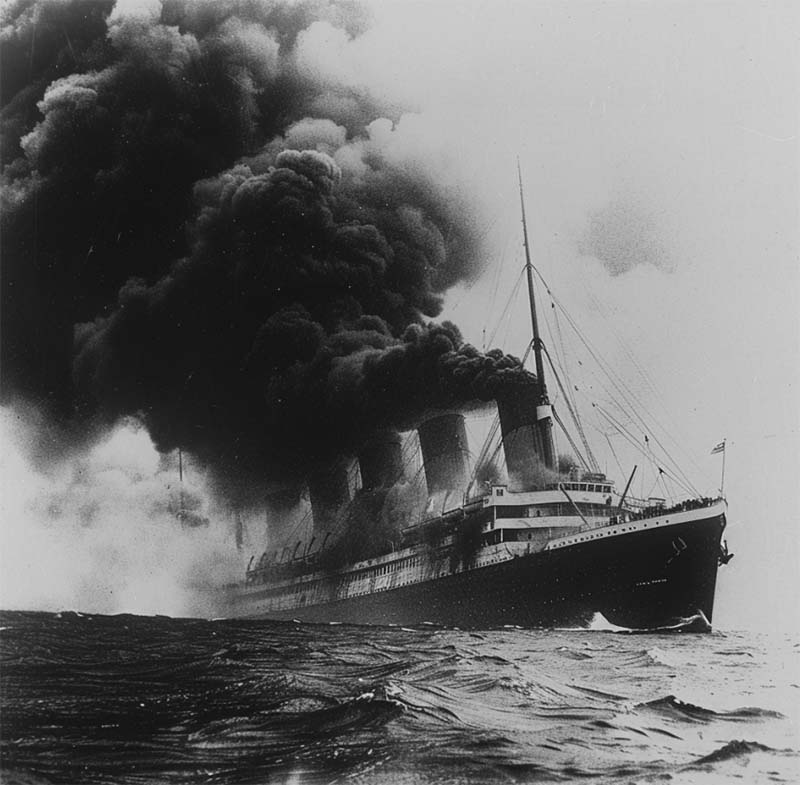

The point of impact of the German torpedo was on the starboard side, amidships just below the bridge. The explosion occurred at 2:10 pm on May7, 1915. Eighteen minutes after the explosion, the RMS Lusitania slipped below the waves at 2:28 pm . Less than half of those on board survived. Captain William Turner, who stayed at the helm until the Lusitania sank, was pulled from the icy waters. At 2:29 pm the questions started.

The Sinking of the Lusitania: A Tragic Lack of Preparation

Dithering and a lack of crew training prevented the port side lifeboats from being lowered before the listing (to starboard) becoming so severe that they could not be lowered at all. Tragically, despite having space for all passengers on the lifeboats, the port side lifeboats sank with the ship.

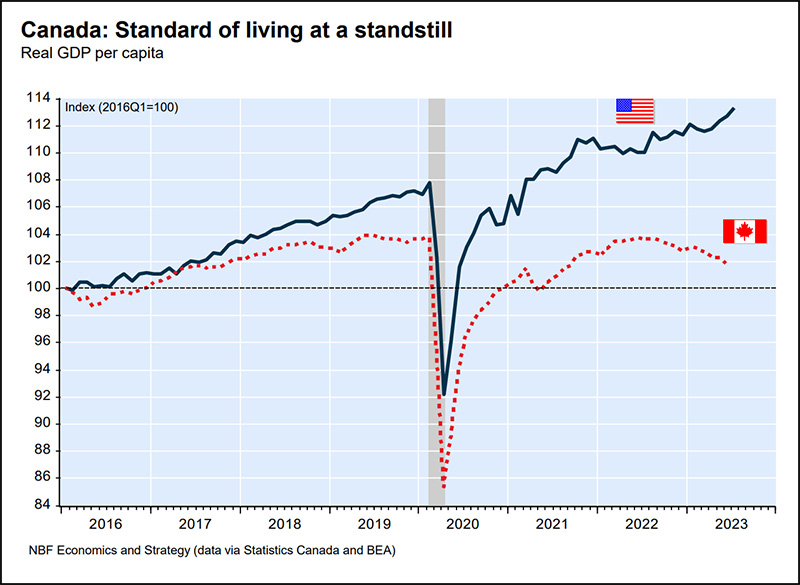

Canada’s Economic “Lifeboat” in Danger

If the Canadian economy was a ship, she’d be listing to starboard. Indeed, it has been taking on water in recent years. Since 2016, Canada has lost $225 billion dollars in foreign investment since 2016. https://financialpost.com/opinion/canada-lost-225-billion-foreign-investment-since-2016 In 2023, foreigners sold $48 billion dollars worth of Canadian stocks – the largest outflow ever. https://betterdwelling.com/canada-just-saw-the-largest-foreign-investor-sell-off-ever/

The Exodus of Canadian Pension Funds: A Harbinger of Trouble

This sad state of affairs is reflected in the fact that saving-supertankers of Canadian Pension Funds have diverted their pensioner’s savings out of Canada towards better performing locales. Like Captain Turner, pension funds have lowered the lifeboats and paddled to safer, more business friendly shores. Unlike Turner, captains of Canadian Industries seem to want to prevent the lifeboats being lowered at all!

In 2000, Canadian pensions had 28% of their funds invested in Canadian companies – last year that fell to just 4%. This won’t do according to several dozen captains of Canadian Industry. They claim that this preference for other locales is costing Canadian companies a higher borrowing rate. Their solution – trap capital in Canada! They want Chrystia Freeland to “amend the rules governing pension funds to encourage them to invest in Canada.” https://www.theglobeandmail.com/business/article-pension-funds-investing-campaign/

The Globe and Mail’s Stand Against Forced Pension Fund Investment

Fortunately, editors at the Globe and Mail are trying to torpedo the idea, “Forcing pension funds to invest in Canadian equities is an idea that seems merely terrible at first glance but, when you really dig into the details, turns out to be truly abysmal.” https://www.theglobeandmail.com/opinion/editorials/article-handcuffing-pension-funds-is-not-the-answer-to-canadas-economic-woes/

Hear, hear! The Canadian Pension Plan illustrates just how costly an error implementing this change would be. CPP manages both the base CPP and the enhanced CPP. The enhanced CPP has a much greater Canadian stock allocation (44%) compared to just 8% within the base CPP. “As of the end of fiscal 2023, the base CPP had a five-year net return of 8 per cent. The enhanced CPP had a significantly lower net return of 5.6 per cent. Or to put it another way, the plan heavily weighted to Canada did only 70 per cent as well.” Simply put – investors can’t afford to risk investing all their retirement assets in Canada.

The Right Question: Focus on Canadian Economic Policies

What’s to be done? I’ll defer once again to the Editors at the Globe and Mail:

“So, what can be done to bring more pension-fund investment back to Canada? The answer is – it’s the wrong question. The solution is to address the policies that are undermining the dynamism of the Canadian economy: an overabundance of regulations; arbitrary and often punitive taxation changes; and protectionist policies that shield too many sectors from the rigours of competition.” https://www.theglobeandmail.com/opinion/editorials/article-handcuffing-pension-funds-is-not-the-answer-to-canadas-economic-woes/

I couldn’t say it any better! It’s not the job of Canadian savers to lower the cost of capital for Canadian businesses. I’ll stay at the helm like Captain Turner, together we’ll make our way to the lifeboats if needed – making sure they don’t sink with the ship!

Glen