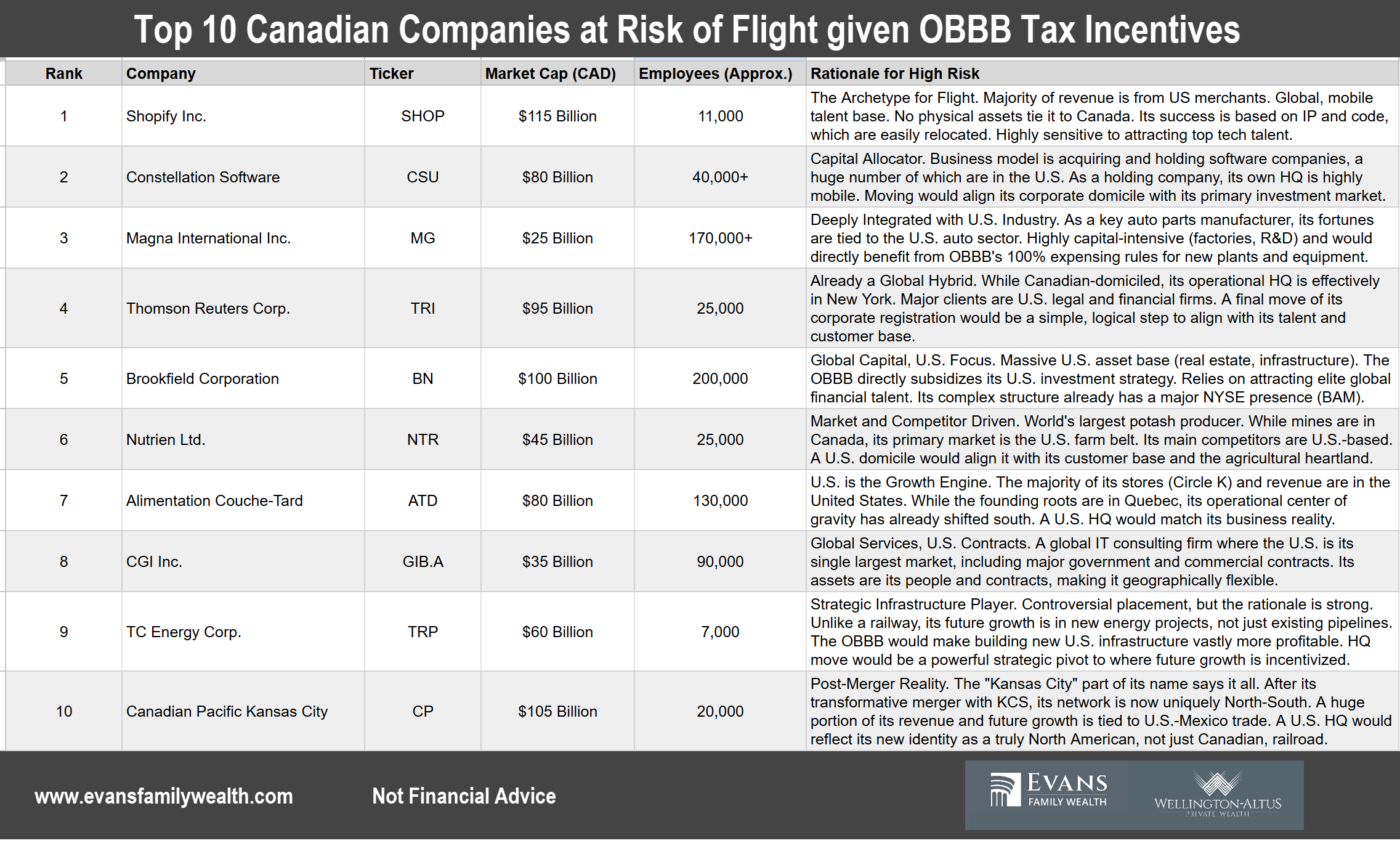

TSX Companies Most Likely to Move South

As investors, we need to understand that every board of every company in Canada has a fiduciary duty to at least run the numbers. At Evans Family Wealth, we’re not tax or trade experts so we relied on ChatGPT o3 Deep Research to run the numbers and identify the most at risk companies in the TSX 60.

Imagine if we lost even a fraction of these great companies?

The Hidden Bill for Canada’s Economy

Add up the profits of the obvious “flight‑risk” names (your Top 10) and the next tier. Consider these estimates:

- $30- 40 billion in pre‑tax profit currently taxed here is “in play.”

- At roughly 26% combined federal/provincial rates, that’s $7-10 billion per year in corporate tax.

- Even if only 40% of that shifts south, Canada still loses $3-4 billion each year—recurring.

That’s before you count lost head‑office jobs, legal/accounting work, charitable giving, and the wider related businesses that come with a headquarters.

Canada has a choice: match U.S. tax breaks or risk losing some of our best companies

Carney now faces another difficult decision. Match (or better) OBBB tax rules or hope that patriotism wins the day. Matching OBBB would hurt in the short term: Ottawa would give up billions in revenue up front. However, it keeps head offices, high-paid talent, and future tax dollars here at home.

Carney’s own actions with Brookfield confirms that Prudence > Patriotism. Just as he did at Brookfield Asset, boards are obligated to follow the math, not the flag. If the U.S. keeps offering a sweeter deal, more Canadian champions will quietly shift south, and we’ll watch billions in corporate tax revenue drift away year after year.

Investors Aren’t Passengers—Here’s How to Pivot

Last week we looked at Carney’s own portfolio holdings (more capital outside Canada than in it) and what that meant for investors. This week we’ve been honest about the risk: Ottawa hesitates, the U.S. doesn’t, and boards follow the math.

Here’s the good news, as investors, we’re not stuck watching from the bleachers. We can tilt portfolios toward the winners of these policy shifts, diversify by jurisdiction, and use tax-smart structures ourselves. We can own the companies (and assets) that benefit from OBBB’s generosity and be ready to pivot if Canada smartens up and levels the field.

Next week, we move from risk to opportunity. The GENIUS Act has effectively blessed the new rails of finance—blockchain, Bitcoin, Ethereum. We’ll map how to participate thoughtfully, size positions sanely, and turn a policy shift into portfolio advantage. We’re not victims; just like Carney repositioned for maximum gain, we can too.

Watch the Video: Billions Rolling South?

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen