The Spectacle of Fireworks

“Whump!” In the distance, the deep but discernible sound of the shell exiting the four foot diameter mortar barrel reverberates under the dark sky. Almost immediately, a red trail like a meteor streaks into the smokey sky. Spectators hush, eyes strained as the trail rises to the heavens. Night turns to day, as the shell explodes in a constellation of artificial suns blinding the senses, dilating pupils and overloading the faculties. Next the sound waves of the deafening explosion impact your chest, arriving seconds later with a palpable thud.

Crafting the Yonshakudama

The 925 lb Yonshakudama shell is the pinnacle of pyrotechnics. Assembled by artisan craftsmen called Hanabi-shi, the precisely placed sub-shells and colour producing stars, packed amongst oxidizers like potassium nitrate, metallic powders and binding agents and equipped with both time and altitude sensitive fuses, take weeks to construct and seconds to explode. For some that might seem like a waste – not me.

The Ephemeral Nature of Fireworks

Japanese culture captures the awareness and appreciation of the transient nature of life and the bittersweet beauty found in fleeting moments. They call this “mono no aware” pronounced, mono-no-ah-wah-reh. At the heart of “mono no aware” is an acceptance and appreciation of the impermanent nature of things. This sentiment is not just about sadness over the fleeting moments but also about finding a deeper beauty and emotional resonance because of their ephemeral nature. What’s more fleeting than a pyrotechnic? The task is to appreciate both the beauty and art of assembling and blowing up the world’s biggest firecracker! Western investors could probably learn from the Japanese.

The Bull and Bear Markets

Investors tend to focus on the big bangs of bull markets. A clear preference for this incendiary growth makes good sense – but misses the fact that these bull markets (like the mighty Yonshakudama) don’t make themselves. Without the work of the Hanabi-shi, the night sky would never light up – even if only momentarily.

I’d probably be giving too much credit to our central bankers to compare them to Hanabi-shi. The hard truth is that there is no bull market without bear markets. The uncomfortable conditions we have been through in the last couple of years are laying the groundwork for the next bull market – which will create the speculative excesses which will be ground down in the bear market that will follow. It is always so.

Signs of a Coming Bull Market

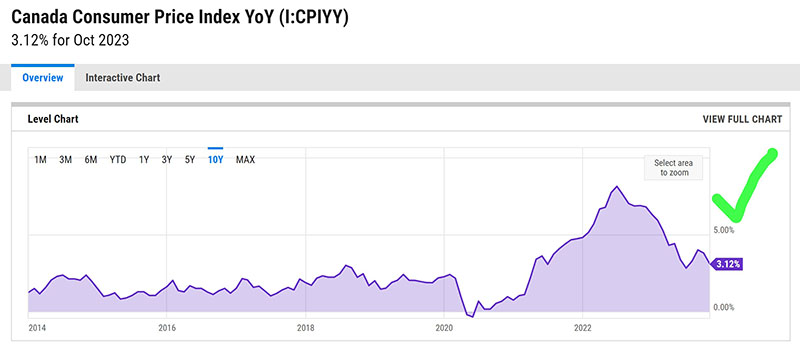

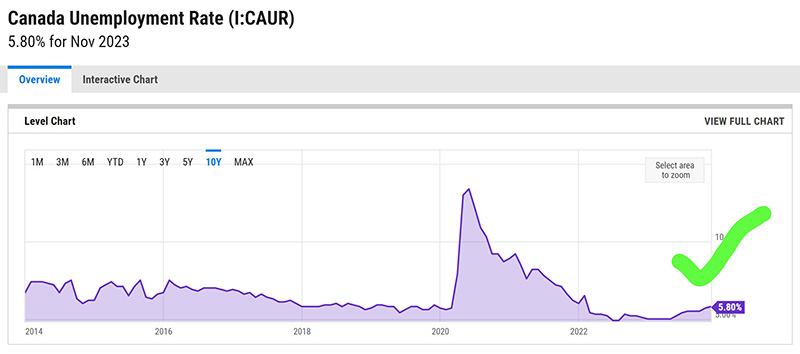

There is increasing reason for optimism that work of the central bankers is almost done. While prices are unlikely to ever return to their previous levels, inflation increasingly seems to be under control. Unemployment is now rising. The expectation now is that the Bank of Canada will begin cutting interest rates by the middle of next year.

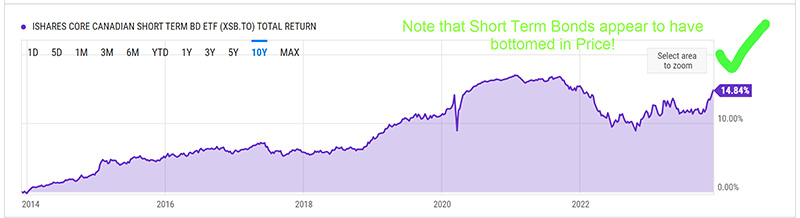

I’m hesitant to blow the “all-clear” whistle, because it strikes me that risks still abound. But we can compare what we would expect to be true if we were at the bottom with what is actually happening. If we were at the bottom of this bear market, we’d be expecting to see bond prices increasing as interest rates begin to fall (in expectation of the central banks cutting interest rates). We’ d also be expecting Consumer Prices to be falling down and Unemployment to be rising. Let’s check.

source: YCharts.com

Assessing the Current Situation

Check, check, check. There seems to be little doubt that substantial progress has been made during this bear market at restoring the fundamentals that are required for the next bull market run. Are we there yet? Maybe, maybe not. Frankly, it depends on how much more damage will come from the interest rate hikes that have already been done. Do we experience a recession or a soft-landing? I’m inclined to think that a recession is likely coming our way; but investors, like spectators at a fireworks demonstration, are leaning in, hushed, waiting to hear, “Whump!”

The Long-Term Investor’s Perspective

Long term investors like you and I, have learned to enjoy the sound and fury of bull markets while stoically accepting the impermanence of them – like the Japanese. For us long-suffering long term investors, the wait might be nearing an end.

Glen