France’s striker Antoine Griezmann lofted the free kick into Croatia’s penalty box. Players of both teams jumped to defend or to head in the free kick. One player rose higher than the others, heading the ball just over the head of the Croatian goal keeper and into the top corner of the net. Mario Mandzukic’s goal put France ahead of Croatia and helped them secure the 2018 World Cup. There was just one problem – Mandzukic played for Croatia!

Own goals are a surprisingly common feature of soccer – but few are as consequential as Mandzukic’s. Hockey too has its share of own goals. As it turns out, so does economics. National Bank economists are out with a shocking report (https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/etude-speciale/special-report_240115.pdf) on what they describe as Canada’s own goal. They call it the “Population Trap”. Let’s dig in.

Canada’s own goal – What is the “Population Trap”?

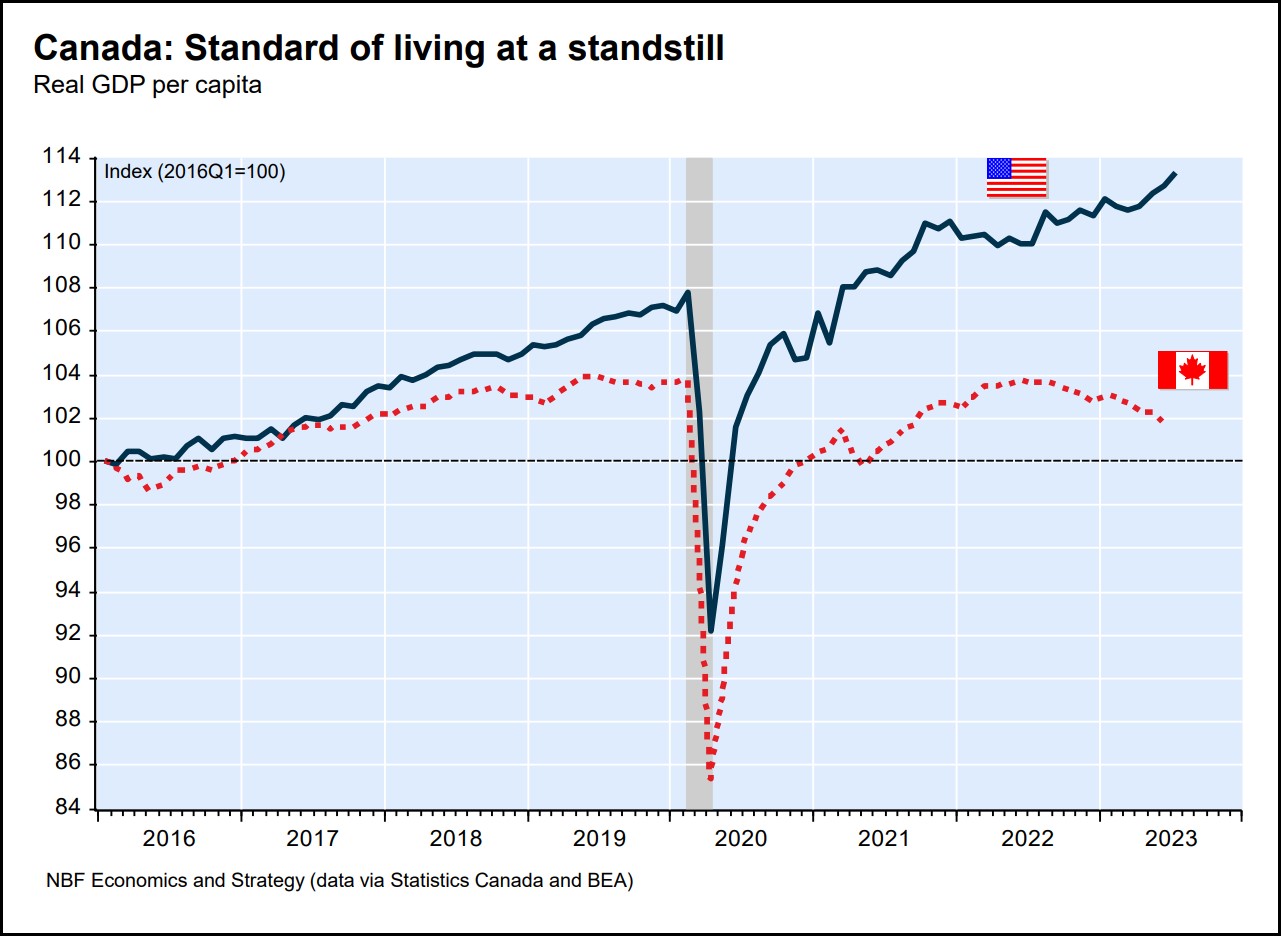

A population trap happens when a fast-growing population uses up all the extra money in an economy just to keep things running as they are. This means there’s no extra money left to make things better for each worker. Even if the economy has more money overall, the amount of money and resources for each worker doesn’t increase and can actually decrease. Think of it this way – if all the money needs to be spent to build more housing, how will businesses grow and Canadian productivity increase? The result is a declining standard of living, unaffordable housing and a stressed healthcare system.

https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/etude-speciale/special-report_240115.pdf

Wondering how it’s come to this? Canada’s population grew by more than five times the OECD average in 2023 – increasing by 3.2% compared to the OECD average of 0.6%. Incredible. Canada added another 1.2 million people in 2023 – worsening the housing and healthcare shortage. These shortages will require many years of intense spending to remedy.

Oh Canada! Investment outlook dims

Canadians agree that immigration is a good thing – but like all good things, extreme doses come with side effects. This isn’t a political commentary – as investors, our task is to assess the implications of the political decisions on our portfolios. Patriotism aside, let’s be honest, a country that has declining real per capita income may not be an ideal investment target.

Global Opportunities Abound

Fortunately, Canadian investors have investment options outside our borders. This chart is a reminder that prioritizing Canadian investments over US has been a losing bet in recent years. I’m bullish on third party managed mutual funds that focus on Global and International opportunities as well.

source: YCharts

I take no joy in passing along this information. The Croatian fans groaned when Mandzukic scored on his own net, but then cheered their team on despite it. We need to do the same. Canada has dug itself a hole – it will take time for us to recover. Until then we can hope our leaders will eventually learn the first rule of holes – stop digging!