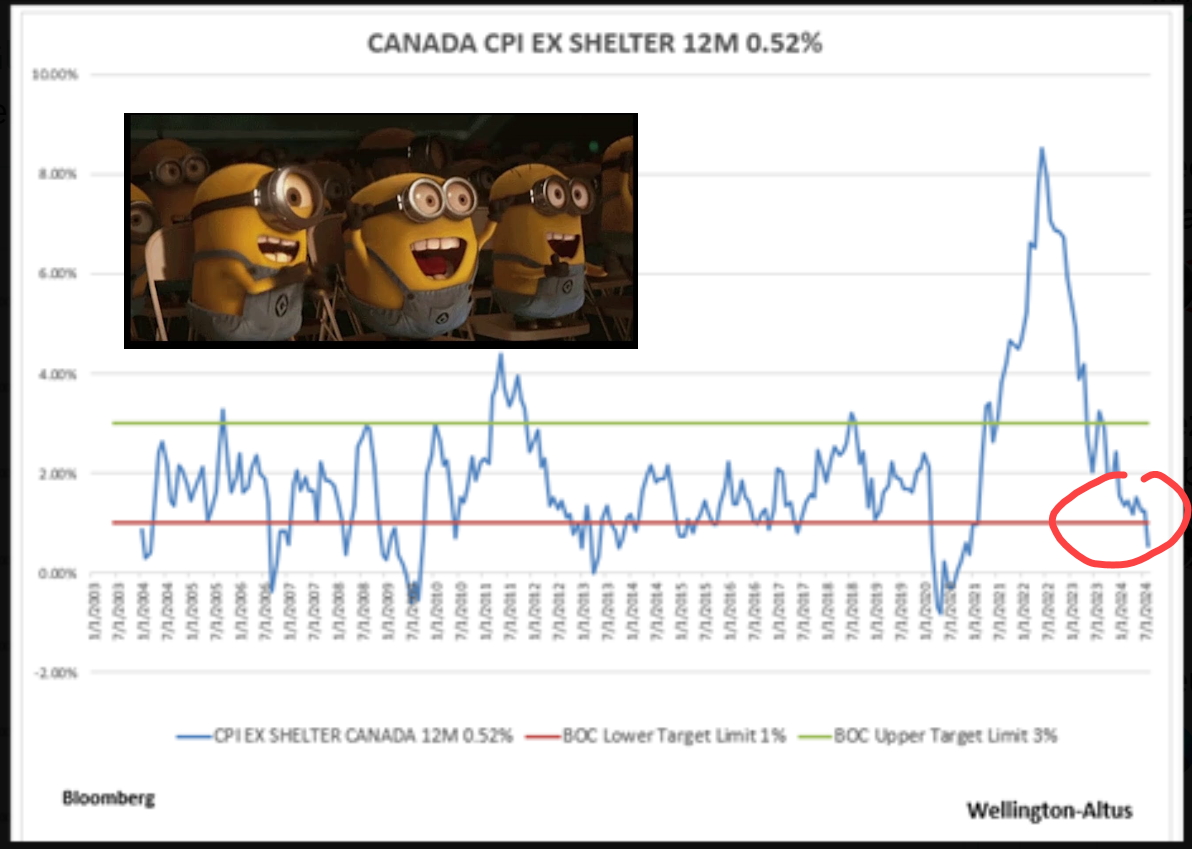

Great news was announced on the inflation front in August—inflation is back to the Bank of Canada’s target of 2%.

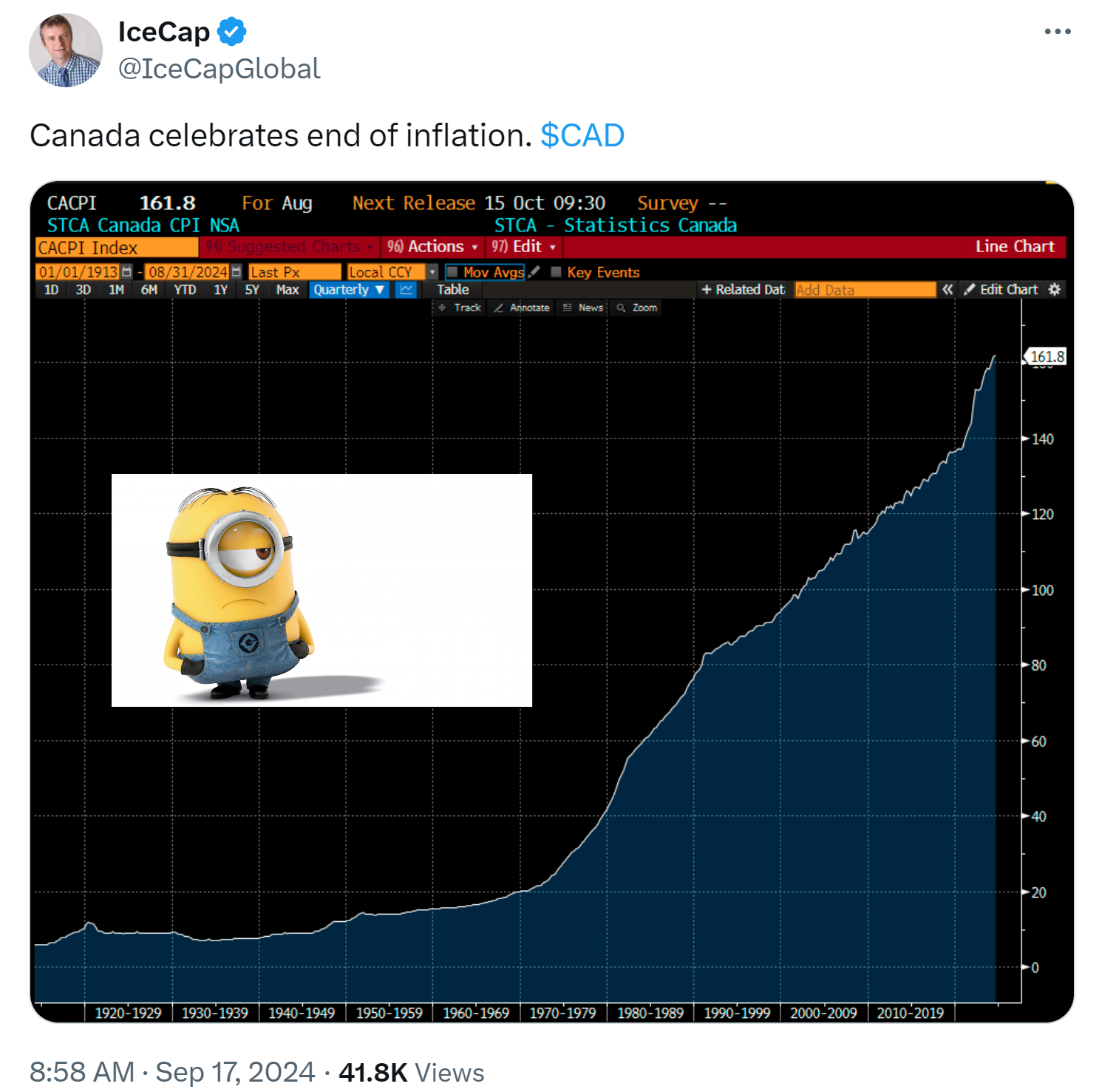

Despite all the back-slapping, high-fiving and self-congratulatory talk, please remember that inflation is still rising! Now just at a lower rate. The chart below illustrates the inexorable trend higher in the Canadian Consumer Prices. Nothing stops this Consumer Price Index (CPI) train, or the housing train—not if the government can help it.

Source (Minion added)

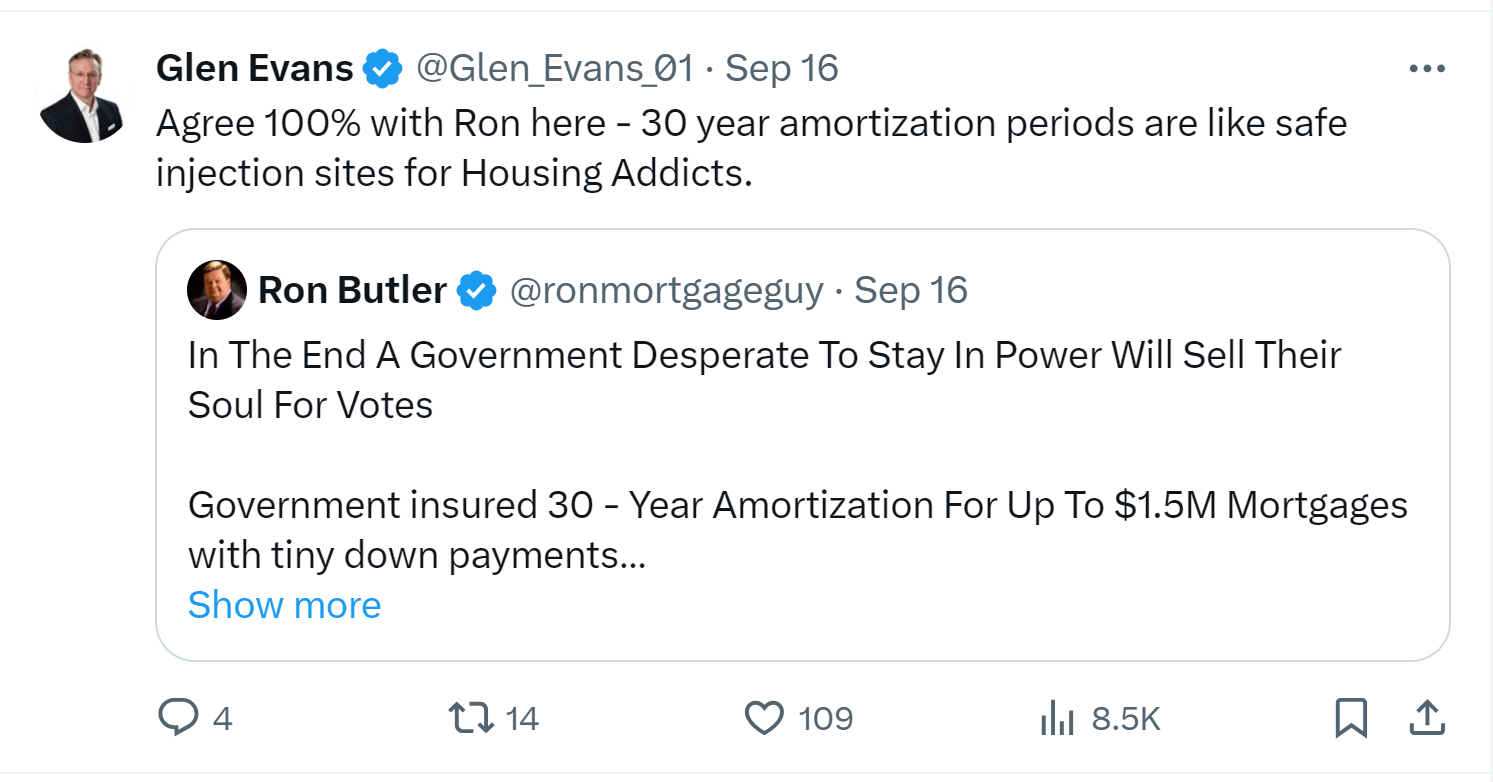

Recently, housing prices have fallen a bit. To counter weakness in home prices Canada’s Mortgage and Housing Company (CMHC) recently announced 30 year amortization periods and increased insurance caps of $1.5 million. These changes are expected to see housing prices once again rise when combined with lower interest rates. In our Orwellian world, the government and some influential voices in the press are praising this as a means of increasing “affordability”. Changing the rules to keep housing prices rising literally is the opposite of increasing affordability.

I had a fun exchange on Twitter with Mortgage Guy Ron Butler on this subject. He liked my take on Canada’s housing addiction:

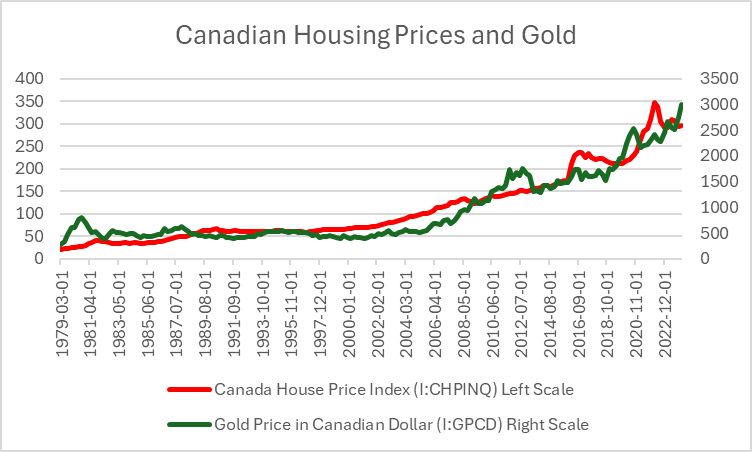

Our exchange got me thinking. We know home prices have risen dramatically over time when denominated in the Canadian dollar as the chart below shows (what a great investment right?):

source: YCharts.com © 2024 YCharts, Inc. All rights reserved

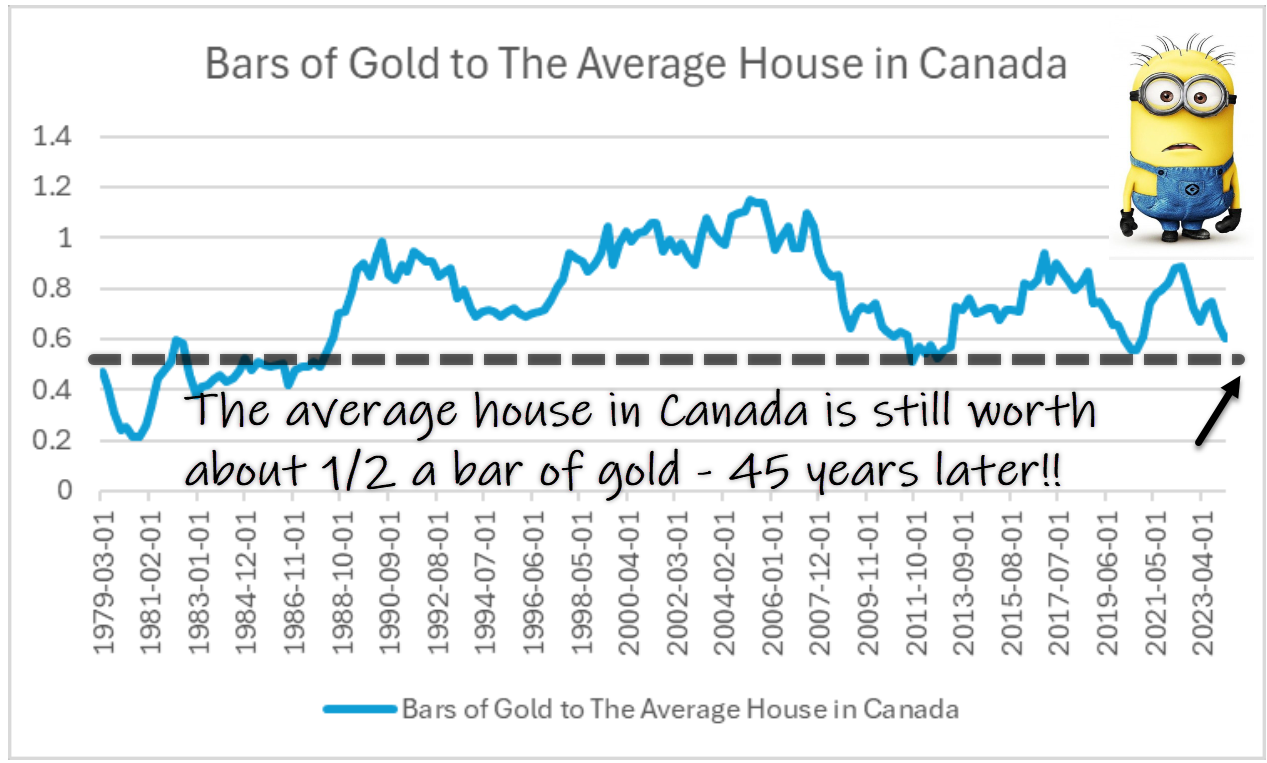

Of course, gold has also increased dramatically when valued in Canadian dollars. Remember that gold is a store of value – a hedge against fiat currency devaluation principally by inflation. Which raises the question: how many bars of gold were required to buy a house in 1979 versus today?

Source: data, YCharts.com, calculations, author. © 2024 YCharts, Inc. All rights reserved.

Would you believe that the price of a home in Canada has barely budged when priced in gold? Half a bar of gold (400 oz) bought the average Canadian Home in 1979 (0.46). Today, slightly more than half a bar of gold is required (0.6). Basically half a bar of gold—virtually no change over 45 years. That’s right, the entire “housing is a great investment” narrative is really more a reflection that housing prices are a decent hedge against rampant inflation rather than wealth creation.

In other words, the rise of housing is a myth when housing prices are expressed in a non-inflationary asset like gold. Nothing stops this inflation train, the rise in housing and inflation are two sides of the same coin. Pity the young home buyers whose government increases “affordability” by any means except allowing prices to fall.

This is why we invest. Inflation is unstoppable, returning it to “just 2%” misses the point entirely—you and I are still losing purchasing power every year. We must look for investments that perform better than gold and value them for what they are—precious. That’s why we recommend stocks—historically, they fare better than even gold and housing (and you don’t have to fix the roof or change the furnace 😀).

Watch the Video: Canadian Homeowners – Your Home is Worth 16 Pounds of Gold

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen