The Shocking By-Election Results: A Call for Change in Canada

Judging by the recent by-election results in the Toronto-St. Paul’s district Canadians are increasingly frustrated and looking for change. A Liberal stronghold for 30 years has flipped Conservative creating shockwaves – source. From an investor’s perspective this outcome was predictable. Consider the following short list of issues:

- The Canadian standard of living has been stagnant from 2017 while the US standard of living has increased more than 10% – source.

- Canadian non-residential investment per person has collapsed to decade lows.

- Because of the collapse in investment, productivity per person has also fallen – this was described as Canada’s Achilles heel by Bank of Canada Governor Tiff Macklem in a recent speech – source.

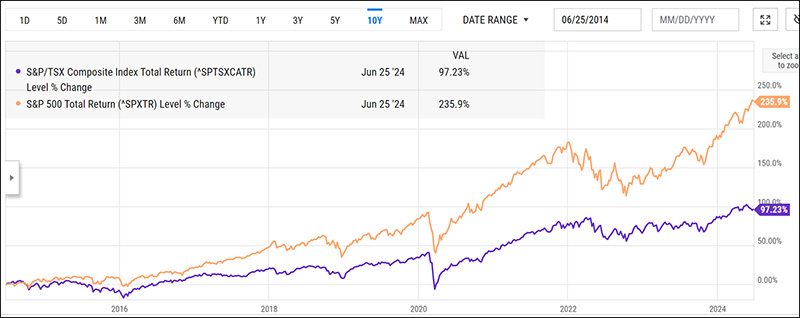

The US Stock Market vs. Canada: A 2:1 Outperformance

The combination of the above has resulted in the US stock market outperforming Canada’s by more than 2:1 over the past 10 years!

source: YCharts.com

Crisis Worsened by Tax Changes Pushing Talent to the US:

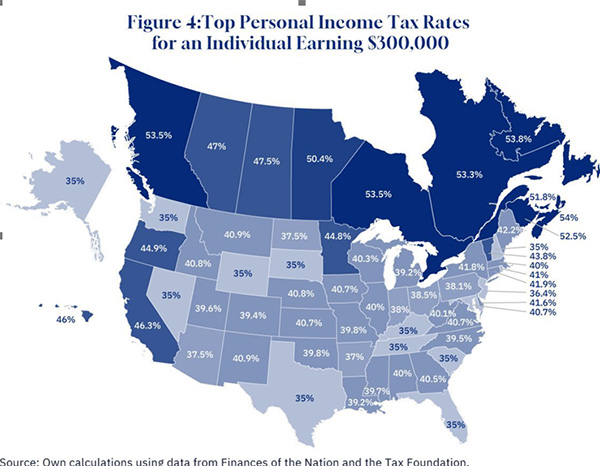

I share Macklem’s and the voters of Toronto-St. Paul’s concerns. This is a crisis. Increases in capital gains tax further worsens the problem. Top earning Canadians paying more tax than almost anywhere in North America. This is reaccelerating the brain drain as doctors, business and talent choose not to stay in Canada.

Diversification: The Key for Canadian Investors

Simply put, Canadians are poorer and more highly taxed than they were in 2017. That’s a bad combination for incumbent governments. If these poll results are indicative of a trend, then it appears Canadians are finally demanding better of their leaders. The road to recovery for Canada will be long. In the meantime, what should investors do? Answer: diversify!

Avoid Home Country Bias

Clearly Canadians need to avoid over-concentrating on underperforming Canadian markets. Home country bias refers to the tendency citizens have to hold most of their investments in their home country. This is a costly mistake. ETF giant Vanguard recommends Canadians have a maximum of 30% of their equity allocation in Canada and 70% in international stocks – source.

The Good News is that it has never been easier for Canadian investors to diversify. My clients have been ahead of this trend for years now, but the recent deterioration requires us to reassess whether we have done enough to protect ourselves.

What Could Change the Outlook for Canada?

As a patriotic Canadian, I have to believe that we will eventually solve these problems. We are a country with almost unimaginable natural resources in a world in desperate need of them. At present, investors are glum and capital is moving out of our country. Importantly, these policies have pushed down the Loonie and seen bets against it reach all-time highs. A change in leadership (Mark Carney or Pierre Pollieve) could see those bets unwound quickly.

As investors we have to balance patriotism and prudence!

We’re here to help.