The Acceleration of Time – Midjourney

It’s not just you – time really is speeding up! It’s true, because of the Big Bang, the universe is like a Slinky that’s constantly expanding, causing galaxies to move apart and light waves to stretch making light from more distant galaxies appear more red than closer ones. As this cosmic slinky stretches faster over time, it appears that time itself is speeding up on a universal scale.

Cosmic Slinky – Midjourney

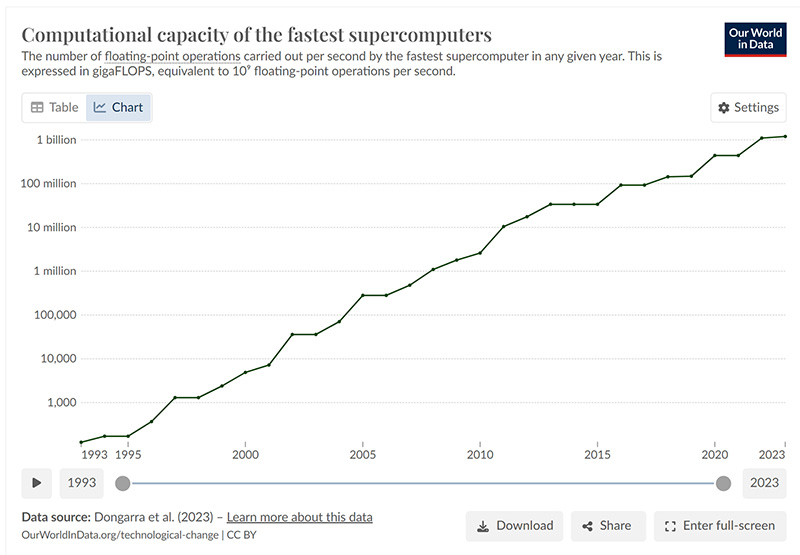

I can relate! The older I get the faster time seems to fly. This is particularly true in finance. It’s only a slight overstatement to say that the Big Bang in the last 50 years was the discovery of the transistor. The pace of development has been accelerating at an exponential pace ever since. The constant doubling of transistors on chips has led to exponential growth in computing power. The next few doublings will bring advances that appear magical.

– Note that the Y axis on this chart is logarithmic!

We are living through a moment of remarkable technological innovation. Take humanoid robots as an example. Always thought to be science fiction, robots are fast becoming science fact. Figure AI, Optimus, Digit, Apollo, and numerous other robots are already being put to work. Advances in Neural Networks have created the possibility to train robots based on “video in, action out”. In other words, the robot can watch and learn without ever being “programmed” to do a task. The applications are endless.

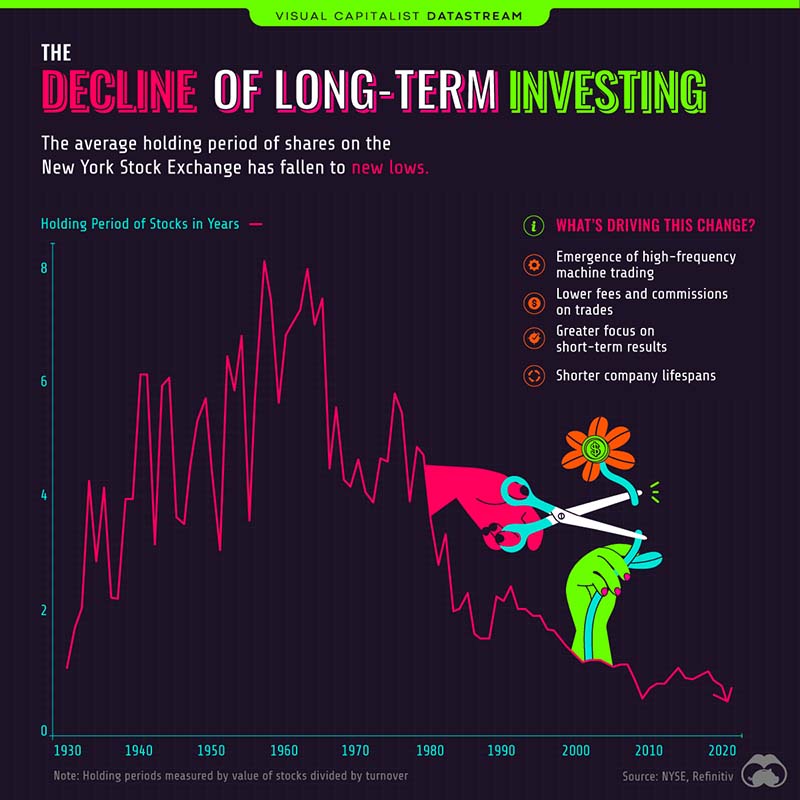

The technological advancements are happening everywhere and all at once. They will create new winners and new losers – just like with every other technological revolution. With time and computing running faster than ever before, maybe that explains why investors are selling investments faster than at any point in history. The average holding period for investments has fallen from over 8 years in the 1950s to about 5 1/2 months!

This seems extreme to me. The balance between “riding-it out” and “riding it down” is generally only knowable with the benefit of hindsight. Stories abound of investors like Bill Miller who famously held Amazon through multiple 90% drops. People only retell the story because Amazon (and Miller) survived! Nobody tells the story of the nameless investor who rode Pets.com down to zero. So, a balance must be struck.

The flip side of this “universe speeding up” story is the irony that U.S. mega-cap technology companies seem to be like galaxies in a universe of their own – continuing to expand at increasing speeds almost like the universe itself! If this persists the only answer for investors will be to continue to own these rocket ship securities for the foreseeable future! I find myself leaning to this side of the debate.

Midjourney

The tech behemoths of our age, these galaxy-sized companies measured in trillions of dollars of enterprise value are actually defying the laws of gravity by increasing their profits despite their growing size. Shouldn’t companies like that command a hefty premium relative to smaller, less profitable companies? You betcha! But how much of a premium is too much?

The Magnificent 7 tech companies are all trading at hefty valuations prompting many analysts to question their prospects. Others worry that since the tech companies are outpacing almost everything else, that they are at risk of falling back to earth. My advice? Enjoy the ride. Expect ups and downs.

We are in the midst of the AI technological revolution. There is little doubt in my mind that this will eventually lead to a bubble. That said, we are still in the early phase where the infrastructure for this revolution is being built. Like steam engines replacing water wheels, and electricity replacing steam engines, the build out phase will take years. For the time being the major incumbents and the ‘picks and shovel’ producers like semiconductors and power generation companies are the best way to play, eventually we will see companies emerge who have leveraged AI to build new markets and products. Some believe that Tesla will be the first company to really emerge.

Birth of a Galaxy – Midjourney

If the incumbent tech companies are galaxies, it is likely that new galaxies will emerge from the gas and dust that cloud this field currently. Over time stars will begin to form in the denser regions of these clouds and eventually group together and create the structure of a new galaxy. One thing is for sure – it will happen faster than we expect!

What a time to be alive!

Glen