I think we too often make choices based on the safety of cynicism, and what we’re lead to is a life not fully lived. Cynicism is fear, and it’s worse than fear – it’s an active disengagement.

– Ken Burns

The Danger of Cynicism in Investment Decisions

You’d never know it by reading the news, but you and I are among the luckiest souls to have ever lived! By nearly any metric, today is the best time in history to be alive. We’re the safest, healthiest, wealthiest and most peaceful generation in world history.

The Current Technological Revolution: A Game-Changer for Investors

We’re also privileged to be living through one of the most consequential technological transformations in history. This transformation has the potential to make the industrial revolution look quaint by comparison. Developments in Artificial Intelligence, Blockchain Technology, Computational Biology, Energy/Battery Technology and Robotics are now increasing at exponential rates. Too often, investors’ response to these opportunities is based on fear and cynicism.

Navigating Investment Opportunities with Cautious Optimism

A better response is cautious optimism balanced with a healthy dose of skepticism. Getting that balance right is likely going to distinguish those who successfully navigate this transition from those who miss the boat entirely.

The Risk of Missing the Boat: Fear Holding Back Investment Growth

Many in my industry risk missing the boat altogether. Game theory is at play here. Investment advisors who become cynical know that nobody gets fired for buying the bank stocks in Canada! I’m not an expert, but I spend a lot of time trying to remain informed about developments in these areas. Without a commitment to continual learning, ignorance alone can create cynicism. Advisors who were burned by the tech bubble may be tempted to use fear to shut down client interest in tech, but hiding behind fear is no way to grow investment portfolios!

The Magnificent 7 and the Concentration of Returns in 2024

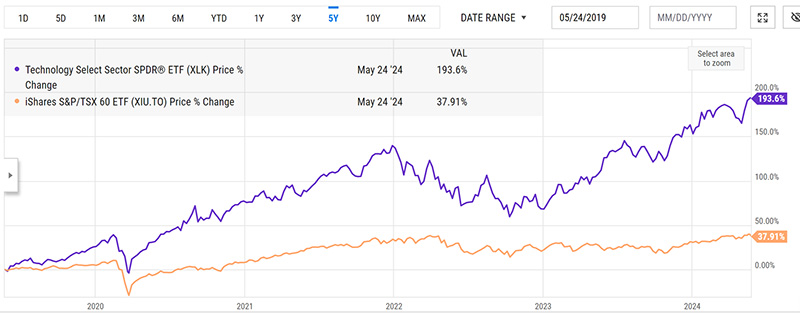

Tech has outperformed the S&P/TSX 60 stock market by 5x over the past 5 years (see chart below). 5x! It is reasonable to debate how much exposure each individual investor should have in this sector. Currently, technology comprises 31% of the S&P 500 (source YCharts.com). The right amount for you may be substantially less than that – but it probably should not be zero. Make no mistake, diversification is still fundamental to investment success – prudence dictates balancing exposure across all industries! That said, imagine missing the greatest investment opportunities of our lifetime by embracing fear and cynicism?

Source: YCharts.com

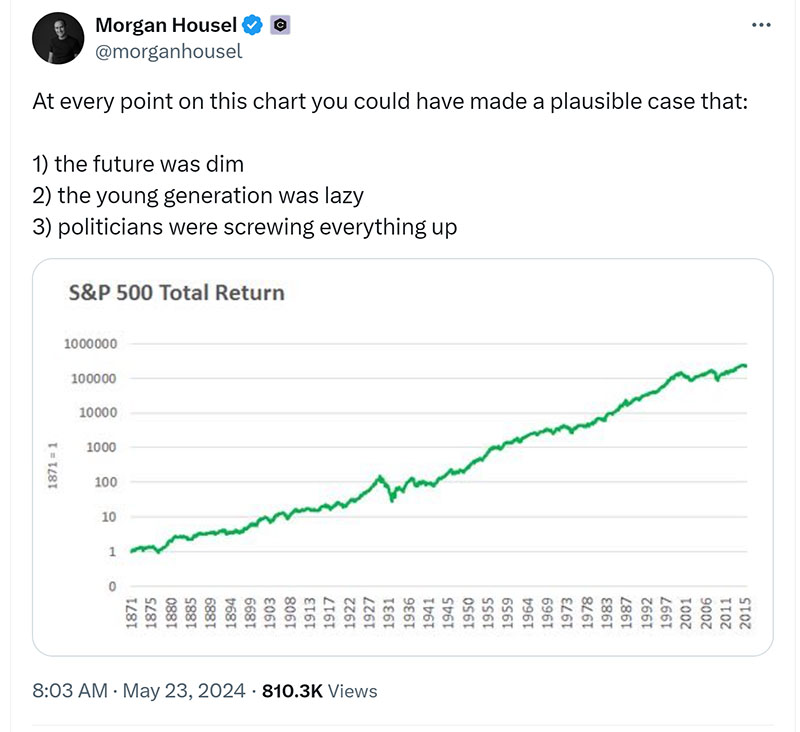

I love this tweet:

https://twitter.com/morganhousel/status/1793613842792247688

I believe strongly that the wealth building opportunities that are ahead of us will not be evenly distributed. We saw that last year when a handful of tech companies (referred to as the Magnificent 7) were responsible for almost all the gains of the S&P 500. In 2024, the leadership has narrowed even more with one company generating almost one third of the returns! (https://www.etf.com/sections/features/you-owe-your-sp-500-gains-nvidia#:~:text=NVDA%20accounts%20for%20a%20third%20of,2024%20returns%20in%20the%20S%26P%20500%20index). We seem to be in a new world of increasing concentration of returns. New thinking will be required to navigate this world. That’s one of the reasons I’m so happy to be at Wellington-Altus.

Dr. Jim Thorne’s Insights: Favoring Steady Growth in Tech and Beyond

Our Chief Market Strategist, Dr. Jim Thorne is a welcome breath of fresh air. Jim has been prescient on Bitcoin, and a long time technology bull. He sees further gains for stocks, gold and Bitcoin this year and writes: “It would be wise for investors to favour companies with steady growth, as the difficulties faced by cyclical businesses have shown up in their earnings reports. Investors should concentrate their attention on leading companies the “winners” of the current era.” https://wellington-altus.ca/may-market-insights-out-of-options/

It’s no easy thing to find the right balance between optimism and cynicism. That’s why we’ve built modeling and statistical tools to help us remove our inherent biases from the investment process. Over the past 12 years we’ve written over 45,000 lines of code to help us navigate this new world. At Wellington-Altus I can share more about our work – I’ll be talking more about that in future articles. Until then, know that our tools will help us guide investment decision making while mitigating the greatest risk of all – purely subjective investment rationale.

Cheers,

Glen