Photo: Life Magazine

On June 19th, 1940, Paris surrendered to the advancing Germans. The City of Lights dimmed under Nazi occupation. The news of France’s armistice with Germany rocked Britons. The long feared German invasion now seemed imminent. The survival of the great island nation rested on the stooped shoulders of a portly, cigar chomping man. Winston Churchill may have been portrayed as an English BullDog in the press but in truth, while he had two dogs, neither was a BullDog.

Winston Churchill had a black dog and brown dog. The brown dog was a miniature poodle named Rufus. Rufus and Churchill were inseparable. The dog frequently sat on a chair at the dinner table, eating off fine china beside his master. He accompanied Winston to the war room and across England. The black dog also followed Churchill like a shadow – but it was neither friendly nor welcome.

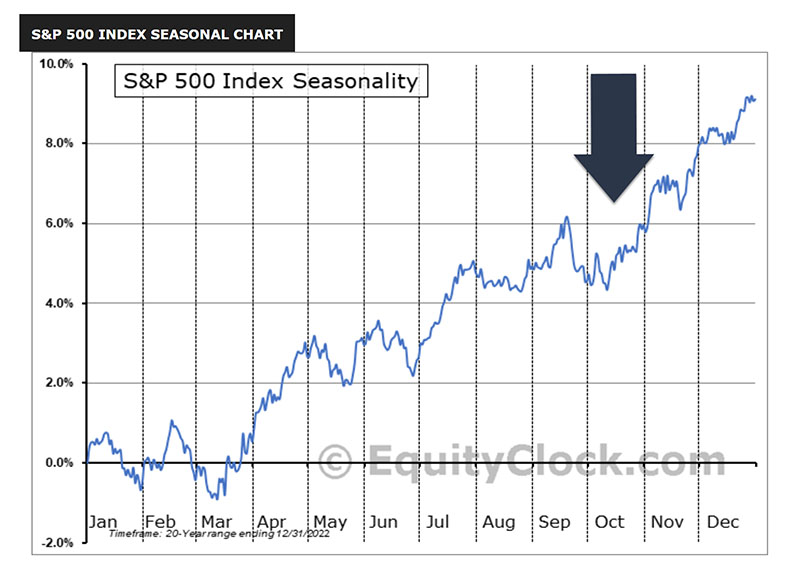

Churchill called his frequent bouts with depression his “Black Dog”. Investors might be able to relate, especially at this time of year. Late fall and early winter brings shorter days, longer nights and the winter blues. Seasonal Affectiveness Disorder is more prevalent in northern latitudes affecting almost 10x as many residents of New Hampshire as Florida (don’t even ask about Ottawa) further blackens the outlook. Perhaps that’s part of the reason the stock market tends to swoon in October as the chart below shows:

source: https://charts.equityclock.com/sp-500-index-seasonal-chart

Finding the Good News

Do you ever think that people who aren’t at least a little depressed with the state of the world just aren’t paying attention? 😀 Let’s be honest, wars, inflation and ever increasing interest rates have the market struggling (and more importantly investors) for the second consecutive year. It’s not just you.

The Black Dog of bad news is ubiquitous. Finding Good News requires a little more effort, that’s the bar I set for myself when I write. You don’t need me to find bad news! Good News is like my golden retriever Rumble, putting his head on my leg to get a scratch behind the ear. He just brings a smile to your face. Here’s how I found him yesterday – just a big ‘ole pile of fur! I hardly knew which end was which!

Oh there he is — so elegant!

Resilience in Leadership and Investing

What does this have to do with investing? More than you might think. Despite Winston’s Black Dog, he summoned his energy and provided the leadership his country needed (maybe with a little help from Rufus). At a time of existential anxiety and uncertainty he projected calm and assurance even when he didn’t feel it himself. Investors sometimes have to do the same – especially when times are tough.

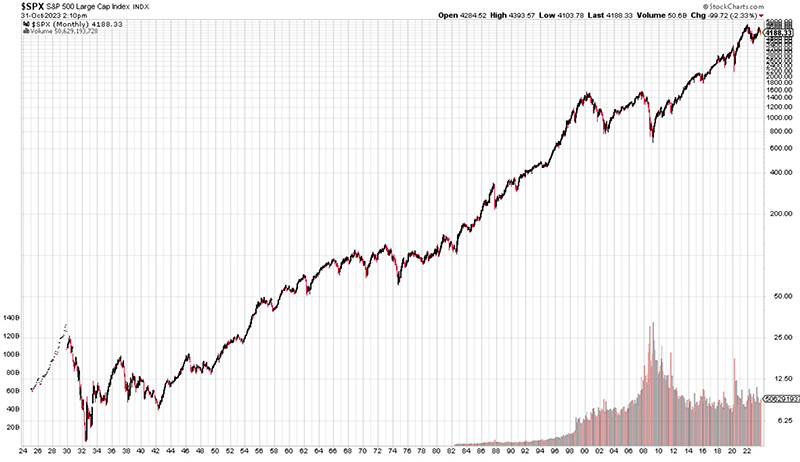

Here’s the truth, in our investment career, France will fall, wars will be fought, crises and recessions will come and go. Sadly, some investors will fall victim to the negativity and capitulate. It is always so. Zoom out and consider the long term performance of the S&P 500 for the past 100 years:

The Value of Optimism in Capitalism

Churchill said that “Democracy is the worst form of government except for all the others.” If he were talking about investing he might have said: “Capitalism is the worst form of economic system, except for all the others.” The reason that optimistic investors triumph in the end is that capitalism has triumphed in the end. That’s the Good News – optimists win. We will too.

Glen