Year: 1846,

Location: Atlantic Ocean off of the coast of Nantucket

The harpooner stood in the prow – balanced despite the swells – with a shout, he launched the spear. Panicked and in pain the whale bellowed and dove. Chaos erupted in the boat as the line tightened; yanking the boat forward in a surge of foam and spray. Men clung to the sides, adrenaline high, as they were towed through choppy waves by the desperate animal, their lives hanging by a taut, blood-streaked rope.

Hermann Melville’s Moby Dick which was published in 1851 – five years after the peak of the US Whaling Industry and eight years before the first oil well in America was drilled – immortalized the whaling industry. Can you believe that whale oil lubricated some of the fine machines of the industrial revolution for a century before petroleum products replaced it? Mind Blowing.

A Bath of Black Gold

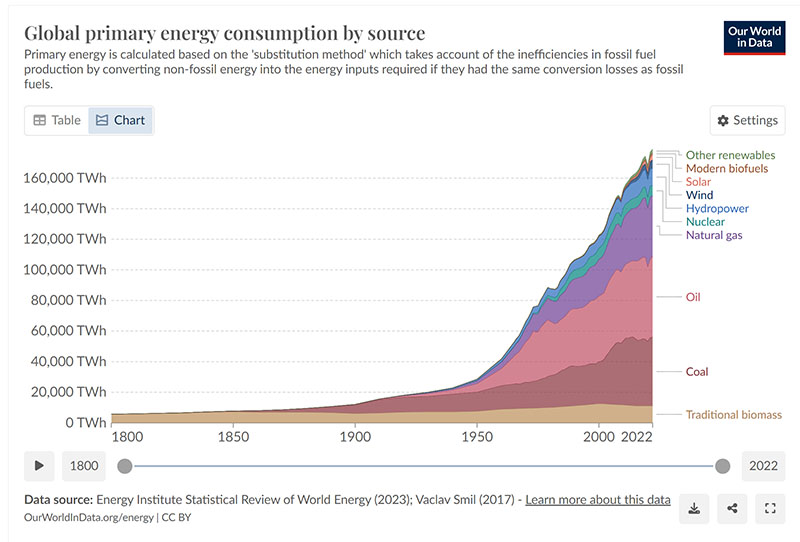

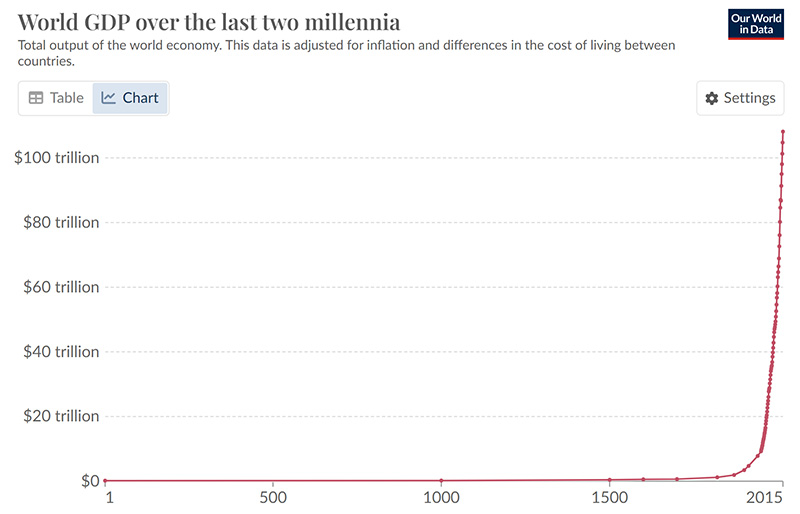

The world changed on August 29, 1859 when Edwin Drake’s steam-powered drill struck oil at just 69.5 feet in Titusville, Pennsylvania. Drake’s discovery would soon end the profits (and horror) of the whaling industry and change the course of civilization. The era of cheap and abundant energy began as the bathtub Drake had placed beside the well began to fill with black gold. This inflection point in history can be seen in the charts below. For millennia, human kind was stuck in scarcity – energy abundance unlocked all that we now call civilization.

source: https://ourworldindata.org/global-energy-200-years

source: https://ourworldindata.org/economic-growth

Energy: The Engine of Civilization

Energy is life – the correlation of Global GDP (chart above) and Global Energy Consumption (top chart) is uncanny. What unlocked the amazing abundance we have seen since the 19th century has been fossil fuels. Abundant, cheap energy is considered fundamental to all human thriving. That truth has incentivized us to transition from less dense to more dense energy sources throughout history. Whale oil was replaced with Petroleum. Wood was replaced by coal. Animals were replaced with steam engines and nuclear offered an off-ramp from petroleum that society chose not to take.

The Promise and Problem of Green Energy

In recent years, the Green Energy transition has been forecast to replace fossil fuels. If successful, this would represent the first time in history that energy has transitioned from a more dense to a less dense energy source. With western governments backing, OffShore Wind Farms will now dot the horizon of Nantucket where the sails of Whaler ships once billowed.

You might expect that investors in Wind and Solar would be harvesting fat premiums as governments have been subsidizing the construction of new renewable energy sources – not so much actually. After a spectacular run-up in price in 2020, Solar, Wind and Green Energy ETFs have cratered (down -40% to -60%), while traditional energy and Uranium have skyrocketed (+150% to +220%). Strange, right?

source: YCharts.com

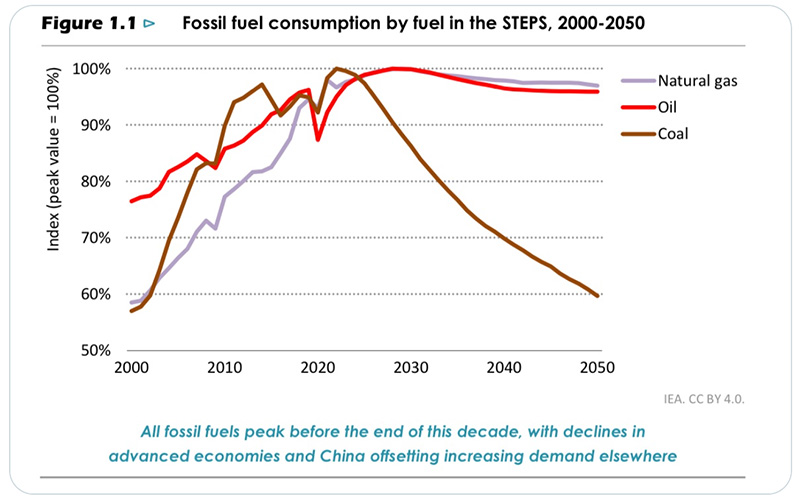

I read a lot about the energy transition, one of the better sources is the International Energy Agency, IEA. They recently updated their World Energy Update. I found this chart reading through the report. While we environmentalists will cheer the drop in coal, notice that Natural Gas and Oil only modestly decline?

Fossil Fuels: Still In the Driver’s Seat

The report proudly claims that fossil fuel use will peak in 2030, but it sure doesn’t look like it is dropping much after that. As you might expect, Big Oil CEOs have repeatedly questioned the forecasts of the IEA. Recently, both ExxonMobil and Chevron put their money where their mouth was by announcing massive acquisitions. As an investor, you might be wondering, if oil and gas stocks are a good enough investment for ExxonMobil and Chevron – why not for me? Based on the recent performance, and the expected usage through 2050, their businesses look pretty good:

source: YCharts.com

What’s Dragging Down Green Energy?

This still doesn’t answer the question why are Wind and Solar stocks underperforming? Higher costs and early failures (and, ironically, dozens of dead whales) have called into question the feasibility of offshore wind projects – source. The largest wind turbine manufacturers including Vestas, Siemens and GE have all suffered losses, failures and cost overruns which threaten to imperil the green transition the IEA is banking on. We are seeing so much backtracking of European countries on their Green Energy aspirations that a term has been invented to describe it – “Greenlash”. https://www.reuters.com/sustainability/greenlash-fuels-fears-europes-environmental-ambitions-2023-08-10/ Major automotive makers like Ford and GM have recently recanted on their EV sales goals. Solar stocks too have been struggling despite the support of the Inflation Reduction Act. What should investors do?

Facing Reality as Investors

We might not be happy with this development, but as investors our first job is to face the world as it is rather than as we might hope it is. Since you pay me to manage and grow your money, that means being invested in energy – including fossil fuels. The day may come when I’ll need to pivot and add to the Green Energy names that are down (indeed, given how far some of these names have fallen, I imagine that day may be soon).

Investors need to be careful to avoid Ahab’s error. Remember Captain Ahab? In Melville’s story Captain Ahab was obsessed with the white whale – pursuing him at any cost. Eventually, Ahab harpooned Moby Dick, only to become entangled in the rope and dragged down into the abyss. Legislators, playing with taxpayers funds, have more than a bit of Ahab in them. Like Ahab they seem determined to pursue their climate agenda at any cost. Investors with skin in the game – their own limited capital – need to be more careful. We need to make sure we’re not chasing the White Whale.

Glen