Success stories motivate and inspire people. Canadian business success stories doubly so—both because they are relatively rare and because of our natural tendency to downplay our accomplishments. Bill Hammond, of Guelph based Hammond Power Solutions leads the 100 year old overnight success story you’ve never heard of—until today.

Hammond Radio 1920s (source: Gemini)

A Family Business That Outworked the Odds

Bill’s grandfather, Oliver Hammond founded the steam-powered company O.S. Hammond and Son in 1917 out of a shed in the backyard. Oliver died young and his four children (youngest age 13) took over in 1925. They grew to over 500 employees during the Second World War making radios and transformers. Oliver’s great grandchildren, Bill (who was training as a landscape architect) and his brother Rob, acquired the business from their father Fred and an uncle in 1978.

From Guelph to the Globe

Bill and Rob took the company public in 1987 and split it into two parts in 2001: manufacturing and power solutions. Bill led Hammond Power Solutions. Like most Canadian companies, Bill soon realized that they could only grow so far at home—to compete in the U.S. he would need to increase production. He immediately got to work building (rather than buying) a state of the art facility from scratch in Monterey, Mexico. Ten years later they acquired a transformer company in India (eschewing the trend to buy in China).

Bill Hammond (source: Gemini)

Why Hammond is an AI Powerhouse

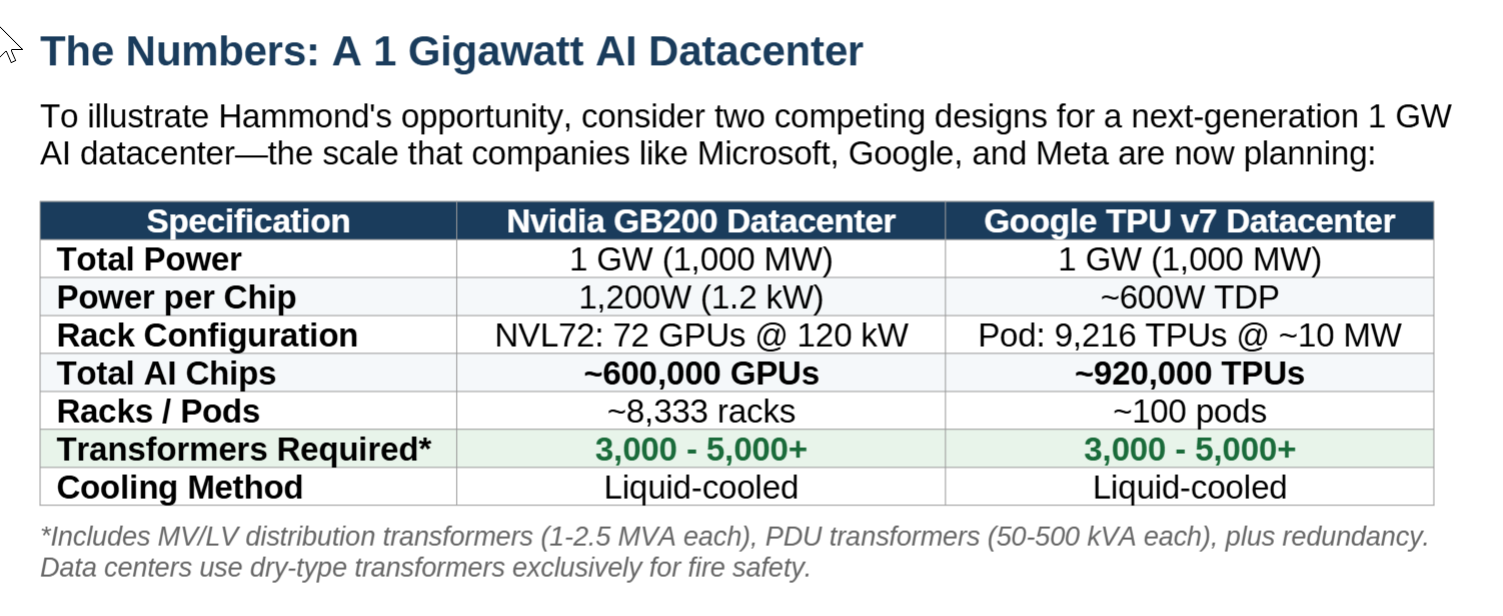

Artificial intelligence (AI) is created in massive data centers that use as much energy as aluminum smelters. That electricity needs to be stepped down, regulated and controlled to eliminate harmonics which can damage the chips. Hammond provides the massive transformers outside the data center but more importantly the thousands of smaller “dr-type” transformers that are used to smooth the electricity used at the chips.

A Rare “Picks and Shovels” Winner No Matter Who Leads AI

Importantly, Hammond isn’t aligned with Nvidia or Google. In AI there is a debate about architecture with GPUs (Nvidia) leading but TPUs (Google) possibly catching up. Hammond wins regardless of which architecture wins. Here’s a table showing the demand for transformers is basically the same for either architecture:

Source: Claude 4.5 corroborated by Gemini 3.5)

Massive Market Potential

The opportunity for Hammond is large—each 1 Gigawatt AI data center will need about $150 million dollars of transformers and we expect 40 to 50 gigawatts of new AI data centers in the next 10 years. Hammond’s transformers are top quality—but they have a service life of about five years. So replacement alone will keep Hammond very busy for years to come.

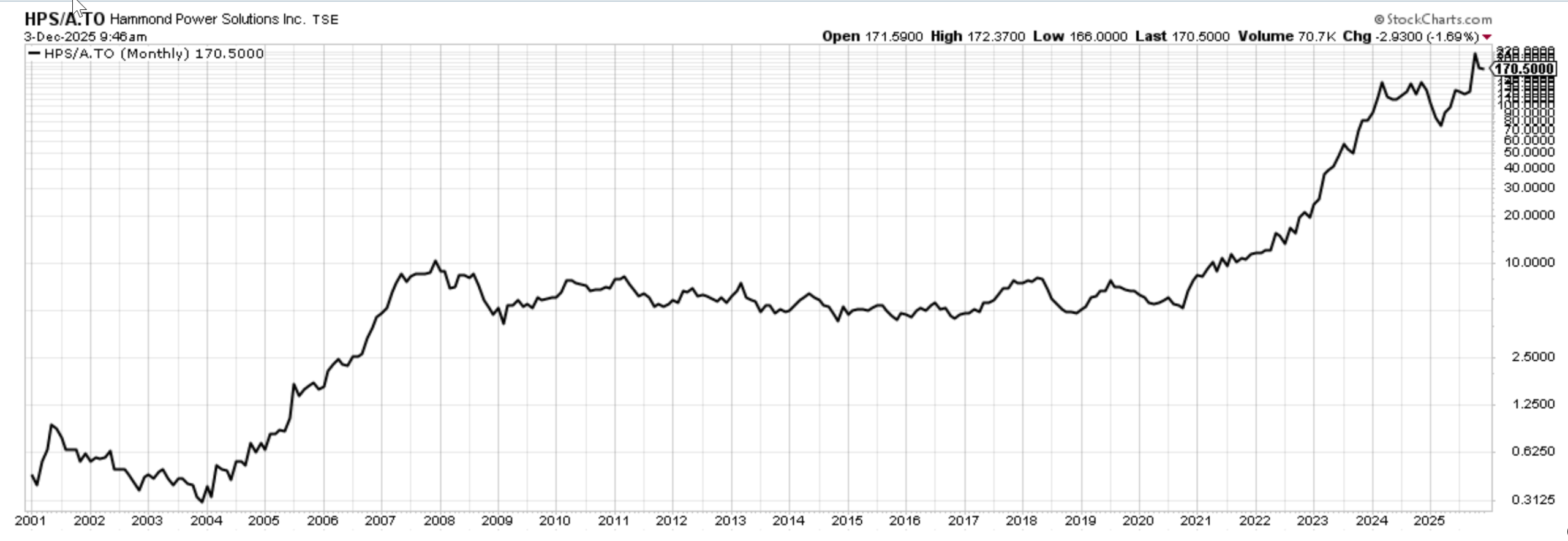

Chart courtesy of StockCharts.com

Why We Bought Hammond

After reporting blow-out earnings in their most recent quarter Hammond spiked to new all-time highs prior to correcting in November—where we bought them in the Canadian Focused Equity Portfolio and the North American Focused Equity Portfolio. We love stories like Hammond Power Solutions’ 100 year “overnight success”.

The Canadian Story We Need Right Now

Like all good stories they involve family, grit, risk-taking, humility and vision. The great thing about stories is we can see part of ourselves in them. Our current Canadian moment is one of uncertainty—so it’s especially important to remind ourselves that we can win. Briana, Anne and I are committed to making sure you take part in these kind of Canadian success stories!

Our Family, Serving Your Family.

Glen