“When the facts change, I change my opinion. What do you do, sir?” is often said to come from Keynes, but it’s probably made up. More recently, it might be applied to Bill Gates, whose new climate memo represents a remarkable climb-down from his 2021 book “How to Avoid a Climate Crisis”. Here’s how he opens the new memo:

Wow! Gates might be talking to himself here since his 2021 book was very much premised on that doomsday view. His new view is much more consistent with the work of Bjorn Lombord who wrote his book “False Alarm” (2020). Lombord’s data driven approach to the economics of climate policies has always resonated with me. So what changed Gates’ mind? Progress.

Innovation, Not Degrowth Solves This

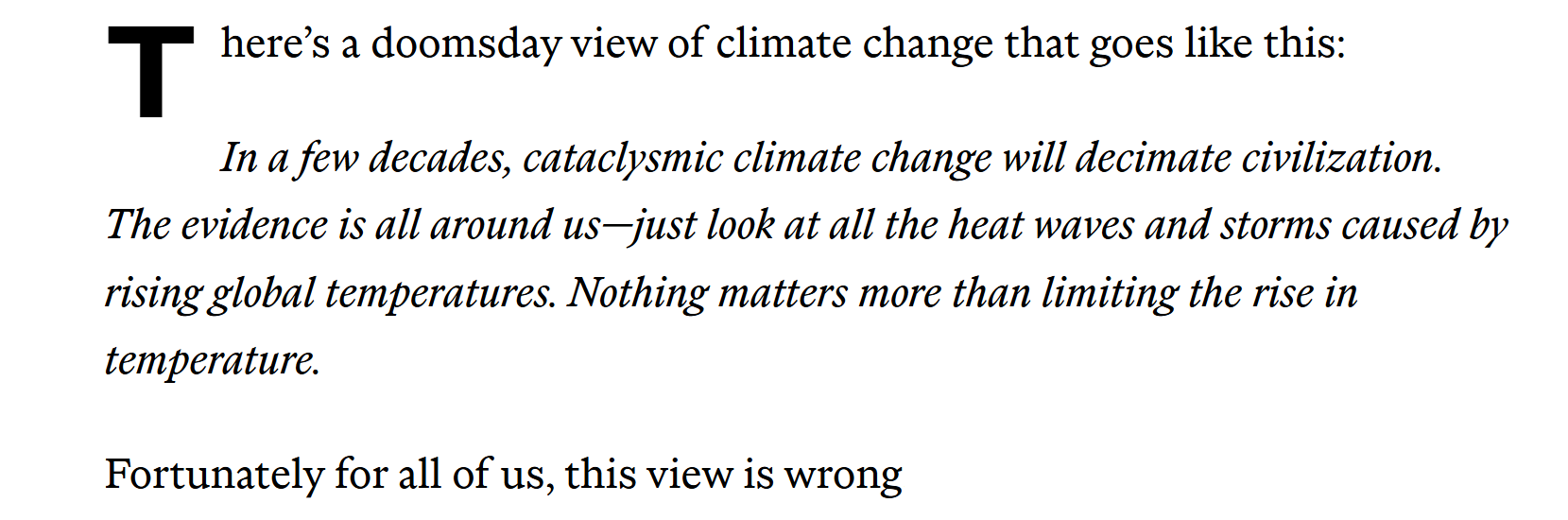

In his memo Gates points out that innovations over the past 10 years have reduced expected future emission by 40%. He believes that AI will further reduce future emissions. We don’t need to focus on inhumane “degrowth” strategies.

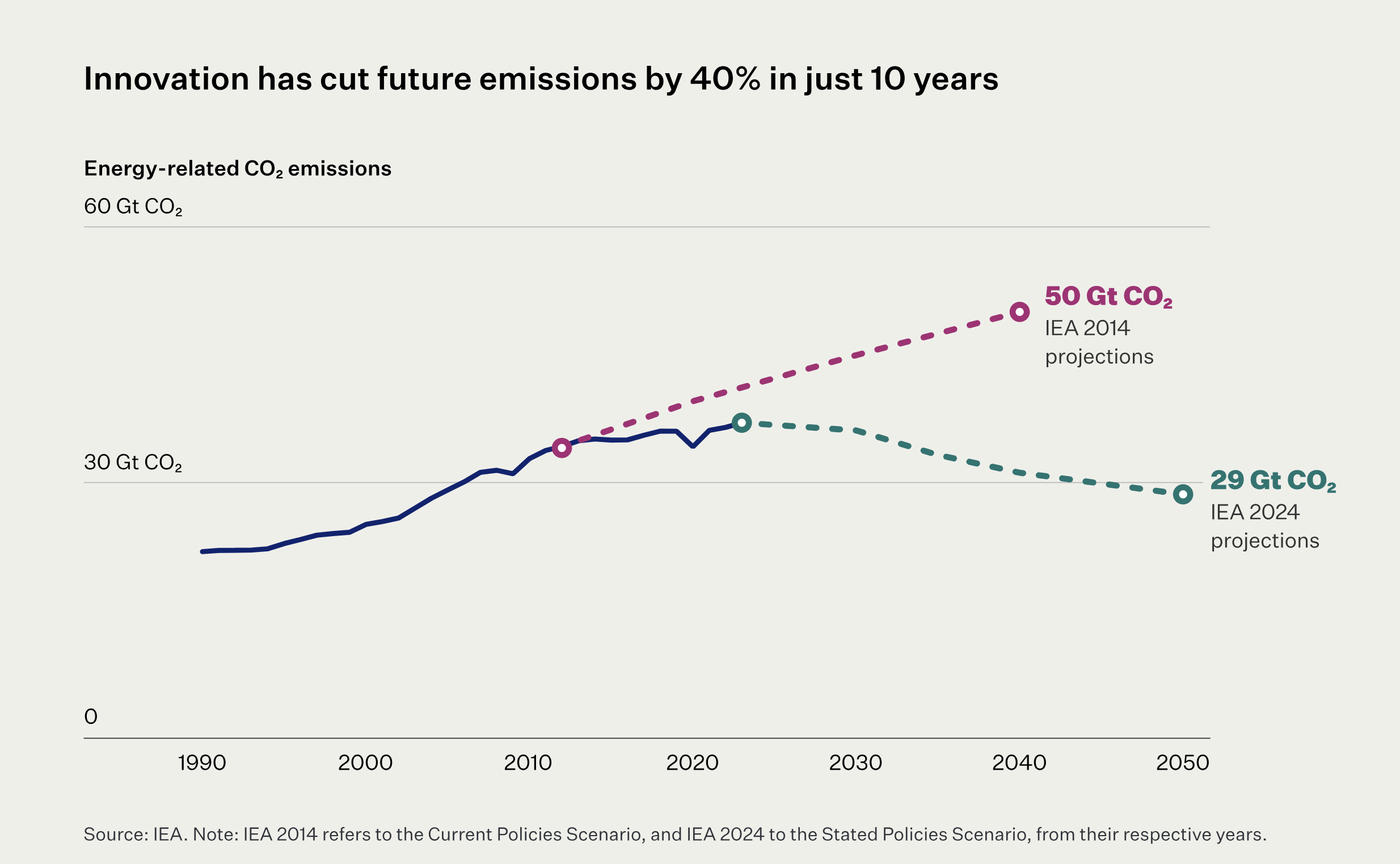

That improvement comes despite an expected doubling of energy consumption by 2050. He writes:

“…the world’s demand for energy is going up—more than doubling by 2050.

From the standpoint of improving lives, using more energy is a good thing, because it’s so closely correlated with economic growth. This chart shows countries’ energy use and their income. More energy use is a key part of prosperity.”

The Good News for Canada

This is very good news for Canada and for all energy producing countries. Recognizing that energy abundance is the key ingredient to human well-being (despite the implications of missing our warming targets) is a reality that Canadians should celebrate.

Nuclear Revival: Brookfield and Cameco Lead the Way

Last week we saw Brookfield and Cameco announce plans for an $80 billion dollar investment in nuclear power plants in the US.

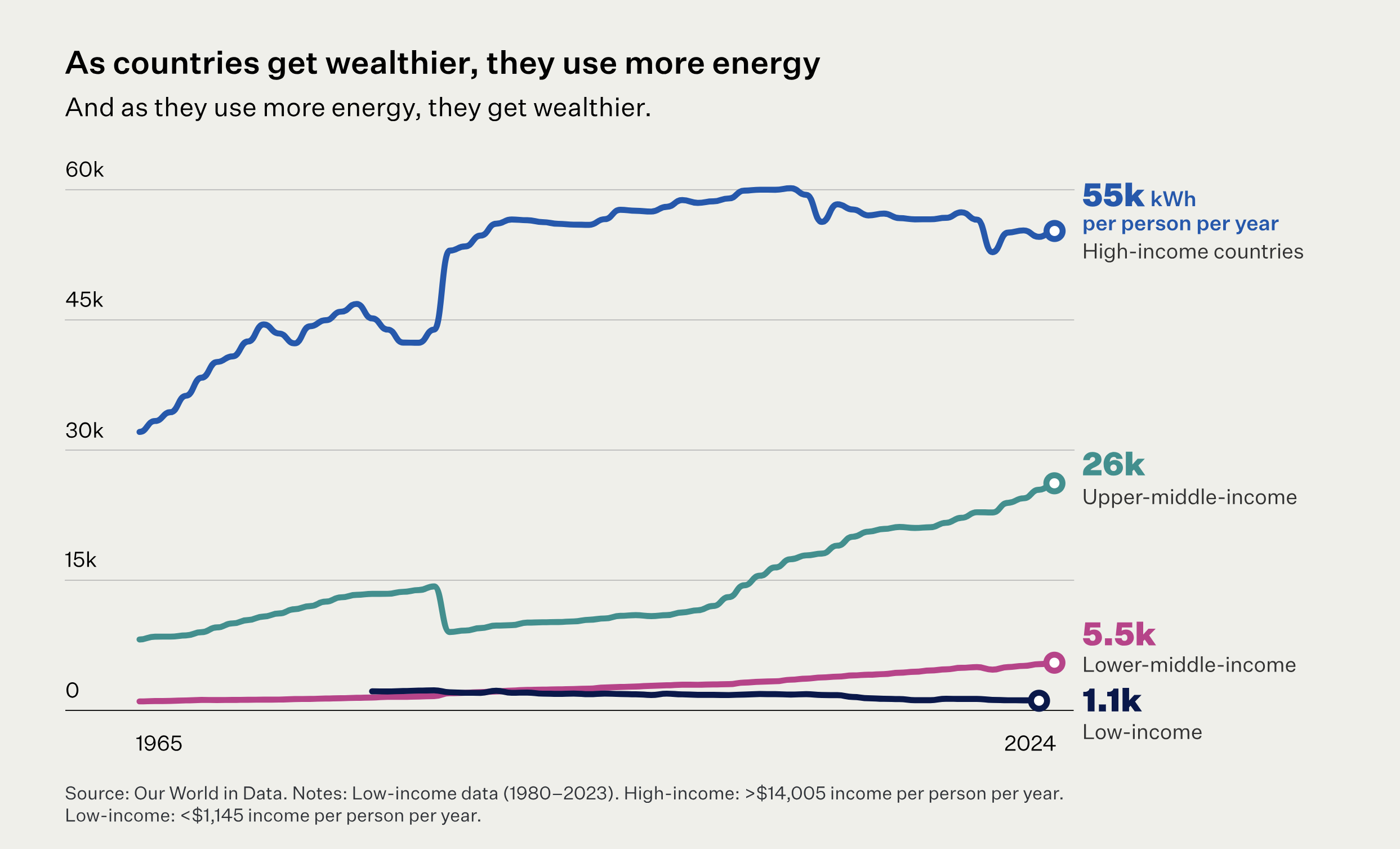

Those companies bought the world leader in nuclear power, Westinghouse in 2017. The acquisition was a bold bet since the world had turned its back on nuclear energy following Japan’s Fukushima disaster in 2011. Patient shareholders have been rewarded and Cameco’s stock jumped over 20% on the news. Nuclear is back!

YCharts.com © 2025 YCharts, Inc. All rights reserved

Why Canadian Investors Should Care

So why should Canadian investors care about nuclear power stations being built in the US? In part because if you own my Canadian Focused Equity Portfolio you’ll be happy to know that we have owned Cameco for a long time! Also, Canada accounts for about 15% of global uranium supply.

More fundamentally. Gates’ new-found pragmatism and his articulation of a more centrist “pro-growth,” “pro-humanity” approach to climate change may signify a recognition among the intelligentsia that all energy sources will contribute to the well-being and thriving of the world.

When the Facts Change: The Power of Contrarian Thinking

Think about the foresight of Brookfield and Cameco in buying Westinghouse in 2017! This is the essence of value and contrarian investing. Last week I wrote about oil prices having fallen 40% from their 2022 highs. I may be early, but I suspect that contrarians adding to great Canadian oil companies will be rewarded.

Chart courtesy of StockCharts.com

Why This is Important Now for Canada’s Economy

Canada is at a cross roads, our economy is struggling and compared to Mexico, we have bungled our trade negotiations with President Trump. Prime Minister Carney has re-invoked the Harper era phrase that Canada is an “Energy Superpower”.

That recognition alone runs counter to Carney’s own view, articulated in his 2021 book “Values” that claimed hydrocarbons would have to stay in the ground. He seems to be working towards a “grand bargain” that balances new exports and carbon-capture technology to offset the footprint.

Not Just Nuclear and Fossil Fuels

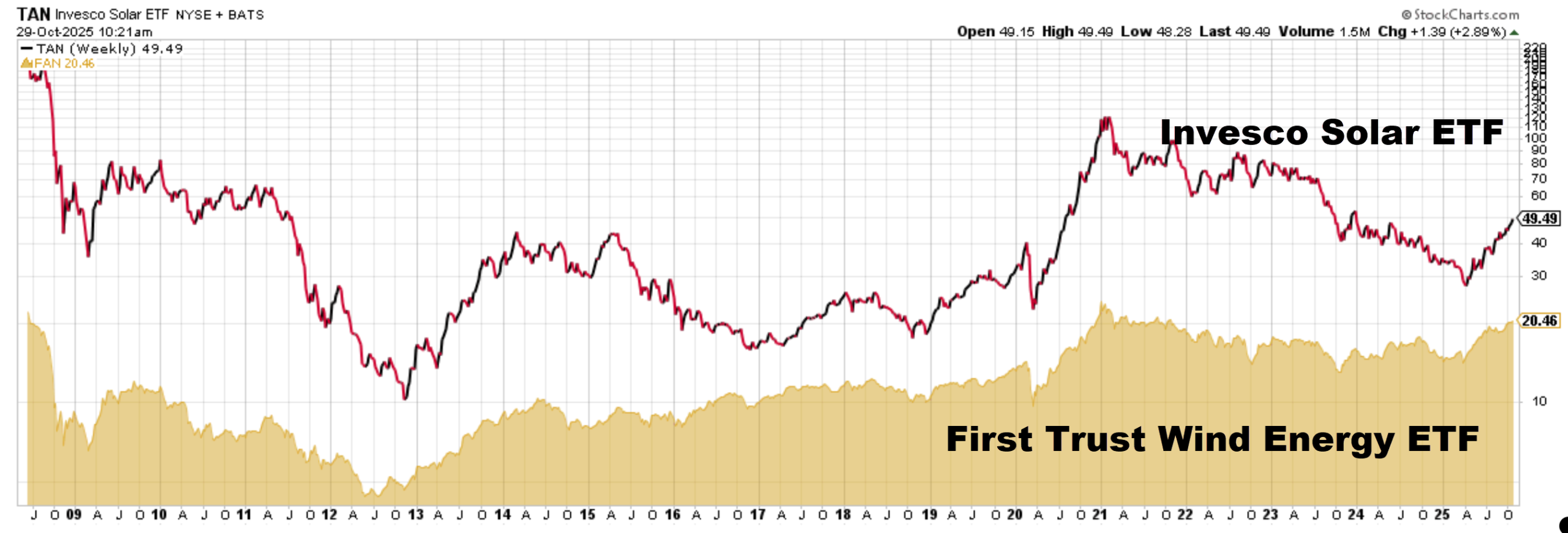

Bill Gates is taking some flak for his pivot, and I recognize that his change may not be welcome news to some readers. The beauty of the energy market is that we can find investments that align with your preferences. Wind power and solar are currently beginning to show signs of life after a long term bear-market:

Chart courtesy of StockCharts.com

My Take: Energy is Life

Here’s my philosophy: energy is life. Every good thing is found downstream of cheap, abundant energy. I’m for all kinds of energy and for the innovation to make it better and more climate friendly. Happily, the West looks to be moving on from the “de-growth” narrative to adopt a more humane balance. Gates summed it up nicely with this quote, “If given a choice between eradicating malaria and a tenth of a degree increase in warming, Gates told reporters, ‘I’ll let the temperature go up 0.1 degree to get rid of malaria. People don’t understand the suffering that exists today.'”

Watch the Video: Bill Gates’ Climate Pivot

Glen