“There are two kinds of economists: those who know they can’t predict the future and those who don’t.” —John Kenneth Galbraith

Learning from Historical Market Recoveries

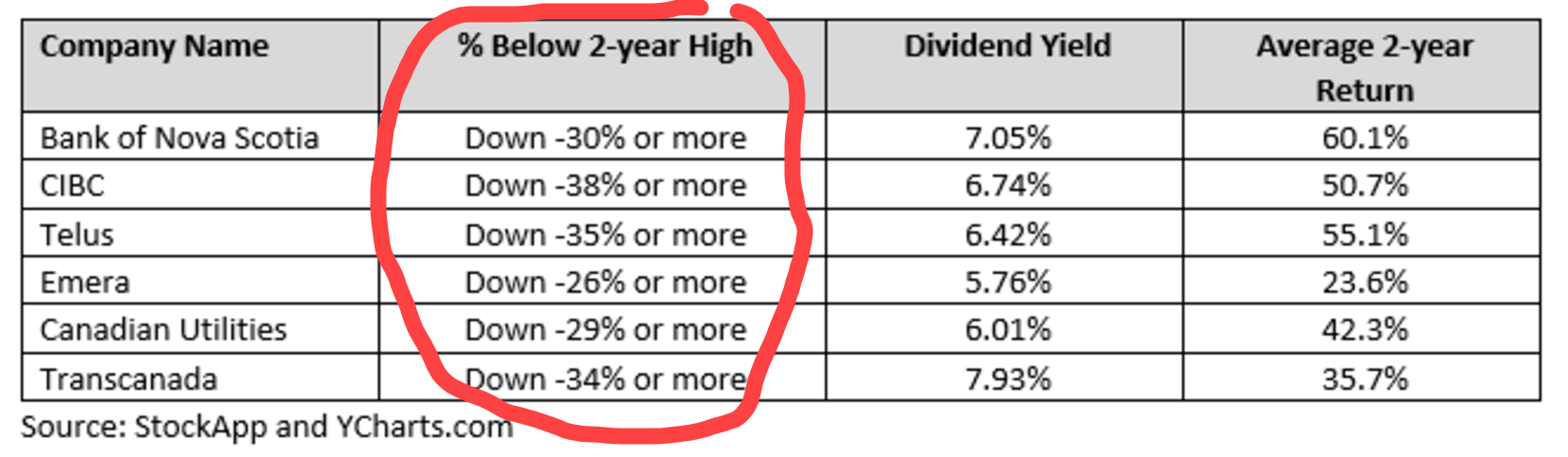

A little over a year ago we published a bold piece of research—not a forecast—but a historical study of how Canadian blue chip stocks performed on average two years after the kind of collapse we saw in October 2023. Remember this table? Look at those losses!

We titled that article “Il Gigantes” named after the piece of marble that Michellangelo carved his David from. It is one of my favourites—you can read the whole thing here. At the time I wrote it, Canadian blue chip stocks were down over 30% from their highs. The fear was palpable. To say that this study was against the grain is an understatement. Here was the punchline from the piece, “To be clear, we can’t be certain that history will repeat—but we can hope it rhymes.”

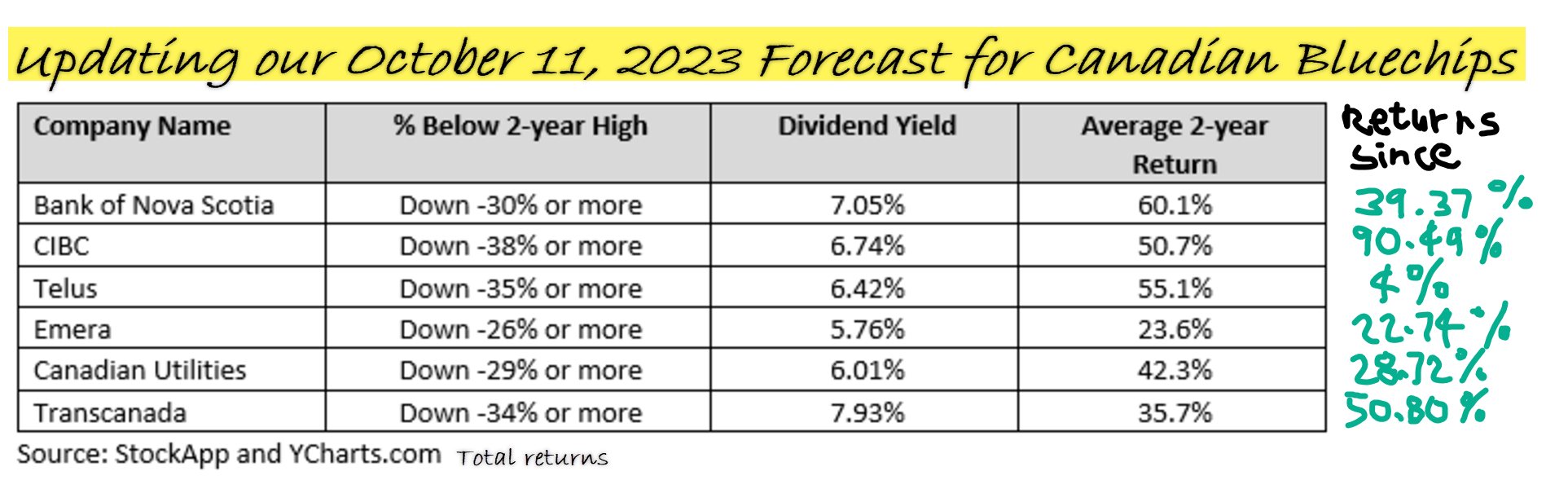

Oh it rhymed! Just a little over one year later let’s update that chart:

Turning Losses into Gains: The Power of Historical Data

Isn’t that amazing! There is no genius here. Quite the contrary. Since I know I can’t predict the future, I invested in building custom software to examine how the share prices have performed in the two years following prior periods of weakness. No forecasts needed—just historical precedent and humility. We’ve written over 40,000 lines of code to acknowledge that since we can’t predict the future, we owe it to our clients to learn everything we can from the past!

Why Patience Rewards Long-Term Investors

Congratulations on holding on through difficult times and reaping the reward that patient investors typically have. Not everyone can celebrate, because many capitulated by selling near the lows—convinced by smart-sounding economists or bearish financial advisors that the world was coming to an end.

Beware of Bearish Narratives: How Fear Impacts Investments

I’ve been doing this a long time—this pattern repeats every cycle. Bearish economists and advisors prey on individual investor’s fear—the media loves it and amplifies their growls. Worse, our brains are specifically designed to pay more attention to bad news than good news. Giving your attention to the bears is like inviting them to a picnic—there’s not going to be any pie left for you!

I’ll never forget one of my first discussions with a new client—I was suggesting her asset allocation was far too conservative given her goals and time frame. She agreed, indicating she had long wanted to have more growth, but her former advisor (a perma-bear) always scared her off. In her words, “it never seemed like a good time to buy”. Happily, she has participated in this bull market! Not everyone has.

Meet the Weasel-Bear: A Cautionary Tale for Investors

Perma-Bears are easier to recognize than their cousins, the weasel-bear. These cute little guys lack the conviction of the perma-bear. I think they may be more dangerous—they are a funny looking bunch. Picture a bear with little weasel legs. 😀

Weasel-bear as imagined by Midjourney 😉

As the stock market begins to make new all-time highs, their little weasel arms can’t quite reach the keyboard to enter any new buy orders. “Be careful!” they warn. “Markets are overvalued!” “AI is a bubble!” “Bitcoin is a scam!” They justify missing the entire bull market under the guise of ‘prudence.’ They’re not actually overprotective mama bears, that charge at both real and imagined threats, they’re more conniving than that.

Weasel-bears are trying to have their cake and eat it too (they are, afterall bears!). They want to be on record telling clients “to be careful” without having the conviction to do anything about it. Here’s a classic example. Look at the dividend yield column of the table above. Many of these Il Gigantes were paying 7% near their lows. Despite that, weasel-bears were recommending structured notes on the Canadian banks at the lows rather than the underlying securities themselves. These expensive products cap the potential upside of owning the stocks while offering downside protection. That’s like closing the barn door after the horse has bolted. Imagine missing that recovery!

Why Fear-Based Investing Always Sells

So why do the bears keep growling? It sells. Sooner or later, the market will drop and they’ll be able to say, “I told you so”! Let’s be clear, the longer this bull market lasts the closer it comes to the end; but bull markets can go on for a long, long time. Our job as investors is to participate in the bull market, not whine about missing it.

Staying the Course: Evidence Over Fear

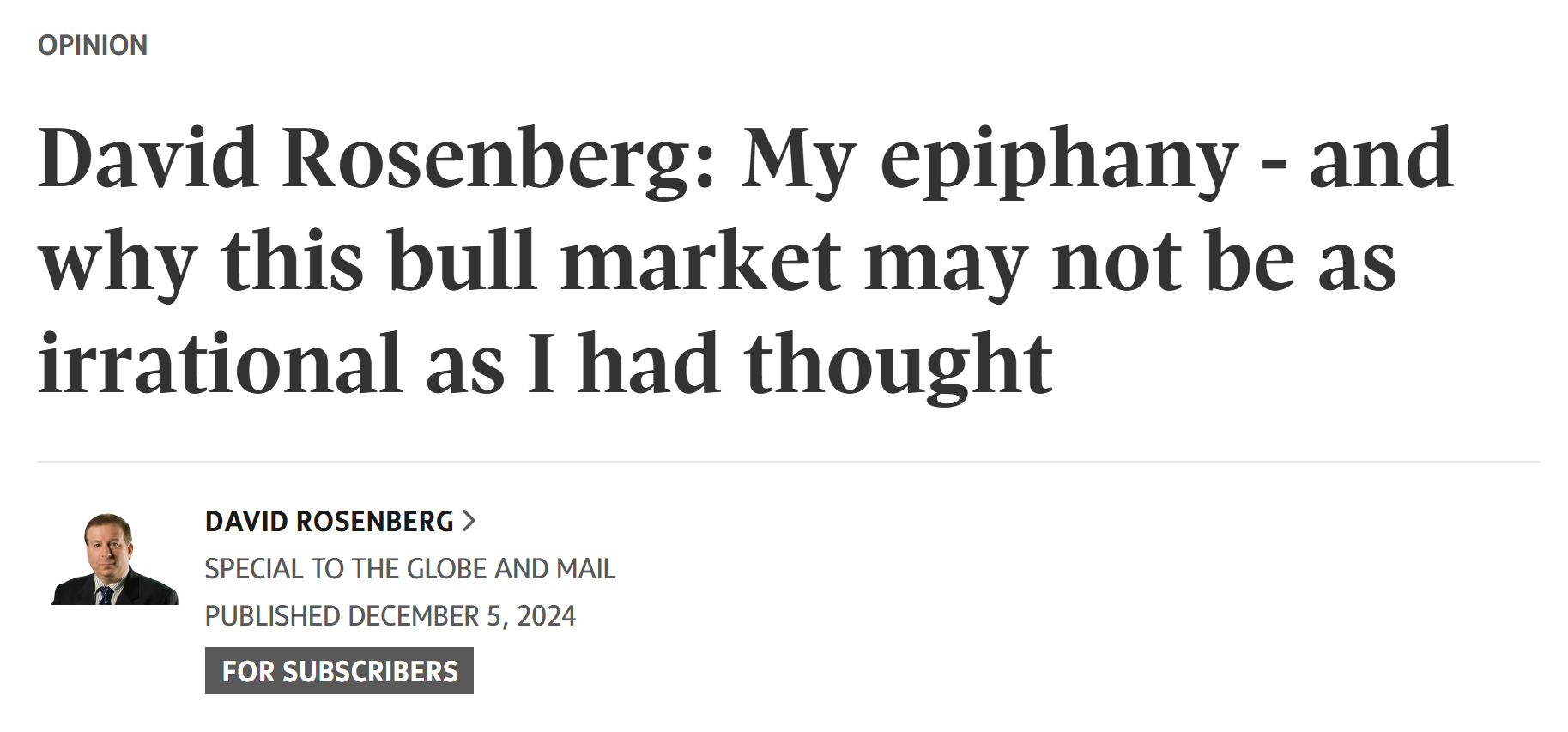

Recently, noted Canadian “perma-bear” David Rosenberg issued a mea-culpa (not his first) for having been bearish through this whole bull market. Astoundingly, the weasel-bears held up his apology itself as evidence that the end was nigh!

Whoops:

Help Friends and Family Avoid the Bear Traps

I’ll offer no forecasts here except to say that we continue to use our empirically tested, historically-based methodology to help us assess the relative health of this market. At present, it is very healthy. Yes, markets are overvalued, but earnings are growing, breadth is increasing and volatility remains very low even as central bankers cut interest rates. The incoming President is set to unleash a pro-growth agenda. While corrections are par for the course, we remain invested.

This holiday season, there will be two types of investors—those unwrapping high returns will be smiling and those unwrapping big lumps of coal will be frowning. Briana and I are delighted to have helped bring a smile to your face. Help us help your friends and family be among those with big smiles next year! Forward this blog post with our invitation to meet and we’ll make sure they don’t feed the bears any more!

Watch the Video: The Most Important Lesson for Investors – Don’t Feed the Bears

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen