In 1892, the world’s attention was riveted on the disappearance of a racehorse and the apparent murder of its trainer. You’ll know the story by how it was solved and by who:

“Is there any other point to which you would wish to draw my attention?”

“To the curious incident of the dog in the night-time.”

“The dog did nothing in the night-time.”

“That was the curious incident,” remarked Sherlock Holmes.

The “dog that did not bark” is an appropriate way for investors to understand the significance (if any) of last week’s sharp market declines. If Sherlock Holmes were on the case he would probably point to the fact that credit spreads (another measurement of market anxiety), like the dog in the story, virtually slept through the mini panic. Investment advisors are part-time detectives, and occasionally markets provide a mystery we need to solve. Let’s grab our hat and pipe and investigate.

Understanding the Market Dynamics

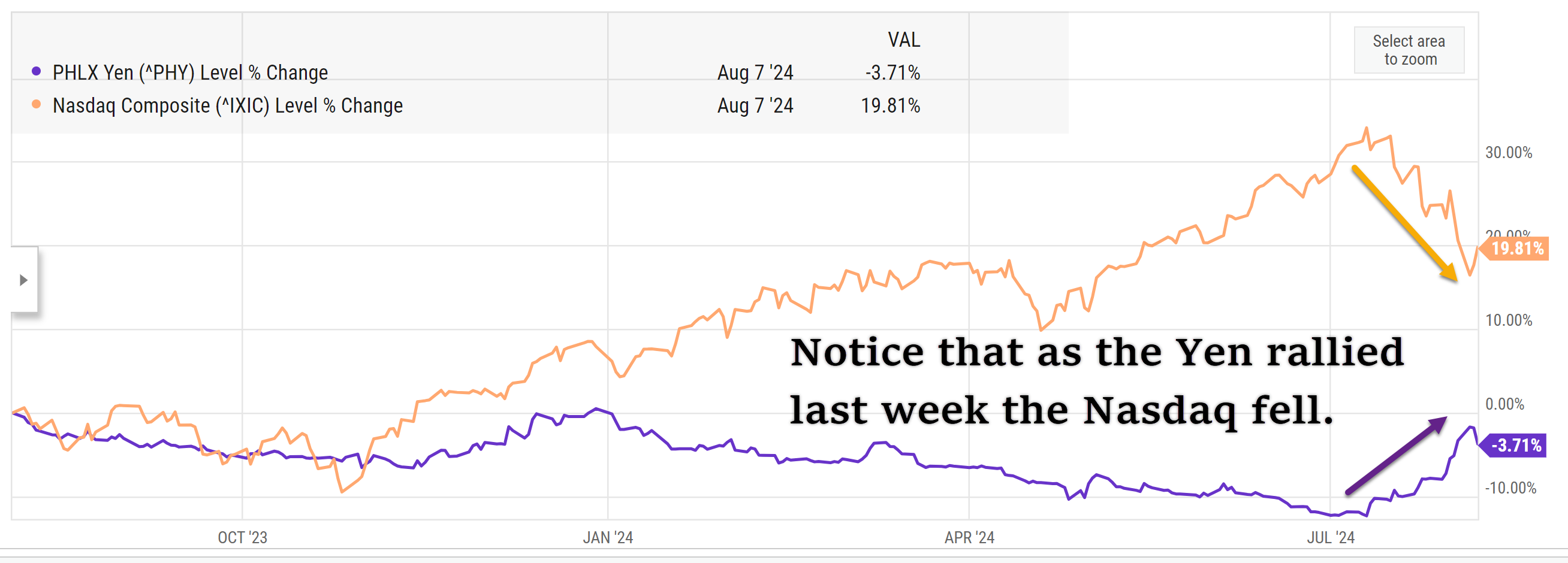

The major factors contributing to the recent market sell-off include a growth scare in America, indicated by a surprisingly low non-farm payrolls reading, and a Bank of Japan interest rate hike that sent the yen soaring, thereby crashing the carry trade.

Growth Scare in the U.S.

Investors reacted strongly to the U.S. non-farm payrolls report, which showed weaker than expected job creation and an increase in the unemployment rate to 4.3%, the highest level since 2017, excluding early pandemic years. This data point led to speculation that the U.S. economy might be heading toward a recession. However, despite these labor market signals, other economic indicators paint a different picture.

The U.S. economy grew at an annualized rate of 2.8% in the second quarter, and the Federal Reserve Bank of Atlanta’s GDPNow model recently updated its estimate for third-quarter GDP growth to 2.9%, up from 2.5% earlier in the month. This model, which provides a “nowcast” of GDP growth based on available economic data, suggests a steady expansion rather than a contraction.

Sal Guatieri, a senior economist at the Bank of Montreal, suggests that while the U.S. economy is slowing, it is not contracting. The rise in unemployment appears to be driven by an influx of new job seekers and re-entrants to the labor market, rather than an increase in layoffs, which remain below pre-pandemic levels.

Additionally, the ISM Services Report on Business for July 2024, showed the Employment Index expanding for just the second time this year, with a reading of 51.1%, a significant 5-percentage point increase compared to the previous month. This indicates a modest recovery in the service sector employment, further supporting the notion of economic resilience.

Bank of Japan Interest Rate Hike and the Carry Trade

The Bank of Japan’s recent decision to raise interest rates has had a significant impact on global financial markets. Over the past two years, the yen’s depreciation and Japan’s low-interest rates had encouraged global investors to borrow in yen to invest in higher-yielding assets elsewhere—a strategy known as the “carry trade.” With the Bank of Japan now tightening monetary policy, the yen has appreciated sharply, leading to significant losses for those engaged in the carry trade. This has prompted a wave of asset liquidations, contributing to the recent market volatility.

source: YCharts.com

The Curious Incident of Credit Spreads

While the spike in the VIX—the so-called “fear gauge”—to near-record levels has dominated headlines, it’s important to note the “dog that didn’t bark” in this scenario: credit spreads. Typically, a significant increase in market volatility is accompanied by widening credit spreads, signaling greater perceived risk in corporate debt. However, this has not been the case during the recent market turmoil.

Source: FRED

Source: FRED

As illustrated in the chart above, the ICE BofA U.S. High Yield Index Option-Adjusted Spread has remained relatively stable, only rising slightly compared to the extreme volatility seen in equity markets. This suggests that credit markets do not share the same level of anxiety as equity markets, indicating underlying stability in corporate credit.

Opportunities Amidst the Chaos

Despite the turmoil, there are several opportunities for investors:

- Valuation Adjustments: The market correction has led to more attractive valuations, particularly in sectors that were previously overheated. This presents a buying opportunity for fundamentally strong companies that are now trading at a discount.

- Sector Rotation: With the shift in economic dynamics, there is potential for sector rotation. Investors might consider reallocating their portfolios toward sectors that are likely to benefit from the current economic environment, such as consumer staples, utilities, and certain technology segments.

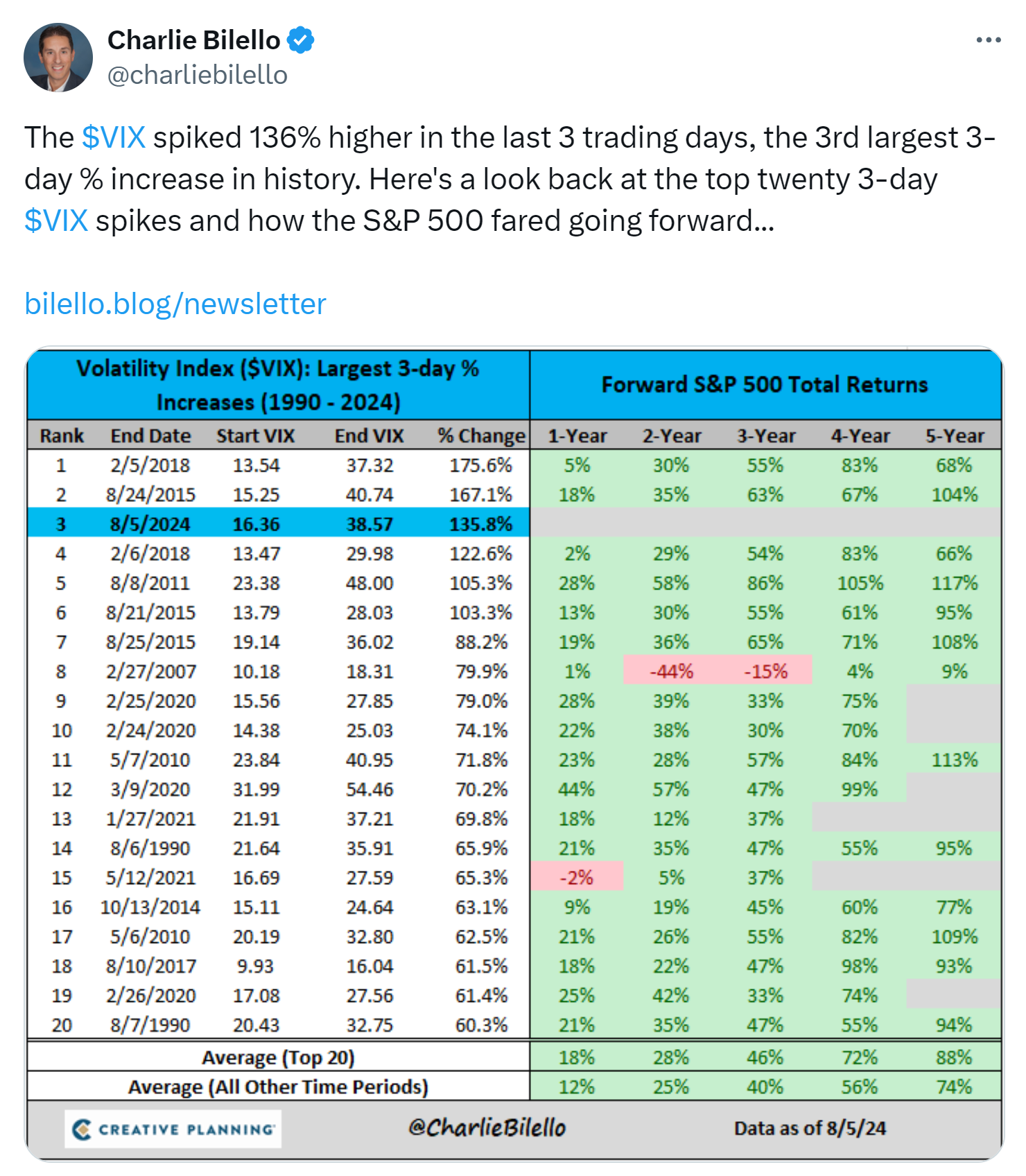

- Historical Context of VIX Spikes: As highlighted by Charlie Bilello, the VIX spiked 136% over three trading days, one of the largest increases in history. Historical data indicates that significant VIX spikes have often been followed by strong forward returns in the S&P 500. For instance, after the VIX spike on February 5, 2018, the S&P 500 saw a 5% return in one year and 83% over five years.

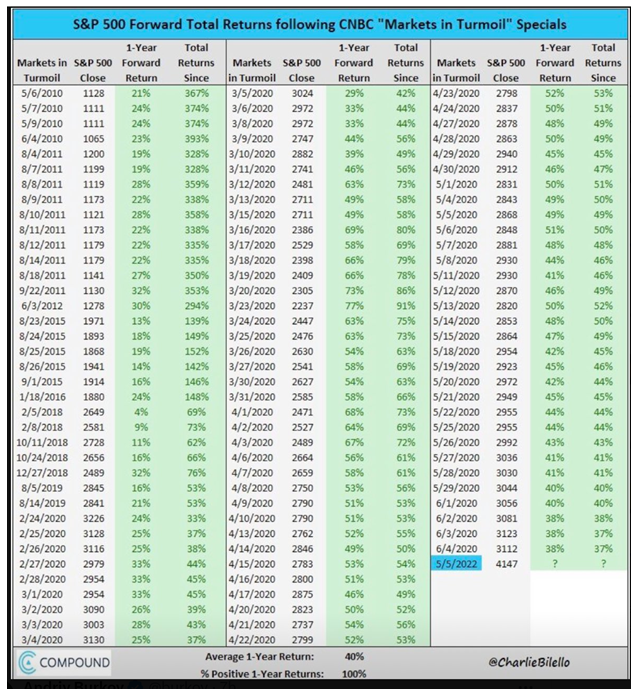

- S&P 500 Forward Returns After “Markets in Turmoil” Specials: Historically, S&P 500 returns following CNBC’s “Markets in Turmoil” specials have been positive. On average, the one-year forward return is 40%, with a 100% positive return rate. This historical trend suggests that current market conditions could present a buying opportunity.

- Big Tech’s Growing Capex and AI Investments: Major tech companies such as Microsoft, Alphabet (Google), Meta, and Amazon are significantly increasing their capital expenditures, primarily driven by investments in AI infrastructure. For instance, Microsoft expects to spend over $50 billion on capex in 2024, a 50% year-over-year increase. These investments are likely to drive future growth, making these companies attractive long-term investments despite current volatility – source.

Conclusion

While the recent market sell-off has undoubtedly caused concern, the mystery of whether we should fear an imminent U.S. recession is probably answered by the fact that the dog (credit spreads) did not bark even as equity market volatility spiked explosively. We should expect that more volatility is likely in the coming months (August through October are seasonally the weakest months). That said, it appears safe to say that the U.S. economy continues to show signs of growth, and the recent adjustments in valuations present opportunities for strategic investments. Briana and I will continue to be vigilant.

Source: Midjourney

Congratulations on solving the mystery, Holmes!

Dr. Watson