In the 1860s, New York financiers gathered outside at “The Curb” to make and settle political bets. Later that site would become the American Stock Exchange—to make and settle political bets. Unlike today’s pollsters, they put their money where their mouths were, confident that financial stakes would reveal the real political sentiment of the day.

American Stock Exchange source

By the 1890s, these betting activities moved upscale to the Waldorf Astoria, with the markets growing to over US$200 million (in today’s dollars). The advent of Prohibition and subsequent legal restrictions led to the decline of these betting markets, paving the way for the rise of professional pollsters. This transition, as recent election outcomes suggest has left everyone poorer.

Waldorf Astoria: Photo courtesy of Waldorf Astoria New York Facebook

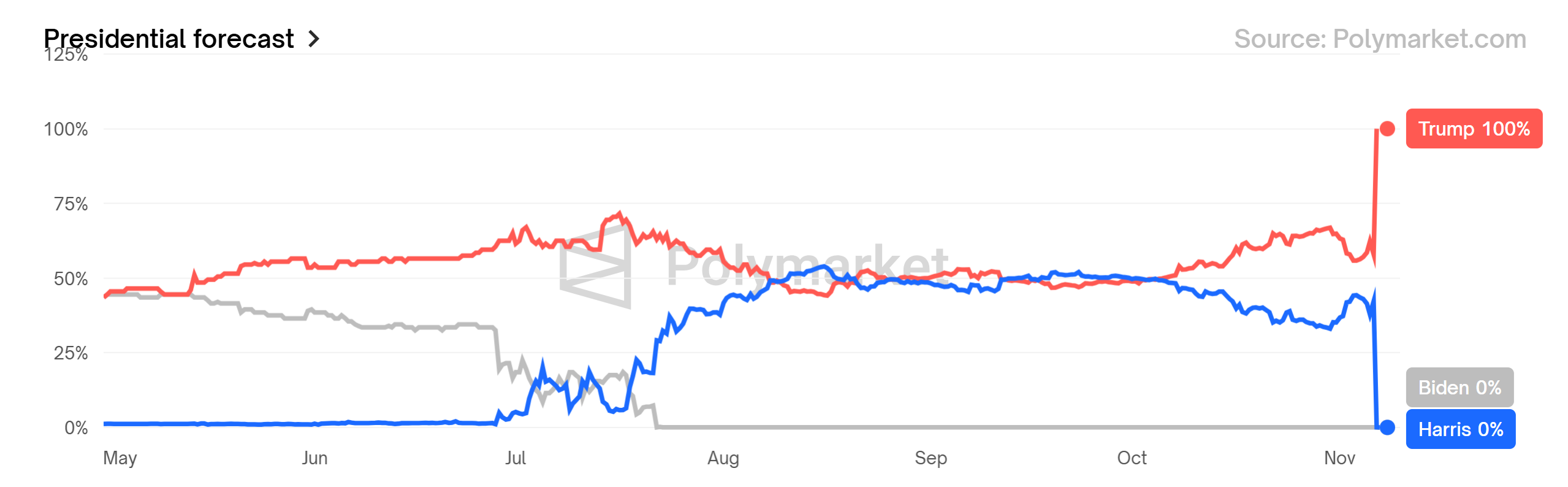

Enter modern prediction markets like Polymarket, PredictIt, and Kalshi—which could render traditional pollsters obsolete. While pollsters misled Americans with narratives of a close race, these prediction markets reflected a different story, one grounded in capital-backed sentiment. Regardless of one’s feelings about the election outcome, investors should recognize the power of these new technologies, which combine market dynamics with capital to yield insightful predictions.

Shayne Coplan, founder of Polymarket, posed a question on election night that underscores the power of these new platforms: “Why would the pollsters be right? They don’t actually have inside information—if they did, they should use it to bet on Polymarket.” As investors, we are witnessing remarkable shifts in market accessibility and technology. Trading hours are expanding, with platforms like Robinhood now offering nearly 24-hour trading access, allowing investors to respond to market dynamics around the clock. Just a few years ago, cryptocurrency was a niche investment class; now, with recent political developments and growing adoption, it appears ready to go mainstream. These transformations are set to profoundly impact financial markets, making way for a new era of capital-backed, real-time sentiment tracking that surpasses traditional methods.

As portfolio managers, our task is to develop non-correlated strategies—investments that don’t all move in the same direction simultaneously. Non-correlated assets provide a buffer, balancing risks and stabilizing returns across market conditions. When one asset dips, another might hold steady or rise, protecting the portfolio’s value. We will always look for those opportunities.

Some of my peers may be uneasy with the blurring line between speculation and investment. Purists won’t be quick to cheer technologies like cryptocurrencies and prediction markets entering the mainstream. At Evans Family Wealth, our goal is to create resilient portfolios—capturing growth while prioritizing stability, regardless of market direction. We’re not purists, but we are prudent. In our view, these are enabling technologies. Fighting technological innovation is a bad bet.

Watch the Video: This Election’s Biggest Losers!

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen