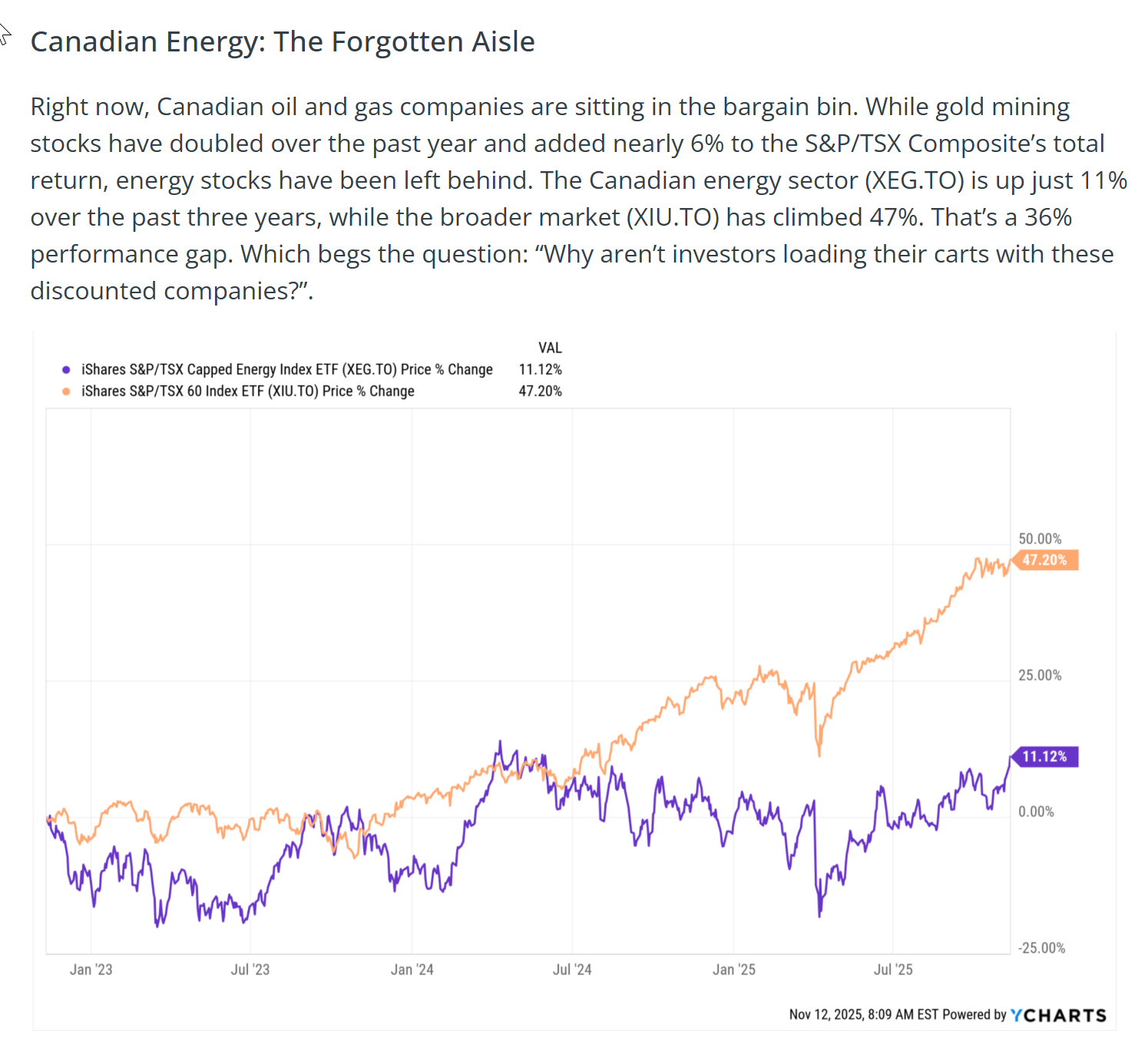

Revisiting Our 2025 Energy Outlook

Last year the Canadian oil and gas sector struggled. Let’s check-in to see how 2026 is shaping up. Before we do, here’s a reminder of we wrote in November:

The entire article made the case that Canada’s energy sector might be poised for outperformance. That view was far from consensus. We didn’t just talk about it—we took action—increasing our exposure in our Advisor Managed Accounts.

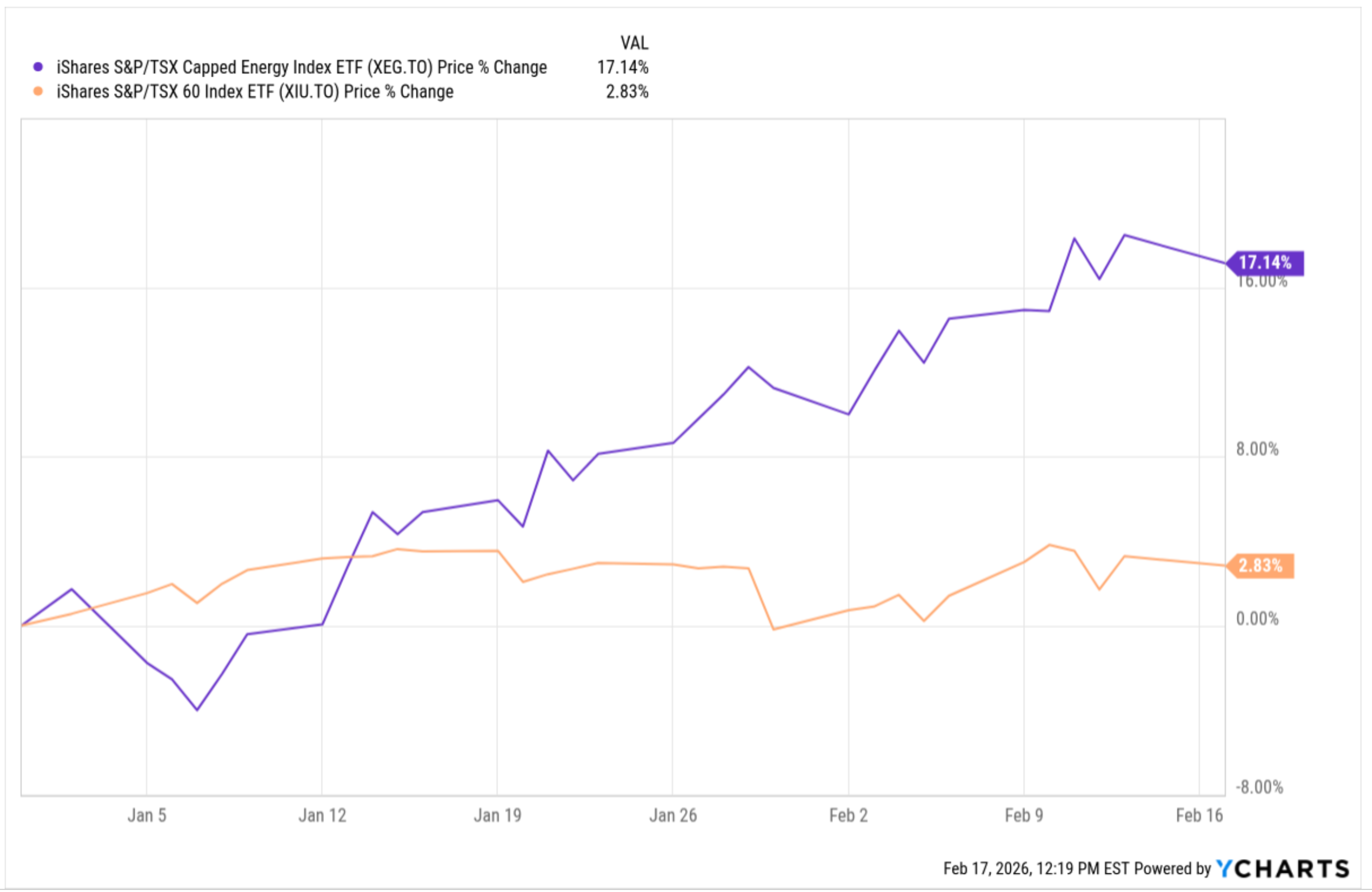

Oil Prices & Producer Response

At the time, oil was struggling to stay above $60/barrel amidst concern about a vast “glut”. Bearishness was in the air with calls for oil to fall to the $40’s. The sentiment peaked with the U.S. capture of Venezuelan President Nicolás Maduro and the seizing of the oil fields. Let’s update that chart to see how things have changed in 2026:

YCharts.com © 2026 YCharts, Inc. All rights reserved

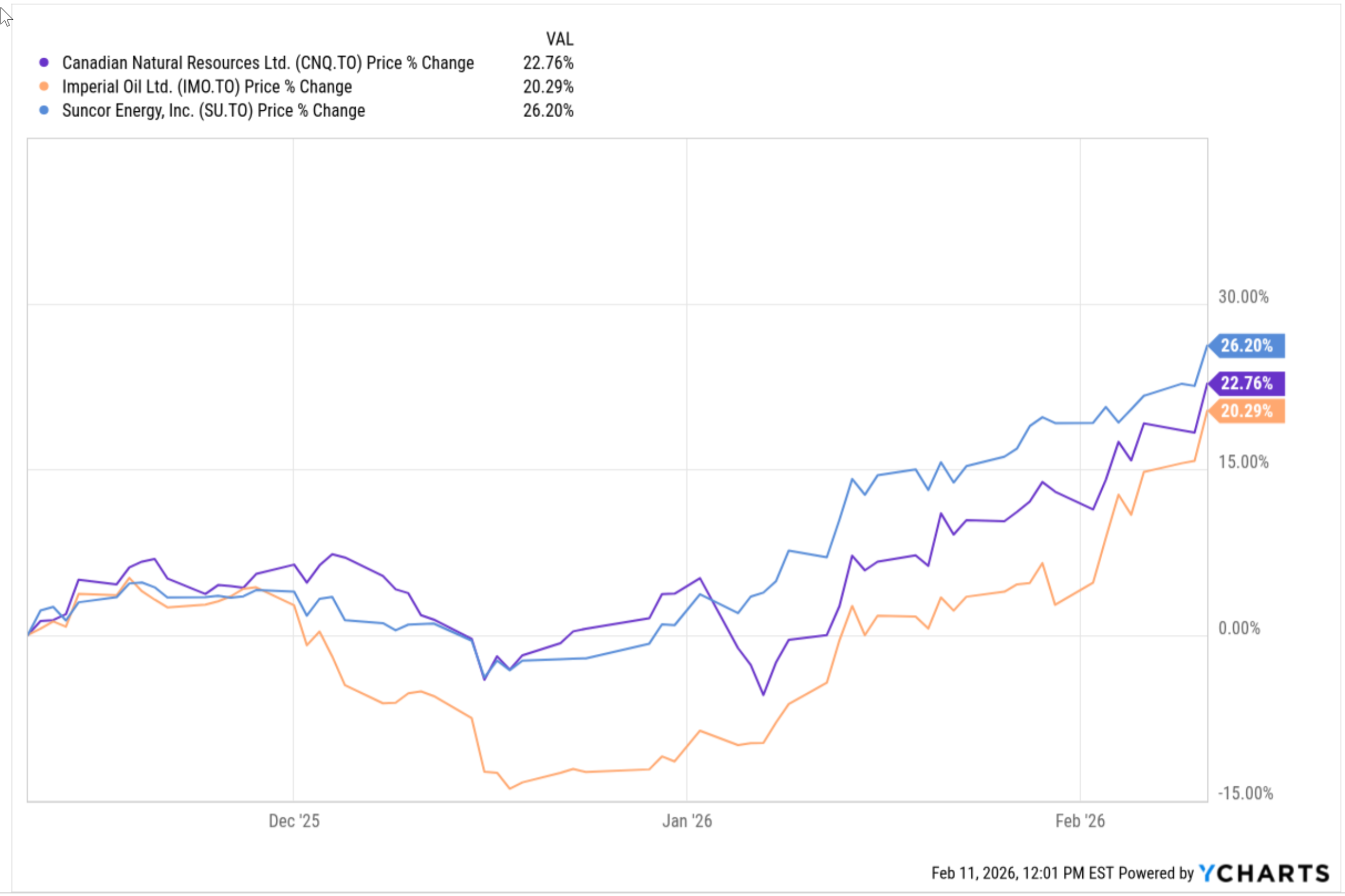

Leading Canadian Energy Stocks in 2026

We weren’t just buying oil and gas, but also copper miners in our managed accounts. We’re glad we did. Overall the sector has bounced since November with Suncor and Canadian Natural Resources leading the way:

YCharts.com © 2026 YCharts, Inc. All rights reserved

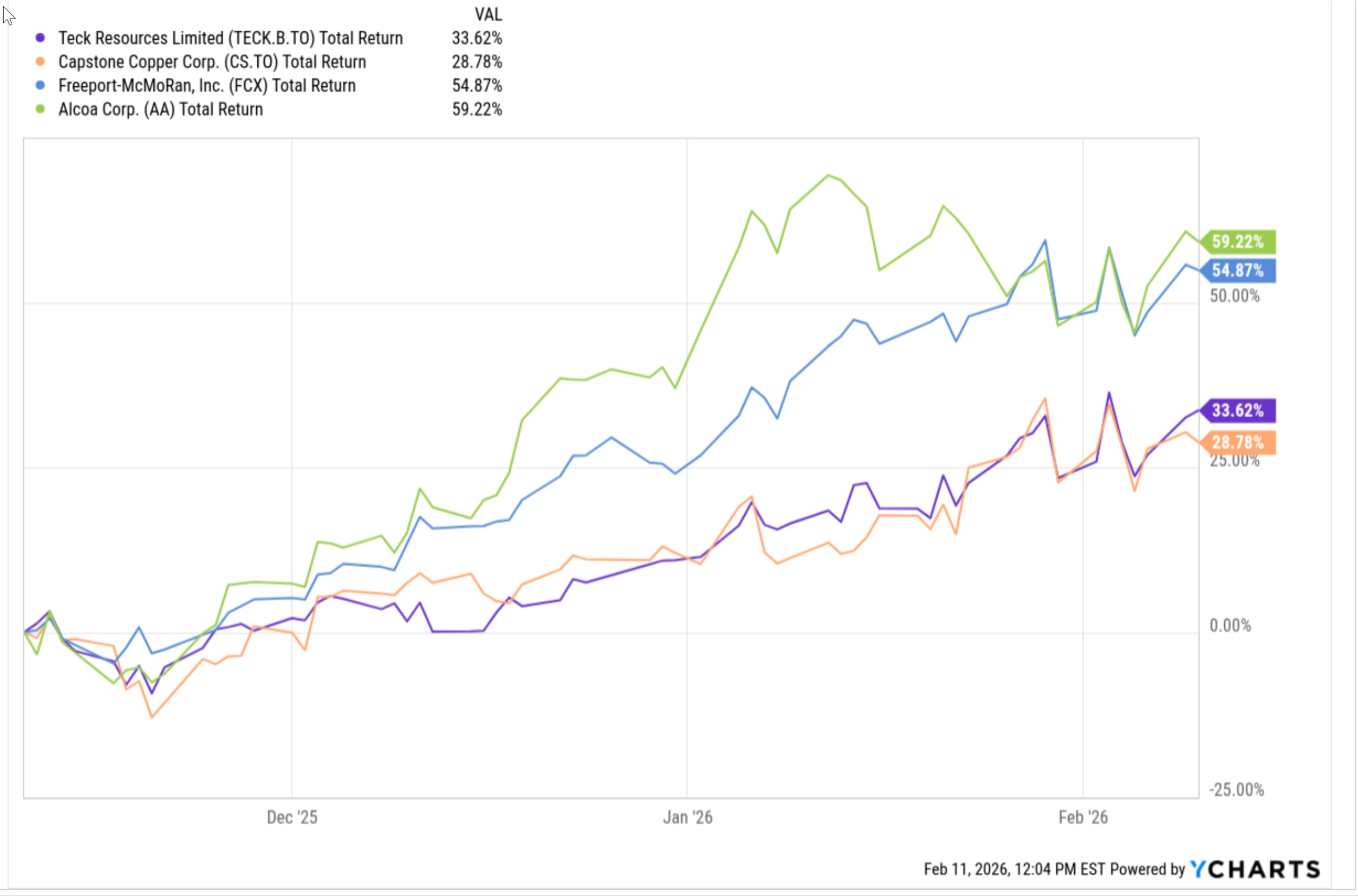

Base Metals: Copper’s Strong Start

What about copper and base metals? The sector has advanced over 34% led by some of the names shown below (holdings in our models):

YCharts.com © 2026 YCharts, Inc. All rights reserved

Why Patience is Paying Off

For those of you who have entrusted us with the management of your portfolio in our Advisor Managed Models, congratulations! This business isn’t easy—so we celebrate our wins! We continue to believe this is early days for both metals and energy.

No doubt there will be plenty of ups and downs but we expect further gains ahead. There’s a broader lesson here—about being willing to be contrarian—even when it requires patience. Your patience is being rewarded, congratulations!

Glen

PS: If you’re not benefitting from our Advisor Managed Models, we’d love to walk you through how they work and decide whether they would be right for you.