The Gold Standard Moment

Montagu Norman, the Governor of the Bank of England had a problem. An increasingly urgent problem. One that he could not solve. So he paced the decks of the liner cursing his bad luck at having forgotten the code book prior to boarding for Liverpool. The steadily increasing number of messages he had received from the radio room sat unread in his stateroom.

The Great Depression was rocking Britain in 1931. Norman’s unshakeable faith in the Gold Standard (backing the pound with gold) was proving to be ruinous—the pound was crashing and the cabinet grumbling. His plan was to return to England to save the pound (and the gold standard). Disembarking, he had no idea that his world had changed.

You see, two days earlier, while he was in the middle of the North Atlantic the cabinet had voted to abandon the Gold standard. His staff had frantically sent those messages asking for his direction on how to preserve the system.

Prime Minister Mark Carney might feel a little kinship with his predecessor.

When we wrote about our investment thesis The Cold War 2.0, we couldn’t have predicted that within days, Venezuelan President Nicolás Maduro would be removed, that Iran would experience domestic unrest or that America would raise prospects of taking control of Greenland. That said, we didn’t forget the code book. The U.S. National Security Strategy, released in November 2025, plainly stated:

“We will deny non-Hemispheric competitors the ability to position forces or other threatening capabilities, or to own or control strategically vital assets, in our Hemisphere. This “Trump Corollary” to the Monroe Doctrine is a common-sense and potent restoration of American power and priorities, consistent with American security interests.”

The World Has Changed—or Has it Just Changed Back?

It’s tempting to believe that Republican President Donald Trump is an outlier. History suggests otherwise. Remember it was Democratic President Jimmy Carter, in 1980, that declared that the U.S. would repel by force any foreign attack on the Persian Gulf. Democratic President Kennedy pushed America to the brink of nuclear war by pushing Russian missiles out of Cuba. Indeed, the author of the Monroe Doctrine, President James Monroe, was himself a Democratic-Republican. As ugly and repugnant as we might find it, the National Security Strategy is consistent with American policy throughout history.

The U.S. National Security Strategy Investors Should Read

Here are three other quotes that Canadian investors should take seriously:

- “The United States will reindustrialize its economy, ‘re-shore’ industrial production…”

- “the United States must never be dependent on any outside power for core components—from raw materials to parts to finished products—necessary to the nation’s defense or economy.”

- “America requires a national mobilization to innovate powerful defenses at low cost, to produce the most capable and modern systems and munitions at scale, and to re-shore our defense industrial supply chains.”

Why Canada Matters More Than Ever

There is no other country on earth better positioned than Canada to prosper from these U.S. goals. The great risk for Canada is that Prime Minister Carney hasn’t got the code book. He must feel a little like his predecessor Montagu Norman, disembarking and realizing that the world has changed since he attained Canada’s highest office.

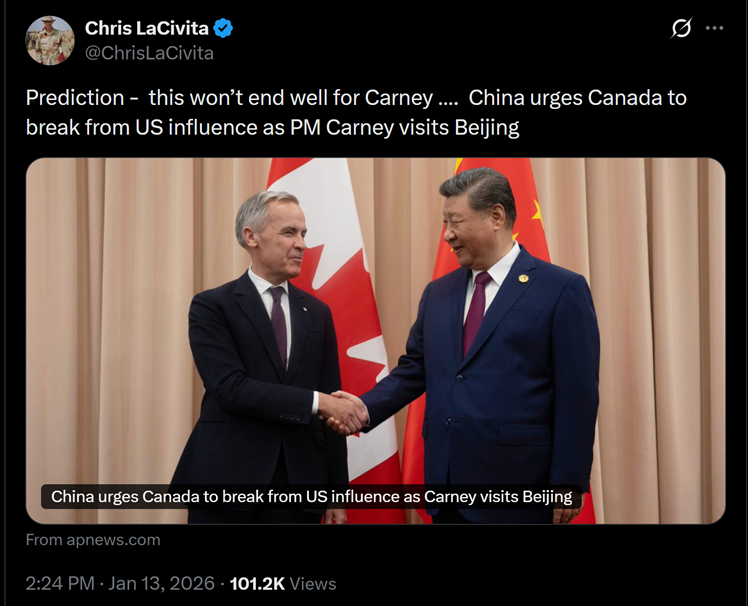

Prior to recent events, aligning closer trade with China to gain leverage in trade negotiations with the U.S. made perfect sense. Since the release of the U.S. National Security Strategy many believe it risks antagonizing our largest trading partner. The reaction by Trump’s 2024 co-campaign manager to the Associated Press headline is a flashing caution light. Yes, the world has changed.

Think about it this way—you’re biggest client, responsible for almost 80% of your business wants to renegotiate your contract. She’s gone to the bother of publishing a guideline on what she’s looking for in a vendor. She’s articulated both what she wants vendors to do and not do. Are you going to read the guideline?

What the U.S. Is Asking of Its Allies

We can’t predict the outcome of these negotiations, but we have no doubt about what the Americans want out of allies and trading partners. The U.S. National Security Strategy isn’t written in code. It clearly tells us what to expect and early results suggest that (unlike most briefing documents) this one should be taken seriously. It’s only 33 pages and written in plain English and you can find it here.

At Evans Family Wealth, we don’t do politics—we do investment management and financial planning. Despite all the anxiety, I don’t remember a time when the investment and trade opportunities have been so clearly laid out. We might prefer the strategy was different, but we take the world as it is, not as we’d prefer it to be.

Glen