source: Midjourney

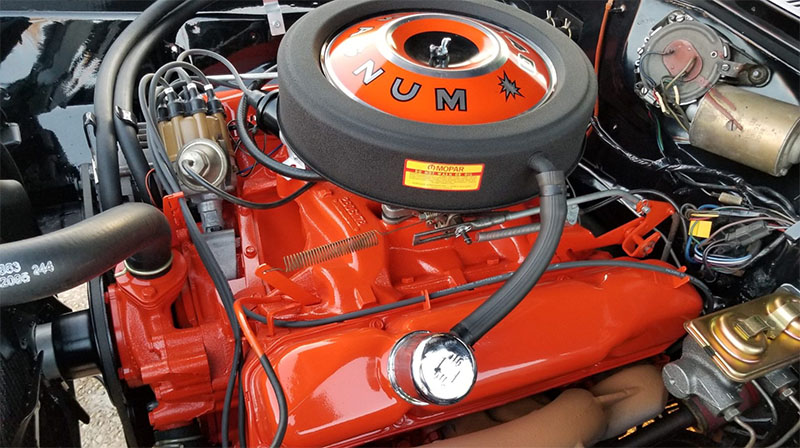

The Chrysler 440 cubic inch motor was the largest of its big block engines. Debuting in 1966, this 7.2 litre behemoth featured pistons that were almost 5″ in diameter. Gear heads will debate whether it, the Ford 427 or the Chevrolet 454 were the biggest and baddest.

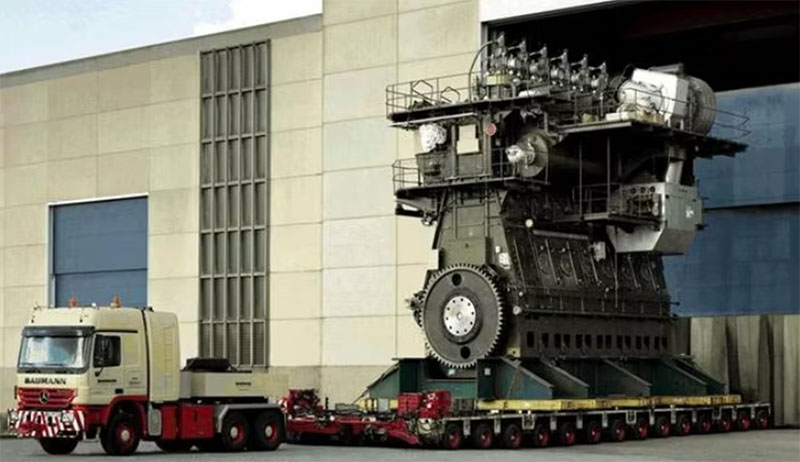

They’re all wrong! All of these motors would fit inside a single cylinder of the Wärtsilä RT-flex96C ship engine. Each cylinder of this Finnish built whale has a displacement of 1,828 litres. Three stories tall with 20 foot long, 38″ diameter pistons, the largest diesel maritime engine on earth generates a staggering 107,000 horsepower.

Source: Adobe

This engineering miracle powers some of the largest container ships on earth, steadily churning the water at 15 to102 RPMs. Imagine that instead of carrying containers, that ship was the US stock market. Then tech companies would be the storey tall engine pushing the vessel forward. Indeed the pistons in seven of the eight cylinders would be composed of the largest technology companies on earth:

These companies have powered the US stock market to the top of the global market leader board for many years. All technology companies (including Tesla and Amazon) make up almost 40% of the S&P 500. In Canada, technology only accounts for a meager 10% of the index. If the US market is a container ship powered by the largest engine on earth – by comparison Canada’s a kayak.

source: Midjourney

The difference in allocation to technology explains most of the relatively poor performance of the Canadian stock market compared to the S&P 500. The other major difference between the Canadian and US stock market is that Canada has almost 3x as much exposure to our big banks, energy and utilities as the US has. What if we corrected that?

I’m a gear-head when it comes to financial markets – when other guys are getting greasy turning wrenches in the garage, I’m generally working away at the computer. (I admit it, I always wanted to be gear-head but I’m really just a geek! 😀) Years ago I dug into the historic returns and weights of the two indexes and discovered that if we just changed the Canadian sector weights to that of the US, we could dial up a similar return to the US. This week I decided to run a quick update and sure enough, the numbers still hold up:

source: YCharts.com

What you’re looking at here is a synthetic TSX created with the sector weights of the S&P 500 (purple line) compared to the S&P 500 in orange and the TSX 60 in blue. Notice how closely aligned the orange and purple lines are? To be clear, that’s using the Canadian sector ETFs with the weights of the S&P 500. So we own none of the Magnificent 7 – we own Canadian technology instead. Think about that for moment – we generate basically all of the upside of the S&P 500 without any exposure to the engine powering it! (Full disclosure, Canada is seriously lacking in some areas like health care stocks – so I substituted Canadian dollar hedged Global ETFs where necessary.)

So far this has been a history lesson – we’ve explained why the TSX has underperformed the S&P 500. That doesn’t answer the more pressing question – will the US outperformance (i.e. Tech) continue? Let’s get more specific – should Canadian investors like you radically reduce your exposure to Canadian banks and increase your exposure to technology – to as much as 40% of your portfolio? Probably not.

Another gear head analogy. Ever ride in a sports car or muscle car? It’s amazing – I love the sound of a big block with a performance cam and dual exhaust – rumbling away. You feel it in your chest. The feel of the car squatting and breaking loose, the smell of burnt rubber – it’s visceral and exciting. Similarly, the cornering capability of sports cars defies common sense – they corner like they’re on rails – all wheel drive pulls you through the corners. You need special bolsters to keep yourself from sliding out of the seat! Each is awesome in its own way – what they are not is smooth. You feel the bumps.

Take another look at the purple and orange lines – see how much more they dropped in 2022? Intuitively, you know that having 40% of your portfolio in technology is going to increase the volatility of your portfolio. What is unknown is by how much.

Sure I like speed and cornering – but you know what I’m a really big fan of? Brakes. Especially on investment portfolios. I may be a techno-optimist but that doesn’t mean that I think investors should pile into technology without any regard for having brakes. History teaches us that speed might get us to our destination faster – but brakes will ensure that we survive!

Glen