“Video killed the radio star…” The Buggles

Baroque opera killed the medieval lute. “Too quiet!” was the complaint. Happily, it didn’t stay dead – rather it was resurrected, Frankenstein-like and re-named the theorbo. Theor – what? Imagine a giraffe and a ukulele had a baby and you get an image of this remarkable musical instrument. The Theorbo was created by luthiers attempting to provide a greater range of sound to match the on-stage drama of the opera.

The Theorbo source: https://collections.ed.ac.uk/stcecilias/record/95956

The Revival of the Theorbo

Italian craftsmen in Florence attached an enormously long second neck to a lute and strung another 4 non-fretted bass strings alongside the 8 or 9 pairs of strings of the lute. You can imagine what purists thought! Despite the ungainly appearance, the theorbo caught on because in addition to providing a greater sound range and richer tone, it also created a louder “sympathetic resonance” (think reverb) as the bass strings vibrated even when not plucked, creating a louder and more sustained sound. This was the sound the opera required!

Innovation and Progress: Addressing Problems with Solutions

Isn’t that great! It’s the story of all innovation and progress: a problem arises and a solution (however strange looking) is developed and implemented. The US Federal Reserve and Treasury Department are masters of this innovation process (for better or worse). Their creations move markets and dictate the terms on which investors play. Investors like you and I need to pay attention because it’s not always obvious when their Frankensteins turn into monsters.

The Federal Reserve’s Power and the Emerging Fiscal Dominance

I continue to marvel that a handful of seven technocrats at the Federal Reserve, have historically had nearly complete control of the US economy. Critics claim that this near total control is being eroded by the enormous deficits the Biden Administration has implemented through the US Treasury Department. Put simply, the US Government is running a deficit that is the equivalent in size to 6.4% of the entire US economic output – while unemployment is at 3.75%. Historically, deficit spending was limited to war time and to periods of recession. No longer. Critics claim that this unhinged level of spending is preventing the Federal Reserve’s interest rate hikes from having the desired impact of slowing the economy and bringing inflation back to the targeted range. Worse, they claim that issuing the debt to pay for this spending (about $1 trillion every 100 days) may jeopardize their efforts to control inflation. https://www.msn.com/en-xl/news/other/as-us-debt-bomb-spirals-towards-35-trillion-hedge-fund-boss-warns-politicians-are-spending-at-the-expense-of-future-generations/ar-BB1l1dn4

The term for this development is fiscal dominance – a situation where the government’s fiscal policy starts to override the central bank’s monetary policy, potentially leading to high inflation that the central bank is unable to control. (Hello Frankenstein!)

The Impact of Government Spending on the Economy

I’ll leave it to others to debate the long term implications of fiscal dominance. Let’s consider what this “spend-a-thon” means for investors. Here’s how one analyst I follow describes it, “With public debt levels closing in on 100% of GDP and with deficits north of 6% of GDP, the economic impacts of the public spending cycle dwarf the impacts of the private consumption and investment cycles. The fate of the economy is determined by the spending decisions made by politicians”.

source: https://www.fallacyalarm.com/p/tracking-fiscal-flows-in-real-time?utm_campaign=post&utm_medium=web

If correct, that means we Portfolio Managers need to add another neck to our lute if we’re going to continue to play with the band! For my entire career, the Federal Reserve was the conductor of the US economy – increasingly it appears that the politicians have taken control. What is the likelihood that spending will decrease in an election year when the Democrats appear to be trailing Trump in the polls?

Tracking Fiscal Flows: A New Tool for Investors

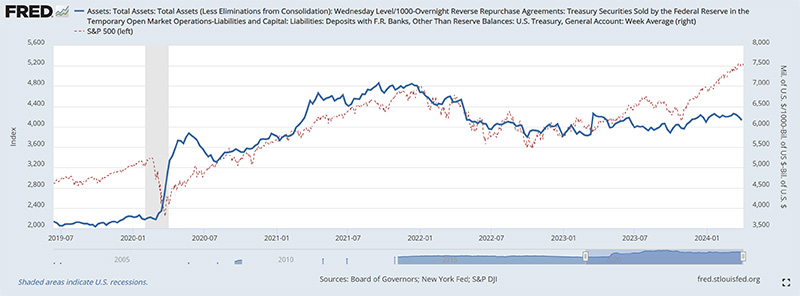

We need new tools to measure the impact of this spending. Here’s a simple one that illustrates the point. The blue line in the chart below is the sum of the assets at the Federal Reserve. The dotted red line behind is the S&P 500. You can see that the stimulus the Federal Reserve implemented in the pandemic is correlated with the recovery of the stock market in early 2020. Data scientists will remind us that correlation isn’t causation so let’s look further. Once the Fed began to reduce its balance sheet in 2022 the market fell. As their balance sheet stabilized, so did the market. Recently, the market has diverged from this indicator as fiscal spending (from the Treasury) has replaced the stimulus that had been provided by the Federal Reserve.

source: Federal Reserve

This sounds more complicated than it is. Think of it this way, while the Federal Reserve has been trying to extinguish the fire of inflation by raising interest rates – the US Government has been fire-hosing gasoline on the fire in the form of deficit spending. If the US Government continues to borrow 6% of GDP to spend, that is going to “goose” financial markets particularly once the Federal Reserve stops raising rates! In this new world, the spending decisions of the politicians sets the “temperature” of the US economy and by inference the stock market! The US Treasury has usurped the Federal Reserve.

Adapting to the Changing Landscape: “Don’t Fight the Treasury”

My take? We used to say, “Don’t fight the Fed”. Now we probably need to say “Don’t fight the Treasury”. Debating the relative risk and wisdom of these developments is best left to the academics. As the Buggles sang: “Video killed the radio star”! It is always this way. Our task isn’t to judge, it’s to act in the face of these developments. I’m working to develop tools to better track the Treasury Department’s spending so that we can all prosper from this changing landscape while enjoying the opera – because no one wants to hear Frankenstein sing!

Glen