Diamonds may be a girl’s best friend, but friends can be fickle. The chart of diamond prices (Chart 1) shows the sparkle has faded. De Beers, founded in 1888, built a cartel that at one point controlled 90% of global supply—but its dominance barely lasted a century. Gold, by contrast, has been humanity’s store of value for more than 4,000 years. If anything, it has proven to be not just a girl’s best friend, but the banker’s best friend.

Chart 1

The Bank of Canada’s Gold Exit: A Costly Move

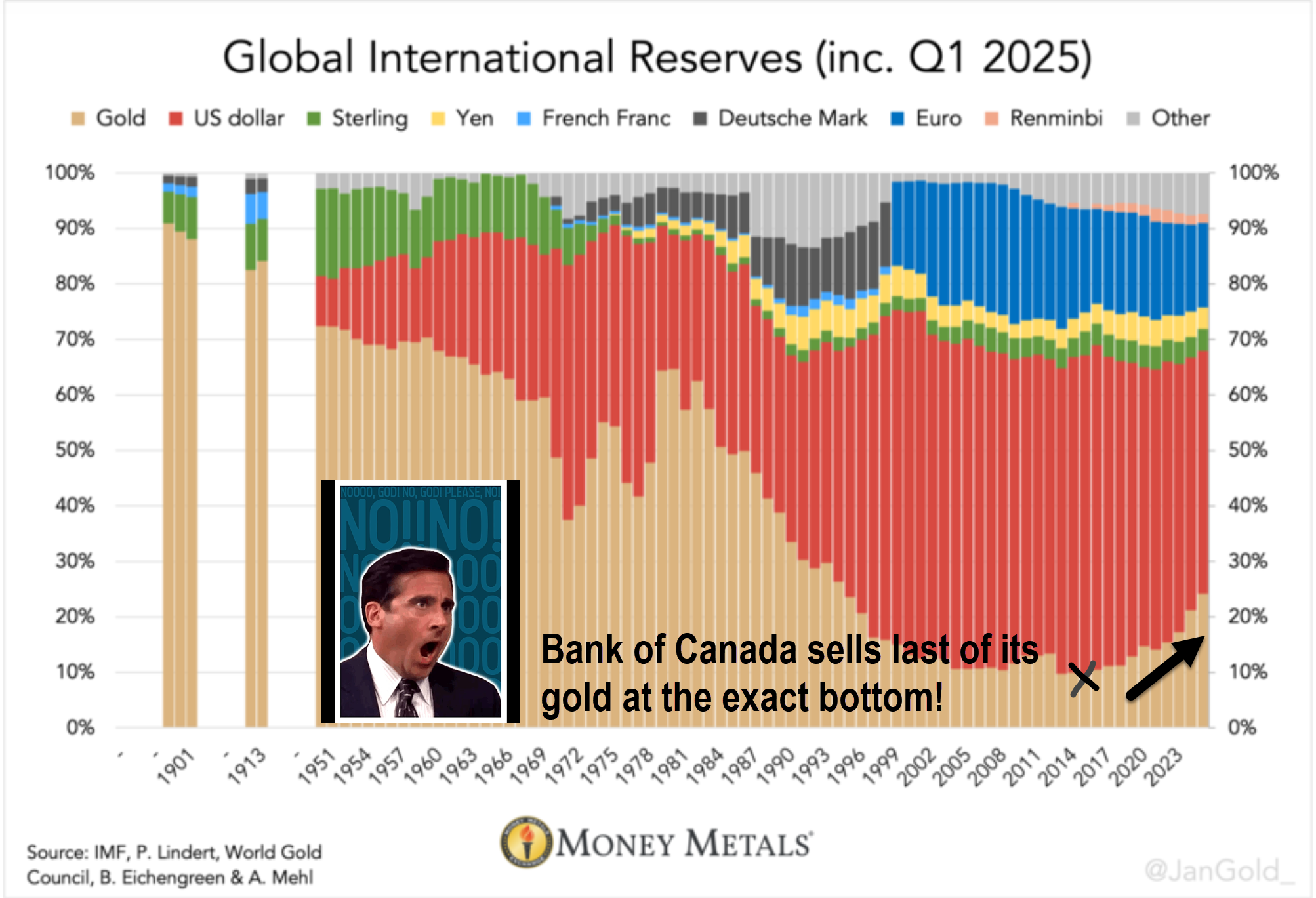

Bankers too, can be as fickle as friends. In 2016, the Bank of Canada (BoC) sold off the last of its gold reserves, abandoning the ultimate inflation hedge. Back in 1965, Canada held 32.9 million ounces (1,023 tonnes) of gold (worth about $1.2 billion then). At today’s price of nearly $4,800/oz CAD, that hoard would be valued at $157 billion more than the BoC’s current total reserves.

The contrast with Chart 2 shows that the long-term composition of global international reserves is stark. While Canada abandoned gold, central banks across the world have been steadily adding, reversing decades of dollar dominance as trust in U.S. Treasuries erodes.

Chart 2. Bank of Canada Bottom Ticks Gold

When Bonds Break, Gold Takes the Lead

Yields on 30-year government bonds have surged to 20-year highs (Chart 3). In Canada, the anticipated deficit of nearly $100 billion dollars and refinancing needs of more than $300 billion will likely push rates higher here as well.

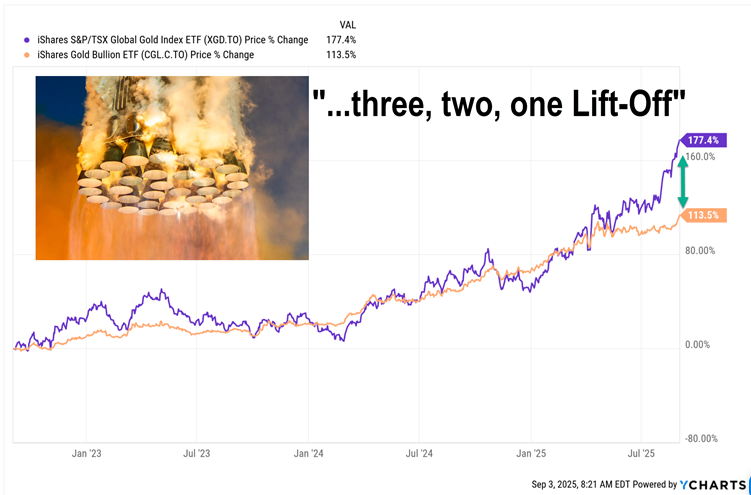

Chart 4. Lift-off for Gold Miners

The Case for Gold Miners in 2025

This is the leverage effect at work: when gold makes new highs, miners’ margins expand exponentially. After years of neglect, gold equities are finally rewarding investors. They are rallying off very low prices and represent a tiny fraction of the U.S. (1%) and Canadian stock markets (8%). If gold continues to rocket higher, the TSX has much more leverage to it. When investors rotate into gold miners, fireworks follow.

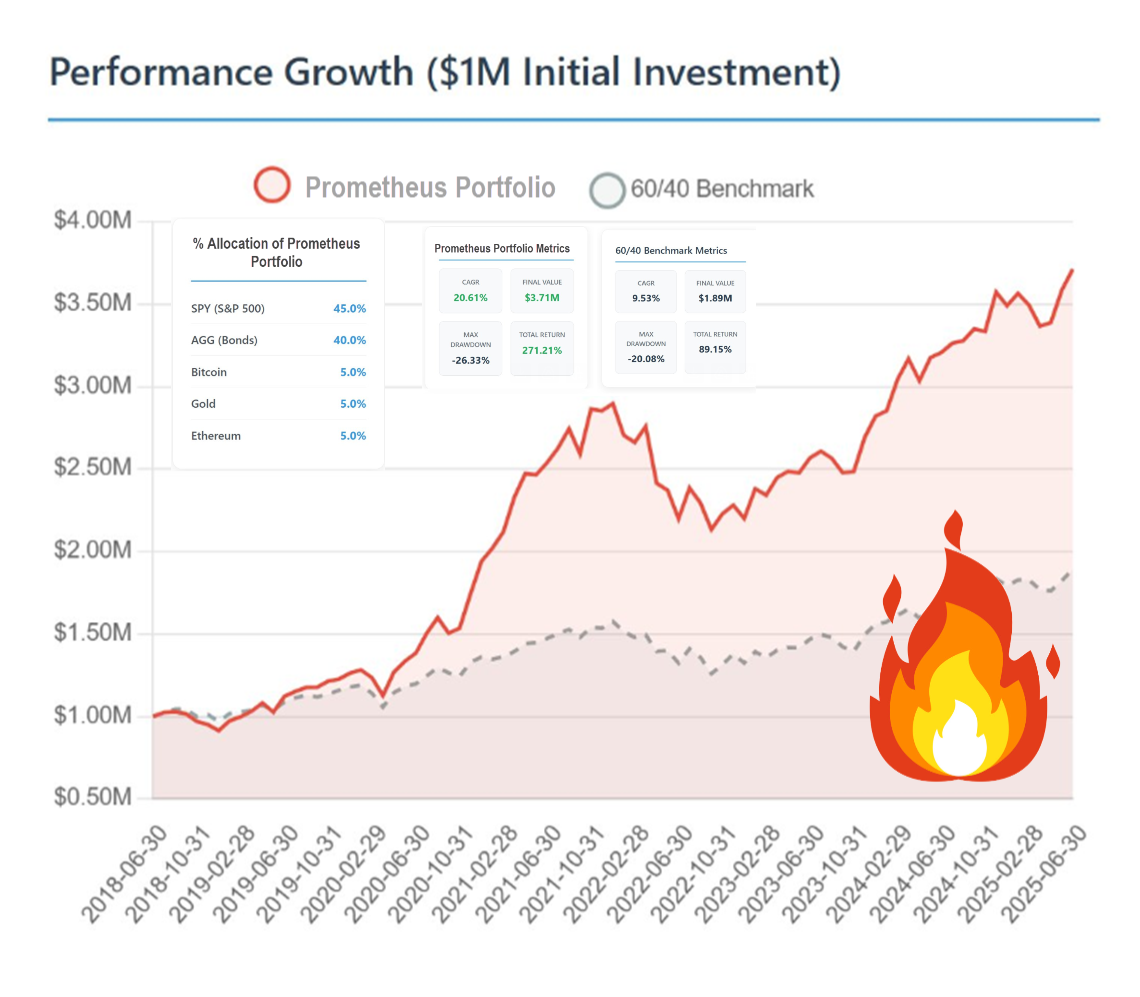

Lessons from the Prometheus Portfolio

Three weeks ago, we illustrated this dynamic in our Prometheus Portfolio—showing how gold and hard assets serve as fire stolen from the gods of sovereign debt. That framework is playing out in real time. Chart 5 is a reminder of the power of substituting gold and digital gold in portfolios.

Chart 5. Recap of Prometheus Portfolio

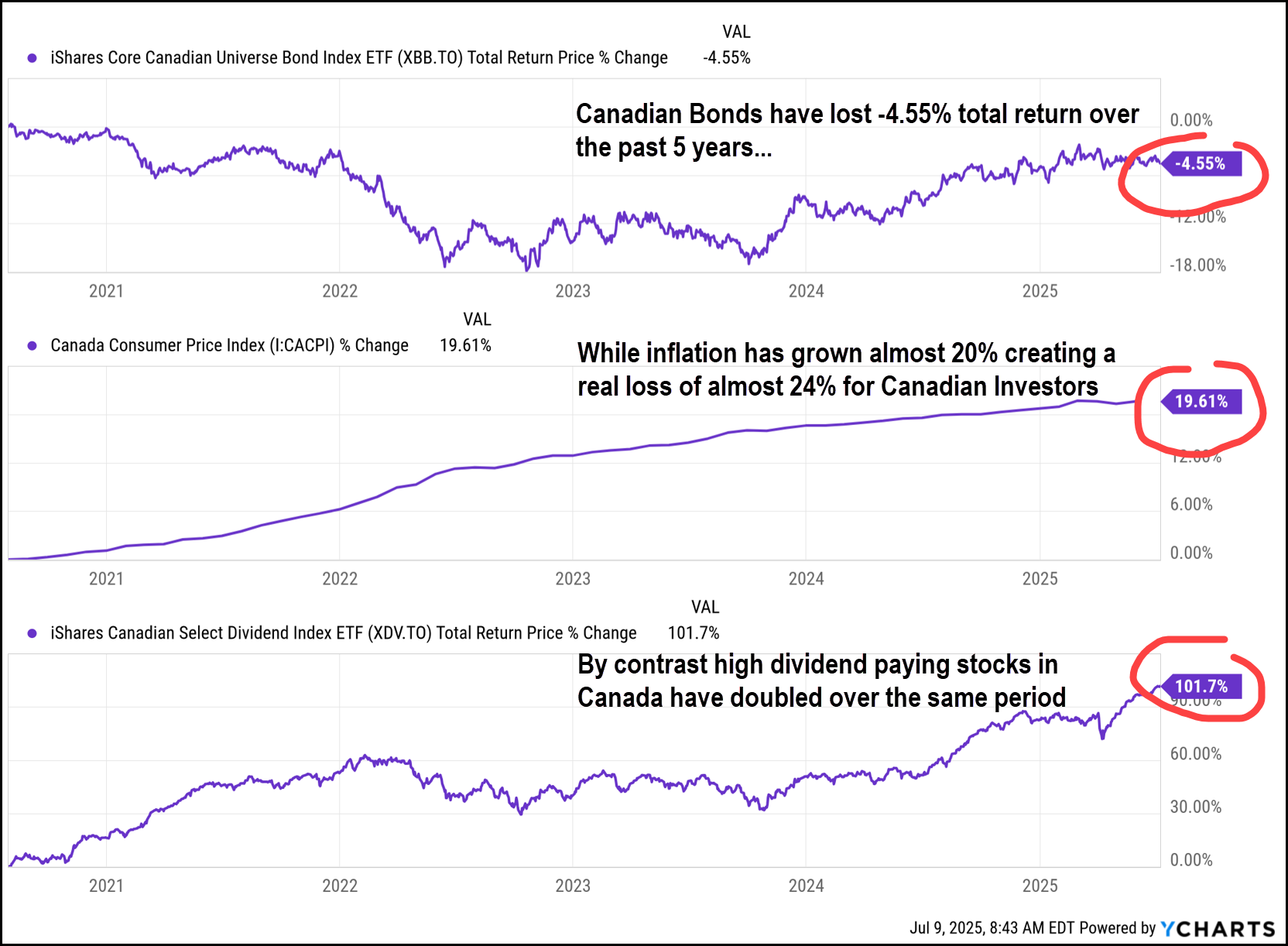

In our “Back to the 1950’s” (https://advisor.wellington-altus.ca/evansfamilywealth/dividend-stocks-vs-bonds-2025/) report we illustrated how poorly bonds have fared since the bottom in rates. Chart 6, recaps earlier work that demonstrated the power of substituting high dividend paying common shares for bonds in Canada:

YCharts.com © 2025 YCharts, Inc. All rights reserved

Chart 6. The Danger of Bonds

Canadian Investors Face a New Dilemma

Canadian investors (particularly conservative ones) now face a difficult decision regarding the appropriate role for bonds in their portfolios. As your financial advisor, I feel the weight of this decision as well.

For decades, the industry has equated bonds with low risk. But the numbers tell a different story:

- Over the past five years, Canadian bonds have lost 4.5% in total return.

- With inflation up nearly 20% over that time, the real loss for bond investors is closer to 24% (Chart 6).

- By contrast, high dividend-paying Canadian equities have more than doubled, rising over 100% in the same period.

This echoes the lessons of our Prometheus Portfolio (Chart 5), which has consistently outperformed the traditional 60/40 benchmark by embracing hard assets, equities, and alternatives while reducing reliance on bonds.

Ironically, the proper trade today may be to reduce bonds even further than the Prometheus Portfolio suggests and substitute high dividend-paying common shares.

Bringing It Home: Time to Rebalance Portfolios?

We opened with diamonds—a glittering friend built on marketing and cartel control. Gold’s value, by contrast, is rooted in geology and 4,000 years of monetary history. Canadian bonds once held a similar reputation for safety, but as our charts show, that sparkle has dulled. In our reviews this fall, let’s discuss whether it’s time to reduce bond exposure further and substitute enduring assets (like dividend-paying equities) that can carry portfolios through the next cycle.

Watch the Video: Gold vs Bonds

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen