The Psychology of Discounts

Have you ever woken up at 5 a.m. to hunt for Black Friday deals? You’re not alone. In 2024, Black Friday online sales hit $10.8 billion, up 10.2%. Over the past decade, this single day has exploded into Cyber Week, now driving over $41 billion in sales.

What motivates millions to set alarms before dawn? The hunt for deals, of course. A 50% discount sparks a stampede. Here’s the irony: that same discount-hunting instinct disappears when it comes to investing.

Canadian Energy: The Forgotten Aisle

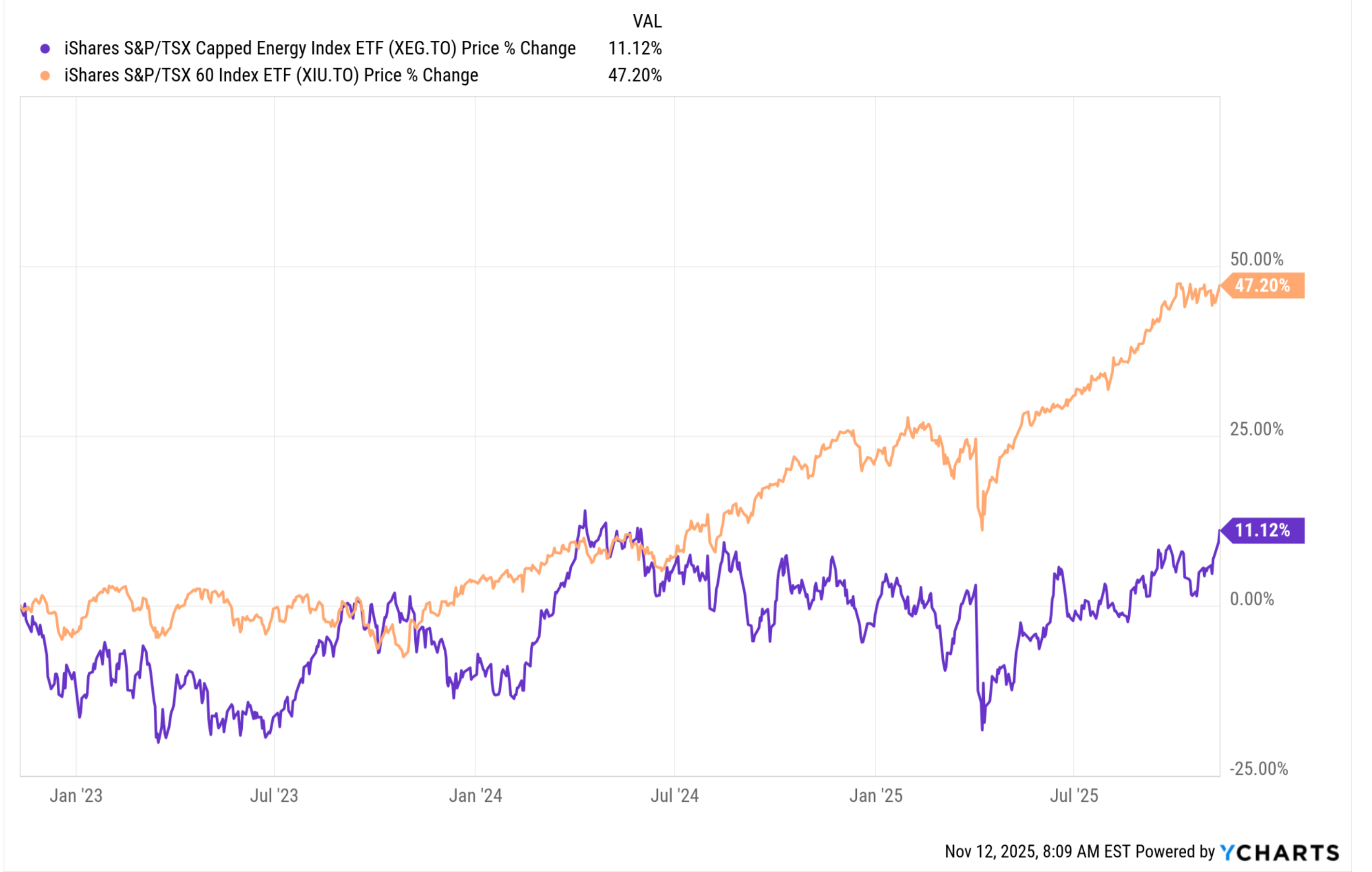

Right now, Canadian oil and gas companies are sitting in the bargain bin. While gold mining stocks have doubled over the past year and added nearly 6% to the S&P/TSX Composite’s total return, energy stocks have been left behind. The Canadian energy sector (XEG.TO) is up just 11% over the past three years, while the broader market (XIU.TO) has climbed 47%. That’s a 36% performance gap. Which begs the question: “Why aren’t investors loading their carts with these discounted companies?”.

YCharts.com © 2025 YCharts, Inc. All rights reserved

Commodity Cycles Have a Rhythm

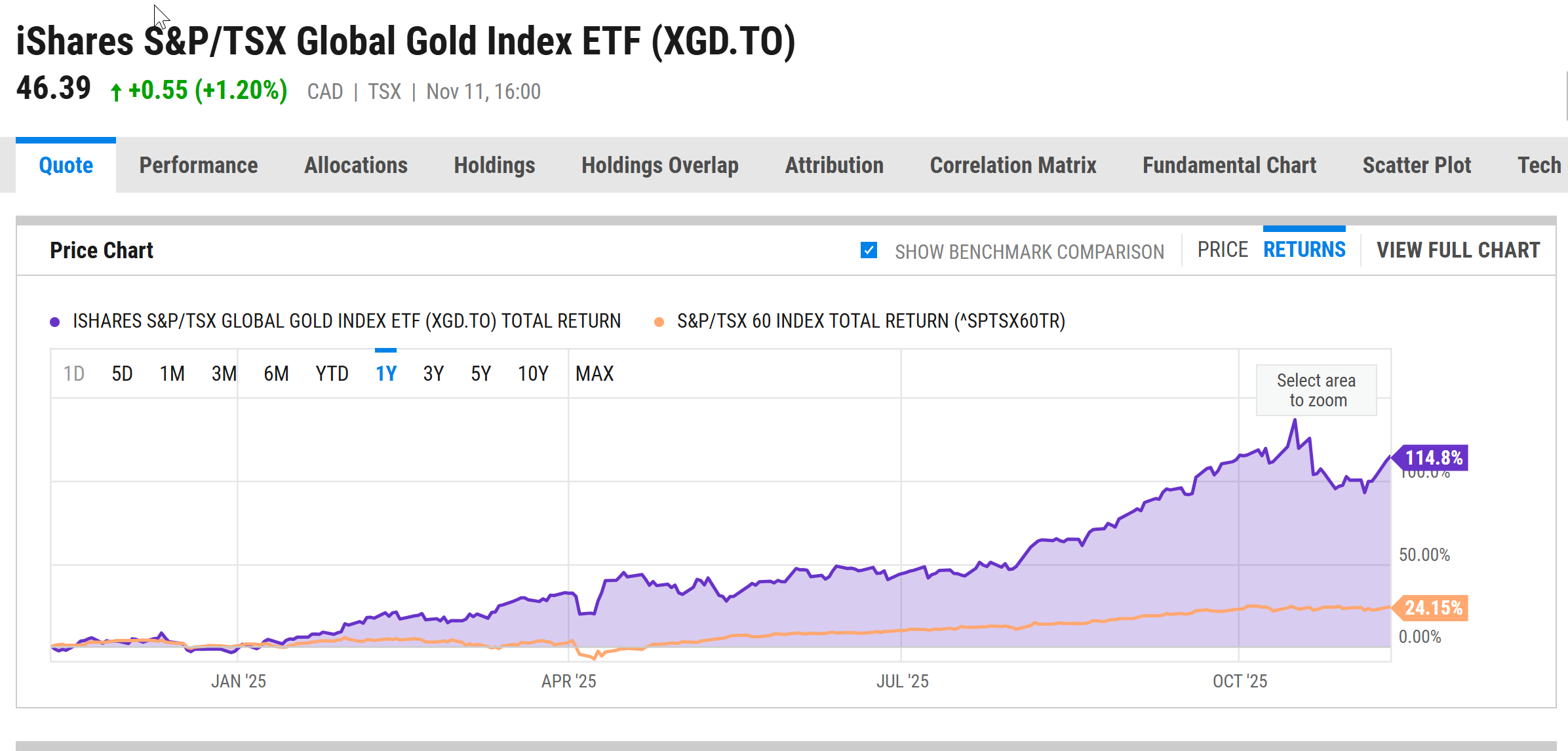

History shows commodity markets move in somewhat predictable cycles or waves. Gold rallies first as a safe haven. Copper follows next, essential for infrastructure and electrification. Finally, oil makes its move as global economic activity picks up. This sequence has played out during multiple commodity cycles.

YCharts.com © 2025 YCharts, Inc. All rights reserved

We may be watching this pattern unfold again. Gold has made its move, with the Gold Sector (XGD.TO) posting 115% returns over the past year. Copper is showing signs of life. Commodity Indices are breaking multi-year downtrends. If oil is next, Canadian investors have a unique opportunity.

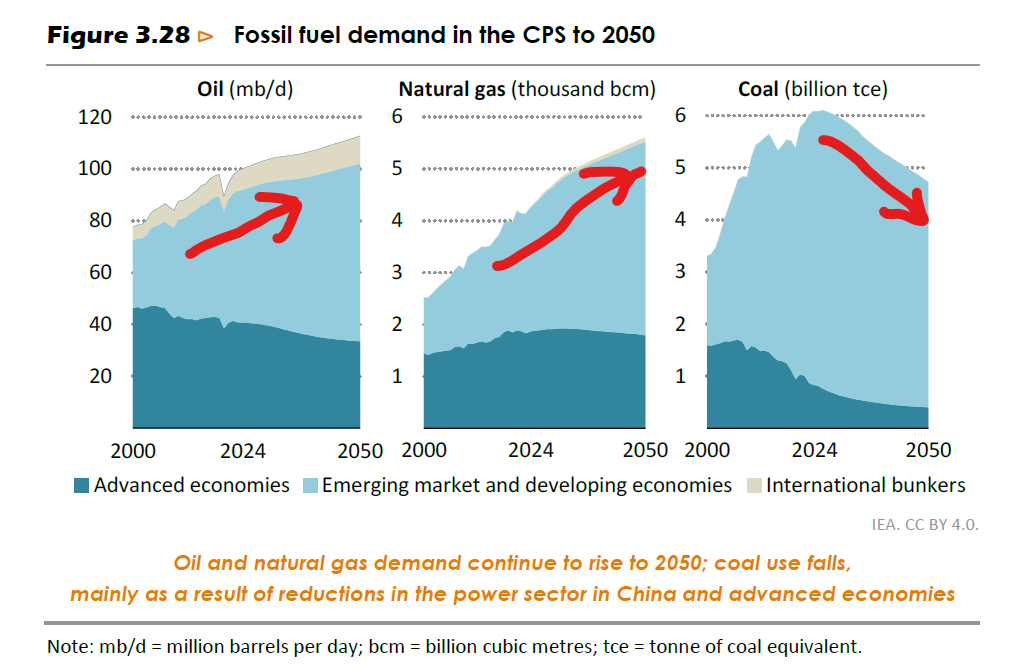

The IEA’s Stunning Reversal

The case for oil gets even more compelling when you look at what the experts are saying. The International Energy Agency just released its World Energy Outlook 2025, containing a stunning reversal. In 2023, the IEA predicted oil demand would peak in 2028. Indeed, as recently as May 2025, IEA projections were being touted by the government as a reason not to invest in energy. Now? The IEA projects demand will reach 113 million barrels per day by 2050, up from 100 million today. There is literally no end in sight.

A Nation-Building Moment

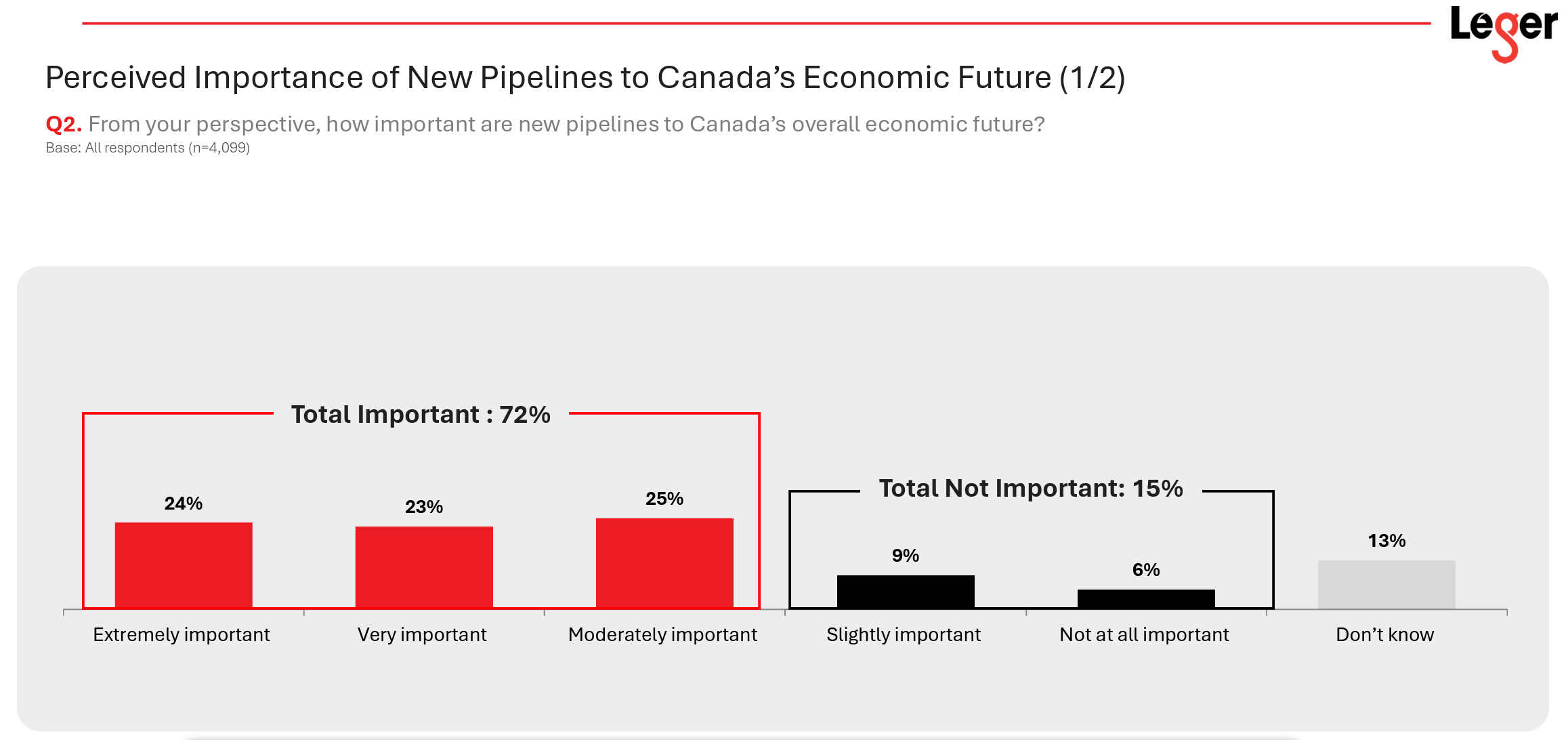

The winds are shifting, Bill Gates has signaled a walk-back of the climate emergency, the IEA has acknowledged that fossil fuels demand will grow and Prime Minister Mark Carney is set to announce new nation-building projects that could include the Northern Gateway pipeline (1,177 kilometers from Alberta to Kitimat, BC, moving 525,000 barrels daily) and the Pathways Plus carbon capture project (capturing CO2 from 20+ oilsands facilities).

Here’s the remarkable part: Canadians are unified on the subject, 72% of Canadians believe new pipelines are important to Canada’s overall economic future (Leger poll Oct 23, 2025). When almost three-quarters of Canadians want critical infrastructure built, that’s a nation-building moment!

The irony is inescapable. Shoppers line up for hours to save $100 on a TV, and yet they ignore an entire sector at generational discounts, right as the country prepares to unlock its potential.

This Black Friday, while others fight over electronics, consider a different bargain. Canadian energy stocks might be the best deal nobody’s talking about. With 72% of Canadians supporting the infrastructure needed, and Carney’s steady hand, the timing couldn’t be better.

Finding the Right Balance

In writing this, I’m aware that a substantial minority of the country won’t be celebrating these developments. You may be among them. At Evans Family Wealth, our job is to help you maximize your returns while respecting your personal ethics. Energy demand is exploding so investors who would prefer to avoid fossil fuels have alternatives to balance growth goals with their ethical concerns. Our commitment is to find the balance that is right for you.

Warmly,

Glen