The Bumpy Road to Safety

Why the Smoothest Journey May Lead to the Wrong Destination

What’s the first thing that comes to mind when I say “gold”? I’m going to guess it’s “safety”, or “stability”, or “protection.” You probably would not think of it as “high risk.” You’d also probably assume that gold is always viewed as “low risk.” You’d be mistaken on both accounts. Why?

How Investment Risk is Actually Measured in Canada

The answer is that the “risk rating” of assets and securities in Canada depends on how volatile the asset’s price has been over the preceding 10 year period—so during the early 2010s gold would likely have been rated “high risk.” Currently, Gold Bullion ETFs are generally rated “medium risk” while gold miners are rated “high risk”.

The Volatility Trap

Under current regulations, risk is measured almost entirely by something called “standard deviation” essentially, how much an investment’s price bounces around over time. The greater the swing, the greater the “risk.” The logic seems intuitive; stability feels safer.

Investment Risk vs Volatility: What’s the Difference?

But here’s the problem. This approach confuses the journey with the destination. It tells us how bumpy the ride has been, but says nothing about whether we’ll actually arrive where we want to end up—with our purchasing power intact. Comparing the performance of “low risk” bonds to “medium risk” Gold Bullion is revealing.

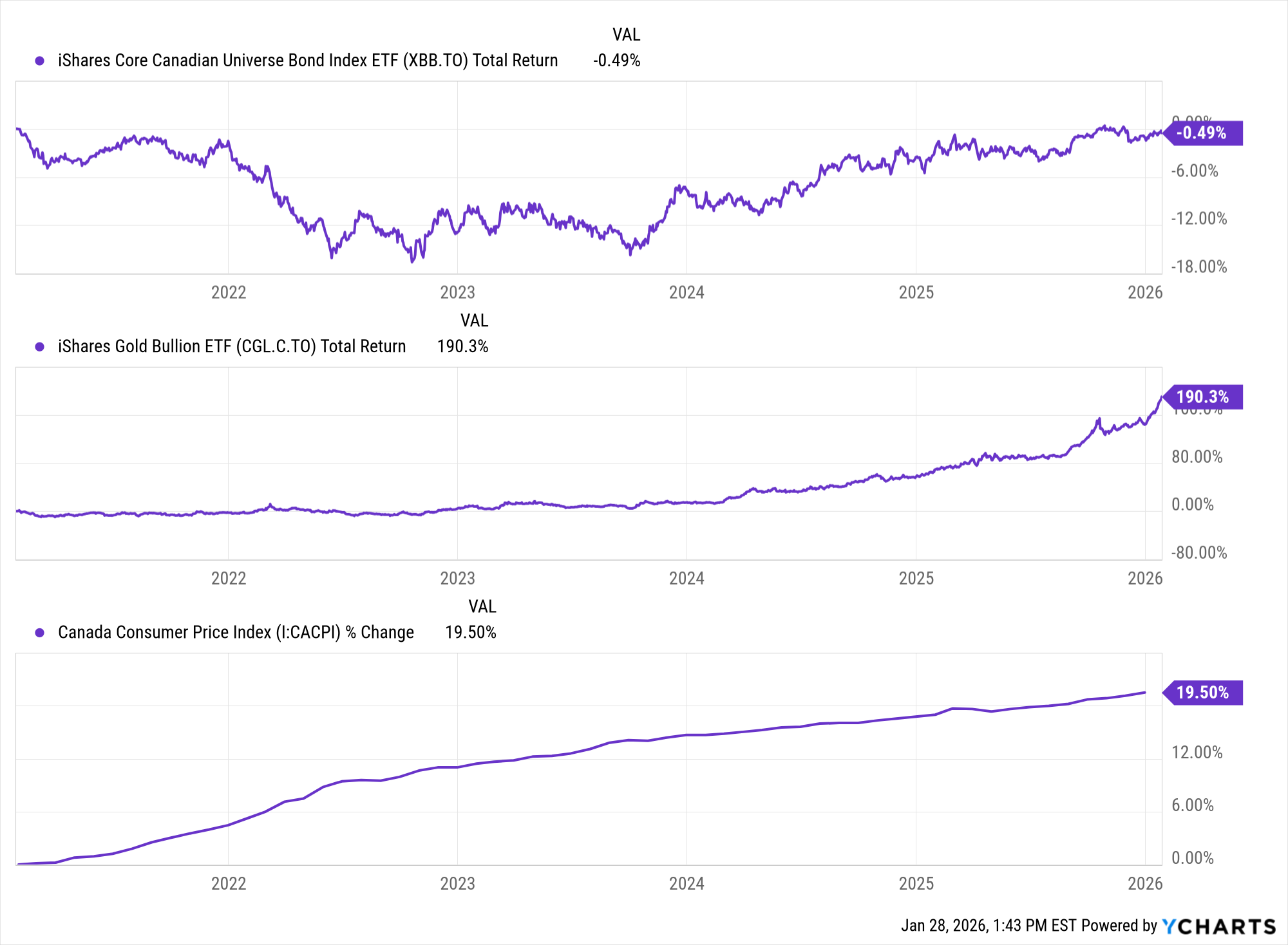

The chart below shows the total return of the Canadian Bond Universe and Gold over the past five years. Bonds lost 0.49% before considering the fact that inflation increased almost 20% over that time period. You might ask how exactly bonds are considered “low risk”. By contrast, gold has increased almost 200% over that time.

YCharts.com © 2026 YCharts, Inc. All rights reserved

When “Low Risk” Assets Lose Purchasing Power

Now, I’m not suggesting gold is low risk just because it went up. My point is the irony. Bonds slowly ate away 20% of investors’ purchasing power, yet they are rated “low risk”? If your goal is to preserve what your savings can actually buy, that distinction doesn’t hold up. It mistakes a smooth ride for a safe arrival.

A Lesson From the 1970s

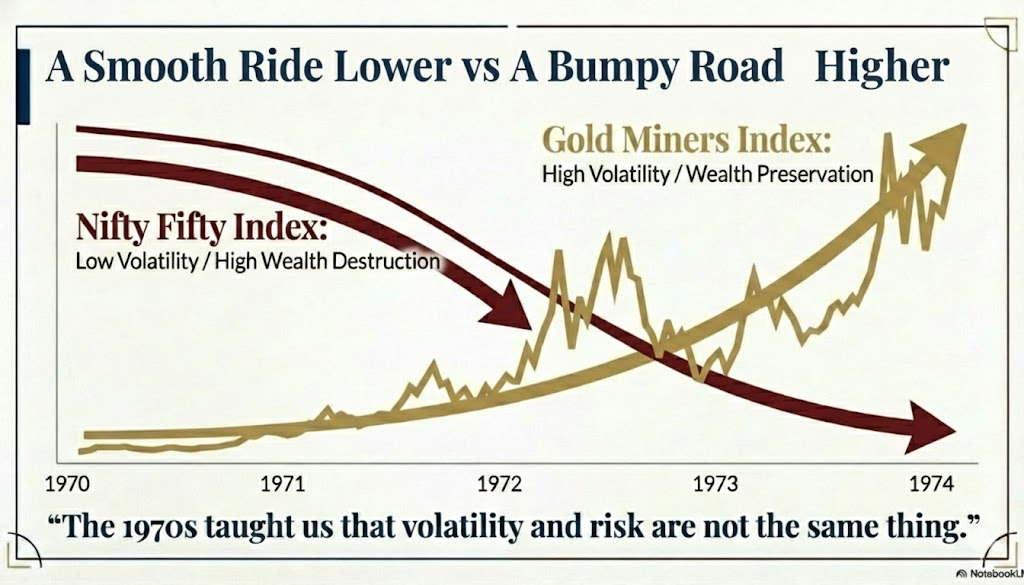

Consider the 1970s. As that decade began, the investment world adored a group of stocks called the “Nifty Fifty”—blue-chip giants like Xerox, Polaroid, IBM, and Coca-Cola. These were companies with pristine balance sheets, stable earnings, and dominant market positions. They had low volatility. They would have been rated “low to medium risk” or even “low risk” by today’s standards—perfectly suitable for a balanced portfolio.

Meanwhile, gold miners and oil producers were volatile, unpredictable, and “high risk.” Compliance departments would have flagged them for only investors with high risk tolerance.

What happened? The Nifty Fifty collapsed. The stable, “low to medium-risk” Nifty Fifty destroyed wealth in real terms. But those “high-risk” gold miners, they rose nearly 200% during the very same bear market. Homestake Mining, the era’s leading gold producer, gained over 375%.

Why This Matters For Investors Today

I share this history because I believe we may be approaching a similar inflection point. I’ve been writing about the structural shortages the world faces in critical materials—copper for electrification, rare earth elements for technology, and the need for Western refining independence. These are the same conditions that made commodities essential in the 1970s—supply constraints meeting growing demand.

Yet, under current rules, the very assets that might protect against this environment are labelled “high risk,” while the assets most vulnerable to inflation are rated “medium” or even “low-medium.”

Working Within the Rules

I’m not here to argue with regulators. The definitions are what they are, and they exist for good reasons—protecting investors from more volatility than they can stomach is a worthy goal. If “risk” means price fluctuation, so be it.

But my job is to help you think about something the risk rating doesn’t capture—outcomes. The regulatory definition looks backward to tell us how bumpy the ride has been. It doesn’t tell us whether we’ll arrive at our destination with our purchasing power intact. That’s a different question—and for most of us, it’s the one that actually matters.

In the 1970s, cash had zero volatility but guaranteed you’d lose purchasing power every single year. A smooth decline is still a decline. No thanks. Remember, risk ratings change as volatility changes—the past does not predict the future. Briana and I are determined to see you safely to your destination—if that means recommending a higher allocation to assets labelled “high risk,” that will be our recommendation. The choice will always be yours—and we won’t pressure you. We’ll walk you through the pros and the cons and together come to a decision which reflects your informed preferences.

The Destination Matters More Than the Journey

None of this is to say we should abandon prudent diversification or chase speculation. Rather, it’s an invitation to think more carefully about what “safety” really means in your portfolio.

A modest allocation to assets that move in the opposite direction of inflation (even if they’re more volatile in the short term) can actually reduce your portfolio’s overall risk where it matters most: at the destination. This isn’t speculation, it’s prudent hedging against a scenario that has happened before and appears to be happening again.

The 1970s taught us that volatility and risk are not the same thing. A smooth ride down is not “low risk.” A bumpy road up can be the safest path to where you actually want to go.

In the days to come, as we update your account documents we will be discussing risk. In our managed portfolios we are considering updating the strategies to allow us to have a greater allocation to securities like commodity producers, even if the regulators deem them to be high risk.

We’re more concerned with getting you to your destination even if the ride is a little more bumpy.

Glen